InvestSMART's Conservative Portfolio: March Quarter Review 2021

First, we should address the fixed income side of the portfolio and we stress the following point – fixed income is one of the core asset classes of any investment portfolio. It provides a strong and solid foundation; its income component provides a consistent long-term income rate, and the capital component is majority backed by sovereign governments or tier-1 corporations.

But we also need to remember that fixed income, like any floating market, can be subject to short bouts of volatility. Its normal advantage is that these bouts of volatility are mild in comparison to its riskier peers such as equities and property but that’s not always so.

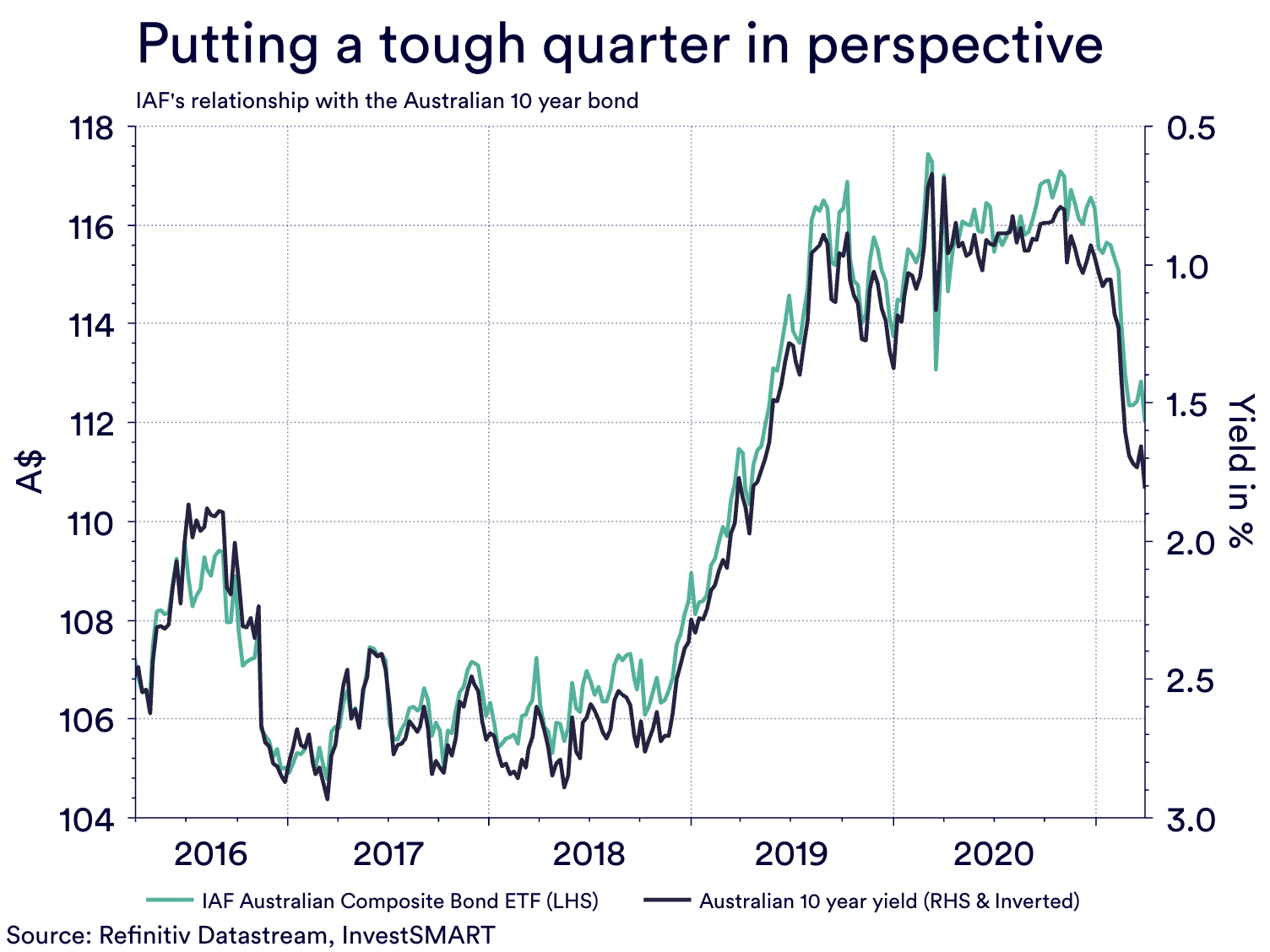

In the Conservative Portfolio we hold the iShares Australian Fixed Income ETF (IAF) for your Australian treasuries’ exposure. Its biggest holding is the Australian government 10-year bond and as this chart shows very clearly, the Australian 10-year bond was sold off in the quarter causing its yield to rise which saw IAF’s sell off mirroring that of the 10-year.

This fall was not isolated to just Australia. Internationally, treasuries suffered a similar fate and actually led to a debate over the merit of fixed income, with some even suggesting it’s facing an ‘existential crisis’ and that it no longer has a place for investors. This is disingenuous, as the same chart above shows the incredible positive movement throughout 2019. We even warned investors back then that that kind of appreciation was abnormal in the fixed income sphere and not to expect this kind of move on a long-term basis.

We are here to remind you of the same point but in reverse – fixed income will return. If we look at the Australian 10-year bond, its price is currently below its ‘face value’ (for more on the inner workings of fixed income, click here to view our fixed income series)

Furthermore, the performance of the Conservative Portfolio during this period needs to be looked at in the context of risk and your tolerance of risk. It also needs to be looked at in terms of your time horizon.

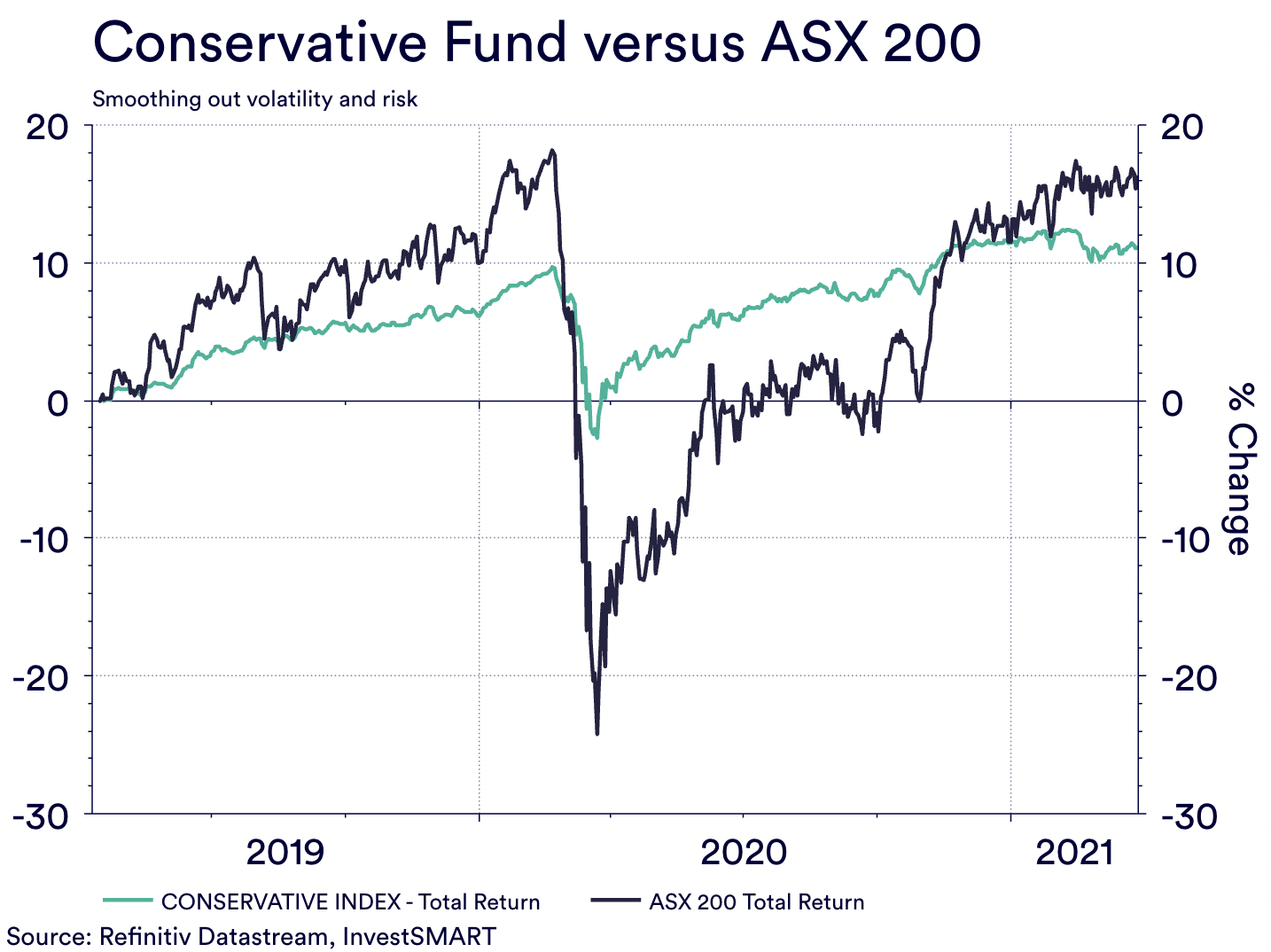

The minimum investment time horizon for a conservative investor is 2 years so if we compare the ASX 200 to the Conservative Index, it puts the last quarter in perfect perspective as this chart shows.

The intra month and quarterly movements of the Conservative Portfolio are significantly less than that of the ASX 200 which is exactly what one should expect. The other advantage illustrated here is that the portfolio does have some exposure to growth markets being the ASX 200 (IOZ) and the Global Index (VGS) meaning it captures some of the outperformance over its more defensive assets but is buffered from the falls risk markets are exposed to i.e., COVID-19.

Investors should continue to apply their personal risk tolerance to their investment goals and although the portfolio was flat over the past quarter, its overall long-term performance shows that it is one of the best investment options to absorb volatility in the market but outperform the single asset classes like cash.

Frequently Asked Questions about this Article…

Fixed income is a core asset class in any investment portfolio, providing a strong foundation with consistent long-term income. It is typically backed by sovereign governments or tier-1 corporations, offering stability compared to riskier assets like equities and property.

The iShares Australian Fixed Income ETF (IAF) experienced a sell-off due to the rise in yield of the Australian government 10-year bond. This was part of a broader trend affecting treasuries internationally, leading to debates about the merit of fixed income investments.

Despite some claims of an 'existential crisis' for fixed income, this perspective is misleading. Historical data shows positive movements in fixed income markets, and while recent volatility has occurred, fixed income is expected to return to stability over time.

Investors should consider the Conservative Portfolio's performance in the context of their risk tolerance and investment time horizon. While the portfolio was flat over the past quarter, its long-term performance demonstrates its ability to absorb market volatility and outperform single asset classes like cash.

The minimum investment time horizon for a conservative investor is typically 2 years. This allows for a better perspective on performance compared to more volatile indices like the ASX 200.

The Conservative Portfolio experiences significantly less intra-month and quarterly movements compared to the ASX 200. It also benefits from some exposure to growth markets, capturing outperformance while being buffered from the risks associated with market downturns.

Investors should continue to align their risk tolerance with their investment goals. Despite recent market trends, the Conservative Portfolio's long-term performance suggests it remains a strong option for managing volatility and achieving steady growth.

Considering risk tolerance and time horizon is crucial because they help investors align their portfolios with their financial goals and comfort levels. This approach ensures that investments are tailored to absorb market fluctuations while aiming for desired returns over the chosen period.