InvestSMART Portfolios - November in Review

Invest smarter with capped fees: An Australian first

We know even the smallest difference in fees can result in substantial differences to your nest egg. Therefore under our new Professionally Managed Account service, we have capped our fees.

Simply look out for the 'Capped Fees' label. Find out more.

Equity market performance

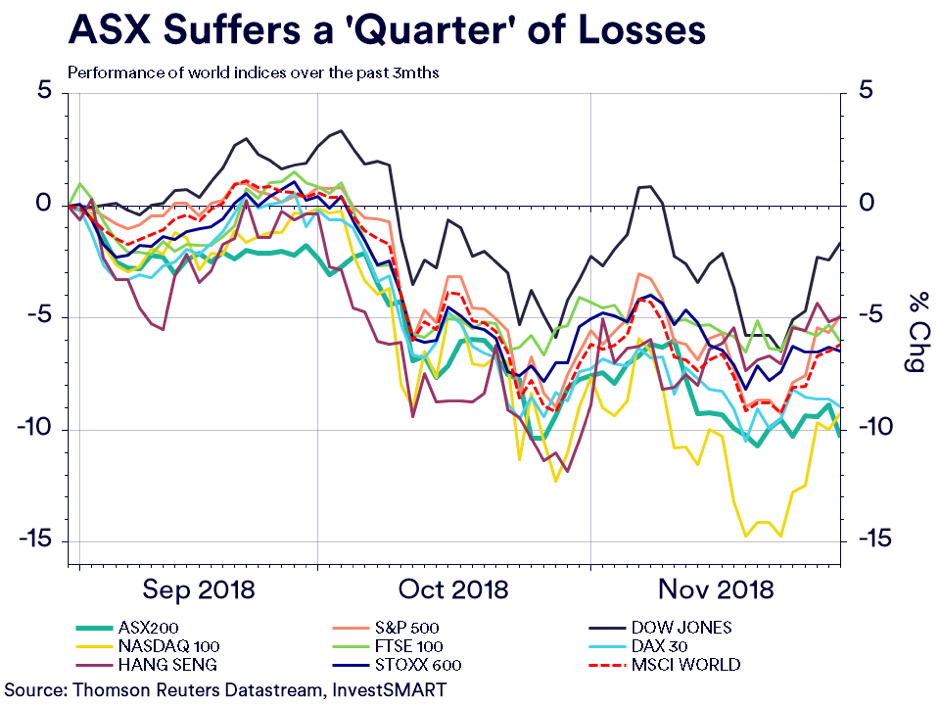

November completed a ‘quarter’ of negative months for the ASX, declining -2.97% over the 30 days of November couple this with the -5.54% in October and -1.77% in September the total decline from September 1 to November 30 is 10.3% - a technical correction. This has made the ASX worst performing market of the majors, the PMA portfolios are exposed too, it is even lagging the NASDAQ, which at one point, was down over 15% over the same period.

However, the geographical diversification of our diversified portfolios has limited the impact of the ASX’s performance. Approximately 20% of our growth portfolios are US-facing and US markets snapped out of their pull back in November – right now the DOW is actually the best performing market we follow.

The main reason US markets rose was Federal Reserve Chairman Jay Powell in late November suggested that US interest rates were ‘nearing the neutral cash rate’. US markets interpreted this to mean the Fed maybe about to slow down its rate hiking cycle. Both the S&P and DOW finished November in the black, if only just, eking out a 0.7% gain.

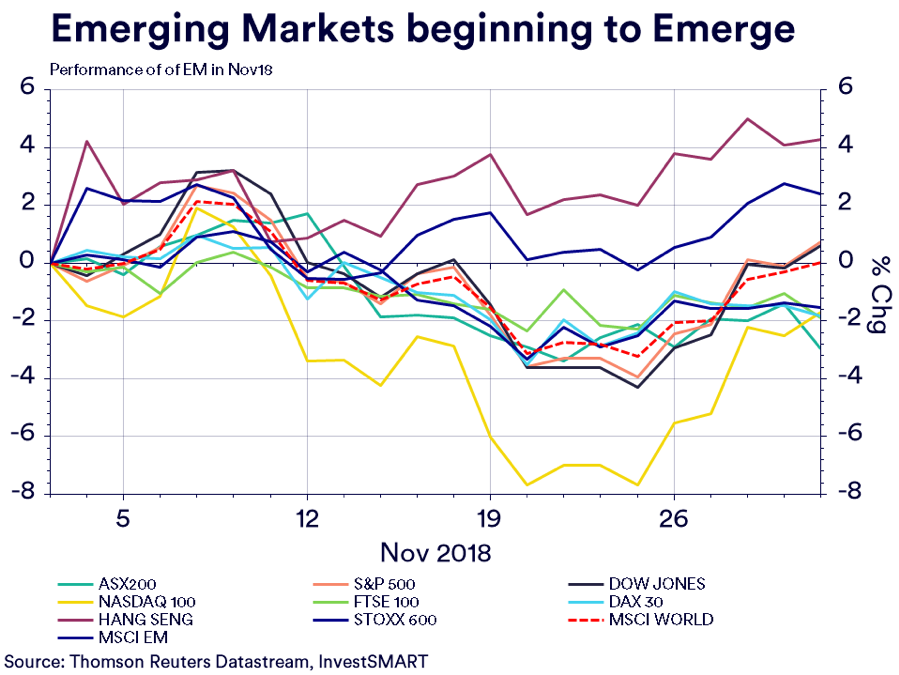

What also caught our attention was emerging markets (EM), which were the best performing indices in November. Most notably, the Hang Seng gained 4.3%. Beijing was a clear driver here as it moved to ‘stabilise’ the declines seen this year with ‘strategic’ stimulation. Our diversified portfolios have international markets exposure through Vanguard’s MSCI World ex Australia index (VGS), the largest contributor to the performance of our portfolios over the past year.

We believed that the pull back in global markets during late September and October had created an entry opportunity, and in the main, this has been proven right. We continue to see growth assets as a strategic place to be in 2019. We believe recent pull backs are providing entry points for those with investment time horizons of 5 years. The November performance is also a good example of why diversification should be core to any investment strategy as it buffers your capital from overexposure to one asset class.

To check your overall investment diversification, visit our Portfolio Manager.

Property performance

Australian residential property fell further in November, declining -0.9% month-on-month to be down -5.3% year-on-year. Sydney posted its largest month drop since May 2004 falling -1.4% month-on-month and is now down -8.1% year-on-year. Sydney is on track for its worst decline since the mid-1980s.

The declines are mostly being led by the falls in the upper-quartile of the market. High value dwellings have fallen -7.2% year-on-year while lower-quarter dwellings are actually up 0.4%. This is most notable in Melbourne where upper-quartile properties are down -9.9% year-on-year while lower-quartile dwelling are actually up 1.7% over the same period.

Rental yields have once again increased month-on-month after bottoming in September. Residential rental yields increased 0.7% in November while commercial property yields held firm. This fed into domestic listed property which bucked the trend of the ASX to finish up in November. Listed property globally also jumped in November and was the best asset class in our diversified portfolios.

Fixed income performance

Global fixed income rallied in November as risk assets were shed seeing fund flows heading to safe haven assets. Yields in the US 10-year fell by approximately 10 basis points to 3.1% in November as sovereign debt globally was bid up.

Comments by US Federal Reserve Chairman Jay Powell’s around the Fed’s ‘neutral cash rate’ was meet with mild caution by fixed income markets. Both the market and the Federal Reserve are still pricing in a December rate rise of 25-basis points which explains the caution. This would be the fourth December in a row the Fed has increased rates, if the forecasts become actual.

The Australian fixed income market also appreciated in November. The Australian 10-year yield fell 10 basis points to 2.65% while the Australian fixed income market saw slight capital gains.

The RBA held the cash rate at 1.5% for the 27th consecutive month and signalled that the status quo will likely hold over the coming 12 months. We expect Australian fixed income to outperform global peers due to the stable nature of Australian rates.

For more information on our Diversified Portfolios, click here.

Download Monthly Update PDF:

Diversified Income | Balanced | Core Growth | High Growth

InvestSMART International Equities Portfolio

The decline that started in October persisted through most of November, which led to the InvestSMART International Equities Portfolio shedding -1.15% over the month. Europe dragged down performance, as did developed markets in Asia. However, on balance, the portfolio’s diversification across global markets well and truly paid off.

US markets managed to snap out of the September pullback (correction in some instances) in November. The main reason for the rise in US markets was a speech made by US Federal Reserve Chairman Jerome Powell in late November suggesting that US interest rates were ‘nearing the neutral cash rate’. US and global equity markets interpreted this as meaning the Fed may be about to slow down its rate hiking cycle - a 'risk-on' event.

To see more information on our International Portfolio, click here.

InvestSMART Diversified Property & Infrastructure Portfolio

Australian residential property fell further in November, declining -0.9% month-on-month to be down -5.3% year-on-year. Sydney posted its largest month drop since May 2004 falling -1.4% month-on-month and is now down -8.1% year-on-year. Sydney is on track for its worst decline since the mid-1980s.

The declines are mostly being led by the falls in the upper-quartile of the market. High value dwellings have fallen -7.2% year-on-year while lower-quarter dwellings are actually up 0.4%. This is most notable in Melbourne where upper-quartile properties are down -9.9% year-on-year while lower-quartile dwelling are actually up 1.7% over the same period.

To see more information on our Property & Infrastructure Portfolio, click here.

InvestSMART Interest Income Portfolio

Global fixed income markets rallied in November as risk assets were shed seeing fund flows heading to safe haven assets. This caused yields in the US 10-year bond to fall by approximately 10 basis points to 3.1%.

Comments by US Federal Reserve Chairman Jay Powell’s around the Fed’s ‘neutral cash rate’ was meet with mild caution by fixed income markets. Both the market and the Federal Reserve are still pricing in a December rate rise of 25-basis points which explains the caution. This would be the fourth December in a row the Fed has increased rates if the forecasts become actual.

To see more information on our Interest Income Portfolio, click here.

InvestSMART Hybrid Income Portfolio

Global fixed income markets rallied in November which caused yields in the US 10-year bond to fall by approximately 10 basis points to 3.1%.

Both the market and the Federal Reserve are still pricing in a December rate rise of 25-basis points which explains the caution. This would be the fourth year in a row the Fed has increased rates in December if the forecasts become actual.

To see more information on our Hybrid Portfolio, click here.

Frequently Asked Questions about this Article…

Capped fees are a unique feature of InvestSMART's Professionally Managed Account service, where fees are limited to a maximum amount. This approach helps investors by ensuring that even small differences in fees don't significantly impact their investment returns over time.

In November, the ASX experienced a decline of -2.97%, contributing to a total decline of 10.3% from September to November. This performance indicates a technical correction, making it the worst-performing major market. For investors, this highlights the importance of diversification to mitigate risks associated with market downturns.

Diversification is crucial because it spreads investments across various asset classes and geographical regions, reducing the risk of overexposure to any single market. For example, InvestSMART's diversified portfolios benefited from exposure to US and emerging markets, which performed well in November despite the ASX's decline.

Jay Powell's comments about US interest rates nearing the neutral cash rate led to a positive reaction in US markets, as investors interpreted it as a potential slowdown in the Fed's rate hiking cycle. This 'risk-on' sentiment contributed to gains in US equity markets in November.

Australian residential property continued to decline in November, with a -0.9% month-on-month drop and a -5.3% year-on-year decrease. Sydney experienced its largest monthly drop since May 2004, highlighting ongoing challenges in the property market, particularly in the upper-quartile segment.

Global fixed income markets rallied in November as investors moved towards safe haven assets, leading to a decrease in yields. For instance, the US 10-year bond yield fell by approximately 10 basis points to 3.1%. This trend reflects cautious sentiment amid expectations of a December rate hike by the Federal Reserve.

Emerging markets were the best-performing indices in November, with the Hang Seng gaining 4.3%. This performance was driven by strategic stimulation efforts from Beijing to stabilize market declines, showcasing the potential benefits of including emerging markets in a diversified investment portfolio.

InvestSMART believes that recent market pullbacks have created entry opportunities for growth assets, making them a strategic investment choice for 2019. With a long-term investment horizon of 5 years, growth assets are seen as a valuable component of a diversified portfolio.