InvestSMART Performance Update: September 2024

InvestSMART's diversified ETF portfolios returned an impressive 11.0% to 19.4% in the 12 months to 30 September 2024. These outstanding returns are through design, not chance. Investing in broad-based passive ETFs, keeping our fees low and not timing the market means InvestSMART achieves strong, consistent long-term returns, outperforming the majority of competitor funds.

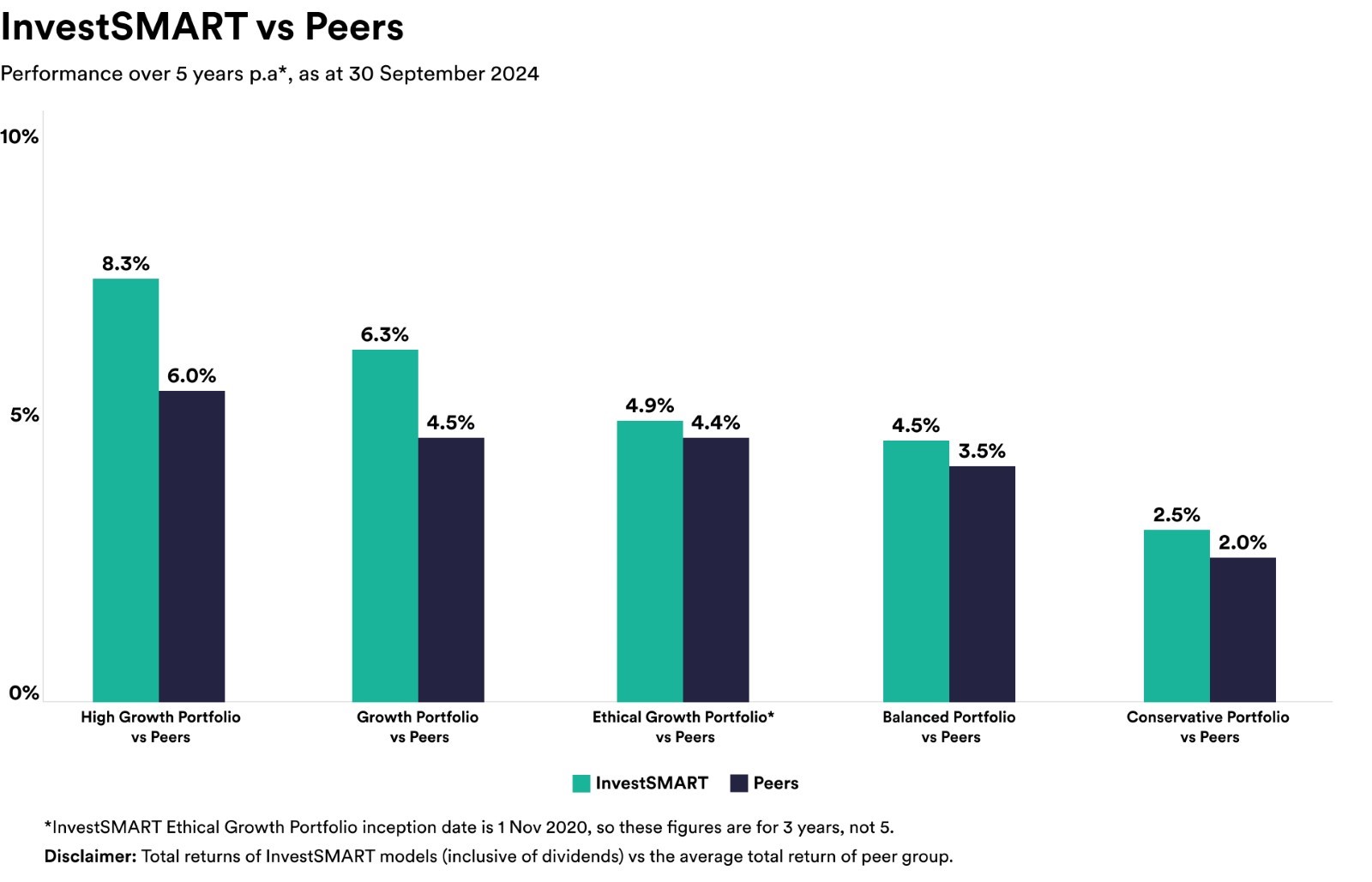

Over five years the portfolios have returned on average 2.5% to 8.3%. The table below illustrates how InvestSMART's portfolios compare to funds in the same risk category over five years. Our 'High Growth' portfolio has returned on average 8.3% over five years outperforming similar 'high growth' funds by an average of 2.3% over the same period. This may not sound like a lot but when you consider the long-term impact of compounding returns the difference is significant. Of course, past performance is not an indication of future performance.

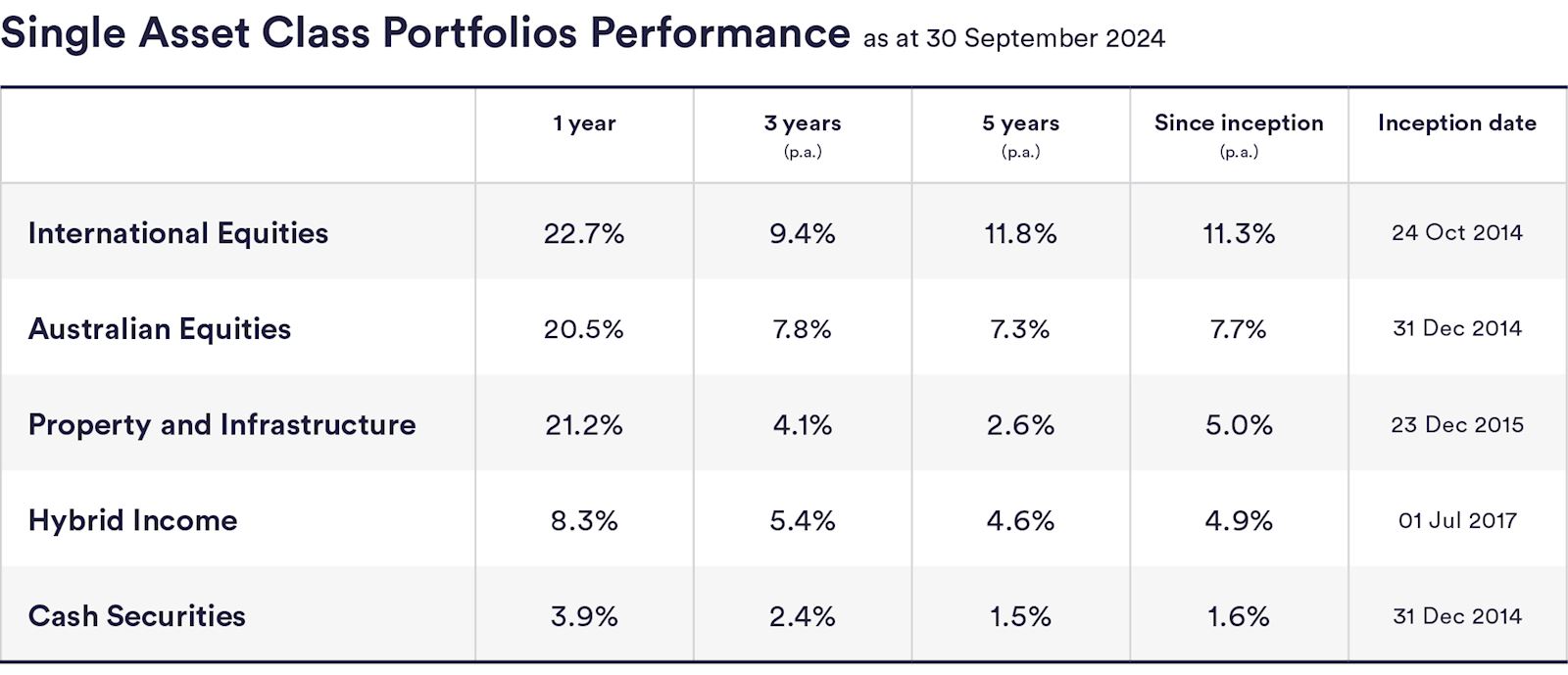

InvestSMART's single asset class ETF portfolios returned 3.9% to 22.7% in the 12 months to 30 September 2024, and 1.5% to 11.8% over five years.

September quarter round up

The S&P/ASX 200 returned an excellent 7.8% for the quarter, and 21.8% for the 12 months to 30 September 2024 and international shares (MSCI World ex-Australia) returned 2.3% for the quarter and 23.2% for the year.

While international shares have been the standouts in recent quarters, this quarter it has been Australian shares, commercial property, and infrastructure that have impressed.

This again highlights the value of diversification in a portfolio. When combining diversification with long-term investing, it reduces risk and gives investors their best chance of achieving excellent long-term returns.

A key theme for the quarter was the cutting of interest rates by central banks around the world as inflation cooled. The US Federal Reserve cut its rates by 50 basis points, while rates were also cut in the European Union, Canada, the UK, New Zealand, Switzerland and China.

Australia is yet to join the rate cutting party, but with inflation now at 2.7%, the Commonwealth Bank is predicting that the RBA could start cutting rates as early as December this year.

The prospect of future rate cuts has helped lead equity and bond markets higher.

However, with the RBA's 'higher for longer' stance on interest rates, this has also led to a slight strengthening of the Australian dollar.

Frequently Asked Questions about this Article…

InvestSMART's diversified ETF portfolios delivered impressive returns ranging from 11.0% to 19.4% in the 12 months leading up to September 30, 2024.

Over five years, InvestSMART's 'High Growth' portfolio has averaged an 8.3% return, outperforming similar 'high growth' funds by an average of 2.3%.

Diversification is crucial in InvestSMART's strategy as it reduces risk and enhances the potential for excellent long-term returns by spreading investments across various asset classes.

In the September 2024 quarter, Australian shares performed exceptionally well, with the S&P/ASX 200 returning 7.8% for the quarter and 21.8% for the year.

Recent interest rate cuts by central banks worldwide have contributed to higher equity and bond markets, as lower rates generally encourage investment.

The Australian dollar has slightly strengthened due to the RBA's 'higher for longer' stance on interest rates, even as other countries cut rates.

InvestSMART's single asset class ETF portfolios returned between 3.9% and 22.7% in the past year, and 1.5% to 11.8% over five years.

With inflation at 2.7%, the Commonwealth Bank predicts that the RBA might start cutting interest rates as early as December this year.