Investor Signposts: July 2, 2018

New beginnings in Australia, while investors await US jobs data.

Australia: New beginnings

- The first week is usually the busiest period of each month. And it is no different for July – the start of the new financial year in Australia.

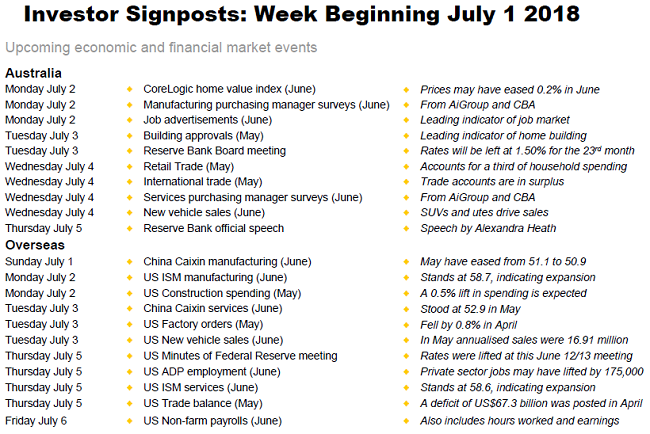

- The week kicks-off on Monday with CoreLogic releasing the June data on home prices. Based on daily data released so far in June, home prices have fallen 0.2 per cent in the five mainland capital cities to stand 1.6 per cent lower than a year ago. The national index may be end up a bit firmer due to higher home prices in regional areas and Hobart.

- Also on Monday ANZ issues the data on job ads for June and both AiGroup and Commonwealth Bank release survey results on manufacturing activity.

- Job ads rebounded in May by 1.5 per cent after three straight months of very modest declines. Meanwhile surveys show that manufacturing activity remains healthy at present, helped by a lower Aussie dollar. The AiGroup measure stands at 57.5 where any reading above 50 indicates an expansion of activity.

- On Tuesday the Reserve Bank Board meets but no change in rate settings is expected – the 23rd month of unchanged rates.

- In terms of economic data on Tuesday, the latest weekly reading on consumer confidence is issued by Roy Morgan and ANZ. And the Australian Bureau of Statistics (ABS) releases the data on building approvals for May. This data refers to council approvals to build new homes. Monthly results can be volatile due to ‘lumpiness' of apartment approvals.

- On Wednesday, there is a raft of indicators or surveys to be released. Both AiGroup and

Commonwealth Bank release results of the surveys of purchasing managers in the services sector. The Federation Chamber of Automotive Industries releases the June sales data for new vehicles. And the ABS issues May data on retail trade and international trade (exports and imports).

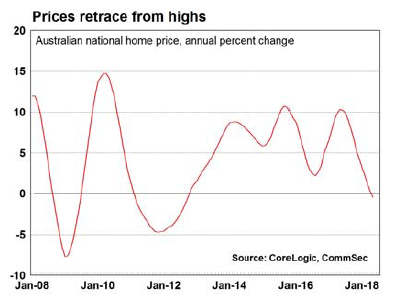

Commonwealth Bank release results of the surveys of purchasing managers in the services sector. The Federation Chamber of Automotive Industries releases the June sales data for new vehicles. And the ABS issues May data on retail trade and international trade (exports and imports). - Retail sales posted a healthy gain of 0.4 per cent in April but higher petrol prices and early mid-year sales would have had had contradictory effects on the May results. New vehicle sales over April and May were softer than a year ago but budding buyers may have just been awaiting the mid-year sales.

- On Thursday Alexandra Heath, the Head of Economic Analysis at the Reserve Bank, delivers a speech to the Urban Development Institute of Australia in Wollongong.

- On Friday AiGroup releases the purchasing manager survey results on the construction sector.

Overseas: investors await US jobs data

- Over the coming week the June data on non-farm payrolls (employment) in the US will be released together with survey results detailing activity in the manufacturing and services sectors.

- The week begins in China on Sunday when Caixin will release the results of a survey of purchasing managers active in the manufacturing sector. The equivalent gauge of the services sector is issued by Caixin on Tuesday.

- In the US, the week begins on Monday when the Institute of Supply Management (ISM) releases the monthly survey of purchasing managers in the manufacturing sector. On the same day, May data on construction spending is issued. Economists tip the ISM gauge to ease from 58.7 to 58.4 in June where any reading above 50 indicates expansion of the manufacturing sector.

- On Tuesday, US data on new auto sales is issued with the regular weekly data on chain store sales and monthly figures on factory orders.

- US markets are closed for the Independence Day holiday on Wednesday.

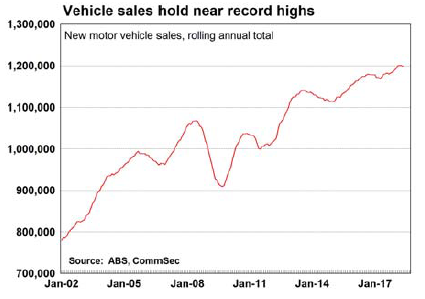

- On Thursday a backlog of data releases are scheduled. ISM releases the June results of the survey of purchasing managers active in the services sector. Challenger releases data on job cuts announced by US-based employers during June. Job cuts announced in May were the lowest in seven months. The ADP survey of private sector payrolls is also issued with analysts tipping a 175,000 lift in private jobs in June.

- Also on Thursday the May international trade data (exports and imports) is issued together with minutes of the last Federal Reserve meeting as well as the regular weekly data on new claims for unemployment insurance.

- On Friday arguably the most influential of the week's data releases is issued – the non-farm payrolls or monthly employment report. In May, 223,000 jobs were created and economists expect that another 188,000 jobs were created in June.

Craig James is the Chief Economist at CommSec

Share this article and show your support