How to become a millionaire by 30

It might not be an achievable goal for you, but it can be for your children or grandchildren.

And before you raise your eyebrows this is not an introduction to a new get rich quick scheme, meme stock or cryptocurrency.

It is a tried and tested investment strategy that requires discipline, commitment and leverages the power of time.

Our investment platform allows adults to invest on behalf of children and we’ve seen a huge spike in enquiries from parents and grandparents searching for ways to create wealth for their little ones.

It is understandable too; in a world where the cost of living continues to rise, they want to find ways to help their kids achieve financial independence or enter the property market without an eye watering amount of debt.

Now, onto this million-dollar investment…

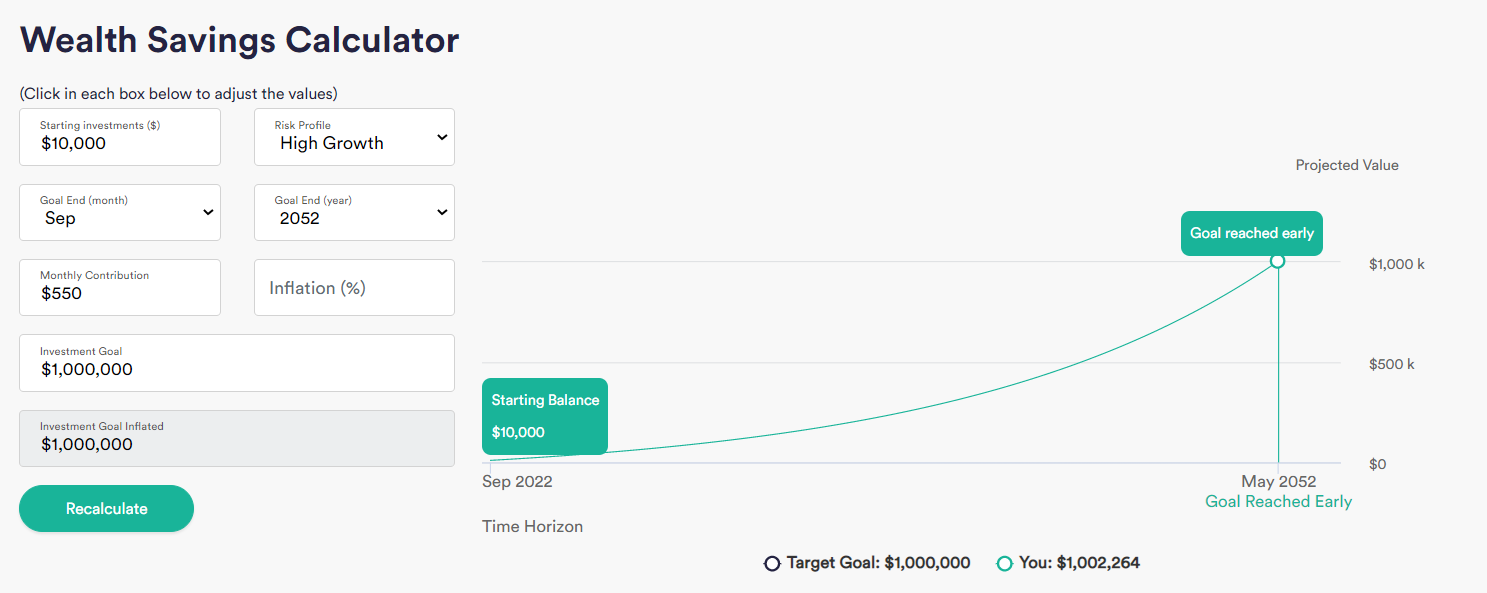

Using our Wealth Savings Calculator and a 20-year historical return, we can see that an investment of $10,000 in a High Growth Portfolio with contributions of $550 per month over a period of 30 years would have grown to $1,000,000 just ahead of time.

Of course, historical returns do not guarantee future performance and there are always costs involved with investing that may reduce profits over time.

We also understand that you may not be able to invest $10,000 for your kids, contribute as heavily and frequently or if your children are a little older have as much time on your side as the example above.

But here's the good news: the investment concepts apply regardless of the circumstances.

First, in general terms, any investment amount applied on a timeframe of five years or more is considered long-term and appropriate for a growth focused investment.

So, no matter whether your children are 5, 15 or 25 there is still time to invest.

Second, contributions of any amount and frequency can help compound your returns over time.

Helping you invest for your kids is one of the best parts of the job, so don’t hesitate to get in touch with any questions at invest@investsmart.com.au

Frequently Asked Questions about this Article…

You can help your children or grandchildren become millionaires by investing on their behalf using a disciplined and committed investment strategy. By leveraging the power of time and making regular contributions to a high-growth portfolio, you can significantly grow their wealth over the years.

No, this is not a get-rich-quick scheme. It is a tried and tested investment strategy that requires discipline and commitment, focusing on long-term growth rather than quick profits.

Time plays a crucial role in this investment strategy as it allows for the compounding of returns. The longer the investment period, the more potential there is for significant growth, making it ideal for long-term goals like helping your children or grandchildren become millionaires.

Yes, you can start with smaller amounts. Contributions of any amount and frequency can help compound your returns over time. The key is to start investing as early as possible and remain consistent with your contributions.

It's never too late to start investing for your children. Whether they are 5, 15, or 25, there is still time to invest. The important thing is to begin as soon as possible and focus on long-term growth.

The Wealth Savings Calculator helps you estimate the potential growth of your investments over time. By inputting your initial investment, monthly contributions, and expected return rate, you can see how your investment could grow, helping you plan effectively for your financial goals.

No, historical returns do not guarantee future performance. While past performance can provide insights, it's important to remember that investing always involves risks and costs that may affect future profits.

If you have any questions or need assistance with investing for your kids, feel free to reach out to us at invest@investsmart.com.au. We're here to help you navigate the investment process and achieve your financial goals.