Growth First model portfolio update

Summary: The Growth First model portfolio, largely composed of small caps, has outperformed during a declining market, with a total return of 9 per cent in its first three months. We can afford to wait and see if there is a more severe market sell-off before using the remaining cash. The portfolio has added a new position in DWS and trimmed its exposure to AMA and NetComm Wireless. |

Key take-out: The portfolio can continue to perform well from here in either a declining or an improving market. |

Key beneficiaries: General investors. Category: Small caps. |

Since the Growth First model portfolio started on July 1, it has achieved a total return of 9 per cent. Meanwhile, the S&P/ASX200 benchmark index is down 7.3 per cent. This 16 per cent outperformance was achieved despite the portfolio having 35-40 per cent cash during this first quarter (currently 37 per cent). If the portfolio was 100 per cent invested in the 11 stocks the return would be approximately 15 per cent.

Usually small caps are the worst performers in a market correction or times where fear is largely driving investment decisions. The fact that the largely small cap portfolio has been able to outperform to such a large degree in the declining market is especially pleasing.

Eight out of the eleven stocks are in positive territory, with Capitol Health (CAJ), ToxFree Solutions (TOX) and Qube logistics (QUB) being the detractors. I am still comfortable with all three of these. Especially Qube: the longer term opportunity from its Intermodal terminal in Moorebank is largely being ignored at current prices.

Capitol Health (CAJ) has been heavily sold off, due to fears around the review of the Medicare Benefits Schedule and its potential impacts on radiology funding. Further, competitor Integral Diagnostics is in the process of listing, and Australia's largest radiology group in I-MED is also considering a listing. It is always tough to pick the bottom, but the worst case for all of these fears is more than priced in to the CAJ share price.

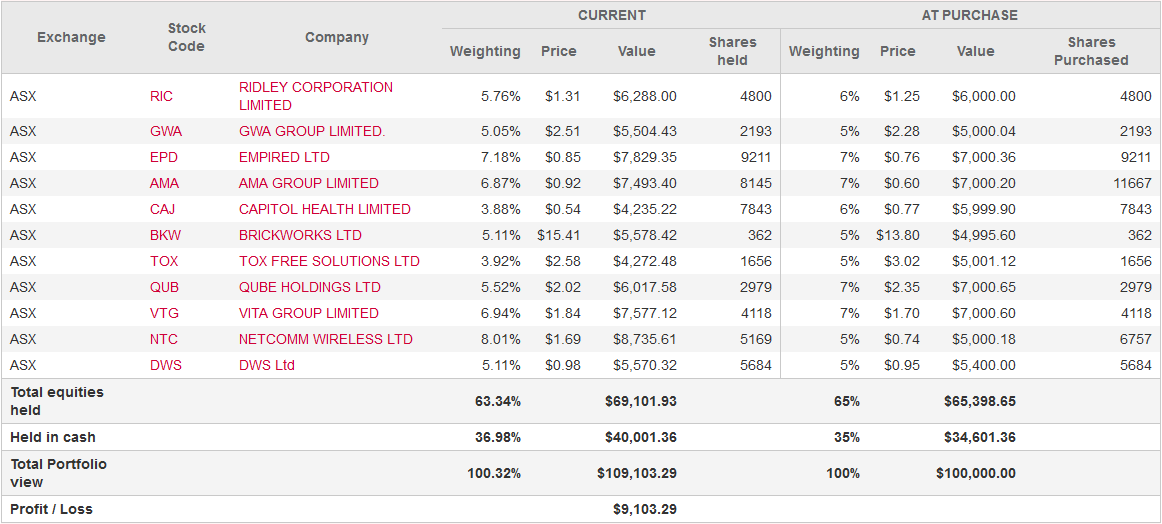

Growth First model portfolio, as at October 2.

Benefits of a high conviction portfolio

The outperformance in the first quarter from this portfolio shows the benefits of a high conviction portfolio that doesn't have restrictions of sector and index weightings. The energy and materials sectors have been decimated and it's a major advantage not having to be invested in these sectors. Similarly the major banks are down around 25 per cent and have had a major impact on any index tracking funds.

Market outlook

Although the market is down about 15 per cent from the near 6000 peak in April this year, generally speaking stocks are not at deeply discounted prices. The market PE multiple has come back from 18 to be in line with long-term averages at 14.

Further to this, small caps with strong outlooks have held up very well in the market sell-off. One of the reasons for this is small caps have under-performed in recent years, as larger cap stocks have seen very large PE re-ratings due to the relatively attractive pricing when compared with low bond rates.

Earlier in the year, many market participants were getting carried away with the view that record low bond rates wouldn't normalise and therefore investors could justify excessive PE ratios. The problem with this theory is that the low interest rate environment hasn't translated into higher economic growth like it has done in past cycles.

This lack of growth was particularly evident in the recent August reporting period, with the market earnings per share declining by 2 per cent, against expectations of 1 per cent growth.

There was a trend of companies not providing guidance due to too much uncertainty. Those that did provide guidance were generally lowering previous expectations.

The pockets of strength were from those that benefit from a lower Australian dollar, and sectors such as tourism, infrastructure, healthcare and non-bank financials.

Income vs growth

Although economic growth is weak, the other factor is that companies are not re-investing in their businesses. Instead they are bowing to market pressures for a higher proportion of earnings to be paid out as dividends. This trend has run its course with payout ratios at unsustainable levels, and companies needing to invest for growth or otherwise face the prospect of lower earnings and dividends in future years.

Part of the reason for the lack of investment is corporates generally haven't lowered their return hurdles despite the significant decline in cost of capital.

Share price gains in recent years have largely been growth from cost-outs, and earnings multiple re-ratings due to the low interest rate environment. Moving forward from here, share price gains are likely to require further evidence of growth.

Using the 37 per cent cash balance

Many of the best performing small caps achieve their gains on the back of specific industry situations under management's control. That is, macro concerns such as lower growth from China usually have little impact. These are the types of stocks we continue to look for and utilise our high cash balance.

Having said that, we think the portfolio is in a fortunate position, in that it can perform well from here in either a declining or an improving market. The high beta combination of stocks means that it can still outperform in an increasing market despite the large cash balance. With this in mind we can afford to wait and see if there is a more severe market sell-off before using the remaining cash.

With the macro environment likely to – as a minimum – cause further fear, and potentially have material impacts to company earnings, there is a realistic chance of further declines.

Re-weighting

Last week we re-weighted our two best performers in NetComm Wireless (NTC) and AMA Group (AMA), and used the proceeds for a new position in DWS Ltd (DWS).

We trimmed 2 percentage points from NetComm at $1.36 for it to have a 6.5 per cent position. But in the last few days it has increased a further 19 per cent to $1.62, and is already back up to a 7.7 per cent weighting. The stock is in profit 118 per cent since we added it to the portfolio at $0.74 in July. It is surging on expectations of potential contract wins including AT T (large global telco). This stock needs to be monitored closely, because the market is speculating on future contracts that may or may not occur. If the contracts are not announced by the end of the year then the share price will decline.

On September 21 we discussed that the contract would increase our valuation range from $1.65 - $3.10 (see NetComm surges ahead). AT T is proposing a rural NBN in the US similar to the rural NBN in Australia. The difference is that AT T's NBN will be available to be rolled out to 13 million homes, vs the 500-700k in Australia. As NTC is the only device maker that has supplied a developed nation rural NBN program, it is seen to have a competitive advantage. Further if NTC wins it, this will increase NTC's chances of other major contracts in the $80 billion global rural NBN opportunity.

Similarly with AMA we still believe there is further upside in the stock, but have just re-weighted it back from 10 per cent to 7 per cent. On September 14 we explained why the acquisition of Gemini de-risked the opportunity and increased the chances of achieving greater scale by acquisition of smaller panel shops (see AMA's transformation).

Introduction of DWS

We have a new 5 per cent position in IT services company DWS (DWS). The sector is very strong at the moment, with a host of corporate and government contracts being rolled out after years of under-spend. The cycle is flatter now, with less focus on up-front capex and more “as-a-service” annuity type work. But a number of the key listed IT services companies have adjusted well and the strength was clearly evident in the reporting season with IT just about being the standout sector.

As well as the strong industry conditions, DWS has begun a turnaround that has seen its staff numbers increase for the first time in three years. It has also broadened its customer base and capabilities through the acquisitions of Phoenix and Simplicity.

Share recommendations update

On July 13 this year I did a review of all the stocks I have initiated coverage on (see A better way to play small caps). At the time the average return was 15 per cent since December 19, 2013. Since this time the average return has increased to 26 per cent, despite the market declining in recent months.

Twelve out of the 19 stocks are in positive territory and three have profited by more than 150 per cent. With small caps it is especially critical to spread the exposure, as when you inevitably get one wrong the declines tend to be larger than a top 100 stock.

Stock | Original | Price at call | Current Price | Current | Return from original |

recommendation | recommendation | recommendation | |||

AMA | BUY | 0.3 | 0.915 | BUY | 205.0% |

NTC | BUY | 0.595 | 1.69 | HOLD | 184.0% |

VTG | BUY | 0.7 | 1.835 | HOLD | 162.1% |

RIC | BUY | 0.85 | 1.31 | BUY | 54.1% |

EPD | BUY | 0.575 | 0.845 | BUY | 47.0% |

CAJ | BUY | 0.42 | 0.535 | BUY | 27.4% |

GBI | SPEC BUY | 0.23 | 0.285 | SPEC BUY | 23.9% |

UXC | BUY | 1.05 | 1.3 | BUY | 23.8% |

BKW | BUY | 13.4 | 15.39 | BUY | 14.9% |

PSZ | BUY | 0.835 | 0.945 | BUY | 13.2% |

SDI | BUY | 0.54 | 0.59 | HOLD | 9.3% |

PTL | BUY | 0.45 | 0.48 | HOLD | 6.7% |

QUB | BUY | 2.35 | 2.01 | BUY | -14.5% |

MWR | BUY | 1.6 | 1.275 | BUY | -20.3% |

TOX | BUY | 3.27 | 2.59 | HOLD | -20.8% |

GLH | BUY | 0.55 | 0.27 | SELL | -50.9% |

CLX | BUY | 2.35 | 1.1 | HOLD | -53.2% |

AZV | BUY | 0.3 | 0.12 | HOLD | -60.0% |

EAX | BUY | 3.35 | 1.25 | HOLD | -62.7% |

488.9% | |||||

Average Return | 26% |