Finding perfect balance in 2016

Summary: Based on our predicted returns for various portfolio building blocks, a balanced portfolio should return an underlying 5 per cent in 2015. If you want to make changes to your asset allocation, start with rebalancing your portfolio by bringing offshore profits home to invest in local shares, looking to emerging markets and reexamining your percentage allocations for each sector. |

Key take out: Your portfolio construction should also take into account your own views on the key trends ahead, such as whether you believe interest rates will rise, your take on future inflation and beliefs about the performance of developing and emerging markets. |

Key beneficiaries: General investors. Category: Shares. |

Rebalancing is about taking profits in overweight assets and reinvesting in them in underweight assets so as to maintain your target allocation. Cash flows aside, this generally means selling what went up and buying what went down. While it sounds counter intuitive, many studies (see Get ready to rebalance, January 13, 2010) show this may add about 0.5 per cent to annual returns – and more importantly, it controls risk. Rebalancing is your starting point for what changes to make in your asset allocation.

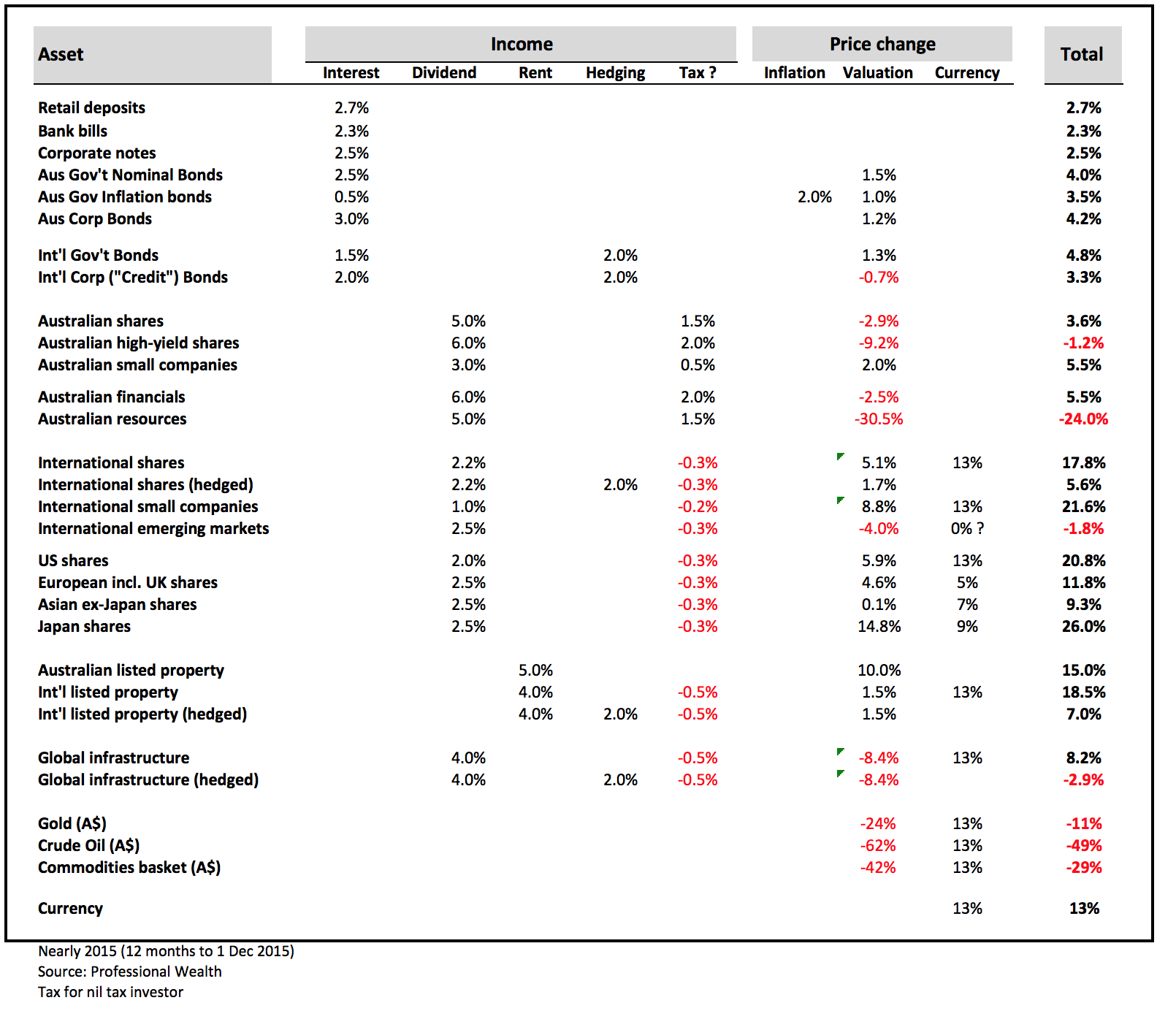

The below table summarises what should turn out to be close to the returns from various portfolio building blocks in calendar year 2015. These are based on 12 month returns to November 30 2015 (and after tax for nil-taxed investments like pension funds).

This leads to some challenging observations:

• The underlying interest income from quality bonds and cash is barely 3 per cent. Returns for bonds of 4 per cent were only achieved owing to small capital growth from falling yields, which at best will add nil to returns in 2016, but could take away 1 per cent if yields rise further than expected. Investors in offshore higher risk bonds were punished with a capital loss, which may make headlines in 2016 if this rout gets worse.

• The prices of large Australian companies fell, while small companies rose. Those seeking high yield gave up their extra income through greater price losses. Investors in resources were smashed.

• High yield bond substitutes, such as infrastructure assets, were hurt after the April call was made that rates are heading up (see From tailwinds to headwinds but I'm still in this market, August 12 2015). Listed property fared better but is on stretched valuations.

• Double digit returns from overseas shares were mainly driven by a 13 per cent fall in the Australian dollar.

• While the currency gains on offshore investments may sound satisfying, it only compensates you for your overseas holiday and one third of local purchases soon to cost more.

• Currency aside, developed market share prices were up by their long term expected about 5-6 per cent. Money printing in Japan boomed, Asia was flat and developing market companies slipped.

• Together this means a balanced portfolio may turn out to only earn about 7 per cent gross in 2015. Take away the illusionary currency effect; then it's about 6 per cent. Take away probably the last of the price gains from falling bond yields, you're left with an underlying 5 per cent return. These returns are the start of a coming “Investor Recession” I predicted earlier (Prepare for modest medium-term growth, January 23, 2013).

Taking these points into consideration when rebalancing with your asset allocation, you should:

• Take currency and valuation profits in overseas shares and bring that money home to invest in local shares. Increase your currency hedging.

• Reallocate profits from developed countries and reinvest them into developing/emerging markets. If you specially made profits in inflated Japanese shares, take them before they blow away.

• If you had a specific resource company percentage allocation, then you should be buying back more of them – happy to do so having taken profits in prior years as your percentage target was exceeded. You did right? If not, don't buy just because they're cheap.

• Reallocate between your “real” assets – trim profits in overpriced commercial property and buy more infrastructure assets with them.

After equally lukewarm returns, rebalancing doesn't give you a strong signal to reduce or buy equities – but maybe your view on future events will.

Forward thinking allocation

While most of the time I think rebalancing is a sensible discipline and your asset allocation shouldn't meander much, you might not agree. This is especially so if you have strong convictions about answers to the following trillion dollar questions:

Will offshore interest rates rise faster or slower than expected?

Most think rates will rise slowly and to a lower plateau level (PIMCO's so called “new normal” or “new neutral”).

In short, the consensus is say goodbye to 6 per cent yields from bonds for a while. Most SMSF investors don't bother with bonds – they are instead cash investors. While that robbed them of excess returns in recent years, I don't think it will hurt them in 2016. Unless you consider yourself a savvy bond investor, I'm inclined to suggest in 2016 you stay away from bonds and especially from high yield ones including hybrid securities. I don't think you'll miss much extra return and you might miss some negative surprises. If interest rates rise more sluggishly then I'll be wrong and it would be worthwhile to lock in using bonds.

Will inflation surprise?

In the movie The Usual Suspects, Kevin Spacey's character offers: “the greatest trick the devil ever pulled was to convince the world he didn't exist”. Perhaps Central Banks and indebted governments want you to think the same about inflation. The bond market isn't worried about inflation (nor movie villain Keyser Söze, whose wealth impact I liken inflation to).

Based on the difference in yields between like inflation-linked and fixed-rate bonds, you only need inflation to average over 1.8 per cent annually over the maturity of the bond, to be better off investing in them. In my opinion that means you can get inflation protection for free.

Other traditional inflation protecting assets for investors sadly are expensive, having been sought after for their yield and/or bought with ultra-cheap money (infrastructure and property). Inflation could arise from a tightening US job market and locally from a depleted dollar.

Are we overdue for a correction?

Yes – though in fairness I just wanted to say that so I could be one of those gurus who are quoted sometime later predicting an eventual share market correction. I believe the US market in particular has enjoyed a very long rally fuelled by low interest rates and it is entirely possible the market will correct and the ample supply of 'short' and robot - (algorithm-led) sellers will exacerbate that. I do think it reasonable to take profits in US shares to reduce that risk. If you agree, reallocate to other markets or set those funds aside for reinvesting.

Are Australian banks next to fall after resources, or will they just become income utilities?

After the disastrous falls in commodity prices, stocks and perhaps next their bonds, it is reasonable to ask what of our local banks? Currently Australian financials represent an unsafe 35-40 per cent proportion of our local share market. Index funds and index following managers do you a disservice not dealing with this. Uber forex, Uber lending and many other fintech businesses could easily eat away the oligopolistic profits of the major banks.

A property crash would do the same to their share prices. I think future profit and share growth is unlikely but so do I think are sustained falls. Perhaps bank shares and the broader Australian market needs to be viewed as income utilities especially while pension fund investors enjoy an insane 2 per cent lift in performance via franking credit refunds (see Dividends: From insane to ludicrous, October 21). You can't afford not to have a view on which way for bank shares.

Will the Australian dollar overshoot fair value?

Since the number one returning “asset” in 2015 was currency, it pays to have an answer to this question also. Earlier (see Dividends: From insane to ludicrous, October 21), I shared my views on how much of your equities you should have onshore and offshore and how much currency hedging to implement and how that should change with the level of the dollar. If you think the Australian dollar has more room to fall then hold off increasing your hedging and local reallocation a little longer.

Is it time for Asian and developing markets to deliver? and value stocks?

Emerging and developing market shares are trading on low P/E valuations and represent one of the few bargains today. Their portfolio value has also been hurt by falling currencies. I agree with rebalancing or redirecting more funds to them but I don't know how long until the payoff. Value stocks have also for many years underperformed growth stocks, and maybe also should be tilted to.

Unless you think Nobel Prize winner Eugene Fama should give back his award for discovering its long-term premium, I think you might also reallocate to them.

Where to with direct property?

You have to think direct property is certain to fall and by a lot, otherwise you probably have to have too much of it for your life stage to worry about answering this question, even if you could. This is because the very high transaction costs and lumpy nature of property make it impossible to make small asset allocation adjustments for most. I think the outlook for most residential property is sideways after many years of above wage inflation growth – and down if there is a large rise in unemployment. Pension and income seeking investors may become frustrated over time with low yields and may add to selling pressures to unlock past profits they can't eat. I wouldn't be looking to buy.

Will the government increase taxes?

Yes. But I doubt this will change much your asset allocation. However you probably shouldn't postpone making planned non-concessional contributions, managing your fund's tax history and/or starting a pension with your super.

May you have a safe and profitable investment year ahead.

Dr Douglas Turek is principal adviser with family wealth advisory and money management firm Professional Wealth (www.professionalwealth.com.au)