Ellerston Market Neutral Fund: Now for something completely different

Summary: The Ellerston Australian Market Neutral Fund (APIR: ECL0013AU) has returned over 10 per cent in each calendar year since inception. The fund employs a market neutral strategy, using a three stage quantitative analysis to pair like companies and take long and short positions, so as to target an absolute return. |

Key take out: Market neutral strategies fit the bill for investors who want to preserve their capital, with the opportunity to benefit from both rising and falling share prices. |

Key beneficiaries: General investors. Category: Managed funds. |

Market neutral

To start this year, we brought you our pick of international managed funds - IFP Global Franchise Fund, BT European Wholesale Shares Fund and Magellan Global, and today we turn our attention to a manager that employ strategies to profit in both rising and falling markets: The Ellerston Australian Market Neutral Fund (ECL0013AU).

Market neutral is an investment strategy that requires the fund to have long and short positions of companies within the same sector. By holding a company long, profit is generated when prices rise, and while being short profit is earned when prices fall. Taking a position on both rising and falling prices allows the fund to target an absolute return instead of being a slave to wider market conditions.

In the most basic example, to achieve a market neutral position the fund would go long $1,000 in ABC Airline and short $1,000 XYZ Airline. The net position would be a zero per cent exposure to the airline sector, and the overall market.

Financial markets are facing a never ending list of risks - sinking commodity prices, aggressively loose monetary policy in the developed world and China's debt problems just to name a few. The appeal of a traditional market neutral strategy is its aim to eliminate the systemic risk of the market by getting the beta of the portfolio close to zero.

In addition to this, a market neutral fund also has more opportunity to create an active return than a long-only manager. When a fund goes short a company it has effectively borrowed the security from a broker and is betting on a price decline so it can be bought back at a lower price than it was loaned at. This means a $1 investment goes a long way - it can be invested as $1 long and $1 short (because you are in effect “borrowing”).

While a market neutral strategy is relatively new to local investors, it's a popular type of investment in US and Europe especially among those investors who want a fund that is more adept at capital preservation than a long-only strategy.

Investment Strategy

There are two separate strategies pursued by the Ellerston Australian Market Neutral Fund.

The first is a relative value, which involves executing a pair trade by taking a long position in one company and a short in another within the same industry. A pair example would be Qantas and Virgin because they are both airlines, with similar businesses. The fund's ability to be both long and short achieves a market neutral position.

It sounds simple, but it involves finding companies that are relatively similar. For this reason, REITs are the most favoured sector of the fund to execute a market neutral strategy.

Finding pairs to trade is the end result of a rigorous 3-step process:

1. The process starts with a quantitative screen used to narrow down a universe of 1,300 pairs to around 50.

2. Qualitative analysis is employed to explain why the 50 pairs appeared in the first step. Generally there are around 10 relationships that can't be explained and these progress to the final stage.

3. The fundamental overlay step identifies 1 to 2 pairs to be traded.

The second strategy is considered “special situations” by the fund, which includes taking a position in a company based on potential takeover targets, placements and initial public offerings.

Opportunities are identified by the 21-members investment team which is separated into areas of expertise across local large cap and small cap, as well as globally. With the focus on capital preservation, the fund is looking for ideas that come with minimal downside risk and on average the fund only dedicates around 20 per cent of the portfolio to this strategy.

To protect against the downside of a special situation, the fund can be long an index through a “put option”, which would turn into a profitable trade if the market fell below the strike price. This type of strategy allows the fund to profit in unfavourable market conditions, while offering a degree of capital preservation not ordinarily afforded to a fund that can't use derivatives.

Shorting bias

In Australia, the practice of shorting companies has been given a bad reputation at times. A case in point would be those investors that shorted JB Hi-Fi and had to close out their positions for large losses when the share price only climbed higher.

The shorting undertaken in a market neutral strategy is done in a very different context. The fund isn't waiting for consumer spending to fall off a cliff or a strong Australian dollar to put Australian retailers out of business. Instead, it's basing its decisions on how the share prices of two companies move in relation to one another, over an average period of 20 trading days. Macroeconomic trends and competitive advantages don't come into it like they might with an ordinary short.

Performance and objectives

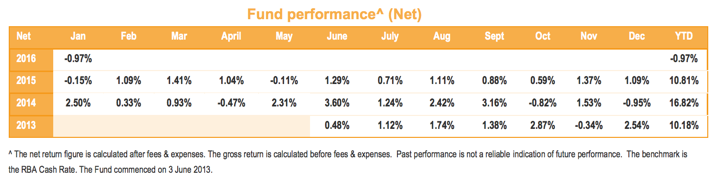

Since inception, the Ellerston Australian Market Neutral Strategy has returned over 10 per cent in each calendar year. As the fund can only own securities listed in Australia and New Zealand, all returns have been generated in these markets.

The return objective of the fund is 5 per cent over the RBA cash rate. A benchmark of cash takes into account that under a market neutral strategy, the fund has a share market exposure of close to zero with the only market risk obtained through special situation opportunities.

With around 80 relative value positions, the fund isn't banking only a handful of pair trades to be deliver the goods but rather small incremental profits from each trade. It's also another way to manage the risk of the portfolio, with the aim to preserve capital in all market conditions.

Considering the complexity of a market neutral strategy, a fee of 1.20 per cent is very competitive. Management is also incentivised to achieve the return objective by receiving 20 per cent of the performance above this measure.

Why market neutral?

The main appeal of a market neutral strategy lies in the ability for the fund to post a positive return, even when share markets are tanking.

1. Having both long and short positions, the fund has potential to profit from both rising and falling share prices. In the case of falling prices it is ideal the short position would suffer a greater price fall (for a gain) that the company held long. When this holds a market neutral strategy can be an effective way to preserve investor capital, while still collecting a positive return.

2. A market neutral strategy has the potential to have lower volatility than a long-only fund. Much of this can be attributed to the fact the relative value trades the fund prefers come from lower beta companies – telcos, utilities and REITs for example.

Until the end of January, since inception to volatility of the fund has been 3.7 per cent compared to 12.1 per cent of the ASX 200 index.

3. Usually the returns of a market neutral strategy are quite unrelated to the underlying securities held. The correlation of the Ellerston Australian Market Neutral Fund with the ASX 200 accumulation index is -0.16. Statistically, we can say its performance has virtually no relationship to the local market.

Adding a fund that has close to zero correlation with Australian shares should lead to lower volatility of an entire portfolio - something many self-directed investors would appreciate in current market conditions.

4. Unlike a traditional long only fund manager, a market neutral fund isn't looking for companies with a competitive advantage or good free cash flow because the reason for buying and selling is different. Basing decisions on relationships between two companies allows the fund to ignore the direction of the wider market.

While sharp highs and lows of share markets can be distressing for investors, this particular strategy can exploit opportunities when volatility within a sector is high.

Your portfolio

Australians have been conditioned to believe owning shares is the only way to achieve prosperity. But as chief investment officers from leading super funds begin to revise down member expectations on returns having a fund that earns return by exploiting the highs and lows of share markets could be beneficial. For those wanting to focus a portion of their portfolio on capital preservation, a market neutral strategy fund fits the bill. But be aware that returns will be decidedly different to major share market indices, which is a bonus when share markets are falling but could mean missing some upside in more buoyant conditions.