Australia's three largest bond ETFs

Happy New Year, I hope 2020 will be a great year for you and your investments.

Low term deposit rates have forced investors to seek income elsewhere and bond ETFs have been big winners with an inflow in the hundreds of millions in 2019.

According to the ASX, there are 17 Australian and eight global fixed income ETFs, although these numbers do not include multi-asset ETFs that may also include allocations to bonds.

I thought it would be interesting to compare the top three to see what they invest in, the level of risk they are taking, historic returns and forward projections.

The Vanguard Australian Fixed Interest Index ETF (ASX:VAF) is the largest with $1.315 billion in funds under management, closely followed by iShares Core Composite Bond ETF (ASX:IAF) holding $1.111 billion with Betashares Australian Bank Senior Floating Rate Bond ETF (ASX:QPON) taking third place with $758 million. Together they have over $3 billion in funds under management.

Summary of the three funds

.png)

Source: Company websites

Note: Reporting periods vary slightly, some figures are to 30 November 2019

Government bond ETFs - IAF and VAF

The VAF and the IAF are alike. Both predominantly invest in government bonds and started in 2012 so the funds have shown similar performance. Do you remember what the cash rate was in 2012? It started the year at 4.25 per cent, then was cut by 50 basis points (100 basis points = 1 per cent) in May and subsequently cut another three times to finish the year on 3.00 per cent.

Since 2012, interest rates have continued to fall. Falling interest rates are fantastic for fixed-rate bonds. They keep paying the same fixed interest rate, but the prices of the bonds rise, so that effectively reduces the returns to be comparable with market expectations.

IAF and VAF have very high allocations to fixed-rate government bonds and would have started investing in 2012. Buying long term bonds (that can be 20 years until maturity) with fixed rates of 4 per cent per annum has been a very successful strategy. Further, in 2019 we had three cash rate cuts, again pushing fixed-rate bond prices higher and resulting in total returns of 7 per cent plus for these funds – an outstanding result.

But, that doesn’t mean the funds will be able to repeat the gains this year. Much depends on what happens with interest rates. Positively, the ‘running yield’ of both funds - the expected income for the coming 12 months, is over 3 per cent per annum, an excellent yield on a very low-risk investment.

Going one step further and assessing the maturity profile of the bonds can help you decide on whether to invest. For example, the IAF maturity profile shows that 16 per cent are due to mature in less than two years but more than 50 per cent of the bonds mature in more than five years, helping to sustain the running yield.

However, if you are a hold to maturity investor, you need to look closer. The ‘yield to maturity’ provides a much better indication of returns over the longer term. The yield to maturity for both funds is close to 1 per cent per annum.

The other risk to performance is rising interest rates. If the market expects interest rates to rise, the price of fixed-rate government bonds will fall and put pressure on annual performance. Rapidly rising interest rates could see negative returns.

Senior bank bond ETF - QPON

QPON has important differences that make it worth considering. Importantly, for income-focused investors, it pays monthly while IAF and VAF pay quarterly. While IAF and VAF invest in fixed-rate bonds, QPON invests in floating-rate bonds.

Floating rate bonds pay interest that is tied to a benchmark, typically the Bank Bill Swap Rate. As the benchmark goes up and down, so does the interest payable to investors. This greatly reduces interest rate risk and makes the prices of the bonds much more stable. Returns are more closely aligned with interest payable on the bonds. This reduces the chance of outperforming but also greatly reduces the chance of negative annual returns.

A rising interest rate environment will see income rise, but the opposite is also true. The expected direction of interest rates matters and much will already be factored into the market, but if there are unexpected cash rate cuts this year, income will fall.

QPON is newer than IAF and VAF and only began operating in June 2017. It invests in fewer bonds and while bank bonds are low risk, they are higher risk than government bonds according to credit rating agencies. The average credit rating of the fund is A , which suggests a strong defensive investment, but not as strong as IAF and VAF.

The running yield is lower as you would expect with floating rate instruments in this environment, but yield to maturity at 1.64 per cent is higher and has the capacity to improve if interest rates begin to rise. Investors looking for an investment that does not need monitoring would be better investing in QPON compared to IAF and VAF.

Descriptions and Top 10 holdings

1. Betashares Australian Bank Senior Floating Rate Bond ETF (QPON)

Betashares is an Australian company with $9.5 billion in funds under management as at 31 December 2019. The company is owned and managed by its Australian based management team along with a strategic shareholding from Mirae Asset Global Investment Group, one of Asia’s largest asset management firms. As at September 2019, Mirae manages over US$135 billion.

2. iShares Core Composite Bond ETF (IAF)

The iShares brand is owned by one of the world’s leaders in ETFs – Blackrock.

Blackrock is a global investment manager with 70 offices in 30 countries. It has USD6.52 trillion in assets under management.

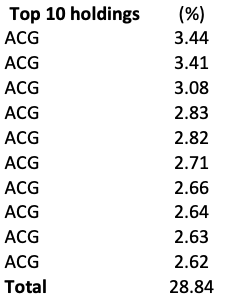

All of IAF’s Top 10 holdings are in specific Australian Commonwealth Government bonds. Details about the maturity dates of the bonds would have provided better insight but were not listed on the fact sheet.

Note: ACG - Australian Commonwealth Government

3. Vanguard Australian Fixed Interest Index ETF (VAF)

Vanguard commenced operations in 1975 and now has AUD8.4 trillion in funds under-investment. It has more than 400 funds available, roughly half in the US and the rest outside.

The Vanguard Group is owned by Vanguard's U.S.-domiciled funds and ETFs. Those funds, in turn, are owned by their investors. The mutual structure aligns its interests with those of its investors.

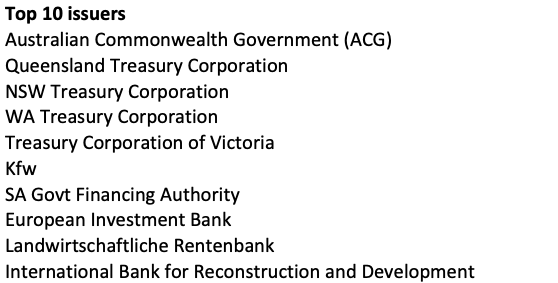

VAF does not provide details of specific bonds, rather it lists the top 10 issuers of the bonds. It states that investment in the Top 10 equals 80.4 per cent of net assets.

IAF is held in the InvestSMART Diversified Portfolios and QPON is held in the InvestSMART Interest Income portfolio. These portfolios are in the InvestSMART Capped Fee range.

Frequently Asked Questions about this Article…

The largest bond ETFs in Australia are the Vanguard Australian Fixed Interest Index ETF (ASX:VAF), iShares Core Composite Bond ETF (ASX:IAF), and Betashares Australian Bank Senior Floating Rate Bond ETF (ASX:QPON). Together, they manage over $3 billion in funds.

Bond ETFs have gained popularity due to low term deposit rates, prompting investors to seek alternative income sources. In 2019, bond ETFs saw inflows in the hundreds of millions as they offer attractive yields and relatively low risk.

Government bond ETFs like VAF and IAF perform well in a falling interest rate environment because fixed-rate bonds maintain their interest payments while their prices rise, leading to higher total returns.

Fixed-rate bond ETFs, like VAF and IAF, invest in bonds with set interest rates, which can benefit from falling interest rates. Floating-rate bond ETFs, like QPON, have interest payments tied to a benchmark rate, reducing interest rate risk and providing more stable returns.

The main risks include interest rate changes, which can affect bond prices and returns. Rising interest rates can lead to negative returns for fixed-rate bond ETFs, while floating-rate bond ETFs may see income fluctuations based on rate changes.

The maturity profile impacts the yield and risk of bond ETFs. Longer maturity bonds can sustain yields over time, but investors should consider the yield to maturity for a better indication of long-term returns.

QPON offers monthly income payments and invests in floating-rate bonds, which reduces interest rate risk and provides stable returns. It is suitable for investors seeking a low-maintenance investment with potential for income growth if interest rates rise.

The largest bond ETFs in Australia are managed by well-known investment firms: Vanguard manages VAF, Blackrock manages IAF through its iShares brand, and Betashares manages QPON.