All is not equal in equal weight ETFs

The theory behind equal weight exchange-traded funds is pretty simple, but in practice the funds can run askew. A quick look at two offerings shows how two similar-sounding ETFs can be very different.

The two ETFs are the UBS IQ Morningstar Australia Quality ETF and the Market Vectors Australian Equal Weight ETF.

The Market Vectors fund, with the ASX code MVW, tracks “the performance of the largest and most liquid ASX-listed companies across all sectors”, to quote the provider’s website.

Companies in the index are weighted equally.

The UBS fund, with ASX code ETF, has only recently changed strategy from tracking stocks that were “UBS Research Preferred” to following the Morningstar Australia Moat Focus Index, “a rules-based, equal-weighted index intended to offer exposure to quality companies that [investment research firm] Morningstar determines have sustainable competitive advantages”, according to UBS.

The Morningstar strategy basically seeks out companies whose share prices are below what it feels is fair value, based on its expectations of future earnings.

HOW EQUAL-WEIGHT WORKS

The equal-weight strategy should boost things along, the theory being that overvalued stocks will not be favoured over undervalued stocks.

Indices are usually constructed using a “market cap” methodology where weightings to stocks are determined by each constituent company’s market capitalisation, being the share price multiplied by the number of shares on issue. If the largest company in the index is worth 10% the value of the entire index, for instance, then 10% of funds will be invested in its shares. With an equal-weight strategy each stock is apportioned the same amount, the thinking being that outperformance will be achieved as prices approach long-term averages. So the expensive ones will become cheaper (but that’s OK because they will be relatively underweight) and the cheap ones will become more expensive (which is fine because they will be relatively overweight).*

OFF BALANCE

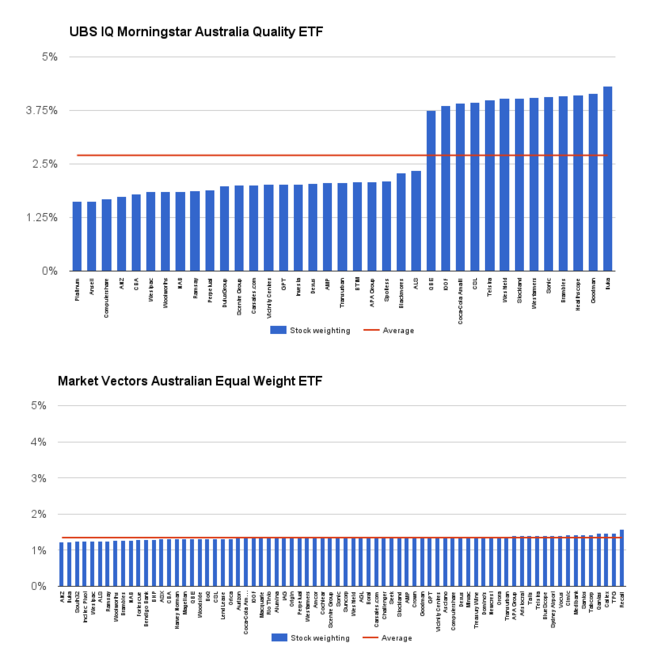

Equal weight portfolios don’t stay equal for long, of course. Share price movements mean that weightings are constantly drifting. The charts show the portfolio weightings for both ETFs at April 4. Where the difference between the largest and smallest weighting is 0.34 percentage points for MVW, the biggest and smallest holdings in the UBS fund are 2.69 percentage points apart. That’s a lot of drift.

WATCH OUT FOR OVERLAP

With both funds picking stocks from the same pool it’s reasonable to expect some overlap, and the two ETFs hold 29 stocks in common (but obviously at different weights). The UBS fund holds 37 stocks in total (so 29 stocks is a big overlap) and the Market Vectors fund holds 74.

If you bought the Market Vectors fund you would hold 81% of the UBS fund (by share of invested funds), and if you bought the UBS fund you’d get 38% of the Market Vectors fund.

Both funds charge roughly the same fees: MVW costs 0.35% and ETF costs 0.30%.

THE VERDICT

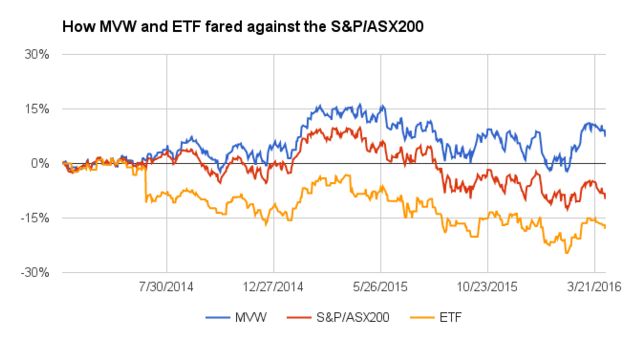

A comparison of the two ETFs since MVW was launched in March 2014 shows how different their paths have been (the UBS fund was launched about 16 months earlier). MVW has outperformed the S&P/ASX200 index comfortably, while ETF has struggled to recover from a sharp loss around the middle of 2014. We’ll have to come back in a year or so to see if UBS’s flip from tracking the stock picks of its own research department to using Morningstar’s “wide moat” strategy has paid off, but in the meantime a 23 percentage point gap in outcomes over 25 months is impossible to ignore.

DIG A LITTLE

ETFs have become popular with retail investors simply because they offer a cheap and easy way to diversify and cut risk. Providers have been busy and the menu of ETFs offered on the ASX has doubled over the past couple of years — and we can expect more growth. In the US trade of ETFs accounts for about 30% of market volume whereas in Australia they make up between 5% and 6% of trade on the local exchange.

The task of picking a fund isn’t easy, however, as this example shows. The MVW fund follows a different stock-picking strategy to UBS’s ETF but if you buy MVW you get more than 80% of ETF anyway. Also, MVW appears to hold to the equal-weight policy whereas ETF has let things drift. Lastly, just look at the difference in returns.

A COMMERCIAL REALITY

Investors are lucky in that the ETF providers’ online portals are deep with information on how the funds work. ETFs get a big tick for transparency. But time is the big decider — it reveals all the cracks. Two products might look vaguely alike but you can bet there’ll be some strategy tweak in one of them, engineered to stand out in the marketing, that will either make it or break as the years pass. UBS’s strategy flip in February could be great news, and we hope it is, because ETF sure has given investors a lousy run.

* A mathematical proof of the equal weight strategy can be found here, if that’s your kind of thing.

Frequently Asked Questions about this Article…

An equal weight ETF is a type of exchange-traded fund where each stock in the index is given the same weight, regardless of the company's market capitalization. This strategy aims to balance out the influence of overvalued and undervalued stocks, potentially leading to better long-term performance as stock prices adjust.

The UBS IQ Morningstar Australia Quality ETF follows the Morningstar Australia Moat Focus Index, targeting quality companies with sustainable competitive advantages. In contrast, the Market Vectors Australian Equal Weight ETF tracks the largest and most liquid ASX-listed companies across all sectors, maintaining equal weightings for each stock.

Equal weight ETFs can drift from their balanced state due to share price movements. As stock prices fluctuate, the equal weightings initially set can change, leading to differences in the portfolio's weightings over time.

Both the UBS IQ Morningstar Australia Quality ETF and the Market Vectors Australian Equal Weight ETF charge similar fees. The Market Vectors ETF costs 0.35%, while the UBS ETF costs 0.30%.

Since its launch, the Market Vectors ETF has outperformed the S&P/ASX200 index, while the UBS ETF has struggled, particularly after a sharp loss in mid-2014. The performance gap between the two ETFs over 25 months was 23 percentage points.

Investors should consider the different stock-picking strategies, the degree of overlap in holdings, and historical performance. The Market Vectors ETF adheres more strictly to the equal-weight policy, while the UBS ETF has experienced more drift.

ETFs are popular because they offer a cost-effective and straightforward way to diversify investments and reduce risk. They are transparent, with providers offering detailed information on how the funds operate.

The UBS ETF recently shifted from tracking UBS Research Preferred stocks to following the Morningstar Australia Moat Focus Index. This change aims to focus on quality companies with sustainable competitive advantages, which could potentially improve performance.