Super Trends at Work Amid Long Bull Run

Written by Alexandra Cain, InvestSMART's Chief Marketing Strategist Evan Lucas discusses how the US market is in the longest bull run of its history. The following article appeared in the Australian Financial Review on Thursday, 20 September 2018.

Local and overseas equities markets are running hot, which is a double-edged sword for high net worth investors.

At this part of the market cycle some take the opportunity to realise gains. But the risk is they will lose out on further profits before the market reaches its peak.

Experts have a range of views about how markets are likely to play out for the remainder of the year.

Evan Lucas, chief market strategist at InvestSMART, observes US markets are in the longest bull run in their 153-year listing history.

Julia Lee, equities strategist at Bell Direct, notes August was the fifth consecutive month of gains for the Australian market. "it's the longest run of monthly lifts since 2009, fuelled by strong global growth, particularly from the US."

Lee says the global economy is in a phase of rising inflation and rising growth, which is great for equities but not so great for bonds.

"This part of the cycle is frequently labelled late. The global economy has been here before and we can look to history for guidance. Generally this phase sees healthcare, staples and energy outperform and we have seen this once again play out in 2018."

What goes up can come down and some experts caution against expecting current market conditions will continue to prevail.

"While we see global growth remaining strong near term, the combination of rising trade tensions between the US and China, high [equities] valuations and the return of volatility has tempered our positioning," says Nathan Lim, head of wealth management research at Morgan Stanley, who has tilted his portfolio accordingly.

"We recently reduced our equity allocation to neutral and added more allocation to neutral and added more weight to the fixed income portion of our portfolios," he says.

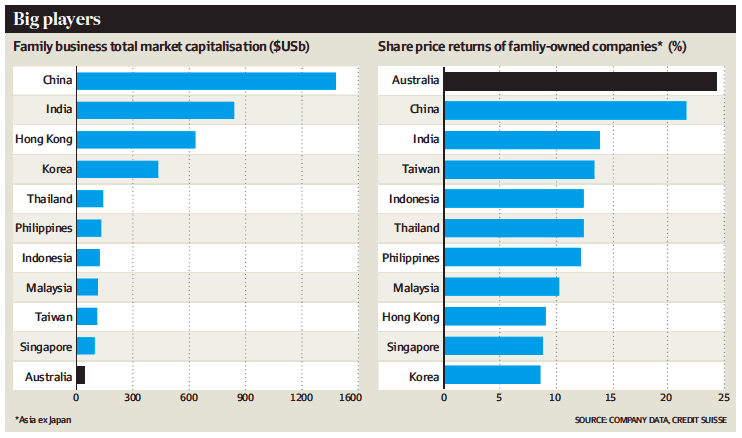

Some high net worth individuals are part of family businesses. Credit Suisse has released its Global Research Institute Family 1000 report, which showed Australian-listed family-owned companies outpaced others in the region, managing a 24.2 per cent annual average share price return since 2006.

Head of private banking at Credit Suisse Michael Marr says that global research indicates financial performance of family-owned companies is superior to that of non-family owned businesses.

BT Private Wealth's chief investment director, George Toubia, takes the view that global markets are undergoing an adjustment.

"This is being driven by a shift from an environment of broad reflation across asset markets, with less attractive valuations compared to a few years ago for equities, credit and real estate."

Toubia expects the European Central Bank's moves to unwind quantitative easing next year will play out in markets.

"This will likely result in higher yields, with additional focus on Italy given the slow level of progress in its debt challenges. This is expected to be a source of short-term pressure on markets, especially for assets that are fully priced and have lower positive fundamental potential," he says.

Many analysts remain bullish.

JBW investment strategist Nick Ryder is one of them.

"We think equity markets can continue to rise in the medium term and bond yields will also rise modestly, keeping bond market returns subdued," he says.

Andrew McAuley, CIO for Credit Suisse Australia, private banking, says "though we are in the late staged of a bull run we remain cautiously optimistic on global markets".

Credit Suisse is recommending well-diversified solutions for its sophisticated clients as one of its key strategies. It also notes there are a number of so-called super trends at work.

These include the values on Millennials around sustainability and clean energy. Another theme is closing the infrastructure gap in transportation, water, energy and affordable housing.

Cheuk Wan Fan, head of investment strategy and advisory, Asia, HSBS Private Banking, says: "We see no imminent signs of a global recession."

Investors have a number of challenging choices at the moment while markets remain buoyant and equities are strong.

When it comes to locking in gains, Manny Pohl, chairman and CIO of ECP Asset Management, says investors have two options: sell the shares and realise the gains or take out insurance using derivatives.

"These decisions come with a cost: in the case of the derivative, it's the price to cover the exposure, which is expensive. In the case of a sale, the cost is the tax on the gain, brokerage on the trade and the opportunity cost of the shares continuing to increase."

Ryder says there is a number of potential strategies for investors looking to protect their portfolios. One is to rebalance portfolios to include more defensive, income-paying equities such as REITs, utilities, infrastructure, healthcare, consumer staples and telecommunications shares, which have historically performed better during recessions.

"Another path may be to increase exposure to alternative investments such as managed funds that invest in unlisted real assets and private equity or invest in funds that adopt a short-term trading or long-short equity investment style that are expected to outperform in an equity downturn or period of elevated market volatility."

Another option is to increase exposure to longer-dated government bonds as safe-haven bonds typically do well in an equity market pullback and provide portfolio insurance at a small cost in terms of overall yield.

It is easy to ignore risks when markets are hot, but investors do so at their peril. "Taking a short-term view, geopolitical risk is high," says Lucas, who adds, "the US-China trade war is entering a new phase, and emerging markets are facing payment risks, capital outflows and US debt-denoted debt tightening.

"World oil prices are creating inflation risk and developed markets are showing signs of slowing. These macroeconomic factors could impinge on equity markets over the coming 12 months."

Lucas says one way to mitigate these factors is to smoothe out overexposures. "If volatility were to increase, maintaining a diversified portfolio across a range of asset classes will provide a level of protection if one or more of these asset classes fall in the short term."

Stuart Fechner, director, research relationships with Bennelong Funds Management, cautions investors about relying on the index to deliver the same good returns over the coming few years as it has in the past few. "This sort of complacency could see a portfolio come unstuck."

To counterbalance this, Fechner suggests investors look for actively manages funds and strategies that have the flexibility to move away from index positions and protect capital should the need arise.

"It would be prudent to review changes made to an investor's portfolio on the back of the low interest rate environment. It is important to review the portfolio if low rates from more defensive, fixed income asset classes have not met investor needs and they moved up the risk spectrum to seek higher returns.

"Not all fixed income assets are the same and, while a basic asset allocation sense a portfolio may look the same, underneath the bonnet it may not be,"

For instance, across the fixed income asset class, government bonds, lower grade corporate bonds, short-duration fixed income assets and longer duration fixed income assets have very different associated risks.

"If we are moving into a different interest rate environment over the next few years, it's important to assess whether the same fixed income strategy is going to serve you well in a different environment."

Frequently Asked Questions about this Article…

Evan Lucas from InvestSMART notes that the US market is experiencing the longest bull run in its 153-year history, which presents both opportunities and risks for investors.

According to Julia Lee from Bell Direct, the Australian market has seen five consecutive months of gains, marking the longest run of monthly lifts since 2009, driven by strong global growth, especially from the US.

In the current phase of rising inflation and growth, sectors like healthcare, staples, and energy are expected to outperform, as observed in 2018.

Investors can consider rebalancing their portfolios to include more defensive equities, increasing exposure to alternative investments, or investing in longer-dated government bonds to provide portfolio insurance.

Experts warn of risks such as rising trade tensions between the US and China, high equity valuations, and the return of volatility, which could impact market conditions.

Research from Credit Suisse indicates that family-owned companies tend to outperform non-family-owned businesses, with Australian-listed family-owned companies achieving a 24.2% annual average share price return since 2006.

Key 'super trends' include the focus on sustainability and clean energy by Millennials, and the need to close infrastructure gaps in transportation, water, energy, and affordable housing.

As we potentially move into a different interest rate environment, it's crucial to assess whether existing fixed income strategies will continue to meet investor needs, given the varying risks associated with different fixed income assets.