Giving up on Dick Smith

Taking the hit on DSH

The investment thesis for our initial buy call and coverage of Dick Smith Holdings (DSH) has not delivered, as the company management has failed to deliver on profit guidance. In light of this I am ceasing coverage of DSH as an income investment with a sell call, and intend to sell the stock from the Income First model portfolio using the open price tomorrow (December 1).

Essentially, the risk and potential return profile of the company has changed to an extent that the stock no longer meets the objectives of the portfolio as set out at inception (to read more on the portfolio's initial objectives, see Introducing our Income First model portfolio, July 20).

What has changed?

DSH has announced to the market a write down to inventory balances and indicated that sales remained weak through November. This has led to an inability to provide clarity on profit expectations for FY16, and as a result, we believe it is time to give up and move on, taking a significant loss in the Income First model portfolio.

Trade (sales) remained weak in November, following on from what I believe was a disastrous October. Given that this Christmas period is going to be a high stakes few weeks for DSH, the risks associated with the business are now of a level that makes investment in the stock speculative in nature.

Given the weak trade DSH is writing down its inventory balance by $60 million. This is a result of poor sales and nothing else. I mentioned in a recent report (Dick Smith disappoints, October 28) that the concerns I had were that the weakness appears to be caused by poor product mix, and advertising strategy – the bread and butter of retailing. With the quantum of this write down exceeding my expectations, it appears that DSH has blown a significant hole in the company.

With the write down DSH now claims it does not have sufficient certainty to provide the market with profit guidance. As such, I do not have any visibility on the company's dividend, or any certainty that one will even be paid. Given that the company was covered by me as a strong income play, I believe it is prudent to cease coverage of the business, noting that it is no longer suitable for the Income First model portfolio.

So what should investors do now?

The DSH share price has been hammered. It is trading near 30c at the time of writing. This, on the face of it, would appear to show a reasonable level of value.

The flip side to this is the risk profile. I think that the risk profile involved in this stock is no longer appropriate for income focused investors. Certainly, the Income First model portfolio will be taking the loss and moving on.

However, for those investors in DSH who may like to take additional risks, there is an argument that suggests the company is trading at levels that are so depressed that value is apparent. While this is undoubtedly true, the market is valuing in the potential for the company to breach debt covenants, and ultimately fail. With the size of the recent inventory write downs, and the poor levels of trading, my view is that anything is possible.

Lessons learned

Were there any early indicators that this company was sick?

In hindsight, the company could be described as having been in a vulnerable position. By this I mean that the cashflow from operations was weak in FY15, as was the cash balance. DSH management flagged this to the market very early as being caused by some strategic early inventory purchases that were made to take advantage of US dollar strength. This seemed at the time to be a perfectly acceptable explanation, and I was under the impression that this high inventory balance would unwind through stronger sales and produce additional operating cash flow. The credibility of this scenario was reflected in two ways:

- Firstly the cash flow and inventory blowout was flagged early, suggesting a purposeful strategy.

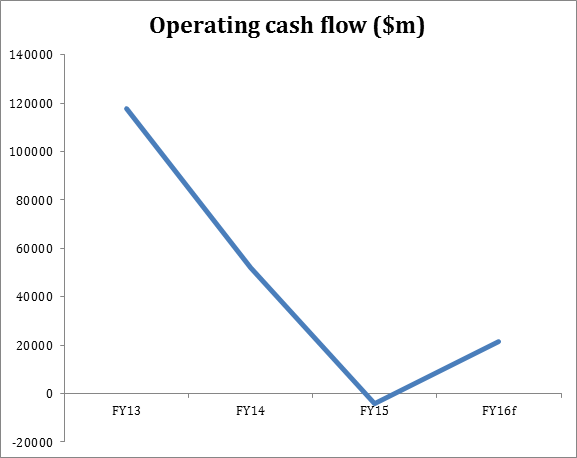

- Secondly, the company's cash flow and working capital changes had a history of volatility due to timing. There will now be a significant write down to the balance sheet instead of any working capital unwind, meaning that cash flow certainty has entirely evaporated. Here is DSH's operating cash flow over the last few years, and as can be seen even now, my forecasts are expecting a trend change – if the trend continued, the business could be in real trouble:

Perhaps the most valuable lesson to be learnt here is that operating cash flow is king. Regardless of management explanations for a soft cash flow result, weakness at the net operating cash flow line should prompt concerns. Forge Group (FGE) had a similarly weak operating cash flow result in the year prior to its major write downs and eventual failure. I am not suggesting that DSH will fail, or follow a similar path. However, the key link here is that where operating cash flow is weak in a financial report, a warning flag should be raised – potentially the strongest one.

Recommendation and coverage cessation

We are ceasing coverage of DSH. The company's risk profile is not suitable for recommendation to an income investor. Yes, there is a chance that this will be the worst for DSH, and we are “selling at the bottom”. There is also a chance that DSH will not come back from this. This is not the binary style risk that the Income First model portfolio, nor the Eureka Report income recommendations, intend to take.

My final valuation is $0.41. This valuation assumes that the company stabilises and recovers following this year and that write downs to inventory are limited to the initial estimate from management of $60m. I believe that there is the chance that trade will continue to endure difficulties, and that further write downs may ensue. Despite the apparent upside to valuation, my final call on the stock is sell.

DSH has proven to be a business plagued with problems, and an initial buy call that has been very value destroying. At times like this it is important to move on and consider the portfolio as a whole, looking for the best way to move further towards our investment objectives.

Model portfolio position and implications

As mentioned the Income First model portfolio will sell its DSH tomorrow morning at market open prices. The intention here is to move on from DSH as it no longer adds to the portfolio in terms of furthering the likelihood that the portfolio will achieve its stated objectives – an above market dividend yield, and some capital appreciation.

Pleasingly, the failings of DSH have been mitigated by two things. Firstly, the portfolio contains around eight strong outperformers, which have led to an overall outperformance. Secondly the portfolio is well diversified, holding a large cash position. This has meant that the value destroyed by DSH has been well contained. It is never nice admitting when you are wrong. The thought process is wrought with pitfalls, and there is every chance that the Income First model portfolio will sell DSH at the bottom. However, given the information at hand, and the clear change in the risk and return attributes of DSH, selling the stock is the only viable decision.

To view Dick Smith Holdings' forecasts and financial summary click here.