Dick Smith disappoints

Difficult times at DSH continue

If you followed the Income First model portfolio and invested in Dick Smith Holdings, then you are probably as devastated as I am tonight. The company announced a downgrade to profit guidance after weak trading in October, blaming a poor product mix and margin pressure.

Needless to say, the share price has been savaged as investors reacted, with DSH closing for the day lower by more than 33 per cent. However, my view is that the market is now pricing the stock for potential demise. Either it is that serious, or DSH is now a screaming buy? I'd argue the latter, but we must consider the former first. DSH has encountered a terrible month in October, and is now cautious that the all-important Christmas period may see further underperformance. If Christmas was a complete disaster then there is a scenario under which DSH could enter serious financial trouble. But my view is that this is unlikely.

The management team has undertaken a strategy to compete harder on price and invest further in marketing and advertising to drive foot traffic and inventory turnover through the coming two months. DSH has a strong level of good sellable inventory on hand and will now embark on turning this into cash, albeit at a far lower profit margin than was originally intended. Hence the company will report lower net profit in FY16 and likely pay a lower dividend. My forecast dividend for DSH is now 10 cents for the full year.

Details of the trading update

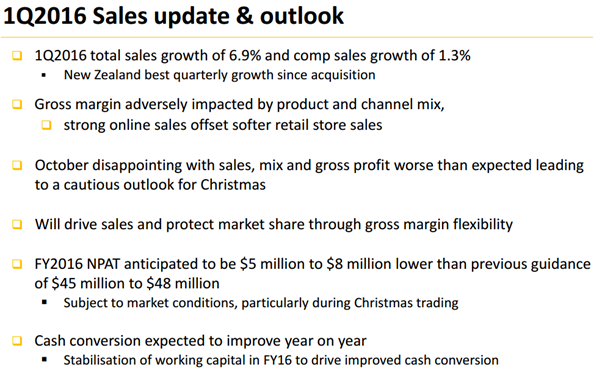

The news from DSH was that trading in the first quarter was in line with expectations in terms of revenue, but that a weak October has led to nervousness ahead of the all-important Christmas trading period. Thus net profit guidance was lowered by $5 million to $8 million, from a previous range of $45m to $48m, to a new expectation between $37m and $40m. Our expectations were already below the guided range at about $43m, but it has been necessary for us to further adjust our forecasts.

Unfortunately, at $37m to $40m DSH is likely to report lower profit than the adjusted (underlying) $43.4m in FY15. I have revised my revenue forecasts and margin assumptions, lowering expectations for both earnings and dividends from FY16 onwards. This has led to a downgrade to my valuation from $2.25 to $1.76, though a buy call is retained.

This marks my second downgrade for DSH, and thus far I have been quite disappointed in the company's performance. Across at Harvey Norman, the company is trading well, with a strong third quarter sales update. So DSH management will need to correct the recent mistakes made if they are to realise the true value of this business for shareholders.

The impact of a weak October on earnings and dividends

One thing is clear. At DSH there has been a substantial lowering of earnings expectations and an acknowledgement from DSH that it wishes to maintain a strong and conservative balance sheet through difficult trading conditions. However, the company has not altered its 60 per cent to 70 per cent payout ratio range. Given the focus on price-driven sales, there is likely going to be a lower gross profit margin in FY16, probably significantly lower.

This is material. In FY15, DSH paid 12 cents to shareholders in the form of a 7c interim and a 5c final dividend. We have rebased our expectations on the company's payout ratio nearer to 60 per cent and lowered our EPS forecasts to align with the new guidance range. The result is that we now expect around 10c per share in dividends for the full year.

This is still a strong yield on the current (albeit horribly sold down) share price. In my view the market has been pushing the stock to a point where it is oversold, on a post-downgrade PE of 6.5. As a result, the buy case remains and the yield on the stock is likely to remain compelling.

Trading update

As mentioned, the share price in DSH was savaged today, as a result of the trading update provided. We last spoke to DSH at the start of September and based on third quarter trading the company appears to be on track. Unfortunately, this has unravelled in October. Here is the update slide DSH presented at today's AGM:

Source: Dick Smith Holdings

Obviously, the total sales growth is nothing to be worried about, and the first quarter of FY16 was largely in line with our expectations. Unfortunately, there are some cautionary words in this update that have led market participants to serious downside conclusions. First, the gross margin for the company has been lower, suggesting profitability is eroding. And perhaps most importantly, the company has warned that the Christmas trading lead in is now a concern after a weak October. Christmas is so important to retailers such as DSH, and this definitely raises questions for the company's ability to even meet the renewed lower guidance of between $37m and $40m in net profit.

What needs to be done to get it right?

DSH must arrest the sales decline it witnessed in October. As mentioned earlier, Harvey Norman, JB Hi-Fi and other direct competitors of DSH are getting it right and reporting strong quarterly updates. So what is the problem at DSH? Management believes it has to do with the sales mix and channel mix eroding profit margins, and there are also some issues with managing the mix, and creating the necessary foot traffic to generate like-for-like sales growth. My view is that this is the bread and butter of good retailing. If management are unable to compete as a result of this, then there need to be some changes.

Most importantly DSH need to get the product mix right. The company's decision last year to run less Apple promotions hurt sales volume and foot traffic, all in an effort to protect margin. DSH needs to carefully consider its market position, product offering and market strategy in order to stay competitive.

The company's CEO Nick Abboud commented that the sales decline in October was very material. This has led to the company's change to guidance, and much of the company's attitude will now be focused on turning around this negative comparable sales trend. Specifically, marketing will shift away from the October focus on digital, towards TV, radio and catalogues. The company will also try to drive cash conversion at the expense of margin to ensure inventory turnover lifts. The attitude is that this will improve underlying earnings and cash flow.

A word of caution is needed here. If DSH aggressively competes on price, its competitors will respond. I am expecting that there will be a lift in sales at the expense of margin as a result of this new price and advertising driven strategy. However, there is every chance that it will generate a new normal in terms of lower gross profit margin. This lower margin is factored into my new forecasts in perpetuity.

Model portfolio approach

The Income First model portfolio has a holding in DSH. In fact I took the decision to add more DSH in mid-August after the share price fell from $2 toward $1.60. At this stage we are not willing to further add to the position despite our view that it is oversold. We are comfortable with our level of exposure at present and the diversification of risk provided.

Overall, it would be fair to say that I have been disappointed with DSH management, and the performance of the business. The share price reflects this and DSH has become the only serious underperformer in the model portfolio to date. My intention is to continue to monitor the performance of DSH. The dividend is expected now to be around 10 cents per share fully franked, which implies a yield above 10 per cent on today's closing price. While this may be bittersweet, little can be done about past performance.

Looking forward, DSH's share price is oversold, and the dividend I am forecasting will be on offer is compelling at current share price levels. We will revise our position as appropriate, but given the current share price we see little value in any knee jerk reactions to our holding.

To see Dick Smith Holdings' forecasts and financial summary, click here.