G8 Education grows up

A strong profit result and derisking commences

Childcare centre operator G8 Education Limited (GEM) reported half-year financials on Monday (August 10), and reminded markets that it remains a business in the midst of a strong growth phase. The company recorded first-half adjusted net profit of $31.5 million, which was an encouraging 83.3 per cent growth on the first half last year. This growth was achieved through both increasing quality in the company's existing childcare centres and additional contributions from newly acquired centres.

Pleasingly, when we last spoke with GEM, the company's CFO clarified that the group believes it is in a position to fund growth from existing operations, rather than raise equity capital on a regular basis. This is encouraging, and in our view derisks the model slightly when compared to our previous assumptions. Overall, we are comfortable with the progress being made by GEM, and note that the company has the propensity to continue to pay a healthy and growing stream of dividends to investors.

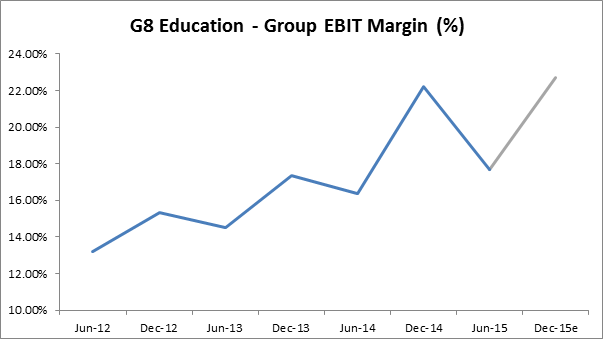

Improving EBIT margin and more to come

GEM management have highlighted in presenting these latest results that the company has been producing improvements in EBIT margin over recent years. Despite seasonality in margins leading to a less than smooth trend, there is clear evidence of the group's performance over the last three years.

Seasonality and like-for-like performances

Childcare is a highly predictable and seasonal business. GEM CFO Chris Sacre estimates that on a like-for-like basis, the seasonality of GEM's revenue split would be 37 per cent in the first half and 63 per cent in the second, with a high degree of confidence. However, the timing of acquisitions (and the varying earnings contribution of those acquisitions) has meant that GEM's seasonal skew has been understated by profit figures. Given this, and given that the group's first half result for FY15 has produced almost as much EBIT as the preceding second half of FY14, we believe that FY15 is shaping up to be another year of significant growth for the group.

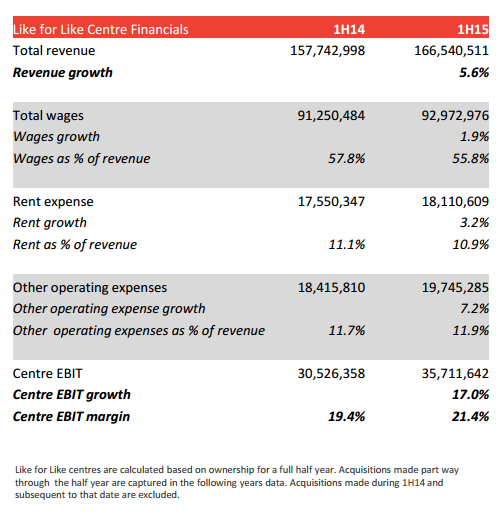

Pleasingly, GEM has provided the below information that shows the improved EBIT margin and the sources of its improvement. My view is that there is evidence that costs are being controlled at a level supportive of margin expansion, which is a trend I believe has some way further to go.

Source: GEM

Revised funding strategy derisks the growth model

Following on from our recent initiation of coverage for GEM (see G8 Education: Rewards and risks, August 3), we are pleased to advise that we have since been provided an update into the company's strategy for growth funding. Pleasingly, GEM has stated that it is in a position to fund growth through operating cash flow, and through the maintenance of current levels of gearing. In a pinch, this means that the company believes it has reached a level of sustainability at which it will not need to raise new equity capital to fund growth. There is one exception – that is for large one-off purchase opportunities, such as the hostile takeover bid for Affinity Education (AFJ) that is currently on the table. Regardless of this exception, we are very pleased to know that the management team is allowing the model to mature.

In light of this, the company will in our view provide strong growth through internal funding, with the ability to produce double digit EBIT growth on an ongoing basis for some years. Additionally, this approach will allow management to make informed decisions on an as needed basis as to whether additional funding is needed for larger purchase opportunities. With this knowledge, we have lowered some of the risk we had previously placed on the company's earnings and balance sheet.

Continuing growth in cash flow underpins dividend

GEM recorded net operating cash flow of $35.389m for the half year. While capital investments continued to absorb cash such that free cash flow was negative, the company's policy of paying out a proportion of cash flow from operations as dividends remains solid. Our view is that the 6 cent per share quarterly dividend remains well supported by cash generation, and that growth in this dividend in the coming 12 to 24 months remains possible.

GEM did not announce a dividend with the result but will next trade on an ex-dividend basis in late September. With the move towards a more mature self-funding growth model, I believe that GEM's dividend is likely to reward investors in coming years, with the added bonus of potential capital appreciation.

Headwinds in some of the portfolio

It is apparent that occupancy rates at G8 owned centres are largely in line with last year, and tracking to budget according to MD Chris Scott. However, recent headwinds in the WA and ACT economies have led to lower than anticipated occupancy in those segments.

That said, I think it is important to keep this in context. The company is exposed to a range of geographies now, with a growing national footprint. Some states may underperform due to cyclical economic factors. I am of the view that this is a risk worth noting, but that the overwhelming trend in the sector, and theme of demand and subsidy support for long day care, easily mitigates this risk when we consider the overall investment case.

AFJ acquisition – no update

As expected, GEM's hostile takeover offer for AFJ remains afoot, but no further update was forthcoming. At the moment, it is a little bit of a wait and see scenario. For now, we should note that the company has outlined that, should the offer proceed, GEM's net debt to equity will be in the range between 1.2x and 1.7x (using pro-forma FY16 equity), depending on how much of the purchase is funded with GEM scrip and how much is debt-funded cash consideration.

AFJ's balance sheet is not geared to the extent of GEM's so the potential for additional borrowings is offset through the use of the AFJ balance sheet, should the acquisition proceed. At this stage I will monitor developments, and provide updates as the takeover move proceeds or fails.

Overall result summary

I am pleased with GEM's result. The profit result was slightly ahead of our expectations and the underlying seasonality bodes well for the company's full-year result. In that light, and given that the positive trend in EBIT margins, earnings, dividends and cash flow has been maintained we are comfortable retaining our buy call on the business. Our valuation has remained unchanged at $4.65.

To see G8 Education's forecasts and financial summary, click here.