G8 Education: Rewards and risks

G8 Education: Everything aligns but the sentiment

We are initiating coverage on G8 Education Limited (GEM) with a buy call for income focused investors. For those unfamiliar with GEM, the company is in the business of acquiring, integrating and operating childcare centres in Australia (long day care), with a small operating interest in Singapore. The strategy to date has been to acquire centres at a disciplined price, lift the centre occupancy through a considered marketing, investment and operations effort, and increase earnings through efficient centre operation.

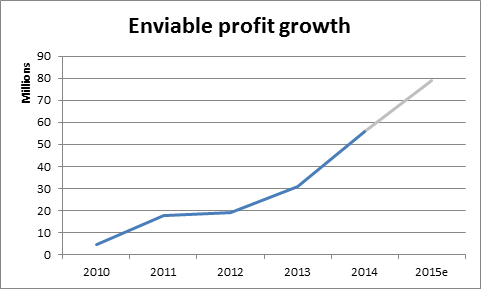

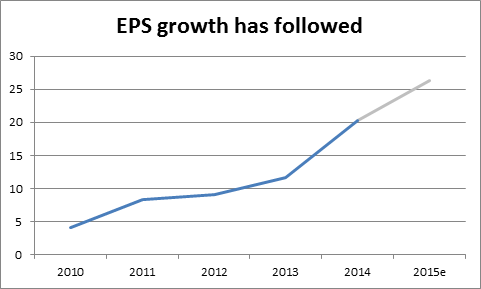

To date, this strategy has been executed with success, driving the company from a first profit of $4.70 million in 2010 to deliver a net profit after tax of $52.731m in 2014. This equates to a compound annual growth rate of an astonishing 83.02 per cent. The company has been delivering growth, but this growth has come as a result of large capital raisings and debt funding that has diluted returns quality.

The company continues to aggressively expand and has made a hostile takeover bid for rival childcare business Affinity Education Limited (AFJ). In light of this, we believe there is a clear need for balance at GEM. The company's cash flows are strong, and profit growth is fantastic. Despite all of this, childcare expansion in Australia is famous for the demise of ABC learning, and GEM should heed the lessons of the past in order to strike that balance between growth and balance sheet stability.

Industry overview

GEM was operating 455 centres at the start of 2015, with that number expected to grow significantly again this year. This equates to over 32,000 childcare places, but still only represents a small portion of a very fragmented market. We estimate that GEM's market share based on number of centres is less than 8 per cent (≈480 centres in a market with more than 6000 related centres). While this may be encouraging, we need to accept that a large portion of the market includes not for profit and community based care. The addressable market from an acquisition and growth perspective is undoubtedly smaller. Notwithstanding this, it is easy to note that the market can bear more acquisition-led growth for GEM in the future.

Changes to, and the potential for further changes to, regulations in the industry have made headlines in recent years as the demand for long day care grows. This problem, and risk, is borne out of the investment thematic that makes GEM so attractive. As dual income families and the use of child care become more and more accepted the supply demand balance continues to shift. Demographic factors including a sharp rise in the number of child care aged Australians is projected to continue, according to the ABS.

This has led the need for continued regulatory support, and more pleasingly, clarity started to emerge in the government's recent budget papers. Essentially, there is likely to be a restructuring of the subsidies provided to those utilising long day care. At this stage our expectation is that there is likely to be an overall boost to subsidies that should be supportive of the industry's ability to pass through price rises in coming years. Currently, the federal government estimates that around two thirds of all childcare funding is subsidised. GEM management believes that this is relatively representative of the company's exposure to government funding.

Proposed acquisition of Affinity Education (AFJ)

GEM announced recently that it had moved to a 19.89 per cent ownership in rival long day care provider Affinity Education Limited (AFJ), and has launched a hostile takeover bid for the business offering 1 share in GEM for every 4.61 shares in AFJ. This offer was then revised to either a cash on-market sale for AFJ at $0.80, or an issue of 1 GEM share for every 4.25 shares in AFJ. The company is a similar business to GEM, and listed in late 2013, making acquisitions of childcare centres, integrating them in order to improve efficiency, occupancy and margins.

AFJ appears to have struggled to live up to its promise since listing, with a recent profit guidance downgrade and a languishing share price. We note that AFJ has tended to pay more for its acquisitions than GEM, but has now amassed some 161 centres maintaining a low level of debt on the balance sheet. AFJ has indicated that it is likely to pay a maiden dividend to shareholders upon announcing results this June, with indication provided that it will pay 60 per cent of net profit.

Unfortunately, GEM management are not able to comment on the acquisition beyond the bidder's statement, and given the proximity of the company's first-half financial results. We will keep in touch with the company, but for now believe that there will be extractable synergies that could drive additional cash flow and dividend upside in FY16.

From a purchase price perspective, AFJ has given EBITDA guidance of between $27m and $32m for FY15, suggesting an acquisition multiple around 5 times EBITDA, and probably (based on our estimates) above 5.5 times EBIT. However, we believe that there are considerable synergies (mostly head office costs), that reduce this multiple towards the range that GEM targets for all of its acquisitions. Based on pro-forma calculations we expect that this purchase multiple will be in the range of 4 to 4.5 times FY16 EBIT. This slight premium to the targeted multiple of 4 is likely justifiable by the convenience of achieving a sizeable purchase in one transaction.

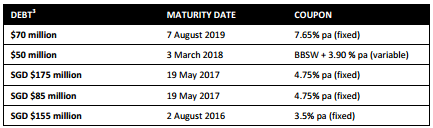

Debt and equity offered for AFJ

It is worth noting that GEM has also created $50m of bank debt headroom in order to refinance AFJ's debt should the takeover proceed. Finally, GEM has issued $S155m fixed rate notes as part of its multicurrency facility in order to fund the cash offer for AFJ. This money has been raised at a fixed interest rate of 3.5 per cent, which is a pleasing drop from previous issues. We note that this increased the group's gearing and currency exposure, but that the use of the funds will be the key determinant of this risk. We await further information as to whether this drawdown relates to the AFJ offer.

It is worth noting with clarity, that GEM is currently offering AFJ shareholders the ability to sell their AFJ for 80 cents cash, or accept shares in GEM instead (at a revised 4.25 for 1 rate). Given that the cost of equity to GEM is higher than the cost of debt, our view on the value of this offer might be influenced by the eventual method of the takeover offer funding, debt or equity.

In the meantime, here are some further details on GEM's debt on issue. Pleasingly, the latest issue has been made at a lower rate, but the near term maturity suggests that GEM will be looking to refinance in the shorter term:

Dividend policy and cash generation

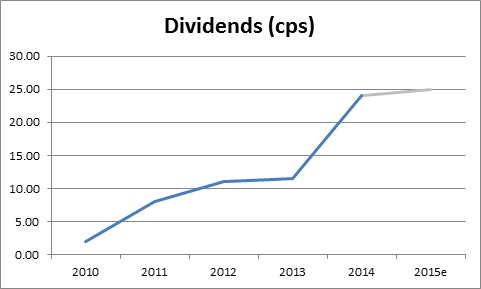

The G8 Education management team and board hold direct and indirect interests in GEM shares such that there is a clear alignment of interests between insiders and shareholders at large. This has in our view driven the company to focus on returns more closely and pay dividends at a handsome rate to shareholders. Officially the company's target payout structure is to pay 60 – 65 per cent of cash flow to shareholders after making assumptions that capital will flow back in for a dividend reinvestment plan, at a 30 per cent uptake. The result of this has historically been that GEM has paid close to 100 per cent of its earnings as dividends, and raises some questions as to the sustainability of those payments.

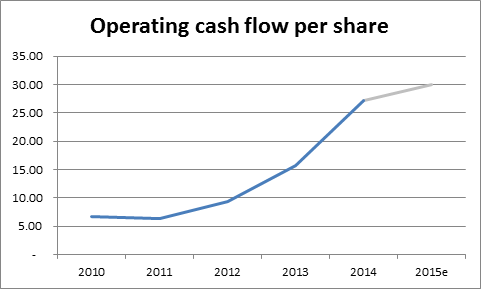

Below are two charts showing the growth in GEM's dividends per share since the company first paid a dividend in 2010. The growth has been nothing short of stellar lifting some 56.5 per cent per annum (compound growth rate). But more pleasing is that this dividend growth has been supported by growth in the cash generated from the company's childcare operations over the same period, which lifted by 41.53 per cent per annum. In every year the cash generated from operations has shown a healthy level of growth supportive of the company's ability to continue to service debt, service growth and fund shareholders.

However, GEM's returns have been diluted by the growth of the balance sheet through equity raisings, and through the issue of corporate bonds that require servicing. From our perspective the company's greatest challenge remains balancing the funding of growth and the rate of that growth with the need for prudent financial management, balance sheet repair, and ongoing dividend payments.

Risks and timing: investment and funding costs are the key balancing act

The GEM story is very compelling. Demographic trends, government support and cultural acceptances are all pointing towards healthy demand for long day care in Australia well into the foreseeable future. Anyone whose has young children or grandchildren can probably tell you stories of waiting lists and rising prices in the sector. However, the past has shown us that attention must be paid to leverage, and to cash flow. GEM's micromanagement of centre operations is an attractive feature to us, in that it provides us comfort that the business is paying close attention to occupancy levels and cash flow.

Even despite this, it makes sense for us to consider the structural risks involved in the roll up strategy being deployed by GEM. As intimated earlier, the business is incredibly thirsty for funding in order to continue to consolidate the fragmented long day care market. The problem is that this requires a very astute balance in terms of the use of debt and equity funding. The attractiveness of low cost debt is clearly apparent at the moment, but brings with it the potential for gearing to become risky. The cost of equity is higher, but new stock issuances are a necessity in order to protect the company's balance sheet.

With this need for balance in mind, it is important for us to note that there is risk involved in this. Both risks of overly burdening the business with debt and risk, or issuing equity at a cost and rate that is harsh on shareholder returns through dilutions and discounts. To date, GEM has managed this situation well, but has in our view been aggressive in its acquisition strategy. This is further emphasised by the current all scrip hostile offer to purchase Affinity Education. Our view is that a period of consolidation, integration and balance sheet recovery would be of benefit following this acquisition (should it go ahead). Thus not only are the sources of funding key, but the pace at which the company is aggregating the market is also in need of a controlled approach.

Summary

We initiate coverage of G8 Education with a Buy call, and a valuation of $4.65. Importantly, GEM pays a quarterly dividend, which at present is 6 cents. At current share prices, near $3.40, this yield is around 7 per cent (or 10 per cent if you include franking credits).

We acknowledge that there is more risk in this investment than a traditional income play. However, with our view that the company is in the midst of a positive demand thematic, and is an industry leader in terms of its growth, scale and ability to operate with high occupancy, the yield is incredibly attractive. So, on a risk vs reward basis GEM has an important role to play in an income-focused portfolio. The volatility might be higher than desired, but we believe the cash flow and dividend stability and potential growth offset this. Thus, GEM will be among our initial stocks in our Income First model portfolio.

To see G8 Education's forecasts and financial summary, click here.