BHP: smaller is better

Recommendation

- BHP will split into two businesses

- The new look BHP will be a more stable business

- The spinoff might present an opportunity

The world's largest mining house; the most profitable Australian business ever; The Big Fella. Size has always been the defining characteristic of BHP Billiton. For a business that proudly wields its immensity as a trophy of its success, management has taken the most extraordinary step since the business was created. BHP will voluntarily break up.

The company has announced it will spin off a collection of mines into a new business to be listed on the ASX. Some say it is throwing out the rubbish; that the spin-off will include all the dregs – the parts of its business the miner couldn't sell.

The consensus is that, because the new business will house mines that aren't good enough for BHP, it won't be good enough to invest in. The consensus is wrong. It's true that the spin-off, should the deal be approved, won't share the quality of its parent – but that doesn't mean it isn't worth a look.

BHP will split into two businesses: one will retain its iron ore, petroleum, and copper assets as well as most of its coal mines. Into the new company will go unfashionable aluminium, alumina, silver, manganese and some coal assets. The dregs of BHP still make a formidable business: the spin-off will likely be worth about $US12bn. It will house assets worth about US$11bn that generate average revenue of US$10bn and net profit of US$2bn.

Ours is a lonely opinion but here it is: we're excited by the spin-off. Shares in the new business will be distributed to BHP shareholders in Australia, the UK and South Africa but the new company won't be listed in London, giving plenty of investors reason to sell regardless of price.

The mines that constitute the new business, although disparaged, are better than average. They include the world's largest silver mine, Carrington, the largest manganese business, a sprawling aluminium and alumina business and an attractive nickel business in Colombia. These mines have been neglected within BHP for years and offer enormous potential for improvement. South African coal assets, however, blight the asset suite.

BHP will offer investors a vote on the idea. It is likely to pass and the new company could be unleashed by the middle of next year. So far, price and financing are unknown but we will be looking at the offer closely. Management has suggested the new listing will carry minimal debt.

Make mine smaller

Today, BHP is a sprawling empire of 41 mines producing almost every major commodity. Yet, last year, BHP generated 97% of earnings before interest, tax, depreciation and amortisation from a dozen mines. With more than 50% of its assets generating just 3% of profit, a break up makes sense to allow the pursuit of productivity gains. There is little doubt that, over the past decade, the company has grown inefficient. BHP says it has saved more than US$6bn over the past two years trying to rectify this and the split will allow it to save a further US$3.5bn over the next two years.

The slimmer BHP will boast stunning operating margins of almost 50% and can still deploy large amounts of capital at attractive rates of return. Following the split, BHP should produce more stable cash flow with less capital intensity to allow regular dividends to be paid. The new BHP will be an attractive business but this is already widely understood and reflected in the price.

Less attention goes to the merits of the spin-off where costs reductions should be greater. The new company's assets are out of favour and cyclically depressed; EBITDA margins are less than half the (admittedly boom-enhanced) 10-year average. There could be more opportunity in the new business than the old.

Management has pledged higher dividends following the split, signaling a dramatic shift in the business. Instead of increasing production to satisfy corporate egos, miners are being forced to seek returns first and expansions second. A maturing of the industry is long overdue and welcome. We are excited by the prospect of a disciplined, less volatile BHP and a cheaper and (perhaps) mispriced spin-off. We'll be looking at both businesses with interest when the split is approved.

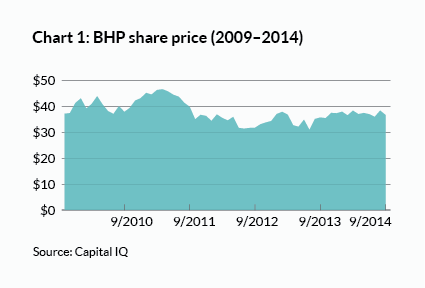

The market has been less sanguine, concerned that the spin-off won't be listed in London and that it will house second-tier mines. Despite these concerns and recent falls in the iron ore price, BHP remains fairly priced today. We would be enthusiastic buyers at lower prices but, for now, we recommend you HOLD.

Recommendation