Aristocrat's flying Fish

Recommendation

If you've been wondering whether our recommendation to sell Aristocrat Leisure six months ago was a mistake, rest assured, you aren't alone. We've been wondering the same thing.

One of the biggest questions it raises, though, is less about how and why the actual decision was reached, and more about how can you tell if it was right or wrong.

The 30% increase in share price isn't proof enough; six months is too short a timescale to remove the whims of the market.

Key Points

-

New acquisitions growing strongly

-

Investment in game development to increase

-

Increase to price guide but sticking with Sell

For example, we recommended members Sell iSentia in March 2017 and the stock promptly went up 50% over the following five months. This short-term price movement may have suggested we made a mistake, but our long-term reasoning has been bang on – since then, the company has announced one bombshell after another. The stock has now halved since our original downgrade.

Aristocrat, though, is not unfolding how we expected, both in terms of its share price and the underlying business. And that tells us that our valuation was probably off.

In December 2017, we were sceptical of Aristocrat's acquisition of social gaming company Big Fish – amplified by its previous purchase of Plarium, which suggested empire-building by a new chief executive. We were also concerned by the large amount of debt that was being taken on to fund it, and a lack of growth in the company's core Australian and North American markets.

Six months on and many of those concerns remain. Revenue growth in North America has slowed from 16% for the year to September 2017, to 11% in the first half of the 2018 financial year. Australian sales growth has slowed from 5% to 2%.

Aristocrat's balance sheet is no clean whistle, either, with net debt rising from $647m to $2.5bn – though, to be fair, operating profits cover interest payments a good 10 times over, offering the company a good deal of wiggle room. And the fact remains that in purchasing Plarium and Big Fish, Aristocrat has made a huge bet on new markets in which management has little experience.

So where did we go wrong?

What we didn't see coming was the monumental improvement in the underlying profitability of those two recent acquisitions, Plarium and Big Fish. This interim result was the first disclosure around these businesses, which together form the core of Aristocrat's Digital division.

The Digital division tripled revenue to US$429m in the six months to March. The highlight, however, was the underlying organic growth in earnings before interest, tax, depreciation and amortisation (EBITDA) – up 60% for Plarium and 34% for Big Fish. We were especially pleased to see daily active users increase 15% at Big Fish, which is almost twice Plarium's size.

This level of improvement caught us off guard – and the market too, it seems – but it's a big tick for management. The Digital division has grown from 13% of revenue in 2016 to 27% of revenue currently, and at this rate it will soon account for a third of Aristocrat's business.

This level of improvement caught us off guard – and the market too, it seems – but it's a big tick for management. The Digital division has grown from 13% of revenue in 2016 to 27% of revenue currently, and at this rate it will soon account for a third of Aristocrat's business.

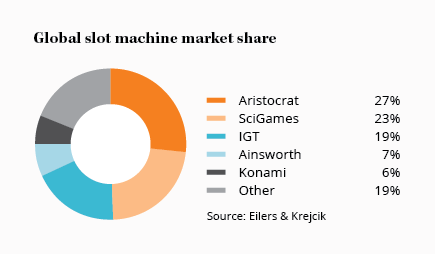

We remain wary of the Plarium and Big Fish acquisitions, but they do provide one glaring opportunity – room for growth. Aristocrat has a 27% share of the $7.5bn global slot machine market, and expanding that already dominant share is difficult given several other large competitors (see chart). Plarium and Big Fish have increased the potential market for the company's Digital business from around US$3bn to US$22bn. With a market share of only 4%, Aristocrat has plenty of headroom, albeit in a more competitive, fragmented market.

It will be some time before we know the sustainability of Digital's earnings and whether integrating the different company cultures will be smooth or choppy, but the improvement in profitability takes some pressure off management and leaves more dollars to be reinvested in game development.

Design & Development

The Australian and US pokies market is considered ‘mature', where Aristocrat has had a long-term presence and market growth is generally slow but stable in the mid-single digits. The way to grow in a mature market – as in any – is to offer something competitors don't.

Here, the company's excellent run of high-performing games has given Aristocrat an edge. Goldman Sachs has ranked Aristocrat first among game suppliers for most profitable games five years in a row (with almost three-quarters of the vote among casino managers). Aristocrat has three of the five best performing premium games.

| Six months to March | 2018 | 2017 | /(–) (%) |

|---|---|---|---|

| Revenue ($m) | 1,641 | 1,228 | 34 |

| EBITDA ($m) | 643 | 499 | 29 |

| Un'lying NPAT ($m) | 362 | 273 | 33 |

| Un'lying EPS (cents) | 56.6 | 42.7 | 33 |

| Interim div. 19 cents, up 36%, fully franked, ex date 29 May | |||

The company released several new games and products during the year, including the Asian-themed game app FaFaFa Gold, as well as new Tarzan, Game of Thrones and Mariah Carey games.

Management knows this is one industry where competitive advantage is only as good as your next game. Design and development (D&D) spending was bumped up from 10% of revenue to 11%, and has tripled since 2013. A quarter of Aristocrat's workforce are in the design labs, with the company planning to add 250 more D&D roles in the second half of the financial year to the existing group of roughly 900.

We're pleased to see ongoing investment in game design despite Aristocrat being the largest in the industry. The company's D&D spending is meaningfully larger than that of its main competitors and it's 10 times larger than Ainsworth Game Technology's budget, which similarly spends around 11% of revenue on innovation.

Price guide

Management expects ‘double-digit' growth in underlying net profit in 2018 and flagged a continued increase in D&D spending. The stock trades on a forward price-earnings ratio of 25 based on consensus estimates for 2018 earnings.

It's too early to tell whether Aristocrat's push into digital games will pay off long term, but this horse has left the gate much faster than we anticipated. While our general concerns over the slowdown in the Australian and US market remain, we need to leave room for the possibility that Digital – now a quarter of Aristocrat's business – continues to grow at breakneck speed.

We're increasing our recommended Sell price from $22 to $27 to give the stock more leeway should Plarium and Big Fish continue to deliver, or the company increases its market share in traditional pokies. That's no small order, but with Ainsworth going through a rough patch of game design, it's certainly possible (see Ainsworth disappoints again). We'll continue to watch how things develop and may make another step-change to the Sell price if sales improve during the remainder of the year.

We're also raising the Buy price from $14 to $17, which would put the stock on a forward price-earnings ratio of around 14. We think that's still conservative but we're mindful of the slow organic growth in the company's core markets and increasing exposure to the highly competitive and more volatile social gaming market. If management tries to make another large acquisition to cement the company's position, it would probably need to raise capital from shareholders.

Aristocrat hasn't played out as we expected – at least not yet – but the good thing about investing is you can have a few missed opportunities and still do okay. Getting out too early isn't nearly as painful as getting out too late so, for the time being, we're sticking with SELL.

Recommendation