Aristocrat acquires Plarium

Recommendation

After taking the reins of Aristocrat from former chief executive Jamie Odell in March, new boss Trevor Croker has already pulled out the cheque book.

Aristocrat has purchased Israel-based social gaming company Plarium for US$500m (around A$625m), with additional payments due depending on the company's performance over the next two years.

Aristocrat will issue US$425m in new debt to help fund the acquisition but with pro forma debt at 1.5 times earnings before interest, tax, depreciation and amortisation (EBITDA), borrowings remain manageable.

Key Points

-

Social gaming company Plarium acquired

-

Aristocrat expanding outside gambling market

-

Sceptical of acquisition

Social gaming company

Plarium develops and publishes online social games that can be downloaded and played on your desktop computer or mobile device. Founded in 2009, it has grown rapidly and generated US$201m in revenue and US$44m in EBITDA in 2017.

Plarium operates a ‘freemium' model: its games are free to play while it earns revenue through in-game purchases. Nine games developed by its five studios spread across the world are currently generating revenue, with its most popular being Vikings: War of Clans.

Plarium chief executive and co-founder Avraham Shalel and 12 other members of senior management will stay on following the acquisition. They have also agreed to defer part of their upfront consideration until the end of calendar 2020.

But why has Aristocrat left its familiar territory of gambling to expand into the social gaming market?

Social gaming market changing

This requires a detour into how the social gaming market has changed in recent years.

Due to the rise of fast broadband connections, the days of gamers purchasing hard copies of games from Harvey Norman or JB Hi-Fi's bricks-and-mortar stores are quickly fading. Moreover, widespread smartphone penetration has created the new and fast-growing industry of mobile gaming.

Instead, gamers now log on to iTunes, Google Play or other websites and download a new game almost instantly.

While gaming studios who sell through Apple and Google usually have to pay 30% commissions for the privilege of doing so, they nevertheless save on manufacturing costs and the costs of distributing their games through bricks-and-mortar stores. So games sold through these channels tend to be at higher gross margins.

The way gamers pay for games has also changed. While one-off, upfront licence fees are still common, some games are now available on subscription. Other developers operate on the freemium model, particularly in the mobile space, relying on in-app purchases from their most devoted gamers to make money. Although most players don't make in-app purchases, the minority who do so on a consistent basis make the revenue ‘recurring' in nature.

Easier to develop games

However, the cost of developing new games has also fallen due to ever-increasing computing power available at lower cost. And the rise of the cloud has allowed various development functions to be outsourced, further reducing the cost of developing games.

Combined with falling distribution costs and the already large but still fast-growing mobile gaming market – global games revenue of US$39bn in 2016 is forecast to grow at 14% annually until 2020 – competition has increased dramatically.

In response, game developers and publishers try to develop ‘franchises' that are the equivalent of Transformers or Star Wars in the movies business. Call of Duty, World of Warcraft and Grand Theft Auto can be similarly updated and re-released every few years, with the holy grail being the development of a successful franchise where gamers religiously play against others.

This creates a kind of network effect: the more gamers playing a game, the greater the opportunity to play against other gamers and vice versa. This creates a larger number of captive gamers salivating over the next iteration of their favourite game, while also meaning the publisher earns more money from subscriptions and in-game purchases.

Similar…

But back to the Plarium acquisition.

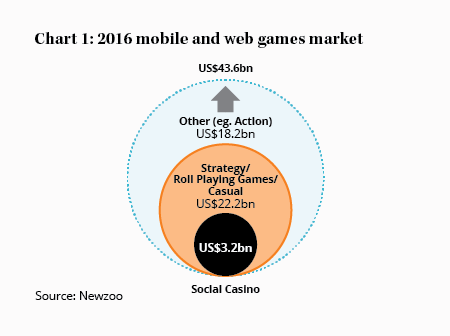

The strategy, role-playing and casual game segment of the online gaming market is valued at US$22bn, far larger than the US$3.2bn social casino segment that Aristocrat's apps Heart of Vegas and Cashman Casino target (see Chart 1):

There are a number of similarities between these two segments: both operate on a freemium model, while the development of successful underlying mathematics or game engines is also similar.

There are a number of similarities between these two segments: both operate on a freemium model, while the development of successful underlying mathematics or game engines is also similar.

Like Aristocrat releasing multiple iterations of hit pokie games such as Lightning Link that are based on the same underlying mathematical model, Plarium tries to develop a successful game whose ‘game engine' or platform can be released across multiple jurisdictions in slightly different formats. For example, this could be a war game that has iterations based on modern combat, the middle ages, ancient warfare and so on.

…but different

Yet we disagree with management's argument that this represents a move into an ‘adjacent' market similar to when Aristocrat purchased Product Madness and moved into the social casino market.

Aristocrat was able to transfer its intellectual property and library of successful games to Product Madness, while also benefitting from spreading its design and development budget across both its land-based games and online gaming business.

By contrast, Aristocrat has no prior experience in the social gaming space and, unlike with your typical pokies player, it probably doesn't fully understand what attracts the typical social gamer to certain games.

It is therefore highly reliant on Plarium management and its team to drive growth, something that may not be as urgent now that Aristocrat has acquired their company. And in any case, senior management are only committed until the end of calendar 2020.

The institutional imperative?

Plarium's most popular game is Vikings: Clash of Clans, but it was only released in June 2015. Unlike World of Warcraft or Grand Theft Auto, we think it's too early to determine whether this could be a similarly dominant franchise, although it might well be.

The company also hasn't disclosed which Plarium games make the most money, nor for how long they've been profitable. And as with movies or pokie games, there is no guarantee its expansive pipeline will yield further profitable games.

Yet the price of 10 times EBITDA doesn't leave much room for error.

Along with Aristocrat management describing the acquisition as ‘transformational' and arguing that Aristocrat is now a ‘technology company', we can't help but be sceptical.

Perhaps Aristocrat's desire to continue being viewed as a ‘growth' company played a part and it appears to be an example of what Warren Buffett calls the ‘institutional imperative'.

Risks rising

So while Aristocrat's purchase of Plarium could indeed emulate the success of its Product Madness acquisition, this transaction has some of the hallmarks of a new chief executive trying to make his mark and pursue growth for its own sake.

And as well as Aristocrat is travelling now, it's important to remember that pokie manufacturers tend to be cyclical, albeit likely less cyclical now that 55% of Aristocrat's revenue comes from ‘recurring sources'.

While growth in Australia is likely to slow from this point, further growth in the Americas and its existing digital business remains likely. Nevertheless, with this growth already expected and the acquisition adding to risks, we're reversing the increase in our recommended maximum weighting made at the time of Aristocrat's interim result. We're reducing it to 5% (from 6%) and strongly suggest you reduce your portfolio weighting to no more than that. For some shareholders this implies a sell-down but others can HOLD.

Recommendation