Why investors should ignore the naysayers

| Summary: Can the Australian economy maintain the momentum? Many commentators believe the latest GDP growth data, showing a 1.1% quarterly rise, is a one-off. But they are ignoring that the domestic economy has been in a growth phase for some time, that the mining boom isn’t over, and that more growth is on the way. |

| Key take-out: Over the last three years, there have only been two quarters of growth that could be regarded as weak. Growth has averaged 0.9% per quarter, or 3.6% per annum – well above trend. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

We found out last week that the Australian economy blitzed expectations with a 1.1% quarterly rise and annual growth above trend at 3.5%.

When I say blitzed expectations, I’m not so much talking about forecasts in the build-up to the release of the number – when partial indicators made it clear that a strong result was in order. I’m more talking about the broader expectation of policymakers and financial market economists prior to that – which was for economic weakness. It was only late last year that the Reserve Bank of Australia was forecasting a far weaker growth profile than what we have now – up to 1% weaker.

The question now for investors is whether that will last or not. Many commentators have taken the line that it won’t, that it was a blip. This was certainly the line taken by the Secretary to the Treasury, Martin Parkinson, and even an RBA board member, John Edwards, was quoted as suggesting: “We’ve still got a long way to go in the transition to non-mining business investment.”

At the outset there is a significant problem with their view. The “elephant in the room” is that this March quarter result was the fourth consecutive quarter of robust growth. It wasn’t a one-off, but rather a continuation of the solid growth we had seen in the three quarters before it.

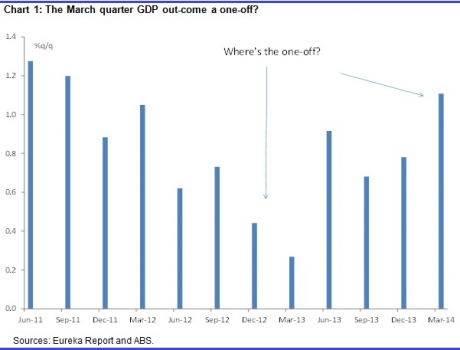

Indeed, the fact is, the economy’s strength predates even that. Take a look at chart 1 below.

The chart shows that, over the last three years, we’ve really only seen two quarters of growth that could be regarded as weak. Outside of that, growth has been solid and averaged 0.9% per quarter, or 3.6% per annum – well above trend. Outcomes over the last two quarters are even closer to 4%. Now it’s very difficult to argue, when nearly every quarter of growth for the last three years (bar two) has been robust, that:

- The Australian economy is weak.

- The March quarter result was a one-off.

Instead, what it shows is that the economy has some seriously decent underlying momentum. That momentum by itself suggests the economy can continue pumping out solid growth outcomes. But there’s more! Think of the export picture. It is true to say that growth in the last quarter was skewed towards exports. Net exports (that is exports minus imports) contributed 1.4 percentage points to the 1.1% point outcome – and that kind of growth can’t last. At the same time though, it’s not unreasonable to expect an ongoing contribution to growth from net exports – and for a lengthy period of time.

To see why, take a look at the opposite scenario, when net exports are subtracted from growth. This occurred in every quarter, bar two, from the December quarter 2006 to the September quarter 2011. Every quarter, for nearly five years. Runs clearly happen, and there is no reason to think that they won’t again – although instead of subtracting from growth, exports will add to growth. Why? The LNG investment boom, of course. The fact is, we haven’t really even started to see the impact of LNG exports on the figures yet.

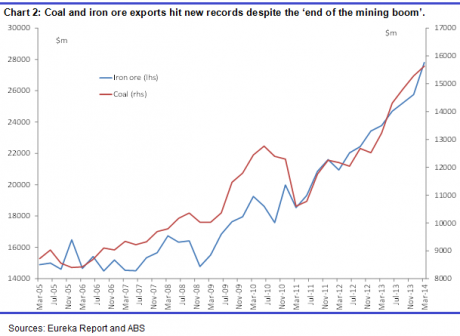

As I reiterated on Wednesday in Heading for parity?, policymakers and the economic community more broadly have given far too much weight to falling commodity prices, while completely ignoring the other side of the equation – volumes. Exports are surging, and they are surging at a time when commodity prices remain very high relative to history. Just because prices are off from their records doesn’t mean they are weak. Moreover, it’s the usual suspects doing the hard yards at this point. Coal and iron ore exports.

Despite the press of a Chinese slowing, we’re simply not seeing that in the figures – or really any sign that we should be concerned about it. China’s investment is still running well into double-digit growth rates, so the naysaying misses the key point. It’s wrong, and it’s been wrong for the last decade. Now think about LNG exports. These are forecast to increase by something like 230% over the next five years – that’s 46% per year. At that rate, LNG is expected to be our second-largest export in a handful of years – not too far behind iron ore. With that in mind, the suggestion that Australia’s economic growth momentum can’t last, because export growth in the March quarter was a one-off, is extremely naive in my view.

Now, having said that, this doesn’t mean that GDP outcomes won’t continue to be volatile. We’re going to see weak quarters again; it’s the nature of statistics. When we do, investors should keep in mind that the broader macro support remains, is unchanged, and will stay in place for a long time. As I’ve outlined before:

- Credit growth and non-mining investment are effectively at recessionary levels now – the only way is up for them, and the recovery is already underway for both. This has a long way to run yet.

- Housing construction has picked up.

- The mining boom isn’t over, as we saw last week.

Recent stronger-than-expected labour market outcomes are also significant and support my view that Aussie growth will remain solid on the whole. Indeed, this week’s numbers were very significant in that regard. Not so much because employment fell 5,000 in the latest month (May). The employment numbers are volatile and, in any case, full-time employment rose 22,000. No, the two significant takes are that:

- The strong employment gains of prior months were held. More broadly, 100,000 jobs have been created so far in 2014, which is very strong growth. All of that is full-time, by the way. Part-time jobs appear to have fallen. What that signifies is that part-time jobs are being converted into full-time jobs as business becomes more confident. That’s a very bullish signal.

- The unemployment rate has been steady at 5.8% for three months. This is significant, because it suggests some of the more dire predictions of an unemployment rate tending to 7% are over the top. The unemployment rate remains low, which contrary to the consensus belief is something that will support growth – not weigh on it.

For the near term, it is true to say that net exports are unlikely to keep contributing 1.4% to growth each quarter. But, then again, and this is something Martin Parkinson and others forget, if it wasn’t for a huge 0.6% points detraction GDP growth would have been around 1.7% for the quarter. And inventories aren’t going to keep taking off 0.6% points from growth every quarter either, nor public investment. So it’s not a fait accompli that growth will be weak in the June quarter. All the pessimism expressed by policymakers is baseless, and they do the country a grave disservice.

So can the Australian economy maintain the momentum? Yes – it absolutely can. If recent data outcomes have taught us anything, it’s that policymakers have a flawed understanding of our current economic circumstances. They called the end of the mining boom some years ago and have put too much weight on the terms of trade.

It looks like they are still operating within that framework. Yet the facts show that this pessimism was unfounded, the paradigm wrong. It makes no sense then to cling to what is clearly a flawed understanding, and continually forecast weakness, while overlooking Australia’s very strong underlying fundamentals. Investors should ignore it.