What's on at Eureka Report and model portfolio updates

It only takes a glance at James Samson's 'Income First' model portfolio (click here) to see something special has been happening at the Arena REIT: James chose the stock back in September last year on the basis the company was "exposed to growing supply in childcare and medical services".

Six months later James' strategic choice of a property trust which veered away from traditional office buildings or industrial estates and instead focussed on key trends reshaping society has paid off very well. Today James looks deeper into this remarkable change in local REITs which is creating some very keen investment opportunities. Make sure you read this important feature: The rise of the specialist REIT.

Don't forget Alan Kohler is back with us on Saturday morning for his first post since returning from long service leave.

Also this week we have two key interviews on the calendar with Manny Pohl of Hyperion Flagship Investments which will be available on Thursday and a champion of small cap investing – Michael Glennon of Glennon Small Companies who will be live in the studio and taking questions on Friday at 11:00am: Both these sessions will be hosted by Mitchell Sneddon.

And also for your diary: We'll have the analysts: James Samson, Simon Dumaresq and Mitchell Sneddon in the studio on Thursday March 24 for our major live webcast event that will be at 12.30 for a special extended time of 45 minutes.

Income First model portfolio

There were no changes to the Income First model portfolio in the past week. Both Steadfast Group (SDF) and Flexigroup (FXL) commenced trading on an ex-dividend basis, adding to the dividend yield of the portfolio with a 2.4 cent fully franked and 7.25 cent fully franked dividend respectively.

Overall, we are comfortable with the portfolio's exposure and performance. However we note that to lift the dividend yield going forward we will be looking to invest additional cash.

This week will see DWS and AHG commence trading ex-dividend on Monday and Thursday respectively.

- James Samson

Growth First model portfolio

A strong week for the portfolio, in line with general market strength. News from Vita Group (VTG) with it announcing the extension of the Telstra agreement until the end of 2020. Netcomm (NTC) was up eight percent today to $2.90 on no news. But as we mentioned after the half year results there are multiple pending catalysts that could be announced in the near term.

- Simon Dumaresq

LIC model portfolio

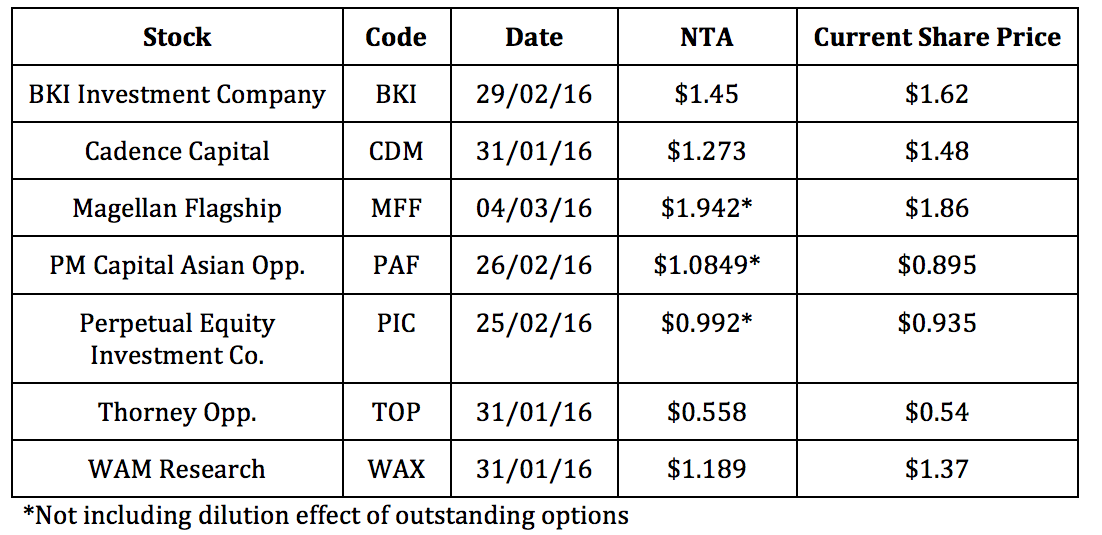

There are no changes to the LIC model portfolio this week. We will be keeping a close eye on the upcoming round of LICs that report monthly. Cadence Capital's NTA has been slipping while the share price has maintained steadily.

We will be looking for a lift in NTA as if the current trend continues the share price will revert back to towards value. Pure speculation here but you might come to the conclusion it is the dividend that is currently holding up the share price. We will keep a close eye on things leading up to the ex dividend date which is April 27.

Each week we get a lot of questions come through about NTAs - my article this week discusses how I think about NTA. Click here to read: When NTAs Matter.

- Mitchell Sneddon