What's on at Eureka Report and model portfolio updates

Welcome to this February 29 edition of Eureka Report – I don't recall a leap year edition before or indeed an edition where we had so many results to cover.

We hope you enjoy reading up on eight of Eureka's stock picks this week.

Don't forget to catch up on last week's interview between our income analyst James Samson and Sue Channon, the chief executive at 'assisted reproductive services' group Virtus - view the video here. Meanwhile this Wednesday we'll be broadcasting James' latest interview with Robert Kelly, the chief executive of insurance group Steadfast.

Later in March, Hyperion Asset Management founder Manny Pohl will be in the studio on March 16, while small caps expert Michael Glennon of the Glennon Small Companies Fund will drop by on March 18 to take your questions in the studio.

And don't forget March 24 for our reporting season wrap webcast – by then we'll have a complete picture for our model portfolios and we'll be taking your questions with Simon Dumaresq, James Samson and Mitchell Sneddon.

Income First model portfolio

Last week was the final week of reporting for the Income First model portfolio, with four companies providing financials to the market.

In the childcare space, GEM and ARF provided full year and half year result respectively, with the highlight being a lift in the latter's distribution guidance for FY16. Additionally, SDF and VRT both reported solid financials for the first half of FY16.

Overall, the portfolio is performing well. Reporting for February is now behind us, and the focus in the coming months will be the opportunity to add to existing positions in a weak market and add new positions following results season.

It is worth noting as well that the judgment from the High Court proceedings between TTS and the State of Victoria will be handed down on Wednesday. This is likely to be a material announcement in terms of TTS' near term distribution capacity and performance.

- James Samson

Growth First model portfolio update

It's been a very busy week for growth stocks, so take the opportunity to read the full reports on our growth stocks in tonight's edition: For the record, we left Ridley as a buy recommendation with an unchanged valuation, while Pental has also been left as a buy recommendation but with an upgraded valuation of 76c.

Separately, are ceasing coverage of home fixtures provider GWA, with a final hold recommendation and a valuation of $2.34. We will also sell the stock from the Growth First portfolio.

LIC model portfolio update

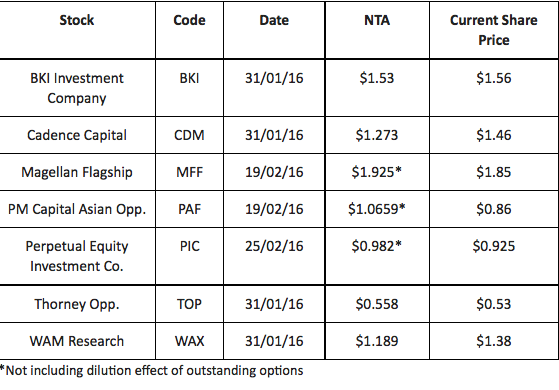

There are no changes to the LIC model portfolio this week. What I will be keeping an eye out is PAF's weekly NTA update, which should be released tomorrow (Tuesday March 1). The reason for this? PAF's largest holding is Donaco International (ASX: DNA).

The ASX listed South East Asia-based gaming and casino business was hammered by the market last week when its result and outlook came up short of market expectations. DNA closed at $0.73 on February 24 and opened at $0.54 the next day. In PAF's last monthly update DNA made up 9.4 per cent of the portfolio. This is the reason managers like PAF take a sensibly weighted portfolio approach. Events like this will happen in the market.

Last week PM Capital's Paul Moore gave an update on PAF and PM Capital's global LIC, PGF. Moore communicated with shareholders the team's view of looking through the short-term market gyrations. He went on to call the discount to NTA both LICs are trading at “irrational” and reaffirmed as the largest shareholder of PAF and PGF he has taken the opportunity to buy more shares and encouraged others to do so as well. To see the full video click here: PM Capital overview.

Speaking of managers owning the LIC they manage, skin in the game is one of my key criteria for picking a LIC and manager. Click here to read my article this week: Measuring a manager.

- Mitchell Sneddon