Pental and Ridley make progress

Ridley Corporation (RIC)

Asia driven Agri-product growth

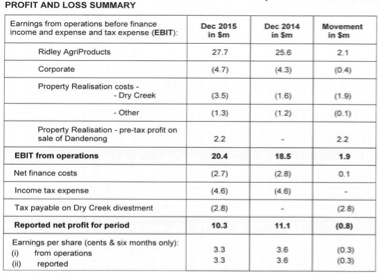

The Agri-feed product supplier Ridley (RIC) recently reported an interim result roughly inline with expectations. EBIT increased 8 per cent to $27.7 million, reflecting growth across most agri-feed segments. Reported profit has a number of one-offs, including $1.5m of incremental costs for the divestment of Dry Creek, and a $2.2m profit on the sale of the former feed mill site at Dandenong. There was also a $2.8m tax payment for the divestment of Dry Creek. Adjusting for these one-offs underlying net profit after tax was $12.4m. Importantly, costs for the maintenance of Dry Creek will cease completely from the March 31, 2016 divestment date.

Ridley continues to benefit from the positive long term outlook for the company's agri-feed products, driven by increasing protein demand. The strategy of releasing hidden property value, and then reinvesting in higher growth animal nutrition products is creating shareholder value. There is no better example of this strategy that the Novacq prawn feed opportunity that management is working hard to commercialise.

There have been a number of recent land sales, and the Moolap property development has selected a developer, and packaged the Lara site ready for sale. Another strategic focus has been selective efficiency projects re-investing in its feedmills to reduce operating costs.

AgriProducts

The dairy sector performance exceeded the equivalent period last year with a strong outlook for the second half, partly dependent on customers' milk price outcomes. Poultry and pig achieved an increased result on improved volume and cost control. The new feed mill at North East Geelong provides additional capacity for Ridley to accommodate anticipated growth to the north and west of Geelong in Victoria. Commissioning of the feed mill is targeted for early 2017. Raw material intake for both rendering sites declined, as a reflection of herd management and strong competition to secure volume to maintain plant utilisation. After a strong result last year, there was a decline in Aqua-Feed volumes partly offset by improved margins. The supplements business was the standout performer, with a large earnings uplift.

Prawn market

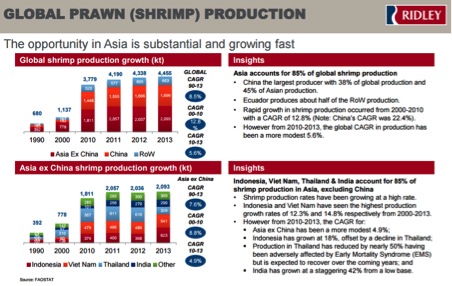

Management have identified a unique opportunity in the prawn feed market, partly driven by increasing demand and lack of supply growth.

The Asian market (including Australia) consumes 3.2m tonnes of prawn feed annually. This is worth approximately $US2.4bn, and provides an excellent opportunity for RIC, given margins in aqua feeds are usually 2-3 times what can be achieved in complete feed.

The company's Novacq product can reduce the reliance on fishmeal, with $1.2bn spent annually in prawn feed. Approximately 20 per cent of prawn feed is high cost fishmeal that is becoming increasingly scarce. Given Novacq can accelerate biomass development, reduce conversion costs and the amount of fishmeal required it is likely to be very popular in the Asian market.

As can be seen below, Asia accounts for 85 per cent of global prawn production, with China having 45 per cent of this Asian production. The rapid growth from 2000-2010 slowed dramatically from 2010-2013.

Novacq – Prawn feed

The investment in the commercialisation of the prawn feed Novacq ingredient has transformational potential to earnings from FY17. Two recent Novacq related transactions include securing a site for domestic production of Novacq and also a 49 per cent investment in a Thailand feed mill. The domestic site is a 10 year lease on unused prawn ponds at the Tru-Blu Prawn farm in Yamba, NSW. It facilitates the scale up of Novacq manufacturing to commercial quantities to satisfy the latent demand for the prawn feed additive and to conduct trials in Thailand. Once commercialised in Australia, can take the intellectual property to the preferred initial licensed jurisdiction of Thailand.

The Thailand feed mill investment provides an immediate footprint into the world's second largest prawn producing country to develop the brand and prepare for the introduction of Novacq into the Thai prawn feed diets. The equity investment of $AU1.1m allows the operation of a quality feed mill with initial production capacity of approximately 30,000 tonnes, and an exclusive contracted to supply prawn feed to the adjacent prawn farm owned and operated by the feed mill co-owners. For a significantly cheaper capex investment (relative to Australia) the feed mill capacity can be increased to 55,000 tonnes. Not only is the investment a low cost opportunity, but Ridley will also benefit from the local knowledge of its new partner.

If the high value, high yielding feedstock input is a success, it will not only provide earnings upside from FY17, but also provide a large positive branding opportunity. To be willing to invest in sustainable and environmentally responsible production of livestock can only help in assisting the company objective of being the leading supplier of high performance animal nutrition solutions.

Summary

We believe RIC is well placed to continue growing earnings at a rate greater than 10 per cent per annum for the foreseeable future. As such, the slight PE premium to the market (FY16 PE of 17, vs ASX200 at 15) is justified.

Strategically the company is well placed, with managing director Tim Hart's reputation on the improve as he executes on planned land sales, operational efficiency projects and growth opportunities such as Novacq.

We maintain our buy recommendation with a $1.65 valuation.

Pental Limited (PTL)

Asian exports begin

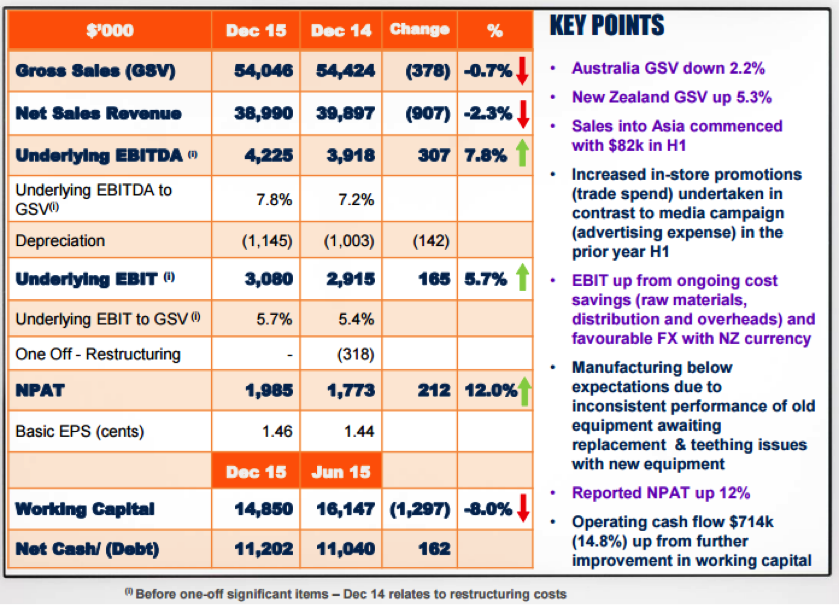

The highlights of the Pental (PTL) half year result were the beginning of Asian exports and the increased profit ( 12 per cent), despite a fall in revenue (-2.2 per cent).

The company is moving towards the end of a $5.3 million multi-year investment program to upgrade facilities at its Shepparton manufacturing plant. The benefits of this investment are starting to be seen, as evidenced by the increase in earnings margins. A longer term benefit will be the increased production capacity.

Other factors behind the improved profit margins include sourcing of raw materials, more targeted marketing expense, exchange rate movements and reduced corporate overheads.

The slight decline in group sales was affected by undersupply of stock due to plant performance issues with old equipment awaiting replacement and teething issues during commissioning of new equipment. A long lead time for new equipment was the main cause. We view this as a genuine one-off that will be partly recovered in the second half. We estimate the combined impact was $1m to $1.5m of sales.

Plant performance issues aside, the group's core supermarket brands continue to perform well (including White King, Velvet, Softly and Country Life), due to management's focus on expanding its pipeline of innovative new products, new channels and productivity savings.

The dividend was up from 0.85 cents to 1c. Operating cash flow was strong due to positive working capital management: The 15 per cent increase to $5.5m compares favourably with underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $4.2m (a 7.8 per cent increase). With zero debt, a major capex program expected to be finished in May, and $11.2m of cash, the company is in a strong position to expand and pursue additional growth. At this stage it would appear that building up capacity to service Asian exports is likely to be the company's most compelling opportunity.

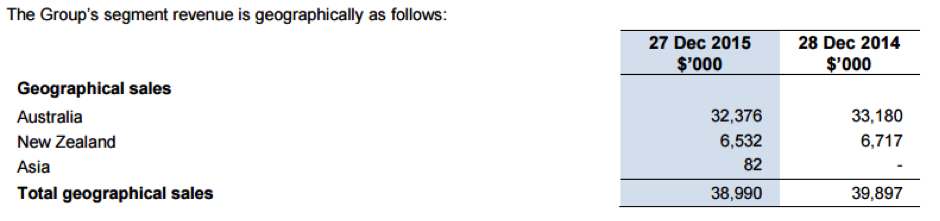

Gross Australian sales were down 2.2 per cent, and New Zealand sales increased 5.3 per cent. Pental has steadily increased market share in key categories. This is an impressive achievement as chief executive Charlie McLeish and his management team have been up against aggressive marketing (and price cutting) by competitors.

Asian export sales

As we discussed on the February 8 (read here), Pental is a more speculative way of playing the China consumer thematic that has driven huge share price growth from stocks such as Bellamy's (BAL) and Blackmores (BKL).

The company's first soap sales into China were achieved ahead of schedule, commencing in December. Charlie McLeish and his team are actively negotiating supply arrangements through a range of distribution channels, including retailers, online shopping sites and pharmacies.

The view is that Pental can benefit from the Asian demand for premium Australian wellness, health and beauty products. The new packaging features iconic imagery and highlights the products' origins as Australian owned and made. Some new products include goat's milk beauty bars, with infusions like honey and green tea.

This process has included a number of meetings with Asian-based businesses in January, along with the development of a range of new products. Management stated: “We are very excited by the opportunities of opening up new distribution channels in the Asian market, and expect more positive results will flow from our endeavours.”

A key difference between Pental and some of the other China-related stocks is that Pental can't afford to increase capacity in the hope that the “grey” market will drive sales to China. Further to this point, the company is doing everything in their power to reduce the chances of been affected by Chinese legislation changes.

After a few trips to China, chief executive McLeish is convinced that the “grey” market will be disrupted by regulatory changes in the next 2-3 years. As such he will focus on distribution channels with the least exposure to potential changes. We are expecting further details to be announced in coming months.

With China sales beginning in December, Asia only represents $82,000 of sales in the first half – but we may not have to wait too much longer for this number to materially increase.

A challenge will be assessing the timing and extent of capacity upgrades for soap bar manufacturing at its Shepparton plant. But it will also give the market a hint of the sales momentum the company is achieving. Slightly lower margin contract manufacturing can also be utilised to fill the gap.

At this stage we understand the first soap line is nearly running at capacity. This line produces 34 bars of soap a minute (after change over times) with two by 7.5 hour shifts, 5 days a week. If we assume average revenue of $0.60 per bar then this suggests capacity of $4.4m revenue. The company can upgrade this capacity to 128 bars per minute for an immaterial $40k of capex. Using the same production assumptions 128 bars per minute provides about $16.5m revenue capacity.

Moving beyond this an extra 200 bars per minute can be added down the track, however this would require an initial material capex investment.

It would appear that the first target is $4-5m export revenue, but chief executive McLeish most likely has more ambitious targets in mind. One percent of the Chinese bar soap market currently equates to about $15m, and this is certainly not out of reach.

At this stage we have very conservative China numbers assumed in our earnings forecasts.

Outlook

As discussed, the company is targeting the release of new products in the second half with a healthy interest from domestic retailers and prospective export customers.

The company will also continue to seek value-creating opportunities such as distributorships, acquisitions and/or divestments of non-core brands in the interests of improving shareholder value.

Competitive nature of grocery retail market consistent with prior periods, but management's attitude has been to focus on innovation of brands to combat price-cutting strategies from competitors and ensure continued growth.

Similar to previous years, the second half is expected to be stronger than the first. At 63c, PTL is trading on a FY16 PE multiple of 15 times our 4.2 cents earnings per share forecast. Looking past this year, PTL has potential for an earnings and multiple re-rating once it successfully executes its Asian export strategy. The first target for management, and when the market will likely re-rate the stock, will be 5-10 per cent of sales from exports.

We have a slightly increased 76c valuation and maintain our buy recommendation.