What's on at Eureka Report and model portfolio updates

Our webcast events get more popular every month and I expect there is a strong chance we may well break a record for attendance this Thursday (February 4) at 12.30pm, when we have our reporting season preview of ER stocks. This will be your chance to hear the market's expectations of our favourite stocks as they get ready to report annual results through the month of February and March.

Joining me in the studio for an extended 45 minutes event will be our analysts James Samson and Simon Dumaresq, along with our resources correspondent Tim Treadgold.

Income First model portfolio

The income first model has continued to perform well. In fact, performance from GEM, ARF and VRT has been quite positive of late.

For now we are awaiting financial results from the February reporting season before making further investment decisions in the portfolio.

Growth First model mortfolio

Over the past week, EPD and CAJ have continued to underperform. We have reviewed EPD and maintain our current position with a buy call on the stock.

Moving into reporting season, the portfolio still holds a strong cash balance, so we will be looking to invest further as opportunities become available.

- James Samson

LIC model portfolio

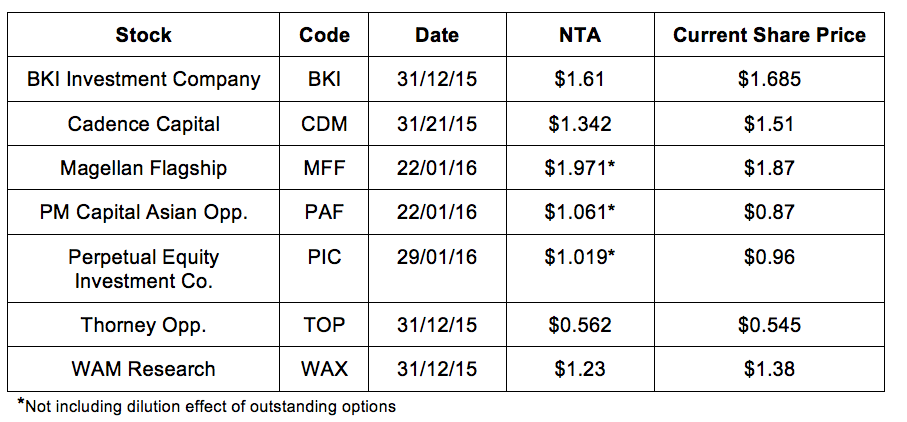

There are no changes to the LIC model portfolio this week, but there are changes to some calls I have on individual LICs in the share recommendations page. Click here to read the article and you will find I am changing my call on WAM Research (WAX) and Cadence Capital (CDM) to a hold and my call on Magellan Flagship from a hold to a buy.

Another change: A subscriber wrote to me (just this afternoon) asking if there was a table with the model holdings and the LICs' NTA and share price. There wasn't, but there is now. Each week I will publish the simple table below. It is straightforward with the date column showing the last reported NTA. PIC updates its NTA daily, MFF and PAF weekly and the rest are updated monthly.

-Mitchell Sneddon