What your ETF is missing

Summary: When looking at high yield ETFs it's important to understand how the group of stocks in the underlying index is decided. The MSCI Australia Select High Dividend Yield Index has eight steps for weeding out stocks - however, some of these, like excluding the bottom five per cent of stocks with a negative one year performance, could mean missing out on opportunities. |

Key take-out: The high yield index reviewed here does pay more income than the ASX200 - though as we've discussed previously, this doesn't automatically mean capital is preserved. |

Key beneficiaries: General investors. Category: ETFs. |

Investing doesn't pay as well as it used to. That's why so many portfolios have been tempted towards riskier growth assets. Providers of exchange-traded funds have met this demand with high-yield passive funds, “Claytons-style” products where the label may encourage an illusion of hopeful expectation. The buzz phrase is “smart beta”.

But the long-standing argument about whether an active manager is better value for parts of the investment spectrum is wide open when it comes to targeting high yield equities.

Last week we looked at four high yield ETFs that had all underperformed the ASX200 recently (to read more, click here: ETFs - has high yield been over hyped?). What those investors gained in extra income was a bitter reward for larger than average losses to capital.

In an attempt to find where the wealth is being lost, or at least to show how hard it is to construct a yield index, we'll look at the SPDR MSCI Australia Select High Dividend Yield Fund, which tracks the MSCI Australia Select High Dividend Yield Index.

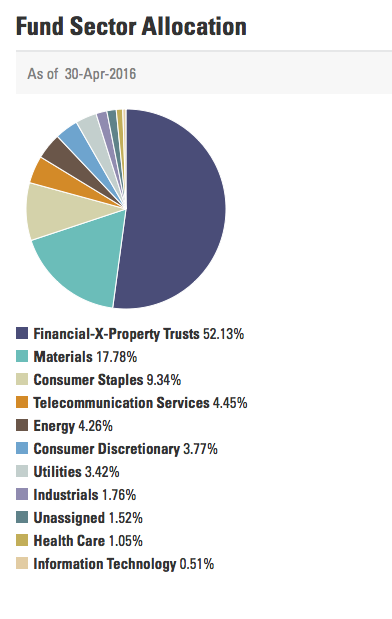

Source: State Street Global Advisors.

For the year to April 30, the ETF was down 9.25 per cent, the index was down 8.98 per cent and the ASX200 was down 4.93 per cent (with all income reinvested).

How the MSCI Australia Select High Dividend Yield Index works:

Step 1: Real estate investment trusts are sifted out because, MSCI says, they “have structurally very high dividend yield”. With REITs the entire tax liability is passed on to the investor, whereas dividends that come with franking credits may incur a small payment to, or refund from, the ATO.

To include REITs would ensure a lopsided portfolio, MSCI claims (although 33 per cent of the SPDR fund that tracks the MSCI index is made up of the big four banks, which account for about 26 per cent of the ASX200).

Step 2: Stocks that pay “very high dividends” are screened out, as are companies that haven't earned “a historical track record” of payments. This sounds like a reasonable hurdle as very high yields can be a signal that a dividend's about to be cut, says Intelligent Investor research director James Carlisle. On the other hand, he says, “if you've got a stock that's yielding seven per cent and you correctly work out it's going to be able to maintain earnings that support that dividend, you're going to do well.” It's possible such a stock wouldn't pass the selection test of a high yield index.

Step 3: Companies with zero or negative payout ratios (loss-making companies) are excluded from the sample, as are those with very high payout ratios, “which … may also indicate that the dividend payment might not be sustainable in the future,” MSCI says. The filter excludes the top five per cent by payout ratio.

The danger here, Carlisle says, is excluding companies where it's not easy to reinvest profits. Cash-generative companies such as ASX and Perpetual pay out between 80 per cent and 100 per cent of earnings simply because they have virtually no capital requirements.

Step 4: Next is MSCI's “persistence screen”, which throws out companies whose dividends per share have shrunk over five years. Stocks which don't have five years' data available are not excluded, however.

The risk here is that investors will miss out on companies on an earnings comeback, where a rebound in fortunes will also shown up in the share price. The assumption that a downward trend will continue in one direction could just as easily sift out value stocks as duds.

Step 5: Companies that earn a “negative quality” Z score for return on equity, earnings variability and debt to equity are cut out. MSCI uses the Z score, a measure of statistical distribution, to find stocks showing “potentially deteriorating fundamentals”. Put very simply, outliers are discarded.

Step 6: Next, the bottom five per cent of stocks with negative one-year price performance are thrown out, which will be a shame if some of them happen to be among the top performers in the following year. “This is where formulaic approaches fall down,” Carlisle says. “The worst performers over the past year are just as likely to do as well or as badly as the top performers.”

Step 7: Of the companies that have made it through only those that pay at least 1.3 times the dividend yield of the MSCI Australia Investable Market index (comprised of about 208 stocks) are included. Of a universe of about 230 companies 40 had qualified for inclusion in the SPDR ETF when we looked in late May.

Step 8: Finally, weightings are applied based on market capitalisation in the parent index. In the Australian ETF, that means a heavy emphasis on the big banks, as mentioned earlier. But where the MSCI high yield criteria is applied to broader markets, such as the world or emerging markets, for example, weightings are capped at five per cent.

Passive aggressive

Running the selection process sounds like a lot of work, but it's no hassle for a computer to parse the data and produce a portfolio. That's why ETFs are cheap.

Whether the selection criteria will work that well when applied in the Australian market is not so certain. We've already seen it's not guaranteed to beat the ASX200 benchmark.

If you're prepared to pay for yield, that's no problem. The high yield index reviewed here does pay more than the benchmark, but not that much (5.74 per cent dividend yield versus 4.76 per cent for the ASX200, for the year to April 30).

When capital levels are depleted, next year's yield will look higher in percentage terms but be lower in dollar terms.

To most people, that's what matters.