The Reserve Bank's rates dilemma

| Summary: Will the Reserve Bank’s next rate move be down or up? More than likely, it will not be changing rates any time soon. But which direction it takes down the track will ultimately come down to whether it wants a lower dollar, or to take the heat out of housing prices. |

| Key take-out: The market is under-pricing the risk of a rate cut in the months ahead. Until the Reserve Bank sees a rebalancing in the economy, it will be more concerned about a serious downturn and the level of the Australian dollar. |

| Key beneficiaries: General investors. Category: Economy. |

The Reserve Bank of Australia finds itself between a rock and a hard place at the moment.

On the one hand it is dealing with an overvalued dollar and, on the other, what appears to be the early stages of a housing boom. As things stand, the official rhetoric from the RBA is that: “Given the substantial degree of policy stimulus in place, the Board judged that it was appropriate to retain the current setting of interest rates. Members agreed that the Bank should again neither close off the possibility of reducing rates further nor signal an imminent intention to reduce them. The Board would continue to examine the data over the months ahead to assess whether monetary policy was appropriately configured.”

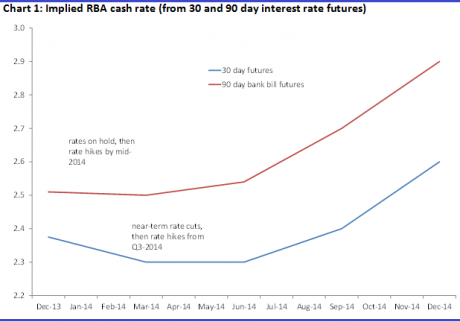

From my read, that very much sounds like a pause with an easing bias, and I don’t doubt that is the RBA’s intention – it was fairly clear. Yet that pause may not last long, and there is some debate in the market as to what exactly the next move might be – whatever the RBA might signal now. The 30-day futures market, for instance, prices in roughly a 40% chance of a cut at the November meeting. Indeed, 12 of 30 market economists surveyed by Bloomberg expect a cut at this meeting (none expect a rate cut next week).

Yet 18 economists don’t think there will be a cut at this meeting or again, and four expect a hike by mid next year. Similarly, while the 30-day futures market has more rate cuts priced in, other instruments don’t. So, for instance, three and six month bank bill swap rates point to a cash rate that is little change at 2.58/59% respectively. Yet that pricing, and that of bank bill futures, points to a greater likelihood of rate hikes (albeit only a very small probability), as does the rates curve more generally.

So why the divergence given the RBA’s clarity? Well it boils down to what concerns the RBA most: A housing bubble or an Australian dollar that, in the RBA’s own words, “remains at a high level” – and that was when it was at 0.89 cents.

Those who think there will be a hike, or even a prolonged hiatus, think the bank is concerned about the housing boom. Those who don’t, probably think the RBA attaches less weight to a boom developing – and more to the currency. Certainly, since the last RBA meeting, the Australian dollar has appreciated by 5 cents, or 6%. It is clearly concerned about the dollar strength then and it has said that plainly.

Conversely it has been more cryptic when talking about the housing market, which is probably why there has been a debate here about its level of concern. Whatever the case, it’s quite clear that since the last meeting, housing market momentum has accelerated, perhaps adding some credibility to the view that its statement at the last meeting didn’t reflect its growing concern. After all, this is a rebound that has largely caught the RBA unawares.

Officially, public commentary on the matter has been limited to ensuring that banks maintain prudent lending standards. Moreover, and while noting in its latest stability review (out on Wednesday) that self-managed super funds and their interest in property “did not currently pose material risks to financial stability”, they warranted “careful observation in the period ahead”. That the RBA felt the need to say anything is offered as proof of the bank’s growing concern. Yet, more generally, the Reserve Bank has noted that: “The risk profile of new household borrowing remains reasonably sound and indicators of household financial stress are low. The continued high rate of excess repayments on home loans is consistent with low rates of financial stress among households with mortgages.”

For me, this doesn’t sound like it is too worried at this point, and I suggested that would be the case in my piece last week No property bubble: It's opportunity knocking. Don’t get me wrong. I think the sudden turn of events has certainly taken the RBA by surprise. Why? Because the bank was of the view, and possibly still is, that household deleveraging and high rates of saving would keep a lid on things. That’s why it suggested that it was important “that those purchasing property do so with realistic expectations of future dwelling price growth.” The RBA is saying this because it is of the view (it must be) that there is no fundamental reason why house prices should rise rapidly, and that price growth will be limited to incomes growth – because of already high debt levels and this process of deleveraging.

As I’ve discussed previously, I think the RBA is wrong on this, and so far market moves support my view. But that’s what policy makers think and a quick change of view is unlikely. Indeed, in the latest financial stability review, it simply noted that households had continued with their more ‘prudent behaviour”.

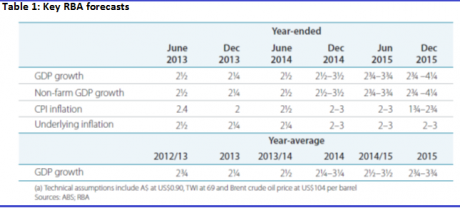

I suspect that would be different if the economic backdrop wasn’t so apparently benign. That’s both the current state of play and the RBA’s expected outlook. Consider that, from a purely macroeconomic perspective, the Australian economy is in a sweet spot. Not too hot and not too cold. In fact, everything seems to be hovering around average or trend rates. Inflation, for instance, is in the middle of the band, economic growth, up to the June quarter at least, is only about 0.6% below trend (2.6% v 3.2%).

Indeed, I think the best that can be said is that the economic state of play and the best guesses as to its future (from the RBA’s viewpoint) are a fairly neutral influence on rates. They don’t demand rate hikes, but they are not pointing to the need for further rates cuts. More generally, I think the RBA has used this set of fairly benign metrics to experiment a little with an exchange rate target. Why would it do that? Because it is very concerned that, with the mining boom ending, there won’t be anything left to drive economic growth. This keeps it awake at night. And think of it this way: there is no point worrying about a housing boom if the economy lurches towards a recession next year. I don’t think there is anything here then that will force the RBA to change its view – especially a housing boom it doesn’t think exists or will likely take off. From a policy maker’s perspective, all that’s occurring is a very healthy rebound in house prices – nothing more.

Now I need to point out at this stage that I think this view is wrong. I think there has been a confidence shock to the country – and that’s it. We are seeing that slowly reverse, so higher rates would be better as they would discourage the build-up of distortions in the economy. The RBA however, is not even close to thinking along these lines.

Noting this, I suspect the recent lift in the exchange rate and the tightening in financial conditions more generally – the Australian 10-year bond yield has increased 50 basis points, or 60bp (now at 3.84%) since the beginning of the year – is of more concern to the RBA. This is seemingly supported by the lightweight effort it has put into jawboning house prices at the moment – but not even house prices; the focus has been on lending and SMSF gearing.

The way I see things then, the market overall is under-pricing the risk of a rate cut in the months ahead. From the RBA’s perspective, the dollar is too high and there is still no sign as yet of a rebalancing in the economy. Until it sees that, the bank will be much more concerned about a serious downturn and the level of the Australian dollar.