The property bubble myth is busted

| Summary: Median house prices across most of the major capital cities are on the rise, with Sydney and Melbourne leading the way. There is ongoing talk of a property bubble forming, but the statistical evidence shows nothing of the sort. House price growth is actually below the average of the last 18 years, and prices in some cities are barely moving ahead. |

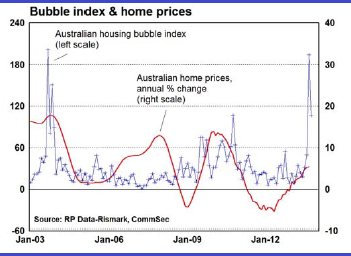

| Key take-out: The Australian housing bubble index – which measures how often media outlets mention the words ‘housing’ and ‘bubble’ together in their reports – has spiked to its highest point since 2003. Back then, house prices were growing at 17.5% year-on-year. |

| Key beneficiaries: General investors. Category: Property. |

Australia and New Zealand Banking Group (ANZ) has fuelled talk of Australian property prices surging up to 20% in the next two years, amid an unprecedented shortage of physical housing stock.

In a report published yesterday, property analysts from Australia’s third-largest bank say the country will experience strong improvement in prices for existing stock. But this will be the most modest cyclical upturn in housing construction in the past three decades, due to rising vacancy rates and growing valuation risks in some of the markets.

This comes despite the release of monthly housing construction figures from the Australian Bureau of Statistics on the same day, where building approvals hit a three-year high in September and smashed forecasts, rising 14.4% against expectations for just 2.8%.

Meanwhile, in another sign of a pending acceleration in Australia’s property market, major mortgage lenders are beginning to lift their fixed rates for home loans, anticipating that the cycle of rate-cutting by the Reserve Bank of Australia is over.

But are we in a bubble? The short answer is, no.

The RP Data-Rismark index released this morning found Australian capital city dwelling values are up 8.2% in the year-to-date, after October added 1.3%.

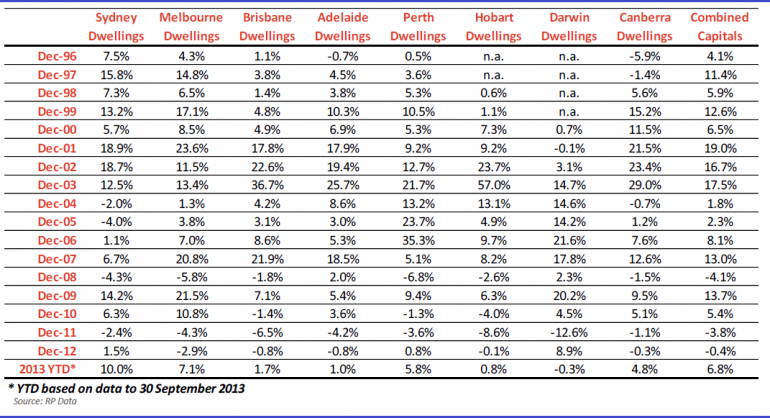

However, if we look at historical house prices going back to 1996, they are still hovering close to the 18-year average of 7.7%.

“If you look at the housing market recovery … it’s nowhere near as strong as those previous growth phases we have seen,” says Cameron Kusher, senior research analyst at RP Data. “And that’s something that is getting lost in the overall commentary a bit.”

Sydney’s 11.6% growth this year and, to a lesser extent, Melbourne’s 7.8% have outpaced the other cities. But as the table above shows, they are climbing out from flat to negative growth in previous years, and are nowhere near their loftiest heights during 2002, 2003 and 2009. (See today’s video with Eureka Report Managing Editor, James Kirby, and SQM Research Managing Director, Louis Christopher.)

The other worry fuelling housing bubble speculation is when housing prices run ahead of salaries.

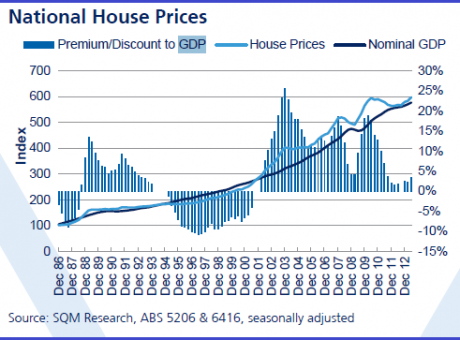

But as the graph below illustrates, national house prices have actually been trading at a substantial premium to nominal GDP since the early 2000s – hinting at overvaluation – and only recently narrowed the gap to 1% in September 2012. This has since crept upwards to 3%.

“When you look at total income across the country versus real estate house price growth, it’s just slightly above fair value,” says Christopher.

Given the Australian housing market is emerging from two years of below trend growth amid record low interest rates, Christopher says it is entirely possible to be perfectly normal and sustainable over the shorter time frame.

Kusher isn’t worried about a bubble forming in the two markets yet. He says if house price rises were to grow at around 5% for the next three to four consecutive quarters, as in the June quarter, they will become unsustainable.

But this is unlikely, because the housing market is seasonal and affordability constraints will begin to take effect soon given how high the prices already are in the two markets.

Further, higher unemployment, which Treasury forecasts will be 6.25% in 2013-14, will begin to slow housing demand as people worry about job security.

Christopher only finds the argument for a bubble to be logical once house prices exceed salaries for three to four straight years.

“At this point in time, when you look at the data, I find it hard to make a case we’re in a bubble right now,” he says.

Hype about a housing bubble in Australia is out of step with reality. Adam Carr also noted this recently in his article, No property bubble: It’s opportunity knocking, and Alan Kohler points to the reality of housing credit and house prices in a separate chart (click here).

As shown below, the Australian housing bubble index – which measures how often media outlets mention the words ‘housing’ and ‘bubble’ together in their reports – has spiked to its highest point since 2003. Back then, house prices were growing at 17.5% year-on-year.

All this unease about a housing bubble is unfounded – at least for now – when looked at from the perspective of Australian housing prices and its premium to nominal GDP over the past two decades.