The markets are moving under us

Summary: Prices for our export commodities look set to stay low for a long time, while our housing market is set to have a sizable vacancy rate that will depress returns and values in the short- to medium-term. Companies that face a way to boost revenues and control costs in a lower growth economy will thrive. The banks will continue to grow but at a much lesser pace, while the retail industry is in the front line in the decline of discretionary spending. |

Key take out: As we face a lower growth economy, stock picking, rather than index investing, is going to be very important. We will need to look for different stocks in 2015. |

Key beneficiaries: General Investors. Category: Strategy. |

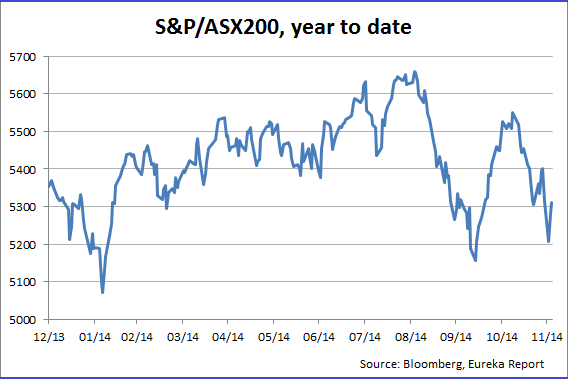

This week saw some real selling in the Australian market and at the same time bond yields declined sharply.

It's true the market bounced back but the bond and share markets are telling us to expect a very different Australia from the one we have become accustomed to over the last decade.

It is not a question of being on the edge of some terrible slump but the pattern of our growth and development is going to change and we will need to look for different stocks in 2015.

The mining investment boom and other favourable developments in the Australian economy have given us a decade of growth and strong performance. Apart from setting up the Future Fund, governments have spent the boom money and set up patterns of expenditure that we have no hope of maintaining unless we borrow vast sums or send taxes through the roof. Being a government politician (in either party) will not be easy.

In simple terms the prices of our three export commodities – iron ore, gas and coal – look set to stay down for a long time because while China may maintain growth, its housing market, which was a key user of steel, is in chronic oversupply. That means that it is going to take a long time to mop up the surplus iron ore production unless China itself cuts back production dramatically.

Oil is in chronic oversupply which hits the gas price and China is getting cheaper gas from Russia. (To read more on oil, click here to read Tim Treadgold's Oil plunge: What to do.)

This underlying situation is being multiplied because big banks have stopped being actively involved in commodity trading and synthetic securities have been created where highly leveraged trades take place. The falling prices have caused huge losses and as people are sold out of these synthetic securities so the price of the real commodity falls further. This accelerates and deepens the fall caused by the underlying situation. We will continue to see big fluctuations, including partial recoveries.

Back home the stimulus that the mining investment boom gave has come to an end and we face the closure of the motor sector and parts of the defence industries and a major shift from bricks and mortar retailing to online trading. The fall in commodity prices means we will gain little taxation revenue from the mining investment revenue.

At the same time we are currently maintaining our dwelling building industry through massive Chinese and Asian investment in one or two bedroom apartments in Sydney and Melbourne and to a lesser extent other capitals. There is strong demand to tenant these apartments but whenever a market is flooded it causes oversupply (ask the commodity producers). There is going to be a sizable vacancy rate which will depress returns and values in the short- to medium-term. Many Chinese will be happy to lose the money because they want a residence in Australia but that view will not be uniform. We will look back on this overindulgence in one sector of the property market like all other booms and, at least in my view, it will affect values in the wider housing market. But that's a year or two down the track when the apartments are completed. Those gearing their superannuation funds for apartment investment need to appreciate this risk.

And so we face a lower growth economy. Some companies will find a way to boost their revenues with a tight control on costs. They will thrive.

Many Australian companies have already increased their profits via cost reductions but may struggle to go much further unless they are able to completely re-engineer their company. In many cases new technologies will assist in that re-engineering.

One way to adapt to this lower growth situation is by mergers and we will see a rise in takeovers as companies seek to overcome low growth with scale. In many cases the winners will be the sellers because the CEOs of the companies that buy will not always have the talents required to deliver the benefits from a takeover. It's a special skill.

In our markets the banking regulators will fear the implications of the looming big rise in empty apartments being constructed. Accordingly they will almost certainly do whatever David Murray's report recommends in relation to increasing bank equity.

So we are entering into an era where stock picking, rather than index investing, is going to be very important.

When I discuss these scenarios with Eureka Report readers the first question I am asked is what will happen to the banks if I am right.

Unless there is a very big fall in the housing market and/or a big rise in unemployment that boosts their bad debts, banks will continue to grow but at a much lesser pace. New entrants will threaten them in parts of their businesses and all of them need to work out a growth strategy – not simply more of the same. I don't think any of the bank boards have fully appreciated this new environment.

Health companies should continue to do well although salaries will not be rising and it will be hard to get pension increases so people are going to look much more closely at their discretionary spending, which will affect health.

The retail industry is in the front line in the decline of discretionary dollars but it will spread to other areas, including sporting event attendances and golf clubs. I am wary of stocks whose prices depend on government regulation. As we saw in NSW power regulators will be trying to help consumers.

On the other hand, contrary to the analysts, the bond market is telling us there is almost no possibility of interest rate rises and the trend is going to be lower.

Accordingly, stocks with sound income performed well this week and were not subjected to the same sell-offs.

Almost certainly inflation will remain low although if our dollar goes lower than US75 cents the cost of imports is going to rise and we will pay dearly for shutting our motor industry, particularly where Toyota could have been saved without big outlays.

But that lower dollar will open up a raft of new opportunities. Going on to Christmas this may sound depressing but remember this is the sort of environment that Europe and the US have been experiencing for many years and they learned to adapt. We will find it strange because the weakness in Australia will come at a time of US recovery and a level of improvement in Europe albeit not great. China will continue to grow in services but not in commodity-using industries. It becomes a very different world. How will we get out of it? The only politician in Canberra that has any idea of how we can prosper in this environment is Trade Minister Andrew Robb.

Tony Abbott needs to promote him so that the rest of the Government and perhaps even the opposition can embrace his ideas. In essence Robb says that we must go flat out on tourism, education, health and exporting other service industries to China. And we need to invest dramatically in agriculture to take advantage of the China-Australia Free Trade Agreement. And that is how we will break out of the current situation.

We are very fortunate that we have at least one minister with a vision for the country and as 2015 proceeds perhaps others will take up the baton. If they don't or the Robb vision can't be realised we face a very long haul.