Oil plunge: What to do

Summary: The recent drop in the oil price is bad news for Australian producers, but in other countries lower energy prices offer a welcome economic boost. Energy currencies such as the rouble are losers, but the transport sector is a winner as fuel bills fall. High-cost oil producing countries will face budget pressure that could trigger social instability. |

Key take-out: All energy producers are losers from a falling oil price as oil is the global benchmark for every form of energy, including coal, renewables and uranium. |

Key beneficiaries: General investors. Category: Oil and gas. |

Cold comfort as it is for investors exposed to Australian oil and gas stocks, they are not alone in suffering from the impact of a falling oil price. This event is truly global and it is a case where panic selling will do more damage than watching and waiting.

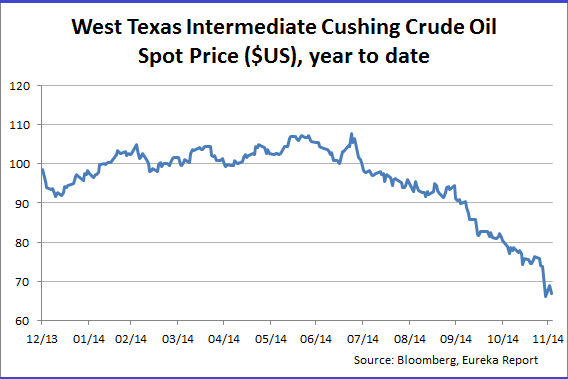

It is not stretching the point to say that the sharp drop in the price of oil over the past few days is re-writing the rule book in financial markets and on the geopolitical stage.

But before looking at those changes, consider this critical point:

The Organization of the Petroleum Exporting Countries is maintaining a high rate of production to force the oil price down now because it believes a squeeze on high-cost rivals will lead to higher oil prices in the future.

If there is any good news in what's happening today that's it. Low oil prices today should, in theory, lead to higher prices tomorrow.

The problem with the theory is knowing how long oil will stay low.

However, if history is a guide the answer is not long, because oil is a commodity which can react quickly to changes in supply and demand pressures. Production can be switched off (and on) at the turn of a valve – which is exactly what's happening as high-cost production is cut.

Unfortunately for a number of Australian companies, especially those close to finalising the construction of liquefied natural gas (LNG) projects based on coal-seam gas in Queensland, the price collapse could not have come at a worse time.

That is one reason why Santos (which also has high debt levels) has been hit harder on the stock market than Woodside Petroleum and Oil Search, which are in production and have access to cheaper conventional gas rather than high-cost coal seam gas.

While the oil price shock is having a negative effect on Australia because it is an energy exporting country, that's not the case in most other countries where lower oil prices are welcome.

Europe, the US, Japan and China are getting a one-off boost to their economies from lower energy prices. In London, where I am currently attending a resources conference, the big oil price drop is not even front-page news, except in the Financial Times, and then only because of the impact on Russia and its currency, the rouble.

The way newspapers and other news sources are treating the collapse in the oil price is a guide to its manifold effects on different countries, companies and currencies, as these examples show:

- Currencies: The rouble, so far, is the big loser from the lower oil price because Russia is also being buffeted by sanctions over its military adventures in Ukraine. Other “energy currencies” will also be hit, with the Australian dollar a prime candidate for a big fall because the oil price drop represents a hat-trick of bad commodity news, coming on top of lower iron ore and coal prices taking our terms of trade down sharply.

- Gold: Down in the early days of the oil price shock but up over the past 24 hours to the time of writing. Cheaper oil means lower inflation (and inflation is a gold price driver) whereas gold has regained ground recently as it re-develops its appeal as a currency of last resort, alongside the US dollar and the Swiss franc.

- China: A big winner from cheaper oil because it is a major energy importer and cheaper energy means lower costs for its manufacturing sector. A stronger China will eventually boost Australian exports to that country.

- The US: Falling energy prices will boost its manufacturing sector, offsetting losses in its oil producing regions, especially high-cost unconventional (shale) oil and gas.

- Technology: Breakthroughs in finding and extracting oil and gas trapped in tightly-packed rocks (the so-called shale revolution) is proving to be a global game-changer with no guarantee that what's been started can be controlled by OPEC's oil-price game.

- Europe: Possibly the biggest winner from falling energy prices because of its heavy reliance on energy imports. When factored in to a lower common currency (the euro) Europe could be on the road to a sustainable recovery.

- Banks: Some banks have a heavy exposure to oil production and oil service companies. Investors are sifting through which banks are hit hardest and might be forced to write down bad loans.

- Transport: Everyone is a winner, from Qantas with its huge bill for aviation fuel to trucking companies.

- Renewable energy: A loser because cheaper oil will discourage investment in alternative sources of energy.

- Coal: Also a loser, for the same reason as renewables.

- High-cost oil producing countries such as Venezuela, Iran and Nigeria will face severe budget pressure, potentially triggering social instability.

- Russia: A huge (and angry) loser which could react violently to a collapsing budget, extending its military adventures north into the Baltic states with their large Russian-speaking minorities.

Picking winners and losers from the oil shock is a tricky business but as a general rule companies and countries which use large amounts of energy (in any form) or import energy (in any form) will be the winners over the next 12 to 24 months.

All energy producers (in any form) will be losers because oil is the global benchmark for every form of energy, including coal, renewables and even uranium.

The higher the cost of the energy being produced, the greater the damage.

In Australia, that means the new coal-seam LNG projects centred on Gladstone will have a rocky start, assuming the oil price stays low and it flows into the pricing mechanism of their sales contracts.

Other Australian LNG projects based on conventional sources of gas will also feel the pinch as they get closer to starting production. There are three in that category: the Gorgon and Wheatstone projects led by Chevron Corporation, and the Ichthys project led by Japan's Inpex.

The most ambitious of the new LNG projects, the Prelude floating gas production development of Royal Dutch Shell, will have become less financially attractive, as will the floating LNG development proposed by Woodside for its Browse gas fields.

A potential win for Australian LNG projects in production or nearing completion is that rival overseas projects will almost certainly be mothballed until the oil price recovers.

In Canada, high-cost tar sands projects are likely to be mothballed because they need an oil price above $US100 a barrel to break even. In Brazil, the development of deep-water oil fields could be delayed because of falling financial returns.

The key points about the latest developments in the oil industry are:

- This is a global event with potentially momentous implications which could destabilise the economies and political structure of a number of countries.

- It is not just oil producers or oil service companies being hit. All energy producers will be affected by the lower oil price.

- The duration of the downturn is unknown. The determining factor is the speed at which high-cost energy disappears from the system.

The aim of OPEC is to regain control of the oil pricing mechanism, a power it held for 40 years until the entry of new sources of energy, especially US shale oil, and the rapid expansion of pipelined gas and LNG with gas snatching market share because of its lower pollution footprint.

The target oil price for OPEC is $US100 a barrel, a level at which most oil and gas projects are profitable.

OPEC members believe they can drive the price back to that target, but there are two great unknowns. The first is how quickly they can return the price to that level, and the second is whether it can be achieved at all given the rapid development of new oil production technologies.

It's not often that an event can be said to have truly re-written the rule book but what's happening today is certainly adding a fresh chapter – with more to come as the fall-out continues.