The best yield stocks post-correction

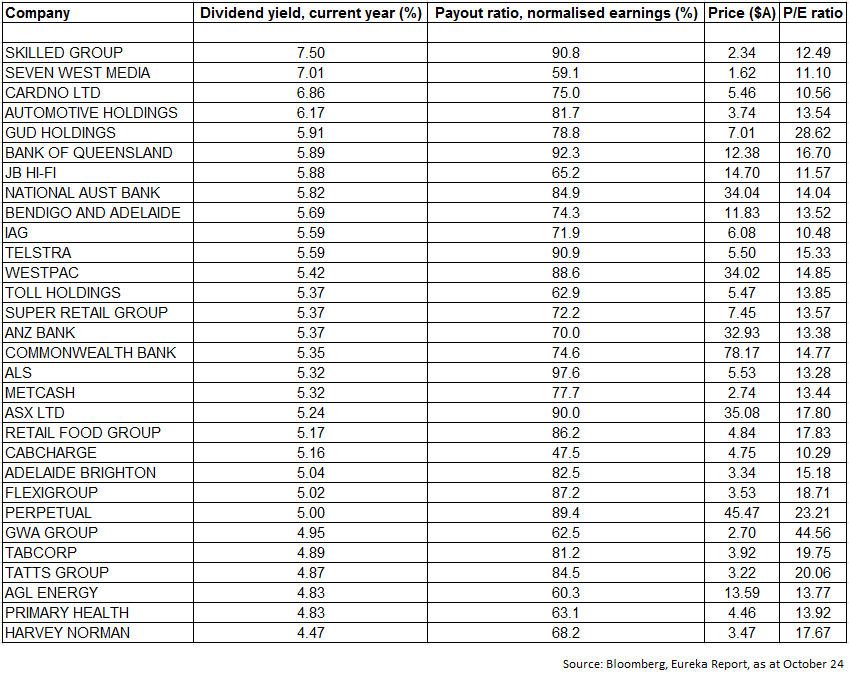

Summary: After the recent market pullback, it's a good time to consider the top yield stocks. We've compiled a table of the companies on the ASX 200 that are offering the best yields. The list includes only stocks with fully franked dividends. It also excludes companies on low price-earnings ratios or high payout ratios, two factors which suggest earnings may not be sustainable. |

Key take out: The big four banks and Telstra still have attractive yields. And remember that any stock offering a yield above 6% requires more research. |

Key beneficiaries: General Investors. Category: Shares. |

The Australian share market has rebounded from its recent pullback but still sits 200 points below the peak it reached at the end of this year's company earnings season, on September 2. After the flurry of selling and buying, it's timely to consider which stocks are now offering the most attractive yields.

The table below features the best yield picks on the ASX 200. The stocks listed all offer fully franked dividends. The list is also filtered to only include companies on a price-earnings ratio of 10 or higher, as low multiples may indicate the market suspects future earnings may not be able to sustain dividends.

Moreover, all stocks listed pay out less than 95% of their earnings as dividends, given that a high payout ratio may suggest attractive dividends are not sustainable. A payout ratio above 100% shows that a company is paying out more than it earns.

Any stocks with three or more recent broker downgrades have also been removed.

A word of warning: any stock offering a yield above 6% invariably requires more research by any potential investor. Remember, high yields do not always point to sustainable returns and may indicate that the market thinks a company has ongoing problems.

The top stock, Skilled Group, is an illustration of why it pays to be careful when looking at companies offering high yields. The contract labour provider's share price has fallen from $3.45 in January to $2.29 this week. In August, the group announced that chief executive Mick McMahon would quit before next year's annual meeting, and handed down a full-year net profit that was 21% lower than the previous year. These are all warning signs for investors.

But stock number two, Seven West Media, has some differences in its story. Although its share price has fallen from $2.38 in January to $1.66 this week, the group swung back to a full-year profit and Bloomberg data shows a dozen brokers have positive recommendations on the stock. Our partners at Stocks In Value say the company is in value, estimating the share price to lift to $1.74 for fiscal 2015. But with a yield of 7%, this falls firmly into the territory where more research than usual is required.

The banks still feature near the top of the list, despite falling sharply during a volatile October. The highest lender on the list is a junior, the Bank of Queensland, with a yield of 5.9%. Rival junior bank Bendigo and Adelaide also comes up well, with a yield of 5.7%.

Among the big four banks, the highest yielding is also the most troubled – National Australia Bank, with a 5.8% yield. NAB's UK banking division has faced ongoing problems, while the lender has moved to float its US subsidiary. NAB's full-year results will be closely scrutinised when they are released tomorrow, October 30.

Other major banks Westpac, ANZ and Commonwealth Bank have a yield of 5.4%. Despite being better positioned than NAB, all the majors face possible headwinds. Investors will be watching the report of David Murray's financial system inquiry, expected to be delivered next month, to see if the banks are required to hold billions of dollars more capital, which could hit earnings. The stellar run of bank share prices over the past two years may be coming to an end, as lenders face other issues such as competition from new payment technologies, and any fall in house prices would also hurt – but dividends look set to stay sweet for some time (see Bank stocks: It's all about dividends now).

However, doubters of the banks have been proved wrong before. Three of the big four banks are reporting in the coming days – after NAB, there's ANZ on October 31 and Westpac on November 3 – which will provide further insight. Having said that, we already know ANZ appears to be on track, courtesy of a disclosure debacle in which the lender accidentally released information on earnings changes that hinted at a rise in full-year earnings to about $7.1 billion. If the other banks' results are as good as this, their shares will look appealing.

Insurer IAG also ranks in line with other financial stocks, offering a yield of 5.6%. With fewer natural disasters since the Queensland floods, general insurers have had a chance to shine. IAG's profit jumped in the year to June and the group expects premium growth in the current year after acquiring Wesfarmers' insurance business.

Telstra remains another strong performer, with a yield of 5.6%. The traditional yield stock has a payout ratio of 90.9%, given its large size can make it tricky to find growth opportunities (see Six ways to identify quality companies). The telco has recently announced a push into healthcare, planning to connect patients and doctors over the phone and the internet. Investors will be keen to see how these plans affect the company's bottom line.

Logistics firm Toll Holdings, which provides express freight transport, has a yield of 5.4%. The group delivered a rise in profit in the year to June and told shareholders it was confident of earnings growth in the current year, based on its drive to cut costs. But the company has conceded that the first quarter of fiscal 2015 has been softer than expected, saying hard work would be needed to lift earnings given growth in the external environment was lacking.

Cement manufacturer Adelaide Brighton has a yield of 5%. The group supplies residential customers, so the ongoing surge in home building activity fuelled by low interest rates is good news. Adelaide Brighton also supplies customers in industries such as non-residential construction, engineering and gold mining. At its full-year results, the company said it expects a recovery in residential building to offset sluggishness in the non-residential sector. But in March, the company suffered a blow after it lost a key contract from customer Cement Australia.

Primary Health's yield is 4.8% and the stock has fallen in price from $5.04 in March to $4.49 this week. The group faces uncertainty around the proposed Medicare co-payment, which could reduce demand for its pathology services. The health care provider recently agreed to buy private health insurer Transport Health, giving it a foothold in the health insurance market.

Some companies on the list are not necessarily there for the healthiest reasons, with falls in their share prices making dividends look attractive. For example, share prices for JB Hi-Fi and Metcash have fallen over the past year.

The companies featured all offer fully franked dividends, and the real value of the dividends is even higher when grossed up. The list excludes companies that offer partially franked or unfranked dividends, such as the property trusts. The exclusion of stocks that have a payout ratio of 95% or above also removes key names such as Woodside, Wesfarmers, Suncorp, AMP and Transurban and fund manager Platinum.

It's also worth remembering that smaller companies can offer attractive dividends. For example, Eureka Report analyst Simon Dumaresq has previously covered IT services company UXC, noting its relatively strong dividend yield and encouraging outlook (see UXC prepped for IT restart). Vita Group, which operates Telstra-branded retail stores, is another yield pick (see Vita's growth offering has yield chaser).

Investing is not only about dividends – capital growth is also key. But with the market expecting interest rate rises in the US to be delayed, demand for yield stocks could continue (see Medibank IPO first impressions: Low yielding and not cheap). Just remember the importance of research, especially if something looks too good to be true.