Small caps in AGM firing line

| Summary: The annual general meeting season has started, giving investors the opportunity to hear about the board’s expectations for future company performance. Unfortunately, the outlook won’t be bright for all companies, reflecting a range of operational issues. |

| Key take-out: The three small caps highlighted below have the potential to issue downbeat outlooks at their upcoming AGMs. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendations: Melbourne IT (MLB): Underperform. Regional Express Holdings (REX): Neutral. Forge Group (FGE): Outperform. |

Not everyone is basking in the post-election afterglow. With the starting gun for the annual general meeting season having already gone off, a number of Uncapped 100 companies have come out early to warn that they can’t shake their earnings funk.

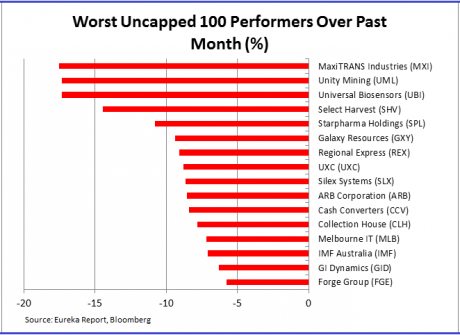

Drilling company Imdex (IMD), trailer and tipper maker MaxiTRANS Industries (MXI), and four-wheel drive accessory supplier ARB Corporation (ARP) are some that have complained about the lack of an earnings rebound despite the dramatic pick-up in confidence after the federal election.

MaxiTRANS crashed 13.7% on the day of its AGM on Friday, and on Thursday ARB Corporation reversed 5.7%, and Imdex fell but managed to recover to close flat.

You can bet we have not heard the last of the downbeat outlooks, given that more than 80% of the Uncapped 100 companies have yet to front investors at their annual meetings.

I am not throwing in the towel and abandoning my view that the next six months will be a strong one for emerging companies as I think there will be more good than bad news from this AGM season. Adam Carr also gave four reasons why you should expect an earnings upswing last week.

For instance, hospital equipment supplier Paragon Care is one that has come out to say it has seen a sharp pick-up in demand for its equipment since the Coalition came into power, and it won’t be only one feeling in a celebratory mood as we head into Christmas.

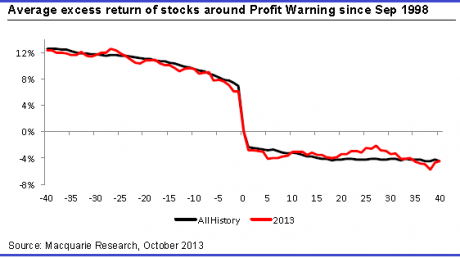

However, it pays to be aware of the companies that are at risk of issuing disappointing outlooks or guidance at their AGM, as research has shown these offenders can lag the market for weeks, if not months.

Looking at the last 15 years, Macquarie Equities has found that stocks tend to fall around 4% behind the broader market in the 40 days after management issues a profit warning. What’s also interesting is that these stocks tend to drift lower in the month leading up to the bad news.

Mind you, not all stocks that fall ahead of their AGM will disappoint, but it’s one of the early warning signals that’s worth watching, especially if expectations are set high for the company.

If you have been following the Uncapped articles, you’d know I am bullish on the market. But the consensus estimates for some companies in the Uncapped 100 might be too bullish.

Melbourne IT (MLB): Underperform.

The domain name registration and web hosting group is in the midst of a major restructure and analysts polled on Bloomberg are anticipating the benefits to start flowing through in the 2014 calendar. Sales are tipped to rebound 28% to $140 million and earnings per share is forecast to jump 40% to 10.4 cents.

That looks way too high to me, as I doubt we will see any real tangible signs of a turnaround until 2015 (Melbourne IT’s financial year is the same as the calendar year) at the earliest. Granted that earnings for the embattled group are coming off a low base, and there are great expectations that the new domain name system will contribute significantly to revenue.

The new name system allows companies registering for web addresses to swap “.com” for just about anything (such as “.flowers” or “.food”). The belief is that companies would book multiple domain names to protect their brand.

Forecasting demand for these new addresses is next to impossible and some experts suspect that demand won’t be as robust as what others might believe.

The other problem is that the English domain names will probably only be available from mid-2014, and will take a year or so to fully roll out.

This leaves me wondering where sales growth for 2014 will come from, especially since total revenue for Melbourne IT are set to fall after it sold its Digital Brand Services and For The Record businesses this year.

Even if Melbourne IT’s web hosting division shows some growth, it is unlikely to book such robust double-digit sales and earnings growth that is implied by the consensus forecasts.

The real question though is whether the market believes the consensus estimates. From the looks of things, I think the answer is “yes” as the stock is trading on a price-earnings multiple of over 15 times based on the optimistic 2014 forecast.

Given that Melbourne IT has really just embarked on its three-year transformation, and no one really knows what the business will look like at the end of the period (management is looking to make some acquisitions with the asset sale proceeds, but the company doesn’t have a good track record on this front), I think the stock should be trading at or below its five-year average P/E of 10.6 times.

While the group holds its AGM in May, I think it will dawn on investors that Melbourne IT is really a 2015 or 2016 story when they listen to what other IT companies say during this AGM season.

You don’t want to be holding the stock when that happens, and I have an “underperform” rating on the company.

Regional Express Holdings (REX): Neutral.

The regional airline should be heading for clearer skies, having come through a tough year or two. But I fear management will be too battered and bruised to offer much in the way of an upbeat forecast.

Regional Express is the only listed company I am aware of to explicitly say how bad the former Labor federal government was for business.

Management told investors when it released its full-year earnings in August that its expects 2013-14 performance to deteriorate further “if Labor wins” but improve slightly “under a Coalition government”.

Its chairman, Lim Kim Hai, went on to say this “is one of the most toxic environments ever to face aviation in Australia” as sales plunged “almost immediately from 1 July 2012 after the federal government’s carbon tax was implemented, together with a whole host of policies hostile to regional aviation”.

The airline posted a 45% plunge in 2012-13 net profit to $14 million and noted that the carbon tax had shaved $2.4 million off its bottom line.

It will be a clear win for the airline when Tony Abbott scraps the carbon tax, but the timing of this is still uncertain and management is likely to shy away from giving any guidance. I also suspect that it will say it has not seen any notable rebound in demand along its routes, and that might prompt shareholders to sell down the stock.

However, with the stock nosediving 16% over the past two-months, and given management’s good reputation, a further dip in share price could be seen as a buying opportunity.

Regional Express’ AGM will be held on November 27 and I have a “neutral” recommendation on the stock, pending the outcome of the meeting.

Forge Group (FGE): Outperform.

All eyes will be on engineering contractor Forge Group when it hosts shareholders at its AGM tomorrow (Thursday, October 24) morning.

There is growing concern that Forge could announce some disappointing news due to project deferrals, which could lead analysts to downgrade their 2013-14 estimates on the group.

The stock has slipped around 7% since the start of the month, and Macquarie is the latest broker to flag this risk after Forge was forced to delay work at the Vista Coal project, Dugold River project and Cape Lambert power station due to regulatory issues and changes to mine design.

This means if Forge is to meet consensus revenue estimates of $1.21 billion for 2013-14, which is up 15% from last year, the Roy Hill iron ore project will have to start on schedule.

While these delays are outside management’s control, shareholders will be keen to get an update of project timing from the company.

Any hints that the Roy Hill project has to be pushed back will likely see the stock dip further.

Forge has been one of my worst “outperform” calls since I highlighted it on September 18, but I am still convinced it will come good for those willing to hold it for at least a year because of its compelling valuation and management’s good track record in winning and delivering projects.

I maintain my “outperform” rating on Forge, but those looking to buy the stock might want to wait for an update at the AGM.

Update: Forge did indeed give a downbeat near-term outlook at its AGM on Thursday and highlighted the increasing risk of project deferrals, which sent the stock dipping 0.8% to $4.84 in morning trade. You can read more about it here. Investors should use the dip as a buying opportunity.

Others in the firing line

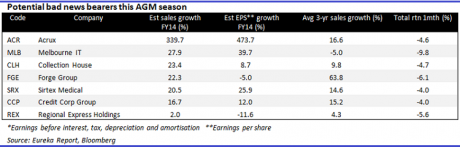

The three companies above aren’t the only ones to watch out for, although they are the more likely ones to deliver downbeat outlooks.

Biotechs Acrux (ACR) and Sirtex Medical (SRX) are also keeping investors on edge after their disappointing full-year results in August, and investors will be keen to get further updates from management.

Spray-on treatment developer Acrux has been hit by a surprising slowdown in growth in the global testosterone treatment market, and demand for Sirtex’s kidney liver treatment has been more volatile than expected.

Acrux’s AGM is on November 21, and Sirtex is scheduled for next Tuesday.

Update: The bad news for Acrux has come sooner than expected with its partner Eli Lilly reporting a drop in sales of Acrux’s flagship testosterone treatment drug, Axiron. You can read more about it here.

Debt collection agencies Collection House (CLH) and Credit Corp Group (CCP) could also be facing some headwinds in the year ahead.

Competition to buy outstanding debt has heated up recently and is making debt ledger purchases more expensive. Further, any pick-up in economic activity and interest rate hikes could also weigh on earnings for the companies.

Analysts are forecasting a more than 20% increase in Collection House’s sales and a 17% improvement in Credit Corp’s top line in 2013-14.

Collection House’s AGM is set for this Friday, and Credit Corp’s meeting will be held on November 7.

Think big, go smalls!

Uncapped 100 - Australia's most interesting small cap stocks | |||||

| Small cap stocks covered by the Uncapped team | |||||

| Code | Name | Rationale | Market cap ($m) | Total return 1-year (%) | Sector (GICS) |

| ACR | Acrux | One of the most successful Australian biotechs in recent history. Widely held by instos. | 525.38 | -6.35 | Health Care |

| ACL | Alchemia /Australia | One of the few biotechs with revenue stream. Good pipeline of oncology treatments. | 199.47 | 9.82 | Health Care |

| AOH | Altona Mining | Noteworthy copper play with Xstrata pull-out of Roseby project in Australia and the good ramp up of its Finnish project. | 78.50 | -45.37 | Materials |

| AMA | AMA Group | Good turnaround story but under the automotive services group is radar of most. | 125.34 | 45.24 | Consumer Discretionary |

| AMM | Amcom Telecommunications | Well covered junior telco but good candidate for core holding. | 511.12 | 64.25 | Telecommunication Services |

| AZZ | Antares Energy | Liquid with good insto support. Already in production with exploration upside in Texas. | 126.22 | -13.16 | Energy |

| ARP | ARB Corp | Well covered but good candidate for core holding due to quality management. | 826.29 | 8.81 | Consumer Discretionary |

| AAD | Ardent Leisure Group | Widely held stock. Earnings more defensive than anticipated. Good yield. Potential core holding. | 809.99 | 56.94 | Consumer Discretionary |

| AJA | Astro Japan Property Group | Strong leverage to Japanese economy makes this an interesting stock to watch. | 245.32 | 26.83 | Financials |

| AUB | Austbrokers Holdings | The insurance broker is a strong performer. Widely held and well liked by small cap investors. | 738.41 | 66.16 | Financials |

| AEU | Australian Education Trust | Well performing childcare centre property owner. Good yield story and outlook. | 277.24 | 45.05 | Financials |

| BDR | Beadell Resources | Will be a very big FY14 for miner as it has to prove it aims to produce 200,000 ounces of gold a year. | 762.86 | -5.39 | Materials |

| BGA | Bega Cheese | Corporate interest in Australian food companies makes the cheese maker worth following. | 604.43 | 127.05 | Consumer Staples |

| BGL | BigAir Group | The wireless microcap has gained strong following over past year or two but is often overlooked by investors and the press. | 145.24 | 66.6 | Telecommunication Services |

| BNO | Bionomics | One of the larger cancer treatment developers in this market. | 327.66 | 146.05 | Health Care |

| BOL | Boom Logistics | Crane hire group is riding out the downturn in construction. It's widely held by instos and is very liquid. | 94.12 | -39.39 | Industrials |

| BRU | Buru Energy | Substantial size but not often covered by press. Widely held with good insto support. | 519.16 | -38.73 | Energy |

| CAA | Capral | An aluminium manufacturer that is actually holding up relatively well given that manufacturing is on the nose. | 94.10 | 5 | Materials |

| CCV | Cash Converters International | Strong performance is attracting investors. It's Australia's only listed pawn shop and pay day lender. | 508.61 | 48.62 | Consumer Discretionary |

| CWP | Cedar Woods Properties | Property developer with good ROE and earnings growth track record. | 528.19 | 79.39 | Financials |

| CUV | Clinuvel Pharmaceuticals | Interesting skin disorder treatment developer that has done reasonably well over past year | 58.85 | -3.75 | Health Care |

| CLV | Clover Corp | One of the star performers in 2012. Operates in growing but relatively stable niche. | 84.24 | -1.65 | Health Care |

| CLH | Collection House | In similar space as Credit Corp. Strong stock performance has attracted a following and the stock appears to be well placed to run further | 218.50 | 81.54 | Industrials |

| CKF | Collins Foods | One of the few food franchise listed companies. | 156.71 | 55.52 | Consumer Discretionary |

| CKL | Colorpak | The small cap packaging company has grown via acquisitions over past few years. | 68.49 | 63 | Materials |

| CCP | Credit Corp Group | Strong price run attracted good investor interest. Leveraged to any rise in loan defaults. Not well covered by press. | 449.32 | 39.47 | Industrials |

| DTL | Data#3 | Well respected IT company that receives little press coverage. | 175.53 | 5.79 | Information Technology |

| DRM | Doray Minerals | Widely held by instos. One of the more favoured gold explorers by brokers. | 100.73 | -17.92 | Materials |

| DWS | DWS | Will be a big beneficiary if governments start spending on IT again. | 195.90 | 3.53 | Information Technology |

| EBT | eBet | Potential alternative to star performer Ainsworth Tech. Has exclusive deal with US poker machine maker WMS. | 50.42 | 200.81 | Consumer Discretionary |

| EML | Emerchants | Trying to change way corporates and governments disburse cash with its trackable and controllable debit card offering. If company can get $1 billion in loaded value on cards, the stock will surge. | 64.20 | 415 | Financials |

| ESV | Eservglobal | Mobile money transfer company that has been gaining traction. Widely held by instos but low press coverage | 124.52 | 194.12 | Information Technology |

| FGE | Forge Group | One of the better performers in its industry. Good track record and potential core holding. | 422.23 | 19.25 | Industrials |

| GEM | G8 Education | Only listed childcare operator. Acquisition strategy paying off with stock delivering solid gains. | 945.95 | 135.73 | Consumer Discretionary |

| GXY | Galaxy Resources | Good upside potential if it can get its problem-prone Jiangsu plant back on track. Won't be easy to right this ship. | 58.43 | -83.61 | Materials |

| GHC | Generation Healthcare REIT | One of the more interesting REITs. Income is more defensive than typical property stock and its greenfield expansion gives it earnings growth potential. | 123.89 | 36.76 | Financials |

| GID | GI Dynamics Inc | Largely forgotten by investors but could attract attention this year as it looks to gain US approval to use its intestinal liner on diabetics. | 317.83 | 42.98 | Health Care |

| GXL | Greencross | Acquisitive veterinary group. Good profit growth and share price performance, but gets little press. | 260.49 | 132.21 | Health Care |

| HSN | Hansen Technologies | Operates in a high potential/growth industry but is not covered by press or brokers. | 177.43 | 37.53 | Information Technology |

| HZN | Horizon Oil | One of better regarded small energy stocks that doesn't receive much media attention. | 435.88 | -12.93 | Energy |

| IMD | Imdex | Drilling company is well supported by instos and should benefit from any rebound in exploration activity. | 177.85 | -43 | Materials |

| IMF | IMF Australia | Litigation funder is unique stock. Stock not liquid but its outlook appears promising given the number of potential class action lawsuits. | 260.00 | 22.06 | Financials |

| IFM | Infomedia | Interesting tech play in the car parts market. Strong share price gain but gets little air play. | 186.02 | 89.92 | Information Technology |

| IPP | iProperty Group | Worth watching as it is trying to be the REA Group of Asia. | 362.80 | 122.22 | Information Technology |

| JIN | Jumbo Interactive | Innovative small cap facing off industry dominated by giants. Worth watching to see if it can carve out a profitable global business. | 113.76 | 57.74 | Consumer Discretionary |

| KOV | Korvest | The construction products and services supplier has been hit by project delays and deferrals. But its relatively high yield could give it some support. | 47.16 | -15.56 | Industrials |

| LGD | Legend Corp | Electronic parts supplier to utilities and other industries. Stable earnings with good yield. Often overlooked. | 74.63 | 3.74 | Information Technology |

| LCM | LogiCamms | Strong price performance and reasonable valuation attracting interest. | 145.92 | 101.14 | Industrials |

| MTU | M2 Telecommunications Group | Amazing growth story and well run company. High free float and strong insto support. | 1,136.62 | 70.63 | Telecommunication Services |

| MXI | MaxiTRANS Industries | Transport equipment maker posted good interim result. Has appealing yield and growth. | 213.43 | 22.54 | Industrials |

| MYX | Mayne Pharma Group | Sizeable generic drug maker with interesting board members. | 397.24 | 206.52 | Health Care |

| MMS | McMillan Shakespeare | One of the best performers since the GFC, but ongoing risk of change to FBT rules is hanging over the company. | 965.09 | 1.21 | Industrials |

| MCP | McPherson's | The personal care and household products supplier had been relatively insulated from volatile discretionary spend and online threat, but its latest profit warning shows it's not immune. | 120.10 | -20.76 | Consumer Discretionary |

| MLB | Melbourne IT | A perennial underperformer could be interesting turnaround story as management is in midst of restructuring the business. | 133.40 | 1.15 | Information Technology |

| MRM | Mermaid Marine Australia | Its strategically located facility on WA coast gives it a key advantage over competition in servicing Gorgon & Pluto projects. | 881.75 | 21.93 | Industrials |

| MNW | Mint Wireless | Huge market potential if the mobile card payment solutions provider can gain market traction. Management aiming for $1 billion in transaction value a year. | 149.43 | 2076.47 | Information Technology |

| MOC | Mortgage Choice | Has a good track record and is leveraged to any housing recovery. The stock is also liquid with good insto support. | 371.53 | 83.35 | Financials |

| MYS | MyState | Well regarded and could make good alternative to bank stocks. Has good yield and earnings growth over past few years. | 407.12 | 39.32 | Financials |

| NAN | Nanosonics | A successful medical tech story. Should be close to turning in maiden profit with its disinfection device. | 228.66 | 75.76 | Health Care |

| NEA | Nearmap | A stellar performer with an Interesting business that offers high quality aerial maps to companies & government. | 177.84 | 1566.67 | Information Technology |

| NTC | NetComm Wireless | Under appreciated small IT hardware maker that is punching above its weight. Hardly covered by press. | 33.46 | 108 | Information Technology |

| NWT | Newsat | Potential large cap if it can launch its own satellite in 2015. | 318.70 | 9.9 | Telecommunication Services |

| NXT | NEXTDC | The cloud computing company is an IT sector darling. Fairly widely held and followed. | 483.34 | 21.78 | Telecommunication Services |

| NHF | NIB Holdings /Australia | Only listed health insurer. Widely held. Good performer. | 1,005.32 | 33.87 | Financials |

| NWH | NRW Holdings | One of the better regarded mining & civil contractors with good track record in delivering on projects. | 404.39 | -27.44 | Industrials |

| OTH | Onthehouse Holdings | Alternative small cap to online property leader REA Group. It is trying to use more timely housing data as a competitive edge against REA. | 63.69 | 30.31 | Consumer Discretionary |

| PGC | Paragon Care | Emerging hospital equipment supplier that has been ignored by market. | 18.62 | 132.6 | Health Care |

| PFL | Patties Foods | Illiquid stock but has suite of well recognised consumer brands. Defensive yield. | 185.65 | -15 | Consumer Staples |

| PEN | Peninsula Energy | Widely held by instos and large free float. It's the only uranium miner on the list. | 76.99 | -21.21 | Energy |

| POH | Phosphagenics | Sizable biotech with a game changing FY14 year ahead. Good insto following but questions of poor audit and governance standard could dog company. | 107.15 | -22.22 | Health Care |

| RCG | RCG Corp | The footwear retailer is one of the best performing consumer stocks as online competition is not a big threat. Company has a good yield as well. | 186.33 | 77.91 | Consumer Discretionary |

| RCR | RCR Tomlinson | Good first half FY13 result and outlook, but will its fortunes change this year with the mining capex slowdown? | 518.08 | 106.6 | Industrials |

| RKN | Reckon | Fierce competition for cloud base accounting software puts it in firing line. | 313.85 | 0.51 | Information Technology |

| REX | Regional Express Holdings | Well run airline that is overshadowed by Virgin and Qantas. | 110.64 | -16.25 | Industrials |

| RFG | Retail Food Group | Owns a number of well know franchise brands. Widely followed by instos. | 597.15 | 47.32 | Consumer Discretionary |

| RIC | Ridley Corp | High corporate interest in the sector and the shrinking pool of agri listed stocks make Ridley worth following. | 261.64 | -20.18 | Consumer Staples |

| RUL | RungePincockMinarco | IT company to resource industry. Facing tough operating climate with new CEO trying to restructure and turnaround company. | 82.69 | 42.68 | Industrials |

| SAR | Saracen Mineral Holdings | Emerging gold producer that is widely held by instos. Hitting milestones and looks cheap. Key asset is close to gold majors, which makes it a potential takeover target. | 147.33 | -49.49 | Materials |

| SHV | Select Harvests | Noteworthy for turbulent past and exposure to soft commodity market. | 229.53 | 245.46 | Consumer Staples |

| SLX | Silex Systems | Its uranium enrichment technology could become one of Australia's best innovations given its potential to change the nuclear power industry. | 417.12 | -33.78 | Information Technology |

| SIV | Silver Chef | Strong jump in the share price of the equipment financing group has attracted a good following. | 251.98 | 99.85 | Industrials |

| SRX | Sirtex Medical | A shining star in the biotech space and one of the best performing stocks in 2012. Great product (liver cancer treatment) and bright outlook. | 712.58 | 25.68 | Health Care |

| SFH | Specialty Fashion Group | In early stages of turnaround. Can the women's apparel retailer sustain the momentum? | 173.97 | 81.12 | Consumer Discretionary |

| SPL | Starpharma Holdings | Noteworthy for its good pipeline of innovations. Well run, widely followed. | 257.17 | -40.26 | Health Care |

| SGN | STW Communications Group | One of few companies able to benefit from online shift. Widely held and good insto support. | 644.11 | 70.31 | Consumer Discretionary |

| SEA | Sundance Energy Australia | Analysts have a favourable take on the oil & gas explorer, but stock is still under radar of most. Sundance provides exposure to prospective Eagle Ford shale. | 494.99 | 30.49 | Energy |

| TAN | Tandou | The only direct equity exposure to cotton prices. Also trades water rights and receives little press. | 69.43 | 15.19 | Consumer Staples |

| TGR | Tassal Group | Salmon farmer is finally turning a corner with an improved harvest strategy and growing demand for product. | 493.00 | 139.67 | Consumer Staples |

| TFC | TFS Corp | The sandalwood products company offers exposure to both the agri and cosmetics industry. It will start commercial harvest this year. | 214.61 | 101.87 | Materials |

| TSM | ThinkSmart | Potential turnaround story worth keeping eye on. | 58.43 | 67.44 | Financials |

| TGA | Thorn Group | One of few retail stocks that is performing well. The Radio Rentals chain owner is also well supported by instos. | 369.26 | 32.33 | Consumer Discretionary |

| TGS | Tiger Resources | Future lies in its Kipoi copper mine expansion in the Congo but miner is fully funded with DRC govt holding 40% stake in tenement. Next 12mths will be interesting. | 259.79 | 5.48 | Materials |

| TOX | Tox Free Solutions | Widely held stock in the waste solutions business. Its unique because it operates in a defensive-growth niche. | 446.59 | 21.83 | Industrials |

| UML | Unity Mining | Growing Tassie gold producer with high free float. Valuation looks compelling too. | 43.52 | -50.4 | Materials |

| UBI | Universal Biosensors Inc | Well regarded biotech and one of few that's successfully manufacturing in Australia. Struck deal with a few global medical companies. | 109.12 | -26.47 | Health Care |

| UXC | UXC | Company has turned corner and enjoyed re-rating. What's next? | 343.67 | 31.6 | Information Technology |

| VOC | Vocus Communications | Telecom stocks are in favour but Vocus is one of the least covered | 220.32 | 46.43 | Telecommunication Services |

| WDS | WDS | Widely held with strong insto support. Engineering contractor diversified across mining, energy and infrastructure. | 130.99 | 71.24 | Industrials |

| WBB | Wide Bay Australia | The building society is trying to turn its fortunes around. Also worth watching for its exposure to Queensland housing market, particularly around major resource projects. | 201.12 | -15.94 | Financials |

| YTC | YTC Resources | Next 12-mths will be eventful after YTC secured funding for its projects from Glencore. | 69.66 | -3.7 | Materials |

| Source: Eureka Report, Bloomberg | |||||