Four reasons for an earnings upswing

| Summary: There are a number of key reasons why investors should be expecting an upswing in corporate earnings this year, beyond the fact that the global economy is slowly on the mend. Australian companies are enjoying a number of benefits, including low employment growth, improved productivity, lower labour costs, and reduced producer prices. |

| Key take-out: Average earnings forecasts of 8% corporate earnings growth are too low given current conditions. |

| Key beneficiaries: General investors. Category: Shares. |

In thinking about prospects for our market over the next 12 months, I presented a few reasons last week (IMF misses on global growth) why growth prospects for the global economy (or the upside risks) had improved.

For me, that fact alone suggests that consensus forecasts for corporate earnings over the next 12 months are probably too low, and so I see a little more value in the market than perhaps others do.

It’s fair to say that the current market earnings multiple of 16.5 appears expensive relative to historic values (on a trailing basis). Whether that is expensive though depends on what you think the future holds. Many would argue that the market is rightly pricing in an earnings recovery. Indeed, on forward earnings basis, that multiple shrinks to 15.2, which is about average and points to a market closer to fair value.

Underpinning this view, however, is an expectation that earnings pick up from about -3% last year to 8% next. That’s a leap many think is too ambitious, especially given the fragile global economic recovery, where, according to the policy consensus, downside risks predominate and have intensified. That is, growth prospects have deteriorated.

Now I’ve outlined in the past why I don’t think the global economy is fragile, and why that should support solid earnings growth. China didn’t have that hard landing and the US economy is moving into higher gear, notwithstanding this latest crisis. Moreover, the iron ore price sits comfortably over $US100 ($US133 at the time of writing) and the domestic housing market is rebounding. There is ample revenue support there. Similarly, the risks are not to the downside. Indeed, I don’t even think it a reasonable proposition given it’s formed on low probability extreme events, which in many cases are illegal (e.g. a US default). If anything, prospects are better, which of course means that prospects for Aussie corporate earnings are better.

Now if that wasn’t enough to convince investors, there are more reasons that we can’t overlook that are strongly supportive of the earnings environment. To my mind they virtually ensure that earnings estimates are far too low, which in turn means that our market still retains value. It is not an expensive market on any reasonable assessment.

Employment growth

Firstly, consider that employment growth is currently below GDP growth and even corporate profit growth (ex mining to exclude price fluctuations) of 3%. That output and profits is growing faster than employment tells you that current workers are producing more, working harder, and that generally means productivity is getting a boost. More output for fewer employees, fewer hours worked – and that’s exactly what the figures show.

Productivity gains

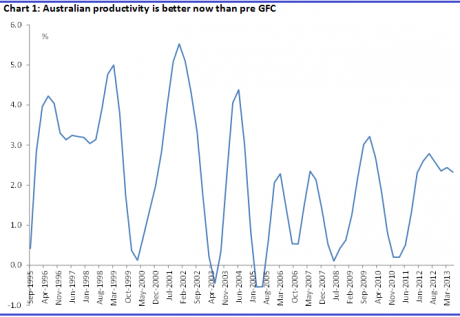

At 2.3% year-on-year, productivity growth is well above the average in the four years prior to the GFC, but not quite up there with the great reforming period in the 1990s. This is great news, and what policy should ideally be striving to achieve, because it increases the chances of achieving the so-called “goldilocks economy”. That is when growth and profits are driven by efficiency rather than inflation.

While productivity growth swings around and is cyclical, this is normal. Productivity growth tends to be lower during times of strong employment growth and vice versa (not always though). Above-average productivity growth suggests above average earnings growth.

Lower labour costs

Similarly, labour is cheap and becoming cheaper. Check out chart 2 below. It shows real labour costs per unit of output. Thought of another way, it shows the relative cost of an employee to make something, sell something, or whatever (adjusted for inflation), and these costs are falling. In fact, compared to 2007, labour costs are about 5% lower. Putting aside any social commentary on the matter, this is good for corporate earnings growth. Labour, especially in the advanced economies, is the major expense for most industries.

Producer prices down

It’s the same elsewhere across the cost spectrum. Not only are labour costs falling (relatively), price growth for other inputs is also moderating. You can see that most clearly in chart 3 below, which shows producer prices for Australia. The latest figures to the June quarter show producer prices rising at an annual rate of only 1.2%. That’s one-third of the normal growth rate and, excluding the GFC, the lowest growth rate in at least a decade – and well below rates of growth of up to 6% in the lead up to the GFC.

It makes sense to me then, that if the key cost inputs for corporates are either falling or growing at their slowest pace in a decade, then earnings aren’t going to be too bad. Because that leaves us with cheap input costs, rising productivity, the lowest interest rates in a generation, strong growth in our major trading partners, and improvements elsewhere.

With all of that to contend with, I’m really having a hard time justifying how analysts could be bearish on earnings. I can’t seriously or reasonably see too many headwinds to that. It’s not that 8% earnings growth is unreasonable or anything – it’s just too low. Consider that pre-GFC earnings per share growth was often around the 20% mark.

I’m not suggesting we should expect that to be replicated now. This was a period of great change, we had two booms, one credit the other mining, and that’s not to forget the rapid technological change brought about by the digital revolution.

Yet, neither should we expect comparatively weak growth of 8% (as an upside) given such strong fundamental support noted above.

On that basis, value starts to become much more evident and I think with current trends, we’re almost certain to see further earnings upgrades over coming months.