Shelter from the storm: Hunting "non-correlated" assets

Summary: Negative correlating assets like bonds do a better job dampening out share volatility than cash and so better support long term returns. Negative correlating gold and low correlating commodities appeal but are a drag on returns. Property despite its many issues may be your best complementary low correlating asset. Hedge funds including “CTA” funds may do so also, but realise they are driving a lot of the volatility you are trying to dilute. |

Key take out: Portfolios should hold assets that zag when shares zig as well as those that do neither. |

Key beneficiaries: General investors. Category: Shares. |

Following so much volatility in share prices you might be wondering if there's anything else you can invest in that offers different returns. If so, you are on the hunt for the holy grail of “non-correlating” and “negative correlating” investments. Here we discuss how asset prices move compared to each other and why building differences into your portfolio is important.

Correlation

If share prices always went up, you wouldn't worry about correlation between assets. Because they don't, it's important to consider introducing into your portfolio assets that go up when shares go down (are negatively correlated) and incorporate investments with returns that dance to a different beat (have low correlations). Correlation is a measure of how asset prices move together. The computed “correlation coefficient” varies from 1 when asset prices move lock step with each other to –1 when they move perfectly in reverse. A coefficient of 0 means asset prices don't relate to any pattern.

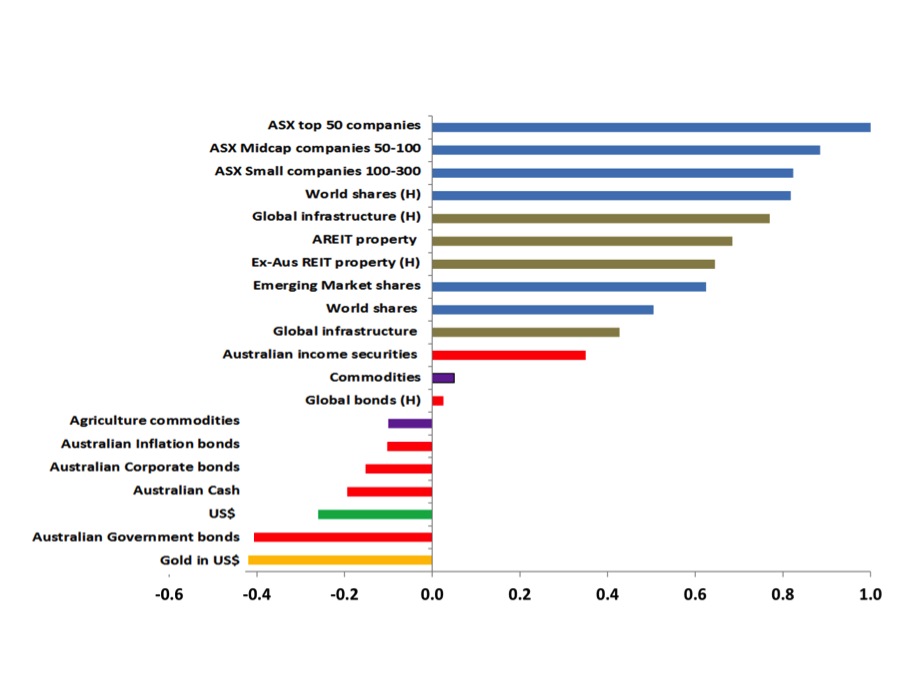

Figure 1 illustrates the correlation in total returns (share prices yield) between the top 50 listed Australian company shares (top bar) and various readily investable assets – company shares are shown in blue bars, real assets in brown, debt investments in red, the greenback in green and gold in, well, gold. Assets labelled (H) are those invested with currency effects hedged out. These are ranked top to bottom from assets that move similarly (positive correlations), dissimilarly (low positive or negative correlation) and in reverse (negative correlations). These correlations were derived for the ten years ending January 30, 2016 and so include the rambunctious GFC period.

Figure 1 – Correlation between the total returns from the top 50 large Australian share companies and various other liquid investable assets for 10 years to January 2016.

Negative correlated assets

Negative correlated assets are the air bags of your portfolio and help you survive a head on share crash. They zag when your shares zig. Specifically, when the value of your shares falls, they generally rise in value. This has two important effects:

1) It mutes the red devil on your shoulder who screams SELL!!! and

2) It pays you profits to fund buying from those who sold.

High quality bonds fit this category, especially in the short term. (Over longer periods, like the last couple decades as interest rates fell dramatically, note it is possible, like the RBA did, to show bonds positively correlated with rising share prices). Amongst the red bars shown, Australian government bonds did this the best and Australian income securities the least, which illustrates the role credit quality plays. Bonds linked to inflation were observed to be less correlated as hoped.

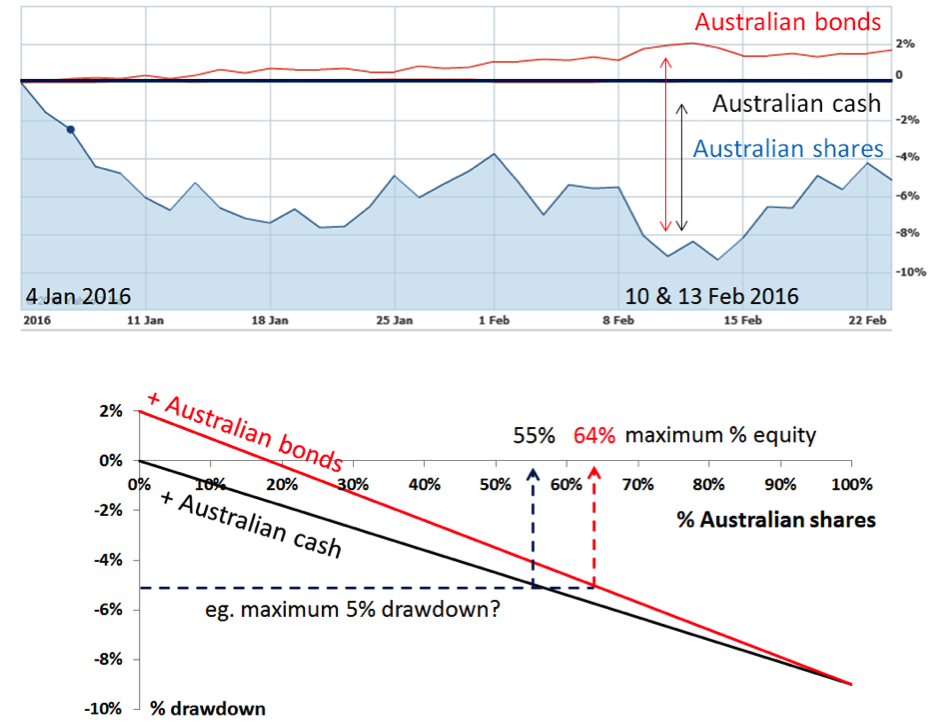

Figure 2 makes an important point to those who scratch their heads wondering why not just use deposits to defend your portfolio? It shows that you could tolerate 9 per cent more equities in your portfolio if you chose to dilute their volatility with negative correlating bonds rather than non-correlating cash (for instance, if you desired capping your monthly portfolio drawdown since the start of the year at an example 5 per cent). Those extra equities add about 1 per cent annual extra expected return – about two thirds from having more shares in your portfolio plus about one third from additional rebalancing (read Get Ready to Rebalance, January 13, 2010).

Figure 2 Relative performance of Australian shares (blue), cash (black) and bonds (red) and portfolio value drawdown as a proportion of equities, if diluted with cash or bonds.

I tried to put into Figure 2 how much less equities you could tolerate if you relied on hybrid income securities to defend your portfolio. However, sadly most of these fell more than the 9 per cent for equities since the start of the year, so the answer is none! By their nature hybrid securities are a hybrid equity and bond like investment. You can see from Figure 1 these have positive, not negative, correlations with equities. They and other low credit quality / high yield bonds sag when your shares and spirit sag. Several years ago I suggested you build your own hybrids (read Build your own hybrids, April 21 2010) and avoid high yield / low credit quality bonds (read Fortify your Portfolio, August 10 2011).

Gold and currencies no longer backed by it

Figure 1 shows gold is the most negatively correlated asset to Australian big company shares over the last 10 years. This supports the view that gold is an insurance policy against share market stress. The problem is that expected returns from non-income paying gold is CPI inflation at best, and probably zero in the midterm. It is an expensive deadweight in your portfolio. The insurance premium for gold (its price) is affordable when no one needs it and its expensive when everyone wants it. With due respect to gold bugs, I still scratch my head on how to fit gold into a portfolio.

The other negative correlating asset to Australian shares has been the US dollar and many other developed country currencies. As I pointed out earlier (read The perfect offshore allocation, November 18, 2015), the Australian dollar often rises with our share market in a “risk on” basis (and “stacks on” when there is a commodity boom). To take advantage of this attractive negative correlation, rather than invest in zero income producing US cash, invest some of your equity mix in US and other developed market country equities unhedged.

Uncorrelated assets

Figure 1 suggests both soft and hard commodity prices generally move independently of Australian share market prices. For agricultural commodities this is intuitive. Almonds don't know the share market fell so to be worth more or less. In Australia energy, metals and materials shares made up about one-quarter of the share market so a small positive correlation with commodity prices is expected – and observed. While timber is an attractive uncorrelated investment, sadly it has a history of disappointing investors accessed through complicated investment schemes.

While commodities could be the holy grail of uncorrelated, easily invested assets, there are many reasons why they are not. First their prices are highly volatile so in uncorrelated ways they interfere with you sleeping at night. Secondly they generally pay no income and have low expected returns so too are a drag on long term returns. Thirdly Australian investors don't need to double up on their exposure given the general economies dependence.

Property

Property is a reasonably uncorrelated investment worth considering despite its many complexities. In Figure 1 you can see listed commercial property and its “real cousin” listed infrastructure are about two thirds correlated before any currency hedging. This correlation is much higher than for the underlying assets whose value doesn't fluctuate that much. Listed funds do so as they are readily tradeable and are used now as bond proxies and can be panic sold off in panics easily.

There is a portfolio reason to invest in property via an unlisted fund or directly to smooth the returns of your portfolio. This is popular with large industry funds populated with a large amount of uninterested investors. There are however many challenges with investing in unlisted property funds for individual investors. If you don't know what those are, just ask those who are still waiting to get their money back after their fund was frozen in 2008 or gave up waiting after their entitlement was written off due to substantially gearing. Earlier I described property as an “optional” asset class (read more here: Doing the property numbers, August 13, 2008), which it remains.

Following mischievous hedge fund shorting and property bubble scaremongering last week, it was suggested CBA shares are correlated with the property market. If logic is correct then if you find buying property a hassle, just buy CBA shares – the transaction and ongoing costs are cheaper, its divisible and the after tax yield is triple at today's price.

Alternative investments

There are many other investments that you could consider introducing into your portfolio to dilute share market volatility. Some of these are illiquid which contributes to their attractive low correlation but creates issue with access and requires extensive manager due diligence.

• Private business – the ongoing profits from most small businesses don't usually correlate with the share market, though the price received in any trade sale can through a general wealth effect. Don't leave working out how to cash out too late, nor exchange its sale proceeds too quickly into the share market.

• Private equity - large institutional investors have preferential access to private equity “deal flow”. Retail investors need to be careful they aren't just getting the scraps.

• Your income – we pointed out earlier (read here: Human capital investing, October 10, 2011) may correlate with the share market and thus may limit what you invest in – for instance in mining shares if you work for a miner and own a home in Perth. Don't forget about “covarying risk” – many unemployed Enron employees with company stock in their 401k did.

• Catastrophe bonds – available only to institutions, are re-insurance like investments that pay out when weather catastrophes are averted. Leave that to Warren Buffet.

• Hedge funds are a catch all label to describe all kinds of highly active investment funds. Their opacity and fee structure, which can sound like a meat pie brand “2 and 20” (per cent annually and on performance respectively), give some investors indigestion (even large California pension fund CalPERS. ASIC provides a good summary of these: read here. Editor's note: Separately, there are local funds which are popular with some investors, which aim to achieve non-correlated returns from particular methodologies: The Blue Sky Alternative Investments Fund (see Alan Kohler's interview, click here), would fit here. Similarly, the Ellerston fund featured by Kirstie Spicer (read her piece today: Ellerston Market Neutral Fund) also aims to achieve a non-correlated return.

• Managed Futures or Commodity Trading Advisors (CTA) Funds – trade momentum and apparently successfully (read here: CTAs) and with low correlations to equities of -0.1 since 1989 (see more here: Correlations.)

• Art, wine, automobiles and other collectables – make interesting alternative investments if allowed by your stiff shirt wearing fund auditor. Griffith Business School researcher Helen Higgs (read more here: Art prices) suggests the correlation between Australian art prices and local shares and housing is only 0.1. Be wary of high transaction costs, low or no income, and buying poorly including at the top of the market when often it's the top of the share market.

Low correlating styles and stocks

Low correlation investing is also relevant deeper in your portfolio. The key message is to consider combining managers with different styles: like growth manager Magellan alongside value manager Platinum (whose value style is out of fashion); and different stocks: Woodside with Qantas (whose prospects correlate differently with energy prices). Each will have their day.

Living with sleep apnoea

Introducing non-or negative correlating investments into your portfolio is one way of dealing with the significant share market volatility and help you sleep better at night. Sadly not all in the investment community are committed to this goal. Some are happy to lend investors shares to short sellers who drive prices down. Some in the media headline “Billions wiped off the share market” one day when the market falls 1 per cent; and then the next day when it recovers by the same the best they offer is “Share market volatility continues”. Central banks have you low in their priority list (read here: It's time central bankers considered citizens, March 18 2015) and have made funding retirement more expensive requiring you to take on more risk. While property is a good diversifier I doubt now is the time to fix any large gaps in your portfolio. Despite their volatility shares are a necessary ingredient in your portfolio. Be careful wishing away their volatility as it is intrinsic to their higher expected return. While it may not feel so, today's high level of volatility isn't unprecedented – the recent years of low volatility was.

Dr Douglas Turek is principal adviser with family wealth advisory and money management firm Professional Wealth [www.professionalwealth.com.au