Readings & Viewings: February 9, 2018

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

What a week. If you're figuring out how to respond to news about 'markets in turmoil' (CNBC, not us), and wondering what a correction means in the scheme of things, you must listen to this week's Stock Trek first. And remember, the media narrative is mostly focused on US markets, and the ASX hasn't gained anywhere near as much in comparison in recent years.

The changing of the guards was always going to be a meaningful moment in history, but the new US Federal Reserve chair, Jerome Powell, probably got more than he bargained for on Monday. It was a rough first day in the office. In saying that, he may have had the foresight to be better prepared.

And check out what Powell said back in October 2012. How eerie:

.jpg)

Some have pointed out there was ‘no place to hide' during Monday's carnage on Wall Street, where every company in every sector, minus five, closed lower. Check out the scoreboard here; the winners were quite a surprise.

But the good news didn't last long this week for air, space and land travel companies. Expedia was one of the biggest plungers on Thursday night on posting its earnings, and Boeing slumped on takeover talks, before recovering some ground.

US markets might be off 10 per cent from their peaks, but the losses this week are still quite slim compared to previous market corrections. A lot of it comes back to bond yields, and calls about the fundamentals changing are getting louder, although there doesn't seem to be any real cause for alarm.

Elon Musk is deadset on evacuating Earth, anyway.

.png)

The SpaceX launched on Tuesday, on a mission to Mars, another world-class marketing ploy by Musk who put his Tesla Roadster atop of the rocket. This follows a cash grab last week where Musk sold $US10 million in semi-novelty flamethrowers in two days. Cars are now floating in space, but they're still missing from the showroom.

After almost single-handedly reigniting the Space Age, few would have predicted the dive Musk's Tesla took just 48 hours later. Tesla returned to Earth the fastest on the Nasdaq on Thursday night, renewing calls for Musk to live in this world for the time being, at least.

Something that perhaps even fewer saw coming was a better result from Snap on Wednesday. Snapshot still posted losses to the tune of $US3.45 billion (take that, Tesla). Losses were down on the quarter though so investors actually snapped up shares, which rose 35 per cent during the session.

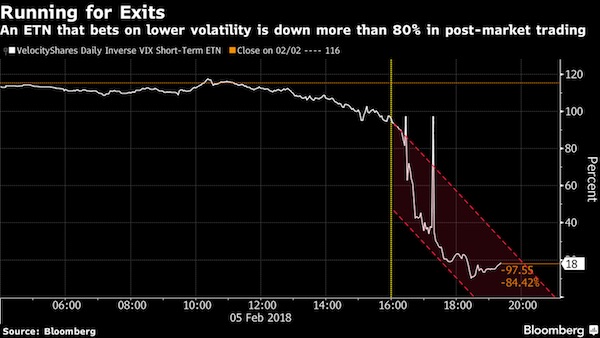

Swings of this sort have enticed punters into the 'volatility trade' in recent years. A once very valuable exchange-traded product, under the ticker XIV, collapsed catastrophically earlier this week leaving investors caught in the crossfire.

These investors were 'short volatility' and some had been bragging about their easy gains to that point. It was the worst place to be this week, by far. The poster boy for this trade, Seth Golden, was game enough to double-down later in the week though, tooting his horn on Twitter that he "planned for this event" and is "disciplined in the VIX-complex".

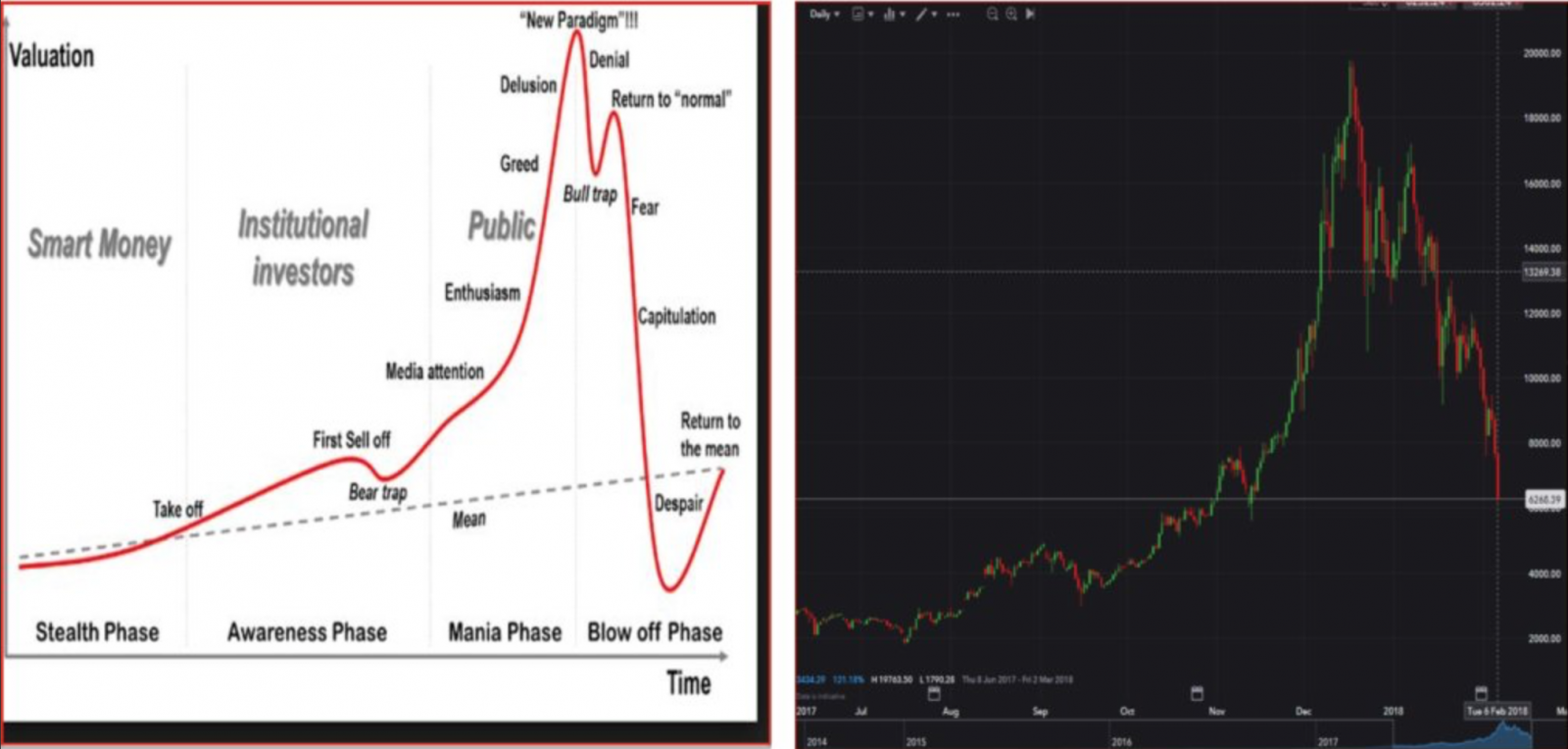

During this week's market comedown, stories were also running rampant about ‘wolves of crypto street' and overnight seven-figure millennials who had made it big on small crypto investments and initial coin offerings, mostly in the last year. All this news reeked of 'peak crypto' and there are big regrets already. Then the chart below was circulated, comparing classic bubble-to-bitcoin prices. Where do you think we're at now in the cycle?

The World Bank chief has come out and said cryptocurrencies are like a ‘Ponzi scheme'.

In light of recent developments in private markets, like equity crowdfunding, for those who still feel like this area of investment operates behind a veil of secrecy, here's an inside look into a venture negotiation.

Britain's biggest employer is facing a record pay claim. Also coming out of the UK, calls that a botched Aussie repair job, that being Wesfarmers' Homebase move, has cost the Brits 2000 jobs. Like the employer, they're obviously not happy chappies either.

Meanwhile, Greek protestors claimed over 1 million demonstrated across the country this week, but police estimated close to 140,000 actually showed up. That's not helping the worker's case.

Is your 38-hour working week looking more like time and a half (without the time and a half pay)? Harvard Business Review debates why we're really working longer.

The Germans have a solution. No time for debating the above, they've legislated a 28-hour working week.

It wouldn't be a news cycle without a bit of Trump, whose tax plan is having an unintended effect – and encouraging divorce.

Stop the madness! Stop giving out free chocolate.

Time for a few lessons in philosophy 101 to calm any jitters. How to decide what to do, right now, by asking one question to help you lead a more fulfilling life.

Why hiring the ‘best' people produces the least creative results.

And those with an interest in living their best life might like to know about what's next for healthcare, courtesy of a Silicon Valley doctor. She thinks ‘prescription nutrition' will become a first-line medication.