Readings & Viewings: June 15, 2018

Welcome to this week's Readings & Viewings, a collection of news, analysis and other interesting snippets we've spotted from around the world during the latest week for your reading pleasure.

Although it was a short week for most of Australia, it was jam-packed with economic data, central bank meetings, and analysis. On Thursday the US Federal Reserve lifted interest rates by 25 per cent, bringing US rates higher than Aussie rates for the first time in 17 years. The Fed has gone full hawk.

.png)

And this is just the start. Several more interest rate rises are earmarked for this year and next. At this rate, if the current job creation continues in the US, the unemployment rate could fall below 3.5 per cent for the first time since 1969. It seems like nothing could slow down the Fed right now.

Macquarie analysts claim "the US economy is in rude health" in one of their latest pieces of research. So then, if that base is sound, what are the risks on the horizon? Macquarie draws attention to the fact that Fed hiking cycles have previously caused disturbances elsewhere.

"With the Fed funds rate having been at the lowest level in history between 2009 and 2016, many worry that as policy tightens it is only a matter of time before stresses emerge, with many pointing to the high levels of US dollar denominated EM corporate debt as a likely catalyst," states Macquarie. "While EM countries came under pressure during the ‘taper tantrum' in 2013, they were 'saved' by the fall in global interest rates in 2014 and 15 – a respite that is unlikely in 2018."

Meanwhile, in Australia, RBA governor Philip Lowe has again indicated the next move in interest rates will be up, however that move “still looks some time away” and it will certainly be a gradual process. His address to the Australian Industry Group didn't include anything ground-breaking. The economy is doing ok, wages and inflation are likely to grow, and interest rates are going nowhere quickly. What was interesting, however, was Lowe noting that productivity was a key factor behind stubborn wage growth despite labour shortages increasing.

.png)

The Trump-Kim summit finally happened. It's old news now, but some commented that Kim was “sweating bullets”. Lip readers quickly took to decoding mutterings, symbolism experts noted Trump's handshake pullback and several other power plays, and others (us) were confused by the shaky camerawork (sign of the times?).

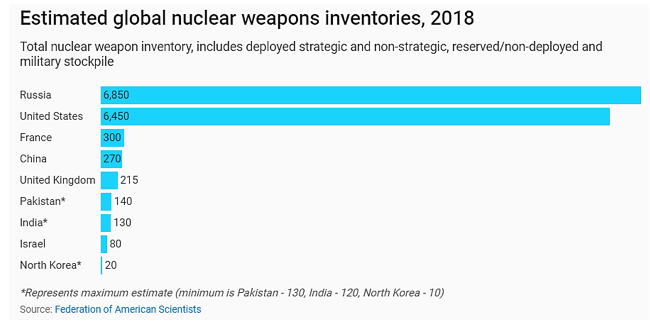

And while Kim may have committed to denuclearisation in North Korea (albeit without a time frame), the world still has a long way to go to full nuclear disarmament. Data from the Federation of American Scientists estimates nuclear stockpiles in Russia and the US outnumber the other nine countries which hold the weapons by a landslide.

Don't get us wrong though; the prospect of denuclearisation is a huge step forward. And apparently not the only benefit to come from the Trump/Kim summit. Property in Dandong, a Chinese trading outpost, has become a hot commodity with home sales reaching an eight-year high – a statistic coinciding with the announcement of the summit. The April meeting between South and North Korea also propped up home prices by more than 50 per cent, according to a local real estate agent.

Meanwhile, home prices are still falling in Sydney and Melbourne. The number of home loans by owner-occupied home owners fell by 1.4 per cent in April, marking the fifth consecutive monthly decline. The number of loans given out fell by 1.9 per cent (excluding refinancing of dwellings) – probably a good thing considering the average home loan in Australia is at a record high of around $400,000.

.png)

The NAB Monthly Business Survey for May revealed a softening in conditions (shedding 6 points to 15) and confidence (losing 5 points to 6). But the ANZ-Roy Morgan Australian Consumer Confidence survey showed sentiment leaped 6.5 points, or 5.6 per cent, to a 21-week high of 123 points. The survey originators believe the early start to winter clearance sales by department stores and fashion chains may have been a factor in lifting confidence.

Hopefully a tank full of confidence inspired you to fill up your tank this week, too. We just experienced the largest fall in weekly petrol prices in eight months.

.png)

.png)

Have you been hitting new highs recently? Hopefully so, and hopefully some of your stocks too. The banks might be giving back their gains, but this week we witnessed all-time record highs for a solid bunch of stocks listed on the ASX.

Appen, CSL, Seek, Fisher & Paykel, Costa Group, Xero, ResMed, GUD, Bapcor, and the ASX itself, were all among those hitting all-time highs this week. Plus, Wesfarmers and Woolworths reached 3.5-year and three-year highs, respectively. Meanwhile, AMP and Retail Food Group stooped to their lowest levels in over a decade.

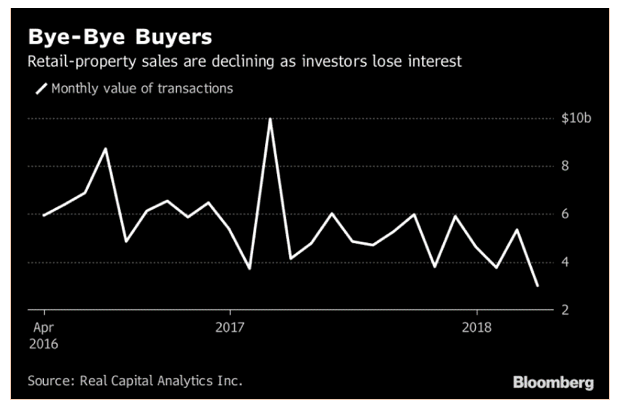

A retail apocalypse. We've been hearing this for a while, but in the US, a slew of landlords are throwing a line out to unload their malls, and not getting any bites according to Real Capital Analytics Inc. There's only a shallow pool of investors willing to bid on a declining mall value, and even fewer who'd pay the asking price.

But in every corner of the market, there will always be winners and losers. Online retailer Boohoo, for example, saw its revenue rise 53 per cent to £183.6 million in the three months to May 31, showing the power that millennial customers can wield. Retail is still a powerful industry, with even The Hague weighing in. This week the Dutch court awarded French designer Christian Louboutin the right to trademark his red soles.

Of course, not everyone can leave court well-heeled, and with a skip in their step. Adding fuel to a long-burning dirty emissions scandal, Volkswagen has agreed to pay a €1 billion fine in Germany over its 2015 emissions rort. It will certainly be feeling the financial burn. The UK's biggest car maker, Jaguar Land Rover, is also having to reshuffle quite a bit as it shifts key production from Birmingham to Slovakia. And similarly, but differently, Rolls-Royce is cutting 4600 jobs.

Tesla is cutting 9 per cent of its staff in favour of bold new hires like this one where the ultimate goal is “enabling human life on Mars”. If you're keen on working there, LinkedIn will also now tell you how long your commute is before you apply for a job.

And what about that job, anyway? Despite the booming US economy, and some states raised the minimum wage, according to an annual report by the National Low Income Housing Coalition there is still nowhere in the country where someone working a full-time minimum wage job could afford to rent a modest two-bedroom apartment.

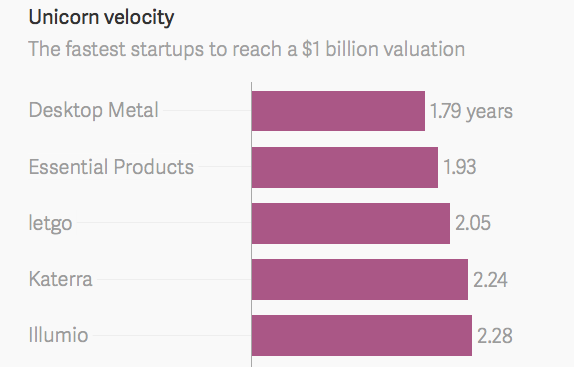

The Tesla of scooters? Californian electric scooter company Bird wants to raise another $US200 million, at a sky-high valuation of $US2 billion. It reached a $US1 billion valuation quicker than any other startup in history, now coming in at top of the charts on the below leaderboard.

Source: Quartz Media / ATLAS

Not small change for scooters, and this isn't small change either. Media ownership just got a little more concentrated, as the US Federal Court cleared a landmark merger of telecoms giant AT&T and Time Warner. The deal is valued at around $US85 billion. Looks like Netflix has a big and scary new (old) arch nemesis.

With media mega-mergers now officially on the table, Comcast has announced a $US65 billion cash bid for select Twenty-First Century Fox assets, eclipsing Disney's existing bid.

The youth movement that could. Vice tried to be the youngest generation's answer to MTV, but now seems to be on its last legs. Other media networks are widely reporting it's failing at its ‘forever young' strategy.

Those concerns you had about the 'bitcoin revolution' have been validated by researchers at the University of Texas. Bitcoin may have finally lucked out, with researchers claiming "a concentrated campaign of price manipulation may have accounted for at least half of the increase in the price of bitcoin and other cryptocurrencies last year", reports The New York Times.

We think that maybe fans of the crypto should start praying to the gods of blockchain.

This should give everyone hope. Two Norwegian lawmakers have officially nominated Trump for a Nobel Peace Prize.

Some light reading for you over the weekend. After a lot of probing, Facebook has finally released a 222-page document on its data collection process. That ad you hover over a little longer, but don't click? Facebook knows you like it.

Happy scrolling, and have a great weekend.