Market Watch

This morning the Federal Open Market Committee (FOMC) increased the Federal Funds rate by 25 basis points to a target band of between 1.75 per cent and 2 per cent. Nothing unsurprising about that.

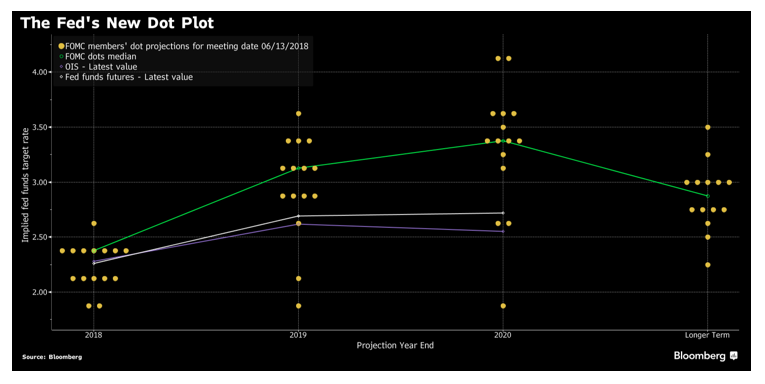

However, what was more interesting was the Fed is now forecasting four rate rises in 2018, three in 2019, and one in 2020. That is turning full hawk. Here is the Fed’s brand new dot plot:

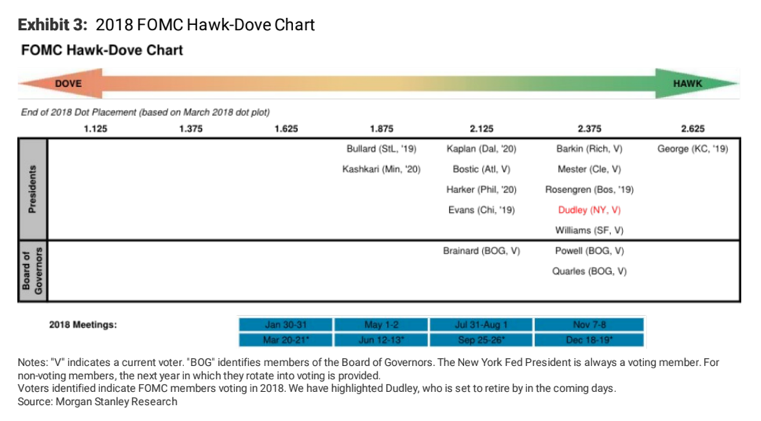

Even more interesting than the chart above is one issued by Morgan Stanley, showing where individual Fed members actually sit. Lael Brainard has moved right up with the rest of the pack. Brainard is a voting member, as she sits on the Board of Governors, so this is significant. Before Brainard’s move up the scale, her views aligned with those of James Bullard and Neel Kashkari.

The Fed statement was also rather poignant, with a change in tone deliberately making for a more hawkish pitch.

The reasons why? The key caveats put in place in the Ben Bernanke era (2006-2014) are now gone, those being the promises of ‘gradual increases’ and ‘rates to remain low over the long-term’.

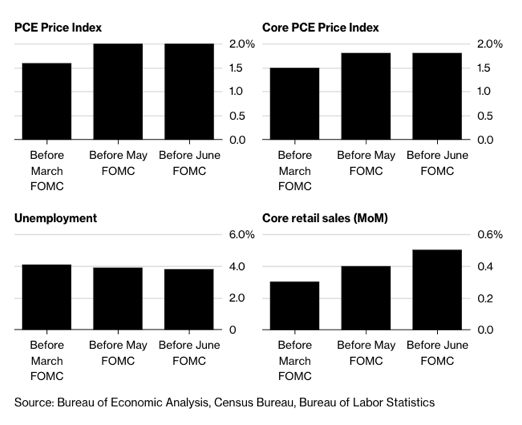

On the economic caveat front, gone is the apprehension that inflation will not materialise and that spending is a drag. In fact, looking at this chart of the economic projection, you can see optimism spreading from the full employment scenario into personal consumption expenditures (PCE) inflation and core retail sales.

An important excerpt from the statement, to this point: “Economic activity has been rising at a solid rate (…) recent data suggests that growth of household spending has picked up, while business fixed investment has continued to grow strongly.”

Fed Chairman Jerome Powell also reiterated this in the press conference that followed: “The decision you see today, is another sign that the US economy is in great shape. Growth is strong. Labour markets are strong. Inflation is close to target.”

My call that the Fed has now become ‘full hawk’ is based on the following line from Powell. When he was queried on moving the Fed’s dot plot to a more hawkish stance, he said: “We are not waiting for inflation to show up”.

Inflation has been the caveat that has allowed the market to underprice Fed rate hike expectations. The June meeting eradicated those beliefs, signalling that rates will move even with the prevailing conditions. The Fed has signalled it will not only support the economy where necessary, it will tighten to prevent an overshoot.

I am now eager to see what fiscal policy does. The Trump administration has turned the fiscal tap on, and one could suggest it would want monetary policy to remain on as well. Is there friction to come? Or will it have a ‘scales effect’ where fiscal policy turns on faster and forces monetary policy to counterweigh it by tightening further?

The main take-out is the credit squeeze is on. The biggest central bank on the planet wants things to cool down in the US and that will mean liquidity in bond and credit markets will slow, pushing funding higher, and granular lending rates too.

Adding more pressure to the Australian housing market and banking sector, Australia in general will experience the impact of this morning’s moves over the coming 24 months.