Raising DWS's valuation

On Tuesday (November 10) DWS Limited held its AGM in Melbourne. The company provided a trading update on the first four months of the financial year, as well as further information regarding the company's board and the progress of recent acquisitions. This was a strong trading update that has provided some additional confidence in our projections for FY16.

My view is that this update lowers near term earnings risk, and shows a continuation of the trend for a strong turnaround in company earnings. With this in mind, I have updated my financial forecasts, and upgrade my valuation for DWS from $1.19 to $1.48. The quantum of this upgrade has been brought about by a slight change in valuation strategy to include a higher weight to discounted cash flow (DCF) methods acknowledging that DWS is also held in the Growth First model portfolio. Operationally, the promising turnaround is indicative of better utilisations and better demand conditions.

My view is that there could be more upside to come as the sector continues to pick up and DWS makes the most of the recent acquisitions.

Trading update – first four months of FY16 looking good

For the first four months of the financial year, DWS Limited has seen a continuation of improved trading conditions. This comes on the back of a very weak FY15, but provides further hints that the suspected turnaround in the business is gaining momentum. The numbers are very pleasing, as DWS showed an unaudited $8.15 million in EBITDA for four months of trade indicating more than a 70 per cent growth on the earnings achieved over the same four months last year.

What is driving such a strong turnaround? Utilisation and acquisitions. The company has been working towards better utilisation of fee earners, as well as a lower cost base from support staff (non-fee earners). So EBITDA margins are expected to have been stronger than in FY15.

While the focus on efficient resourcing and utilisation is an essential for DWS and any IT services business, there is an element of this that comes down to market forces and corporate strategy.

First, market forces seem to be turning. We have witnessed a plethora of earnings upgrades in the sector of late, suggesting that spending cycles are beginning to improve. With DWS taking a large portion of earnings from financial services, telecommunications and government customers, I am comfortable that this tailwind will benefit DWS materially.

Regarding corporate strategy, DWS appears to have made intelligent acquisitions at the right time. As discussed in our previous analysis (see DWS: Servicing a turnaround, September 14), DWS in FY16 will benefit from contributions of both Simplicit and Phoenix, recently acquired businesses. To date, Simplicit is being run on a stand-alone basis, but the benefits will be focused on cross selling. In contrast, the Phoenix business is being integrated, with colocation of staff, and sharing of resources, likely to have resulted in some cost synergies.

Finally, we believe that the acquisitions will enhance EBITDA margin through the addition of a direct relationship with Telstra and other major banks. As IT spending increases at these major businesses, DWS's acquisitions may provide a strong opportunity to win a greater market share, and expand to servicing new customers with new capabilities.

Board changes

At the AGM it was announced that the following leadership changes will take place:

- Danny Wallis will step down as executive chairman, but remain chief executive and MD.

- An existing non-executive director, Matt Ralston, will take over as chairman.

- Two board appointments will be made out of the recent acquisitions, including Jodie Moule (Simplicit) and Hayden Kelly (Phoenix).

- DWS intends to further add a non-executive director to the board.

None of these changes are of particular concern or interest to us in our analysis. Danny Wallis remaining chief executive and MD is important as his return to the chief executive role has definitely coincided with a strong turnaround in the company's operations.

Forecast upgraded and valuation lifts

I remain broadly happy with my forecasts for EBITDA in FY16, though have lowered my expectations for depreciation resulting in a slight lift in net profit forecasts. This adjustment has carried forward into FY17 and beyond, lifting my future earnings estimates.

With respect to the company's dividend outlook, the payout history suggests that the company will pay somewhere near the range of 80 per cent to 90 per cent of net profit as dividends to shareholders. Given that DWS has made two acquisitions, and there is some debt on the balance sheet, it is likely that the company will not pay at the top end of this range. And there is no need to either. At an 85 per cent payout, dividends are forecast to lift by a significant margin and provide investors with a strong dividend yield. Based on present profit forecasts, our expectations are that the full year dividends from DWS will be in the vicinity of 9.5 to 10 cents, implying a dividend yield of 7.3 per cent to 7.7 per cent (over 10 per cent if we include the value of franking credits).

Clearly this dividend is still very attractive, and although the stock has performed well, putting on a 30 per cent lift since its inclusions in the Income First and Growth First model portfolios, there still appears to be upside to the story. I have left my FY16 forecasts largely unchanged. However, the turnaround is now evident, so I have lowered my risk weights applied to future earnings, pushing the valuation higher. Additionally, I have upgraded earnings forecasts for FY17 and beyond, assuming the benefits of recent acquisitions will continue to play out in future years. Here is my forecast summary for FY16 and FY17, noting that I have lowered expectations of depreciation in FY16 and beyond leading to a slight upgrade in the FY16 lines below EBITDA:

FY16 | FY17 | |

Revenue ($m) | 123.38 | 135.68 |

EBITDA ($m) | 23.87 | 26.59 |

EBIT ($m) | 15.25 | 26.38 |

NPAT ($m) | 15.01 | 17.07 |

EPS (cents) | 11.36 | 12.92 |

DPS (cents) | 9.65 | 11.65 |

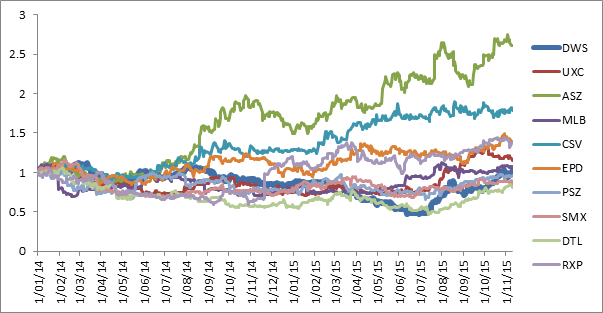

Peer performance and value

As mentioned, the IT services sector has been very strong. Below is a chart of the share price performances of companies in the sector. It can be seen that DWS hasn't exactly led the pack. And this is in my view attractive. Investors haven't yet missed the boat. The company has been trading at a hefty discount to peers on a PE basis, and I believe that the exposure to financial services and telecommunications from a client perspective places DWS in a strong position relative to some peers.

Source: Eureka Report

Summary and portfolio strategy

DWS has rallied since its inclusion in the portfolio, lifting its weight from 5 per cent initially to around 6.7 per cent at the time of writing. While this exposure is getting bigger, I remain comfortable with the level of investment in DWS. The company's recent strength is in my view a confirmation of the original investment thesis, and provides us with further confidence to continue to hold the higher weight. We retain our buy call on the stock with an upgraded valuation of $1.48.

To see DWS's forecasts and financial summary, click here.