Property still safe as houses

| Summary: There are early signs that the recent surge in residential property prices is slowing. But how deep will the property slowdown be? Not very. The Reserve Bank will act swiftly to prevent a major price correction – our economy depends on it. |

| Key take-out: The fundamentals for the property market remain strong – low interest rates, solid demand, no evident economic shocks, and the “RBA put”, which would see the central bank leap into action by cutting rates further to shore up the market. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

Given an opportunity, policymakers can’t resist talking the property market down. So much so, that a lot of this rhetoric has become the zeitgeist – the spirit of the time. This time though, it appears to be more than wishful thinking on behalf of policymakers, and it’s making investors understandably nervous.

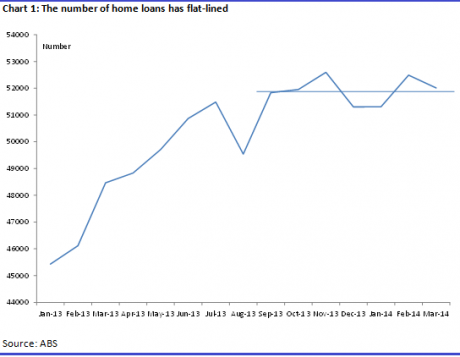

For a start, the number of new home loans appears to be easing. Admittedly, that comes after a strong surge in loan activity during the first half of last year. But the point is, if people aren’t borrowing, robust house price growth becomes hard to maintain.

This is all the more worrisome when you consider that lending is only slightly above average – in terms of the number of new loans being made – and still nearly 20% below peak lending in 2007.

Are they falling or not?

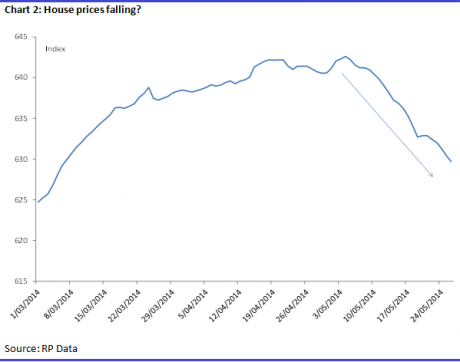

Yet, that’s not the worst of it. The worst part is that house prices themselves appear to be falling. We’re not necessarily seeing that in the quarterly or even the monthly indicators yet and according to RP Data, capital city dwelling prices rose 0.3% in April which follows a 2.3% gain the month prior. The problem is that since a peak in early May, house prices have fallen nearly every day (see chart 2 below). This is daily data which feeds into the monthly series – it implies a fall of around 2% this month.

This is a clear slowdown and the issue now is whether this slowdown reflects those self-moderating forces that the Reserve Bank thinks will slow property down. At this point, and noting that the slowdown is unequivocal in the data, I don’t think this is anything other than the normal price variation around an uptrend.

Why? Well at the most simple level, the math just doesn’t add up. As I’ve suggested before, house price inflation gains its own momentum. Interest rates work, and currently you can lock in the lowest rates for the better part of 50 years for five years or so. Your total return – rent and capital growth exceeds this and you don’t need rapid rental or capital growth for that to be the case.

Secondly, house prices don’t moderate for no particular reason. History shows that there must be a catalyst, such as a global economic shock, a credit crunch, or simply a tightening in policy. It may be the case when Australia was a closed economy, and access to credit was more tightly controlled, that house prices seemingly did just slow. But with price as the main determinant of credit as we have now, that isn’t the case, and over recent decades changes in monetary policy have been the key determinant of house price growth.

With that in mind, we know as a certainty that policymakers do not want to tighten rates – given the currency wars and the fact that no government wants a higher interest bill on their own debt. Even when they do tighten rates, they will do so slowly and we won’t get anywhere near the peaks we saw in 2008. At this point, regulators have been content simply to tighten access to credit, at the margin, by lifting LVRs (loan to valuation ratios). A regulatory response rather than a rates response. The RBA thus far has been reluctant to adopt such measures, and has limited its actions to jawboning and warning banks about lax lending practices. Suncorp has responded by 'dialling back' lending in cases where the LVR exceeds 90%. In any case, lifting LVRs is unlikely to affect investor lending too much – it will affect first home-buyers more.

As a final point, property investors have the ‘RBA put’ to reassure them. It’s similar to the so-called ‘Greenspan put’ or ‘the Fed put’ now. This refers to the tendency of the Fed to place a lot of weight on the stockmarket as a wealth indicator and a sentiment booster for the broader economy. The idea was that if the stockmarket ever looked fragile, or posted a correction of 10-20%, the Fed would come in and cut rates to shore up the market.

The Australian version of that is that if house prices ever corrected, the RBA would be slashing rates in an instant. It may want prices to moderate, but it doesn’t want them to moderate too much or fall.

Recall my piece a few weeks ago (Could the RBA cut rates). I think the RBA made is plane that the only thing preventing a cut in rates now is rapid house price growth. If growth slows, it will cut, and if prices fall, it will slash. And I don’t think it’s a stretch to suggest that if price falls were sharp enough, it would engage quantitative easing. It would probably have to.

That’s not just because policymakers are looking for a new driver of growth now the mining boom has ended. It goes well beyond that. The fact is, house prices are critical for the Australian economy and financial stability. More so perhaps than other countries such as the US and UK. Think of what would happen if prices ever fell sharply.

- New lending would freeze up – demand and supply. Banks wouldn’t want to lend, and people wouldn’t want to borrow. Why buy now when you can buy cheaper in six months?

- Doubtful debts would rise and questions would arise as to whether banks had sufficient capital.

- Bank earnings, and their share prices would drop – perhaps sharply. Given that banks are about 30% or so of the market, the sharemarket more broadly would decline.

And that would just be the start of it – given the recent experience in the US, UK, Ireland and Spain it’s not a stretch to say that international investors looking at Australia would panic about our domestic prospects. We’ve seen that repeatedly in the US, UK and elsewhere in Europe. That could see a more marked capital flight out of the country – irrational or otherwise.

- If that occurred, credit would become much scarcer, not just for would-be home buyers but also for businesses. Liquidity would freeze up as global investors became unwilling to finance Australian banks – exacerbating the credit slump further. Deposit rates would soar. Good for savers, sure, but this would push borrowing costs up sharply.

- The Australian dollar would drop – inflation would rise.

- With any hope of rebalancing the economy lost, unemployment would rise and the budget deficit would expand sharply. But who is going to lend the government money at reasonable rates? The government would have the choice of printing money or raising taxes. We already know the choice that would be made.

Now the above isn’t intended as an in-depth study of what would happen under a house price slump. I’ve omitted things and, as to the exact order of events, it’s anyone’s guess. It highlights a simple truth though – too much is at stake for the RBA to allow sharp falls in property prices.

Indeed, you wouldn’t even need to see sharp falls. A moderation in house price growth to low single digits would undoubtedly lead the RBA to recommence easing. As I’ve discussed in the past, this is because it believes inflation to be low and the dollar to be high – and it wants to rebalance growth.

It follows then that by itself, flat growth or modest house price falls would see even more aggressive action, and so on. Add to that the fact that just as house price inflation has its own momentum, so too does disinflation. Given the high prospect of a severe economic crisis, the RBA would act aggressively to nip even a modest price fall in the bud.

So how deep will the property slowdown be? Not very, is my bet.