Opportunities in a robust US earnings season

Summary: It's a great time to own shares in the US. Its share market is once again hitting record highs this reporting season, with companies beating analyst estimates at the fastest rate in four years amid the country's rebounding economy. Even better, these companies have also raised guidance, providing the “perfect storm” to drive shares higher ahead as analysts raise their future earnings assumptions in turn. |

Key take-out: Quarterly earnings reports provide not only transparency, but also buying opportunities. Short-sightedness from the markets – which are impatient creatures – enables savvy investors to scoop up good stocks that haven't been able to meet expectations at that particular time, such as Facebook, Gilead and FireEye most recently. |

Key beneficiaries: General investors. Category: International Shares. |

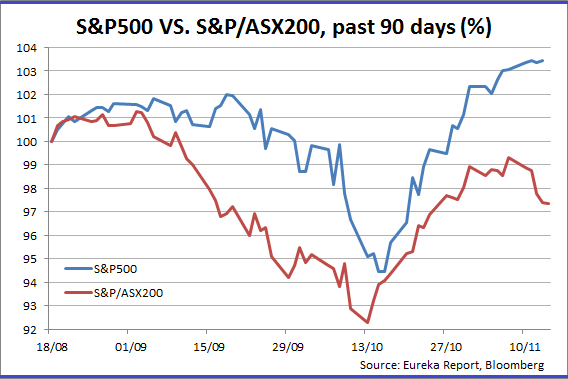

US equities are hitting new highs as the economic rebound continues unabated, with corporate earnings driving the market.

US companies are beating analysts' estimates at the fastest pace in four years, underscoring the strength of the economy's recovery from the longest recession since the Great Depression.

Of the 410 companies within the S&P500 that have reported results so far this quarter, more than 81% have beaten consensus estimates, led by companies from Caterpillar Inc. (CAT) and Time Warner Inc. to Exxon Mobil Corp. (XOM).

That's the highest rate since the first quarter of 2010 and exceeds the 58% ratio for members of the Stoxx Europe 600 Index and the 52% for the MSCI Asia Pacific Index, according to data from Bloomberg. Those numbers underscore the reason for still concentrating on the US market.

Net income per share is up roughly 10% year-on-year, led by the materials and healthcare sectors. Interestingly, the energy and financials sectors drove the earnings growth surprises relative to expectations.

Many companies have also raised guidance and that's really important. After a more uncertain global economic climate in 2013 and much of the first half of 2014, the percentage of companies lifting forward guidance has improved and provides yet another reason for owning US stocks. Historically, all these factors have generally driven markets higher.

Sales growth was a bit soft last quarter but, despite softer commodity prices and a stronger dollar, 60% of those companies that have reported quarterly data beat their respective consensus sales trend projections.

Last week we detailed how six of the Eureka Global Portfolio companies were performing, so I thought a bit of an earnings “primer” might be helpful.

Why earnings are important

Earnings are the main drivers of stock prices and markets. Earnings in most markets are reported quarterly. Some long-term investors criticise this schedule as it pressures companies, management and investors to be too short-term oriented but this isn't going to change anytime soon.

When earnings are reported there exists a “consensus” number in the market. This is a figure based on the combined estimates of the analysts covering the company. Analysts give their estimate for a company's earnings per share and revenue; these figures are most often made for the quarter, fiscal year and next fiscal year.

The market capitalisation of the company and the number of analysts covering it will dictate the size of the pool from which the estimate is derived. This mathematical average is collected by financial data firms such as Bloomberg and Fact Set.

Companies should at least match the consensus earnings per share estimate (or have a good reason as to why they don't). Investors like to see a “beat” even if it's just by a few pennies.

The revenue (top line) number is also important and may be compared to last year's quarter (year-on-year) or sequentially (quarter-on-quarter) in percentage terms. Revenue growth, like earnings, should meet or beat consensus and it gives us a good sense of the growth profile of the company's businesses in real time.

Profitability is expressed usually in terms of an operating or net margin achieved on a certain level of sales. Operating margin is a measurement of how much of a company's revenue is left over after paying for variable costs of production such as wages, raw materials, sales and marketing and R&D. A solid operating margin is required for a company to be able to pay for its fixed costs, such as interest on debt.

Investors like to see margins in line with historical averages or at least close to what the company had predicted in the previous quarter. Unusual volatility in margins can be a red flag.

The key criterion

That brings up probably the most important information contained within the earnings announcement: guidance. In the earnings release or on the conference call, most companies will provide guidance for revenues and earnings for the next quarter or fiscal year.

Generally companies provide a broad range and not one specific number for their earnings guidance. When companies raise previous guidance this is considered positive and the shares react accordingly. Guidance can also be non-numerical and point out arrival of new products or other factors that are material to company earnings.

If a company reports earnings well above consensus (usually on higher revenues) and raises guidance, analysts will usually raise their future earnings assumptions in the form of a positive earnings revision. This is the “perfect storm”. Upward earnings revisions are one of the most powerful factors driving stock prices.

Conclusion

Markets are impatient creatures. They want companies to consistently beat earnings estimates and guide upward every quarter. This is not real life and the activities of corporates do not always fit neatly into every quarter. Also, companies tend to be conservative regarding the near future.

Three of our Eureka global portfolio stocks, Facebook, Gilead, and FireEye produced solid results but not exactly what the market wanted and the shares were weak afterward, creating good buying opportunities (assuming the investment thesis is intact). Quarterly earnings reports provide transparency for investors and can also throw out opportunities for savvy investors.