Making better super sense. Bonds alert. Packer's strategic move

Robert Gottliebsen

Morrison hears the call

Stand up Eureka readers, stand up. It was people like those who subscribe to Eureka who made it known to Coalition party members around the country that the superannuation proposals in the Budget were a complete and utter nonsense and needed to be radically changed.

It took a long time for the Treasurer to understand these simple facts, partly because he was being badly advised. The new proposal means that you can put tax-paid money into your superannuation fund until it reaches $1.6 million.

That means that those running smaller businesses and not able to contribute to superannuation (because of the funding needs of the business) can invest a worthwhile sum in superannuation when they sell the business or run it down. The same applies to those that have savings in other areas, such as a family home or who benefit from an estate.

The new provision does not come into operation until July 1, 2017. That means that, subject to the Senate and current age restrictions, you can invest $180,000 in the current financial year and $540,000 for three years. If superannuation is your savings mode, and you can muster the cash, you should take the opportunity.

Accordingly, superannuation now returns to being a worthwhile savings mechanism because the income in superannuation funds in pension mode is tax-free from $1.6m of capital. Income from higher capital amounts in the fund is taxed at 15 per cent. You will remember that I said to Eureka readers not to make long-term decisions until the final legislation has passed the Parliament and I repeat that advice because, although the Treasurer has signalled a much-needed change in direction, there could be further changes before the legislation goes through the Senate. We will keep you posted.

Bonds cause an engine room meltdown

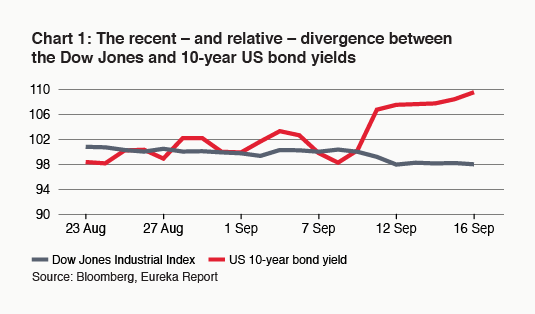

And talking about being kept posted, my last contribution to Eureka (The rates game is about to change) set out the threats to our bond and stockmarkets and how they were likely to cause a fall. Those predictions turned out to be chillingly accurate, but I must confess I had no idea that the dangerous forces were about to explode in a few days.

It is important to understand why our market fell and what we learned from that exercise. It was also an alert to Eureka readers as to whether they felt comfortable during the fall – if you can't ride through falls like that, you have too great an exposure to equities.

To understand the stockmarket you have to look at the bond market, because in the current environment it is the engine room of what is happening in the stockmarket.

In short, something like 70 per cent of all of the developed world's government bonds have been bought by central banks and they have funded those purchases by printing money. Joining them has been a vast array of institutions, including banks and superannuation funds plus traders, who have made a fortune by following the central banks and also buying these bonds.

In Europe and Japan yields went into negative territory and the US 10-year bond yield went down to 1.46 per cent. But the central banks are starting to take their foot off the accelerator, so German bonds went into positive territory and the US 10-year bond yield went from 1.46 to 1.73 per cent. We saw that those bond movements forced the high-yield global sharemarket into reverse, with some big falls.

If the central banks continue to restrict purchases of government bonds the yields will rise again, causing major losses to the central banks' bond portfolios but also for the institutions and traders. And again there will be more share losses.

Goldman Sachs said that the US 10-year bond rate will go to 2 per cent, which would indeed cause great loss in that bond market. As the week closed the US 10-year bond rate stabilised, and with it so did the stockmarket.

I am simply not clever enough to know whether the central banks will keep buying bonds or whether they are really serious about getting off the treadmill. If they do get off the treadmill you must be prepared for more sharemarket corrections, particularly for stocks like banks, Sydney Airport, Transurban and the property trusts.

Of course, here in Australia, our economy is sluggish and the next interest-rate movement will be down rather than up, as is likely in the US. Picking the currency is always hazardous, but if all things are equal and our official rates fall while the US rises, we will see a fall in the Australian dollar, which will help the economy. And it needs helping because a great many Australians are struggling on steady or low incomes, and that is affecting the whole retail sector.

Macquarie Bank estimates that, on average, Australians are working about 20 minutes a week less than they were last year, and that reduces their income. Employment is not affected, because 60 per cent of all new jobs are now part-time. And that trend is going to be multiplied, because we are seeing a tightening of the banking sector as banks are forced to put more capital behind their housing loans and growth is hard to achieve.

At the same time the banks are set to be grilled by Parliament. But don't despair in the banking sector, because most of the big banks are now able to cut their staff costs substantially. Our biggest bank, the Commonwealth Bank, has been the strongest employer and therefore has considerable scope to cut back. I don't think we are going to see mass sackings but rather non-replacement of staff and more part-time work. These will be significant changes that should enable banks to overcome the difficulties they are now facing.

Although for the banks there is competition emerging through new players, particularly in the business lending sector. The banks will need to be very careful in the way they cut their costs. We saw with Medibank the cost-cutting exercise was too severe, and the new CEO is looking for ways to re-engage with customers because he is losing market share. It is a lesson for all those engaging in cost-reduction programs.

A tale of two sales: Packer and Muir

In terms of where you stand with your own portfolio, two very successful people have made strategic decisions that we all should take note off.

The first was James Packer, who instead of borrowing further sums to settle with his sister Gretel Packer, sold about $450 million worth of Crown stock, which put his interest below 50 per cent. James would have had no difficulty on borrowing on those shares to fund that settlement but he chose not to.

Source: Reuters

Similarly, Andrew Muir was planning a float of his Good Guys business but in the end he sold to JB Hi-Fi for $850m. Normally, such a sale would have had a strong JB Hi-Fi share content but Muir wanted the cash.

I was a young boy in Essendon when Andrew's father Ian Muir started a small electrical shop and my parents were one of his early customers. The Muir family have really understood the appliance business.

I think it is sad for JB Hi-Fi that Andrew and his family have taken cash rather than staying in the business via shares and a board posting. The acquisition makes good sense for JB Hi-Fi, but most acquisitions of entrepreneurial businesses where the entrepreneur steps aside face the danger of management difficulties. It mightn't happen, and some of the projections of JB Hi-Fi combined with the Good Guys are very encouraging, but the Good Guys was very much a creation of Andrew Muir and his father and was boosted by partnerships with other entrepreneurs. Converting it to a public company will clearly be hazardous.

US growth, higher rates

Meanwhile, my economist friend in New York, Al Wojnilower, tells me that the US economy keeps on rolling.

Although monthly employment growth of 100,000 jobs (or even fewer, according to Federal Reserve officials) would suffice to hold unemployment below 5 per cent, payroll numbers continue to swell much faster than that. Industry is hiring more workers because they are profitable and productive, contradicting what is asserted by official US productivity statistics, which are flawed in concept and measurement.

The growing number of jobholders keeps consumer spending on the rise, albeit less rapidly than before, now that motor vehicle sales are cresting. But the likely slowing in consumer spending growth will probably be offset by faster spending in other parts of the economy.

Business capital spending, lately reduced by the collapse in oil-related investment, will soon be recovering, since oil-related outlays have hit rock bottom and other investments continue to grow. Government spending, too, especially on the military and on long-neglected infrastructure, is likely to increase after a long period of flat lining, regardless of the election outcome.

Be ready for higher US interest rates after the election.

Click here to read this week's Eureka Weekly Review PDF.

Readings & Viewings

If you thought the fallout from the GFC was long over, think again. The Wall Street Journal notes that Deutsche Bank has been 'asked' to pay $US14 billion to settle over mortgage-backed securities.

It has been a big week on the mobile-phone markets. In the same week that Apple launched its iPhone 7, Samsung has had to pull its Galaxy Note 7 off shelves. This is somewhere been a technology splash and a crash, albeit on two different devices.

The UK government is already attracting fallout from its decision to green light the £18 billion Hinkley Point nuclear power project – part-bankrolled by China – on national security grounds as well as cost.

Yet, while Apple shares have soared this week, this piece explains why Silicon Valley is all wrong about Apple Airpods.

The world's largest hedge fund, Bridgewater Associates, has $US150bn under management. But now it's on a cost-cutting drive to improve efficiencies in its non-investment teams.

Meanwhile, although the US economy remains fragile, Harvard Business School says that entrepreneurship is one area that's improving rapidly.

What do sugar and tobacco companies have in common? According to this piece in The New Yorker, there's an inconvenient truth behind the science of sugar that's reminiscent of 'big tobacco'.

Defensives are expensive, says Perpetual's Nick Buisman: "Central banks' loosening of monetary policy reflects softness in the underlying economy. Today however, this cautionary note is being ignored by markets."

This week's The Economist cover story comes over all Marxist, worrying about the concentration of oligopoly power.

The Atlantic is also worried, claiming that big business is jamming the wheels of innovation.

Another impact of low bond rates: 50- and 100-year bonds are now being issued.

Waleed Ali on why One Nation and The Greens are a perfect match.

Also on politics, Donald Trump reimagined as a sassy gay man works quite well:

Roald Dahl would have turned 100 last month, prompted a rethinking of the author's legacy – which is not all Matilda and The Twits.

Mitchell Sneddon's recipe of the week: "This one contains two of my favourite foodie things, pasta from (my local!) Enoteca and a simple recipe from Donna Hay."

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

While the US sharemarket recovered some of its loss from the previous week as fears of an imminent Fed rate hike declined, other major sharemarkets fell over the last week as bond yields generally rose further and they saw a catch up to the earlier fall in US shares. Commodity prices were mixed with oil down on supply concerns but metal prices up. While the $A bounced around with fluctuating Fed rate hike expectations it ended the week just fractionally lower.

The soap opera regarding the Fed swung back to dovishness over the last week with Fed Governor Brainard remaining dovish and urging “prudence” in raising rates and soft economic data seeing the US money market's assessment of the probability of a September rate hike fall below 20 per cent.

Have central banks run out of bullets? Is fiscal policy now about to take over? The back-up in bond yields (just a flick in a big picture context) and volatility in sharemarkets over the last week or so in part has its origins in concerns that some central banks have hit the bottom of the monetary policy barrel and that the focus will now shift to fiscal stimulus. This seems to be now the standard narrative in financial markets, but when everyone starts saying the same thing I must admit to get a bit concerned. While I think we will see a shift in focus from monetary policy to fiscal policy – see this – I doubt that we are seeing an abrupt turn. First, governments should do more to help boost growth both via structural reforms and fiscal stimulus (where they can) – but a shift in this direction is likely to unfold slowly. Second, central banks would all like more help from their governments but they also have inflation mandates and when inflation is well below target they still have to act. Third, the situation varies dramatically between the major central banks so it's impossible to generalise and say they have all run out of bullets:

The debate (or rather soap opera) in the US is not whether the Fed has run out of bullets but about the continuing process of removing monetary stimulus because it has been successful;

While the ECB did not seem to be in a hurry to do more stimulus at its last meeting it wasn't expected to anyway, it currently sees no reason to rush into doing more and the debate has only been about whether it will extend its current quantitative easing program but it still has plenty of time (and scope) to do that because it doesn't expire till March next year;

The situation facing the Bank of Japan is more problematic because of all major countries Japan is the one where deflation expectations are more entrenched. While the BoJ initially had some success in 2013 and 2014, this has now failed for a variety of reasons. To get a more assured result Japan is one country where "helicopter money" (i.e. the direct financing of fiscal stimulus by the central bank) should be considered;

None of this is directly an issue for the RBA – it has lots of bullets (150 points of rate cuts and hasn't even done QE) and with growth remaining good is unlikely to run out of them anyway.

The bottom line is that a shift in reliance away from monetary policy towards fiscal policy and structural reforms is desirable but it's likely to be a gradual process and vary from country to country. It's unlikely to justify a rapid back up in bond yields (more like a choppy bottoming) or sharp fall in sharemarkets.

In Australia, there was some good news on the budget with the Government and Opposition agreeing on $6.3 billion in savings over the next four years highlighting that sensible bipartisan agreement is possible. A compromise on the “retrospective” aspect of the proposed superannuation savings suggests they are likely to be passed as well. That said this just helps keep the budget projections on track as such savings had already been largely factored into projections and there is still another $40bn or so in savings that have yet to be legislated so the risk to the AAA rating remains.

Major global economic events and implications

US economic data was soft with weaker than expected retail sales and industrial production, a slight fall in small business confidence and weak producer price inflation. While the New York and Philadelphia regional manufacturing surveys showed improvement the components were soft. Although jobless claims remain low and retail sales tend to understate consumer spending the weak run of data lately doesn't support the case for an imminent Fed rate hike.

The Bank of England left monetary policy on hold following last month's easing and seemed a bit more upbeat on the outlook.

Eurozone industrial production fell in July, but business conditions PMIs point to a reasonable bounce back in August.

Chinese economic data was better than expected in August adding to confidence growth has stabilised around 6.5-7 per cent. Industrial production, power consumption, retail sales, investment and growth in credit all picked up pace.

Australian economic events and implications

Australia saw good news on business and consumer confidence but mixed jobs data. While the NAB business survey showed a slight fall in business conditions it is still above average and business confidence actually rose. Meanwhile consumer confidence edged up slightly on the Westpac/Melbourne Institute measure and remains around average, but rose to be well above average according to the ANZ/Roy Morgan measure. The bottom line is that confidence is okay in Australia. August jobs figures were a bit messy but jobs growth is still solid at 1.5 per cent year on year and unemployment is trending down but weak growth in full time jobs is going hand in hand with high underemployment meaning that there remains plenty of spare capacity in the Australian labour market. In other words the economy can still run faster until it is used up.

On the growth front RBA Assistant Governor Kent made a point that is very important for Australia and this is that we are heading towards “the abatement of two substantial headwinds” being the falls in the terms of trade and mining investment. Just as the housing construction cycle starts to turn down in 2018 the big growth drag from these two will likely have come to an end enabling reasonable growth to continue.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Jobs, people and prices

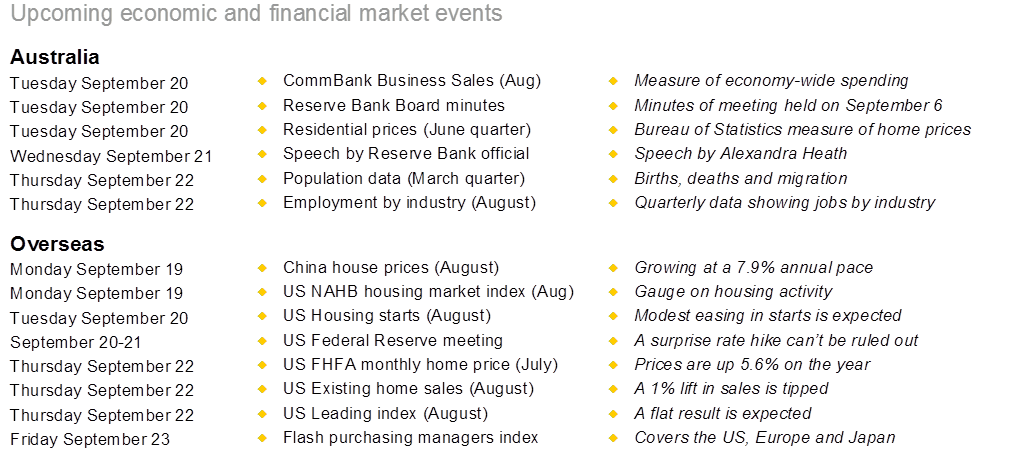

Across major economies, the standout event in the coming week is the US interest-rate decision. In Australia, there is a mix of indicators due for release including population figures.

The week kicks off in Australia on Tuesday when the Reserve Bank releases minutes of the last Board meeting. There wasn't too much new in the statement after the RBA meeting so the minutes are similarly not expected to prove illuminating.

Also on Tuesday the Commonwealth Bank releases the Business Sales index, a measure of economy-wide spending. Sales growth slowed in the early months of 2016 after solid gains in 2015.

The Australian Bureau of Statistics (ABS) also releases data on Tuesday – the Residential Property price indexes. The data is a bit dated (June quarter) but is another check on price pressures in the housing market.

And to round off a busy day on Tuesday the weekly consumer confidence survey is issued by ANZ and Roy Morgan. Confidence has lifted to near three-year highs on a rolling monthly average basis.

On Wednesday, the head of the Reserve Bank's Economic Analysis Department, Alexandra Heath, delivers a speech in Brisbane titled 'Future Skills: The Education and Training Pipeline'.

On Thursday there are two indicators of note. The ABS releases both population data (Australian Demographic Statistics) and employment by industry (contained in detailed Labour Force data)

The population figures cover the March quarter so are still a little dated compared with other indicators. But if more people are being born and more people are coming to our shores then this translates to activities like increased spending and demand for homes.

Each quarter, the ABS releases data on employment by industry in addition to regional and demographic job market estimates. The August data is issued on Thursday.

Overseas: US interest rates hog the spotlight

All other economic indicators take a back seat in the coming week to the US Federal Reserve meeting. The policymakers meet over Tuesday and Wednesday with the decision handed down on Thursday morning at 4.15am Sydney time.

But before the rates decision there is economic data to digest. On Monday in China, the August reading on Chinese house prices is released. Over the year to July, house prices recorded a solid increase of 7.9 per cent.

In the US on Monday, the National Association of Home Builders (NAHB) releases the September index. A reading of 60 is tipped, unchanged from August.

On Tuesday in the US, August data on building permits and housing starts is released. Permits – the leading indicator – are forecast to rise 1.3 per cent in August while starts may have eased by less than 1 per cent.

Also on Tuesday, the regular weekly US data on chain store sales is released

As noted above, the US Federal Reserve meeting will be held over Tuesday and Wednesday. The probability of a rate hike at the meeting has ebbed and flowed over time but it has never really exceeded 30 per cent. In part this has been because Federal Reserve governors and presidents have expressed a range of views on the matter. The only real consistency between Fed officials has been a lack of urgency about raising rates, reflecting benign inflationary pressures.

On Wednesday in the US the regular weekly mortgage finance data is released.

On Thursday, in the US the National Activity index is issued together with the Federal Housing Finance Agency (FHFA) measure of home prices. Home prices stand 5.6 per cent higher than a year ago.

Also on Thursday, the leading index is released with data on existing home sales and the regional Kansas City survey. The leading index is expected to have been broadly unchanged in August after a solid 0.4 per cent gain in July. And existing home sales may have lifted by 0.9 per cent in August after easing by 3.2 per cent in July.

The usual weekly data on claims for unemployment insurance (jobless claims) is also issued on Thursday in the US – a key weekly gauge on the job market.

On Friday, the Markit “flash” purchasing managers indexes for manufacturing are released in the US, Europe and Japan. The indexes are designed to give the timeliest readings of any indicators on economic activity.

Sharemarket, interest rates, currencies & commodities

In the past week, volatility has seemingly returned to global sharemarkets. In the US the Dow Jones fell 2.1 per cent on September 9, rebounded by 1.3 per cent the next day (September 12) before falling 1.4 per cent on September 13. In the previous 44 days there had only been one day in which the Dow Jones moved by more than 1 per cent.

In Australia, there have only been five days with daily moves above or below 1 per cent on the ASX200 since the start of July. On average, volatility in recent months has been around the lowest in almost four years.

Current uncertainties include the timing of US rate hikes, the outlook for Japanese and European monetary policy, the outlook for oil prices and US politics.

Craig James is chief economist at CommSec.