Heading into a 2013 boom

PORTFOLIO POINT: The pessimists have it all wrong. Our economy will be firing on all cylinders next year. The mining boom has a long way to run and the housing rebound will accelerate.

Gerard Minack wrote a great article last week Australian market gets expensive, suggesting that the Australian market was now expensive.

I like Gerard’s stuff. It’s well worth a read and he makes me think. That said, I don’t agree with his view, although I take his point that some stocks have had a hard run of late.

Moreover, it’s true to say that earnings per share growth is being revised lower. For me, that’s where the problem is though. Earnings should be heading north, not south, because in all sincerity I can’t conceivably see how earnings will disappoint or weaken given the macroeconomic outlook. And this ultimately is what matters. Now I know the Reserve Bank recently revised its growth forecasts for next year lower, but I think that was a mistake. The truth is, 2013 could and should be a very good year for the Australian economy and it’s most probable that the economy will be firing on all cylinders – and this should underpin strong earnings growth, in my opinion.

I’ve already discussed two reasons why I think this will be the case in past notes. The first is that consumer spending will remain strong, and the second is that the credit cycle has troughed and is now turning – it will strengthen into 2013. Recent developments lead me to add two more reasons:

- The mining boom isn’t even close to ending or peaking, and won’t peak for several more years.

- In addition to that, residential and non-residential building investment will pick up sharply next year.

I admit to being confused as to why forecasters, including the RBA, fear the mining boom is over. For the RBA it’s to the point that it feels it needs to stimulate other sectors of the economy, noting the “peak in resource investment is likely to occur next year, at a lower level than expected six months ago”. Lifting other components of domestic demand is a goal of policy, bizarre for the fact that domestic demand was growing at its fastest pace in about five years to the June quarter. Further, and as I have illustrated to Eureka subscribers before, this growth was broad-based (ex housing) and not just due to mining. The fact the RBA feels this way just supports my earnings view.

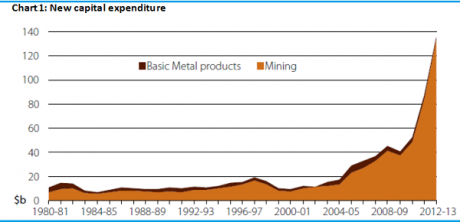

That the mining investment boom will end is right, I think, at some point. Just have a look at Chart 1, which shows the astronomical amount of mining investment underway – up 360% since the middle of last decade. That can’t last forever, and I don’t question that it will end. What I debate is the timing. The RBA’s view that the peak is next year is just plain wrong in my view, and by a significant margin. It seems to be too tied up with the prospects for China and iron ore – I mean the whole conversation about the end of the mining boom was sparked by the sharp decline in iron ore prices.

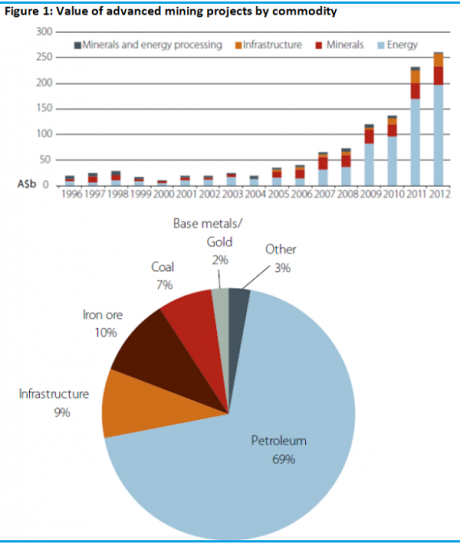

But have a look at Figure 1. It shows the value of our investment by commodity type. As you can see, about 70% is in the petroleum space, with the vast bulk of that liquefied natural gas (LNG). That’s $200 billion of projects at the advanced stage (projects that are committed to or have started) in LNG alone. By the way, it should be noted that most of our LNG isn’t heading to China (which takes 13%). It’s heading to countries like Japan and South Korea, and much of it is already contracted.

The key point to note is that there is virtually no chance this investment is going to be pulled in given the costs already sunk into them and prospects for global energy demand. Global energy demand is rising very sharply. At worst, some might be delayed due to costs.

To give you some perspective as to how huge this really is and why the RBA is way out on its view, consider that total mining investment in the year to June 2012 was about $80 billion – projects waiting to be competed blitz this by a factor of 2.5 times. Then consider that most of the big LNG projects aren’t due to be completed until 2014 or 2015.

Its projects in the ‘less advanced’ stage (undergoing feasibility or awaiting approvals) that tend to get pulled back (usually only temporarily), but here again we have something like $243 billion (assuming no growth, which is unrealistic) in additional projects. That’s a significant pipeline that will ensure strong growth in business investment for many years to come. A peak next year is highly unlikely given the dynamics – $500 billion in projects, or six years at the 2012 mining spend. The emerging market story is not a short-term phenomenon. It will last for decades – so no one is going to seriously pull in investment, and if they do, I would dump their stock.

That done, let’s talk about the second reason I’m optimistic on earnings growth – a rebound in residential and non-residential construction. Chart 2 shows that residential housing starts are their lowest in a decade. Total starts (including apartments) are about 13% below where a simple linear trend (to capture population growth) suggests we should be at. At the same time, a simple linear trend to map population growth probably doesn’t cut it. Consider that net migration is the highest it’s been for two years, and population growth overall is the highest in decades. So we’ve got the strongest population growth in decades and the weakest housing starts in about a decade.

Don’t forget Australia didn’t have a housing glut to work through – Australia is not the US, Spain or Ireland. We didn’t have a construction boom, and so there is ample scope for a construction upswing.

Now, fair to say, that in my note A rate cut won’t cut it for investors, I argued that there would be no short-term additional advantage to the housing construction sector from further rate cuts. This, by the by, is one factor that underpinned my bullishness on house prices (in a note I wrote a week later). I stand by that, as my point was/is that the price of money was never the issue. Confidence was, and I still think that is the case, which is why we haven’t seen rebound to date notwithstanding the very cheap lending rates we’ve seen over the last year.

Looking into 2013 I think the circumstances will be very different. We’ll still have cheap lending rates, and confidence probably won’t be anywhere near as bad. The three reasons for that are.

- Fiscal cliff aside, people have given up talking about a US double dip.

- We won’t go over the fiscal cliff, and even if we do it won’t cause a recession

- As discussed in my note Clearing the cliff overhang, the European crisis is much less dangerous now.

In the absence of that, I’m not seeing too many headwinds. Confidence will likely rebound, and with it residential and non-residential investment.

As for the non-residential space, there is certainly no sign here of some major underspend. Having said that, spending is below trend and well below GDP growth. So far, we’ve seen a fall in this component in every quarter nearly for the last two years. Investment is down some 20% over this period, while the economy is at its strongest in five years – broad-based growth remember. That doesn’t fit.

I think these are all some pretty big macro reasons why we shouldn’t expect weak earnings next year. You can probably tell from the above analysis that construction materials are one of my favoured sectors. Downer EDI has had a rough time of late and looks cheap to me. Similarly, I think stocks like Boral, Adelaide Brighton, Fletcher Building and James Hardie offer immense value and are still comparatively cheap – notwithstanding Boral’s high P/E.

Essentially I’m looking at stocks which are leveraged to this strong construction cycle to outperform the broader market over the course of 2013 – and I think investors should look for an entry about now. The fiscal cliff may present a better entry point so, as always, look to see how severe it is. Don’t wait for it to be resolved though.