Global growth fears are unfounded

Summary: There are concerns in the market that the global economy should fall into recession over the next two years but this is a low probability. Global growth is not materially different from trend and is expected to accelerate next year. Emerging market concerns are now at the fore, although this centres on Russia and Brazil, not China. |

Key take-out: Growth isn't weak and nor is it weakening. Growth is on a sustainable and normal growth profile. |

Key beneficiaries: General investors. Category: Economy. |

Global growth fears have resurfaced again, especially following the US Federal Reserve's decision last week to keep official interest rates steady instead of hiking for the first time since the GFC. Indeed, the Fed's board noted at the time that “recent global economic and financial developments may restrain economic activity somewhat”.

Ordinarily such a seemingly harmless comment might pass without much notice. Except that rates are already at zero and a number of global institutions had been warning in the lead up to the decision that the global economy wouldn't be able to handle a rate hike in the US. So that relatively bland comment from the Fed was in effect a tip of the hat to those concerns.

At its worst there are concerns in the market that the global economy could fall into recession over the next two years. Economists at Citi Group attribute a 55 per cent probability to this outcome. Having said that, this is the same team that said ‘Grexit was a near certainty' back in 2012. At that time this team put a 90 per cent chance of that occurring over the next 12-18 months. Yet now, in 2015 and three years after the supposed ‘Grexit', Greece still remains in the eurozone.

Now I'm not suggesting that short-term investors should fight the market on this one. Stocks are being belted around the globe and that doesn't look like it's played out yet. Indeed, the Australian share market closed some 2 per cent lower today at 4,998.10 points.

Having said that the global recession call, based as it is on a Chinese economic hard landing, is a low probability (see China does not have a debt crisis, September 9). So in my view, we shouldn't take talk of a global recession seriously. Indeed it's not clear to me that global growth fears are even warranted at this point.

What I am saying, is for short-term investors, while they may choose to ‘swim with the tide', to be careful and keep their eye on the bigger picture. Longer-term investors should remain calm and keep a steady hand. There is no disaster scenario in the tea leaves just yet.

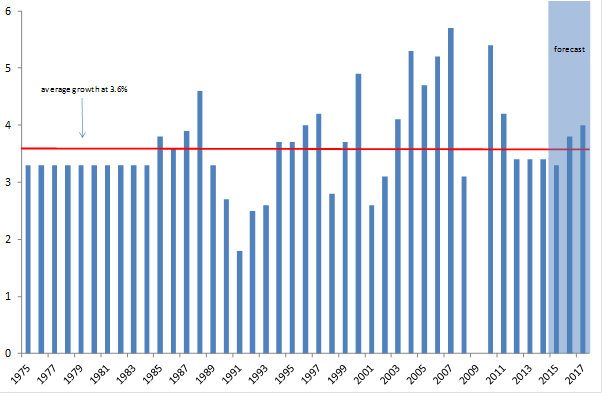

You'll get a clearer sense as to why that is the case from chart 1 below. Global growth currently is only fractionally below trend – a decimal point here or there. Realistically, the numbers are simply not that accurate and a decimal point here or there is indistinguishable from the usual statistical noise. So we're not talking a global growth profile that is materially different from trend.

Chart 1: Global growth has been fine

Source: Eureka Report, International Monetary Fund

In any case, global growth over the last few years has actually been above trend on average, but again, not materially above. More to the point, growth is expected to accelerate to an above trend rate in both 2016 and 2017. Even if that is revised down as is most likely, we will still be talking about global growth around trend. Clearly, such a profile in no way aligns with the rhetoric doing the rounds – and some of the more extreme forecasts for global recession.

Keep in mind that this whole language of global slowing, weakness etc is not a balanced one – and it's highly misleading. Growth is very much normal. Is everything perfect? No. Are there risks? Yes. There are always risks. But these must be regarded as such and not given undue weight.

So at this point, and following concerns in recent years about Greece, a European debt crisis, and a US fiscal cliff etc – emerging market concerns are now at the fore. There are a few things to note here though.

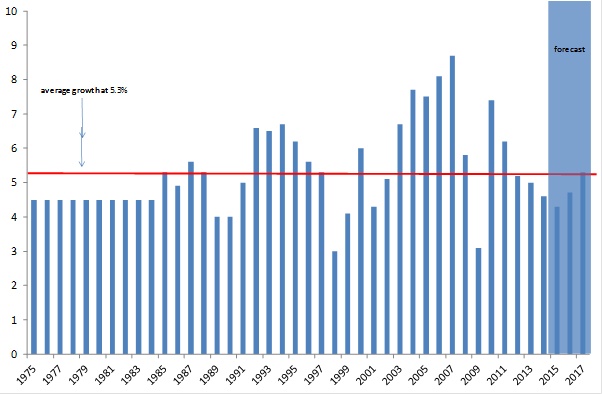

Firstly, growth has been solid in the emerging markets since the GFC. In fact even if you include the GFC, growth has been at trend since 2008. Since then growth has actually been above trend.

Chart 2: Emerging market growth has slowed but is still strong

Source: Eureka Report, International Monetary Fund

Now admittedly, growth is expected to slow to below trend rates over the next two years. Yet this slowing isn't due to a weakening China or the effect of falling commodity prices.

Instead, the bulk of the emerging market weakness is concentrated in the Commonwealth of Independent States (a group of former Soviet states) and in Latin America. Together, these two regions constitute about 25 per cent of the emerging market and led by Russia and Brazil respectively are due to post very weak growth over the next two years.

As to what's driving that – weakening commodity prices certainly aren't helping but really the problems are to be found elsewhere. In Russia, it is mainly economic sanctions, while countries like Argentina and Brazil are being smashed by inflation, a surging US dollar, drought and very restrictive monetary policy. Weak commodity prices are more an issue for government budgets and the accumulation of debt.

More broadly the effect of weaker commodity prices on global growth is best thought of as a wealth transfer. Weaker prices by themselves won't and can't weaken economic growth. What they instead represent is an income transfer from commodity exporters to importers.

Outside of those two regions, emerging market growth is, and is expected to remain, robust. In emerging Asia, growth rates are strong, although are expected to be slightly lower than in the decade prior to the GFC: 6.5 per cent vs 7 per cent. That's not a big deal.

In emerging Europe, growth prospects are actually strengthening, commensurate with the uptick in growth in the developed European economy itself posting above trend growth rates.

The developed economies for their part are doing well. Europe in particular is out of recession and in the US growth rates have been restored back to where they were in the few years leading up to the GFC.

Anything too much worry about there? Not really. The fact is that growth isn't weak and nor is it weakening. Growth is very much on a sustainable and normal growth profile.