Earnings forecasts: The new reality

|

Summary: Analysts are forecasting robust earnings per share growth for our listed companies over the next three years which, if achieved, should buttress the market. However, the RBA's recent downgrade to its growth forecast has many questioning whether these earnings estimates are too optimistic. |

|

Key take-out: With surging building approvals, consumer spending picking up and jobs growth accelerating (despite what you are hearing), earnings forecasts aren't under threat for the medium term. Even if the economy should slow, it would lead to more aggressive rate cuts – exacerbating the hunt for yield. |

|

Key beneficiaries: General investors. Category: Economics and Investment Strategy. |

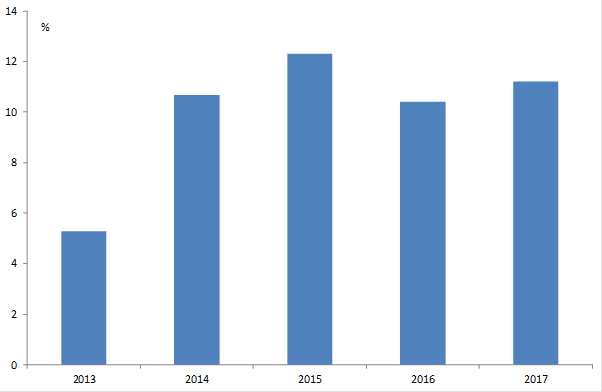

On current estimates, the consensus expectation is that earnings-per-share (EPS) growth will remain robust over the next three years.

Near-term, EPS growth in 2015 is expected to exceed 12 per cent, following an 11 per cent lift last year and a more subdued lift of 5.3 per cent in 2013. All in all these are strong outcomes which, if achieved, should buttress the market, noting still reasonably attractive forward multiples (see Why the ASX has further to run)

The problem is that the RBA has just downgraded its growth forecast and the natural concern for investors is whether these EPS estimates are now too optimistic and at risk.

At this stage, unfortunately, it's perhaps a little too early to garner much from this current earnings season. At the time of writing, only 39 of the approximately 128 companies that are due to report have done so. Suffice it to say that earnings reports to date are generally being well received though.

Chart 1: EPS growth expected to remain solid

Looking further out, the first thing that investors should note is that it's not even clear that the economy is slowing. I appreciate that the RBA's recent downgrades would seem to contradict this – and those downgrades do seem to be more in line with consensus expectations.

However, the actual fact is nearly all the leading indicators for the economy have been strengthening. That's one of the more remarkable features of the RBA's latest cut.

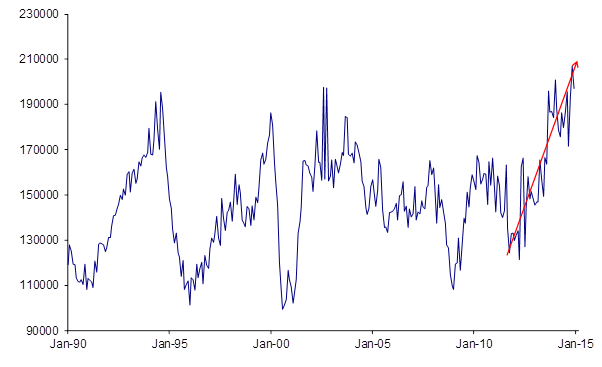

In particular, building approvals are still surging. As chart 2 below shows, approvals are at their highest level in more than a quarter of a century. The spike has been remarkable, with growth of about 50% since 2012. Recent data shows that there is little sign of a loss in momentum (over 16% in the latest quarter), with the market buoyed by strong population growth, a generalised shortage of stock (outside of higher density inner city dwellings) and ultra-low rates.

Chart 2: Building approvals are surging (implied number of housing starts)

Chart 3, below, then shows that consumer spending has also picked up appreciably as well. In the December quarter, the ABS advises that spending was up a very strong 1.5%. To give you a sense as to how strong that is, the historical average is 0.9% quarterly growth.

It is also interesting to note that over the last two years consumer spending has really only been weak in two quarters. Every other quarter has been strong. So chart 3 is a little misleading, as those two weak quarters act to dampen year-on-year growth considerably.

Growth has looked soft at times when, in reality, the actual quarterly momentum has been strong. When you adjust for that, the underlying trend is that consumer spending is the strongest it has been since the GFC – at around 5 per cent per annum. Moreover, thought of that way, consumer spending growth now is only marginally weaker than what we saw during the pre-GFC boom.

Chart 3: Consumer spending is picking up

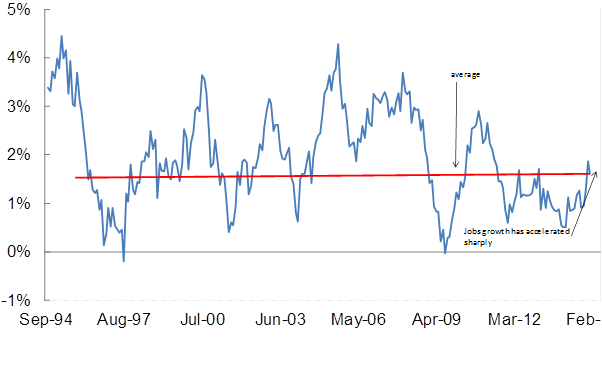

These are critically important developments. As employers, the retail and construction sector account for about 30 per cent of the labour market which dwarves mining's 1-2 per cent. Activity here matters and so it's not surprising then that we have seen a very strong rebound in jobs growth. Indeed, over the last four months jobs growth has been at its strongest in about 10 years.

Chart 4: Jobs growth is accelerating sharply

Again, I realise that this is at odds with everything you read and hear. But this is what the data is saying – and importantly – it's all consistent. I'd highlight at this point that all the commentators and analysts out there sprouting doom and gloom are extremely inconsistent in their analysis.

These are indicators for about 70 per cent of the economy, and they are all picking up – not deteriorating. So I don't see how the RBA justifies their forecasts. They simply state that consumer spending and non-mining investment will remain subdued for a slightly longer period of time, though they offer no satisfactory explanation for this downgrade.

With that in mind, I think EPS expectations are currently about right – something around the 10 per cent mark. Having said that, I think some consensus downgrades are highly likely. Not because the economy is actually weak mind you, but because analysts – the RBA, etc. – are once again forecasting it to be weak.

Note that over the years since the GFC these forecast downturns or weak growth estimates have never been realised. Depending on the magnitude of those downgrades, all it might mean is that we end up actually seeing some ‘earnings surprises' for the year.

I would suggest at this point it's unlikely that earnings would necessarily follow a slower economy lower. For a start – all of this bad new on resources (and more) is already factored into market EPS forecasts for our key resource stocks. Little good news is priced in; Remember Rio's positive earnings surprise last week.

Then have a think about what people are concerned about when they talk of a weaker economy: The drop in mining investment and the terms of trade. It's very confined. Most importantly, the drop in mining investment has almost no EPS implications given the bulk of it is conducted by companies listed elsewhere.

To the extent that the terms of trade keeps falling, the major market impact would be further volatility for resource stocks – but maybe not much given a lot of bad news is already priced in. Further falls would simply be a realisation of those very bearish forecasts. In any case, much of the ensuing decline in EPS would be buttressed by a weaker Australian dollar and the surge in production volumes. As a medium-term influence, the terms of trade will fade.

That's not to forget the fact that if the economy does weaken, it would likely lead to much more aggressive rate cuts – exacerbating the hunt for yield and leading to greater multiple expansion. Temporary earnings fluctuations aren't everything in our new world.

The bottom line is that in this current environment I don't think there are too many scenarios where stocks will perform badly over the medium term. Indeed, it's not looking like earnings are under a material threat, even if the economy should slow.