Doubling down: Investors reignite the housing market

Summary: The rebound in investor activity in Sydney and Melbourne has come amid trends that suggest the housing market should be cooling. |

Key take-out: Dwelling prices in Sydney and Melbourne have increased by almost 10 per cent over the past 12 months. |

Key beneficiaries: General investors. Category: Property. |

Investors are jumping back into property, despite the major banks' hiking interest rates, as the Sydney and Melbourne property boom finds a second wind.

The Australian Bureau of Statistics (ABS) released new data on mortgage lending activity this week, providing evidence of renewed vigour among property investors, which could support dwelling price growth in the near term.

Historical trends suggest that the housing market should be cooling. The major banks' are lifting interest rates and, as it stands, real interest rates aren't even that low in the first place. Buying behaviour in Sydney and Melbourne has been frantic for several years now, which normally leads to a period of softer prices and lower transactions. Meanwhile, rental yields have dropped to their lowest level in recorded history, with rents falling across much of the country.

Each of these factors, by themselves, would be enough to warrant caution for property investors and owner-occupiers. Nevertheless, prices continue to rise and investors cannot get enough of residential property. Let's crunch the numbers.

Lending resurgence

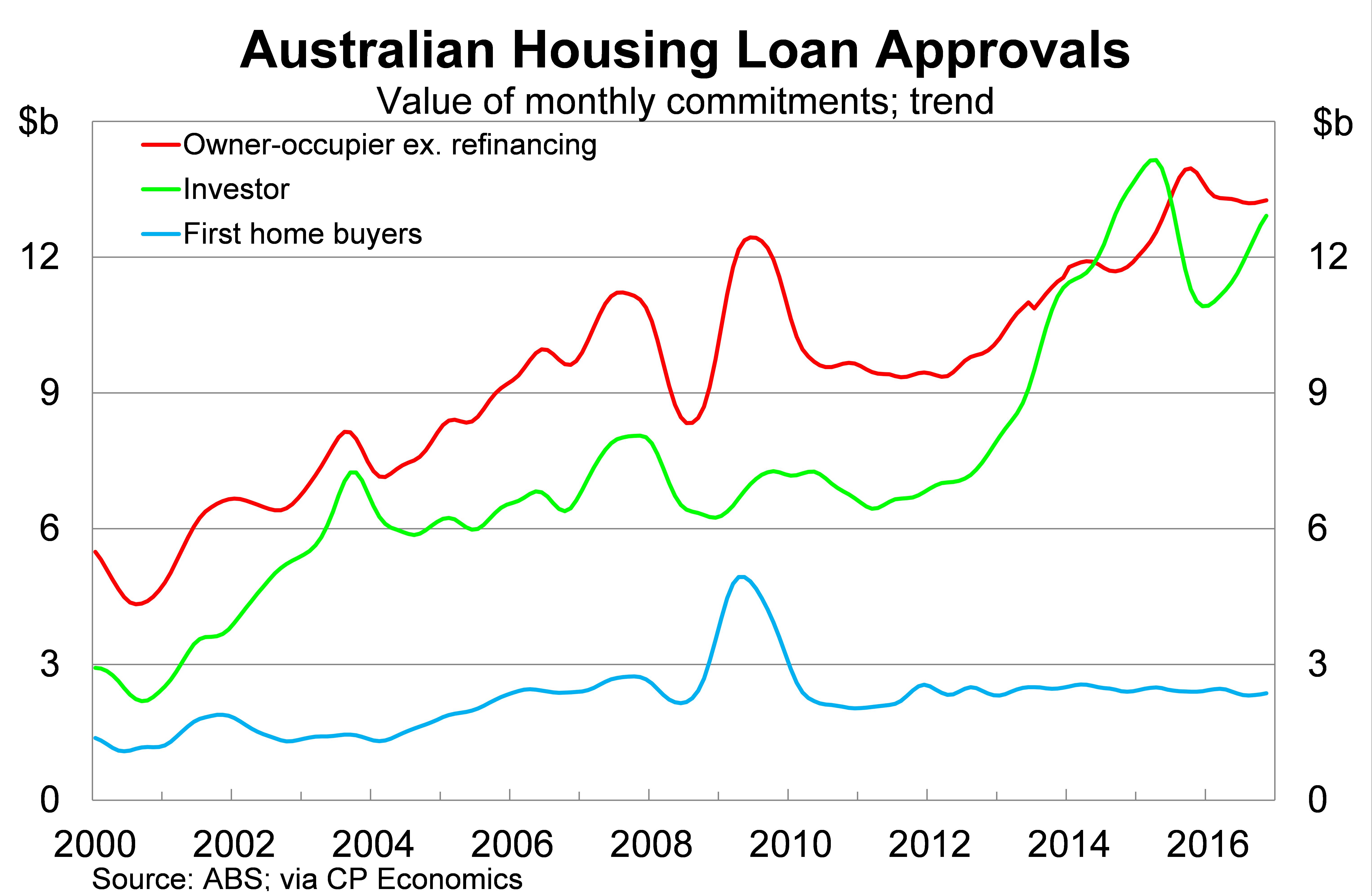

According to the ABS, new mortgage lending activity rose by 0.9 per cent in November on a trend basis, the ninth consecutive monthly rise, to be 5.1 per cent higher over the year. Lending activity has surged 7.4 per cent from its recent trough but remains 2.3 per cent below its peak in May 2015.

Much of that recent strength has been concentrated among property investors. New investor lending activity rose by 1.7 per cent in November on a trend basis, a touch weaker than recent months, to be 17.1 per cent higher over the year.

First-home buyer activity remains weak, reflecting high prices and a difficult savings environment.

Investor activity has already returned to a level that is likely to concern the Australian Prudential Regulation Authority (APRA). The first stage of the recent boom occurred in an environment in which mortgage rates were falling; by comparison, the rebound has occurred in an environment where banks are raising rates. There is arguably greater risk in the system now than there was when investor activity peaked in April 2015.

Greater regulatory oversight and tighter lending standards is a clear risk for property investors over the next few years. It would be a surprise if we didn't see a response from APRA in the coming months.

Record prices

Dwelling prices continue to send mixed messages both with regards to different cities as well as different dwelling price measures.

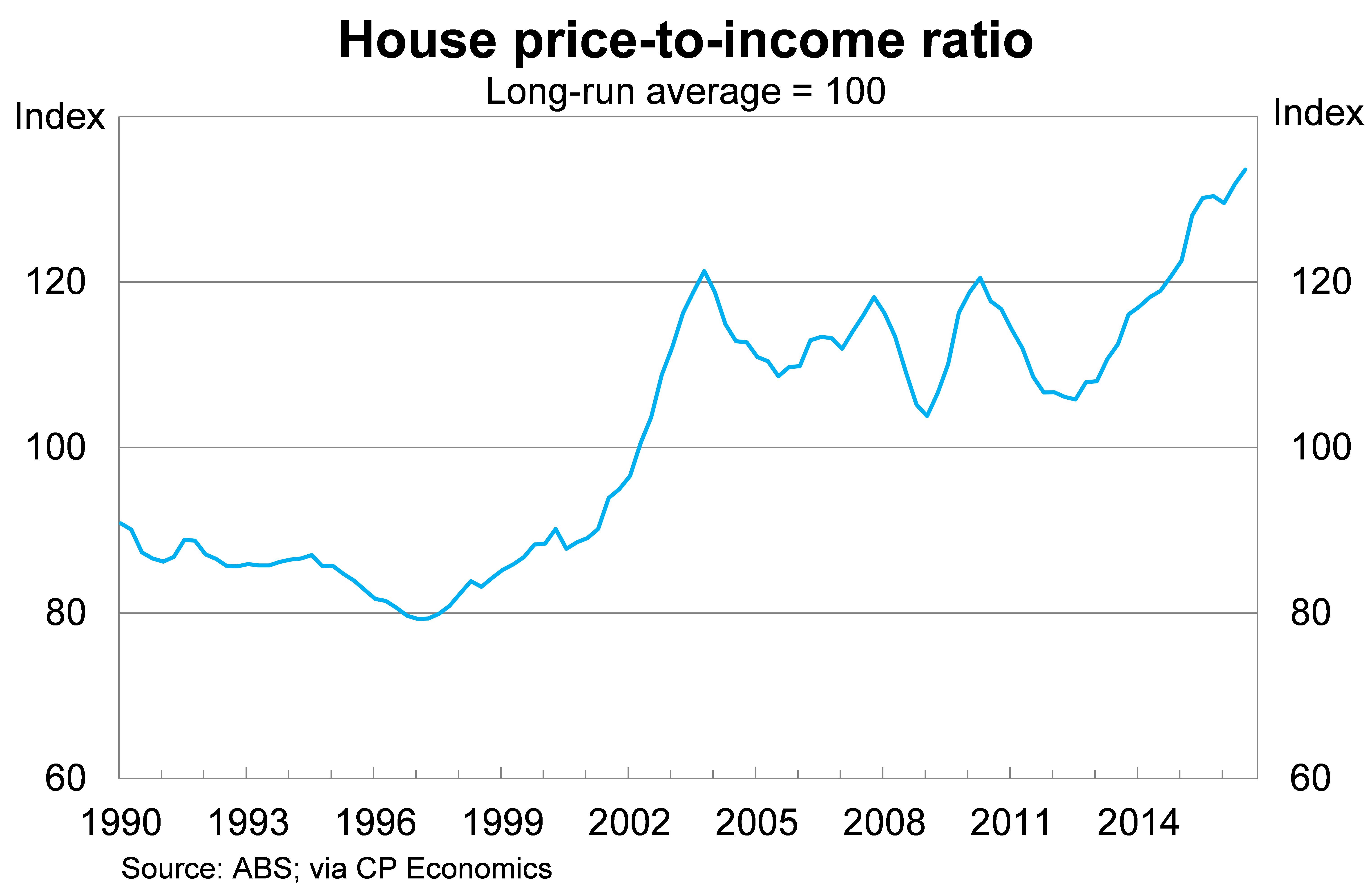

Nationwide housing valuations have never been higher. The house-price to income ratio is at its highest level in history and has increased by 26 per cent over the past four years. The house-price to rent ratio is also at its highest level in history.

Nevertheless, the national figures aren't all that useful since conditions differ significantly from city to city. According to the ABS, dwelling prices in Sydney and Melbourne, for example, have increased by almost 10 per cent over the past 12 months. By comparison, prices in Perth have fallen by 4.5 per cent over the same period.

Other house price measures, such as from CoreLogic, suggest that prices in Sydney and Melbourne have increased at 15.5 and 13.7 per cent over the past year, respectively.

Despite different methodologies, the ABS and CoreLogic measures of dwelling prices have historically been quite similar. Recent changes to CoreLogic's methodology, however, has called into question their accuracy and the Reserve Bank of Australia has started to place greater emphasis on the ABS measure in its reports.

Remembering that mortgage lending activity remains below its peak, it is somewhat surprising that there hasn't been any genuine weakness in the Sydney or Melbourne markets. This might reflect the fact that around 30 per cent of housing transactions do not involve debt – creating a disconnect between lending activity and prices – though it is certainly beneficial for investors to utilise debt.

It's also worth noting that new construction, mainly funded from abroad, may be having a greater influence on prices than has been the case in the past. Capital inflows from abroad may have allowed the housing market to stay strong when lending activity moderated.

Rates brake

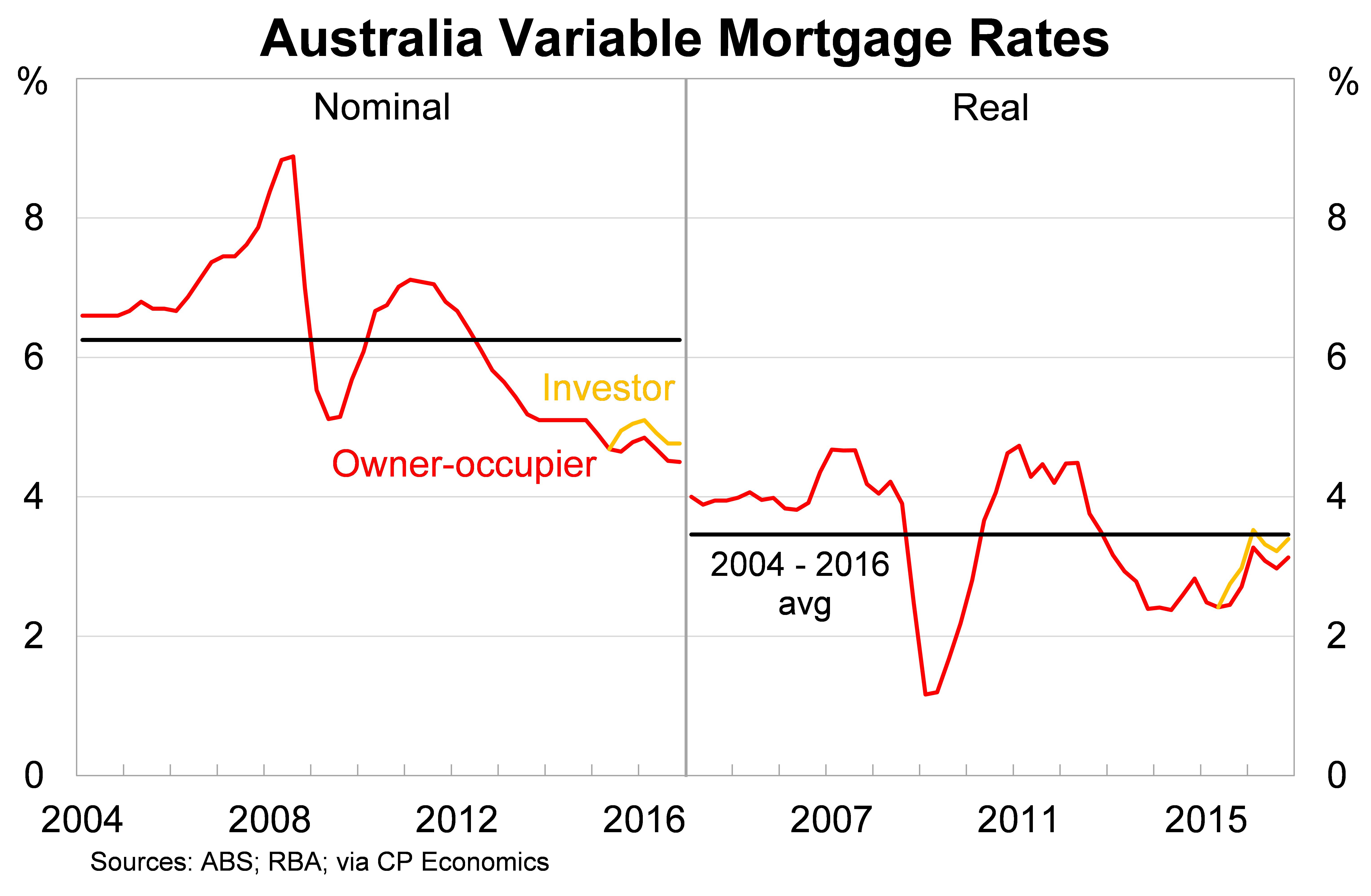

What is fascinating about the rebound in investor activity in Sydney and Melbourne is that it has occurred in an environment in which interest rates really aren't that low.

The graph below compares nominal and real mortgage rates against their long-term average (defined in this situation as between 2004 and 2016). After adjusting for inflation, mortgage rates for investors are just 6 basis points below their long-term average and have tightened by 100 basis points over the past 18 months.

Earlier this week NAB and ANZ announced they would increase their fixed mortgage rates. NAB will increase its two-year fixed rate by 23 basis points and its three-year rate by 20 basis points. ANZ will increase its two-year and three-year fixed rate by 23 basis points.

With higher funding costs – and a requirement to hold greater capital – it is likely that banks will widen the spread between mortgage rates and the cash rate in an attempt to maintain profitability and dividends.

As a result, the cash rate may be at its lowest level in history but lower inflation and rising spreads has led to tighter lending conditions. Property investors are stuck in an awkward position – if inflation returns to more normal levels then they have made a sound investment, but if low inflation is persistent then borrowing costs are much higher than they have anticipated.

It's a risky bet but one that, at least for now, thousands of investors are willing to make each month.

Building activity

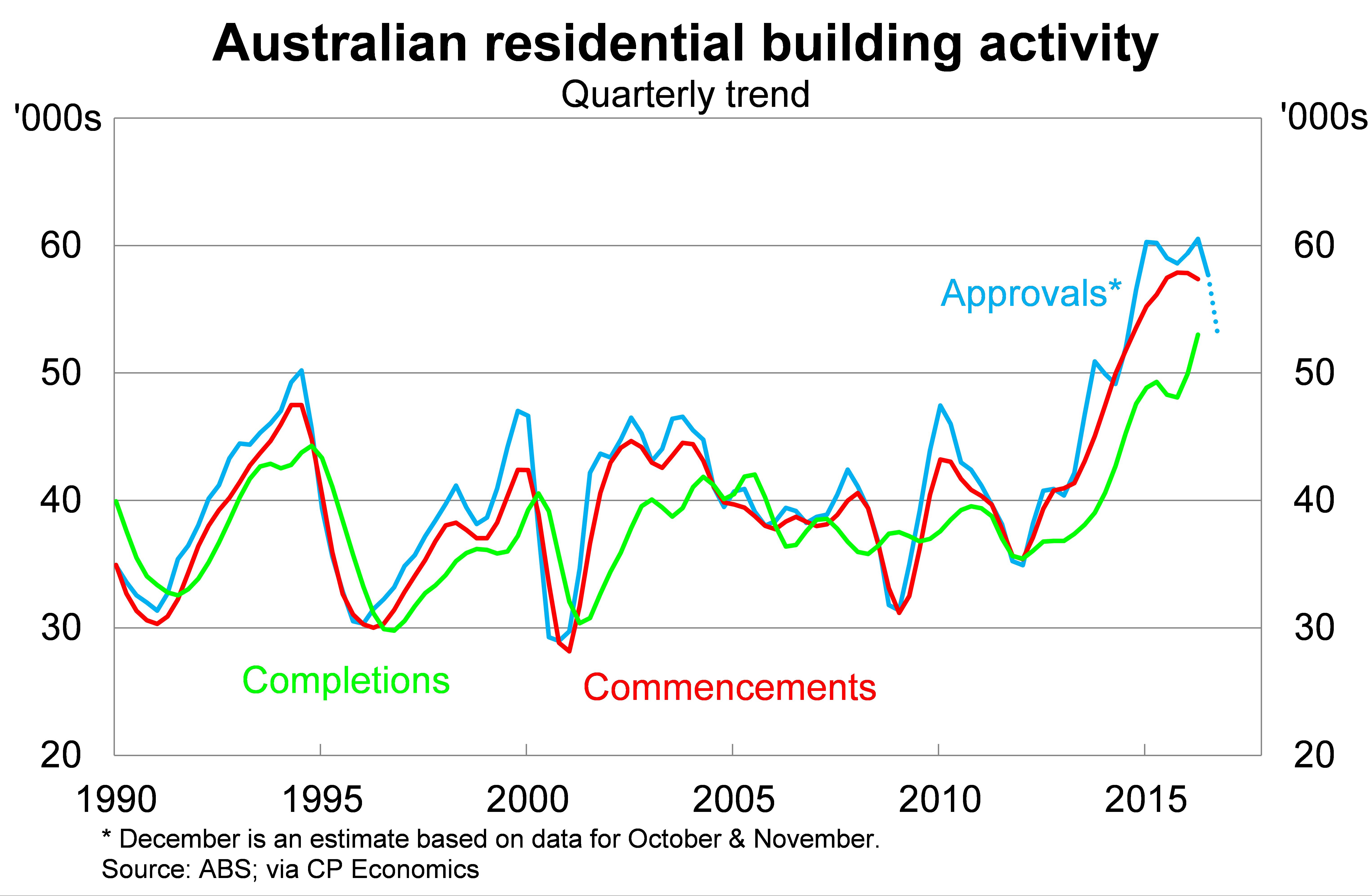

I touched upon residential construction in last week's article (Economic scorecard shows good results, January 11) so I will only touch upon it briefly this week. Although building approvals have started to decline, building activity will remain at an elevated level throughout 2017 (even if construction activity falls a little from its current level).

This creates a range of opportunities for property investors, although the data suggests that these developments are typically funded by foreign investors. Domestic investors are more interested in purchasing established property.

Nevertheless, a large increase in the rental supply is likely to put downward pressure on domestic rents. Rents have always been a bit of an afterthought for domestic investors – the focus has always been on capital gains – but stagnant or even falling rents is hardly ideal for the savvy investor.

We are already beginning to see the effect of the boom on nationwide rents – with newly negotiated rents falling across most cities – and may continue over the next year or two. At the same time, net migration rates have declined to their lowest levels in 15 years, which may lead to lower-than-expected demand for new housing.

Investor activity may have rebounded in the property market but there are still a few headwinds that need to be navigated. Higher supply could weigh on prices and rents and low inflation – if persistent – will increase the debt burden on both existing and new investors.

Investors need to be aware of these factors when they consider their next purchase. They must also be aware that they are entering a market that has remained up a lot longer than most experts suggest. The opportunities for capital gains may not be over but are certainly not as widespread as they once were.