Economic scorecard shows good results

Summary: The retail and mining sectors are benefiting from some nice conditions, although a slowdown in residential construction is set to weigh on GDP – and maybe property prices. |

Key take-out: Cafes and restaurant spending is up 6.6% over the past year and household goods 3.7%. A return to trade surplus is welcome but maybe atypical, while property builds are down for a sixth straight month. |

Key beneficiaries: General investors. Category: Economics, investment strategy. |

We may have started a new calendar year, but the economic debate remains firmly rooted in the final months of 2016.

Over the past week we have started to receive indicators for November, which provides some insight into whether the economy will avoid its first recession in a quarter century.

Australian policymakers and investors will be relieved to know that the recent data flow has been pretty good. Retail sales are growing at a solid pace, while Australia has a trade surplus for the first time since March 2014. Building approvals may have declined recently but this won't hit economic activity until well into 2017.

Retail revival

Australia's retail sector struggled throughout most of last year but has staged a mini resurgence over the past few months. The data for November saw a consolidation of that trend, despite falling short of market expectations, and should be viewed as a positive by market participants.

Retail spending rose by 0.2 per cent in November, following average growth of around 0.5 per cent in each of the past three months, to be 3.3 per cent higher over the year.

With household spending accounting for around 57 per cent of real GDP and the retail sector accounting for around 30 per cent of that, a healthy retail sector is paramount for a thriving economy.

Cafes and restaurants and household goods have been the two strongest industries for retail spending over the past six months. Spending at cafes and restaurants has increased by 6.6 per cent over the past year on a trend basis; spending on household goods is up 3.7 per cent over the same period (with almost all that growth occurring in the past six months).

The main source of risk for the household sector comes in the form of soft wage growth. This has constrained the retail sector in recent years and while there have been pockets of strength the sector has struggled to find genuine momentum.

The recent pick-up in commodity prices, if sustained, could support the retail sector somewhat by boosting income growth. However, I anticipate that commodity prices will fall somewhat throughout 2017 – as I explain later in this article – so any boost should be short-lived.

Property inflection point

Residential construction, accounting for around 3.8 per cent of real GDP, has been a source of strength for the Australian economy over the past few years. It has helped to offset some of the damage done by falling investment across the mining sector.

Building approvals are a leading indicator of residential construction. Released monthly, they are one of the most closely watched indicators of domestic activity and one of the few indicators that provides insight on future, rather than past, activity.

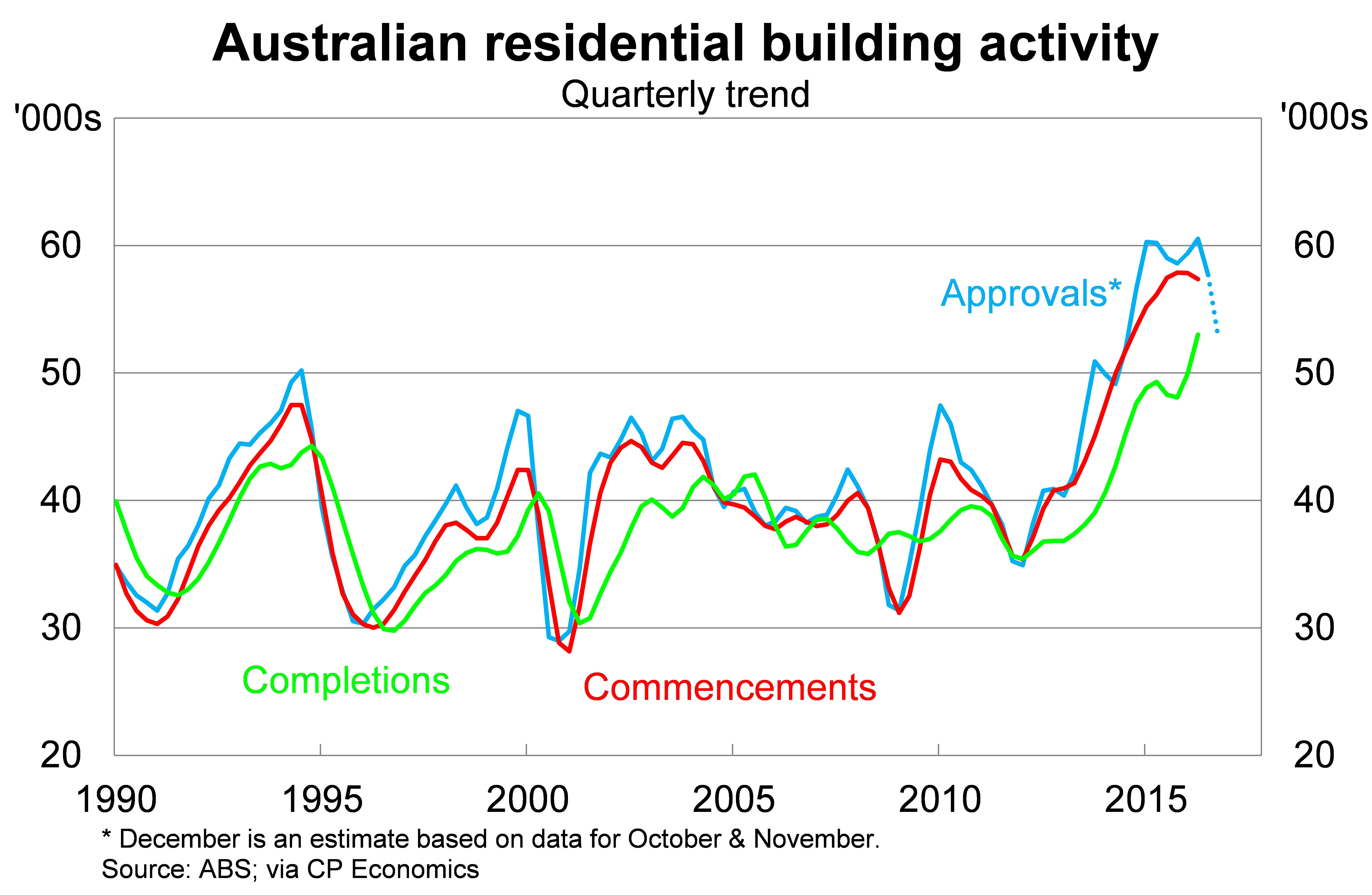

Building approvals fell by 2.9 per cent in November on a trend basis, the sixth consecutive monthly decline, to be 10 per cent lower over the past year. Approvals have now fallen by 13.4 per cent over the past six months and are expected to decline further as approvals return toward more sustainable levels.

The recent weakness has been driven by a decline in apartment approvals, which suggests that the number of cranes that dot our city skylines will slowly begin to decline as projects are completed.

Residential construction activity will remain at a high level throughout 2017 and 2018 in an absolute sense. But beginning this year it will begin to subtract from real GDP growth on a quarterly basis. Construction activity should decline over the remainder of the year, although we may see some growth during the first half.

The relationship between approvals and completions is shown in the graph below. We can get a sense for how long it takes for an increase or decrease in approvals to effect construction and completions.

From an investors' perspective there is keen interest on what this all means for house prices and property investment. Although residential construction activity will begin to subtract from economic growth, we can see that the number of approvals and completions remains at an elevated level. High levels of new supply will put some downward pressure on house prices and rents, although this could be offset by other factors.

International trade

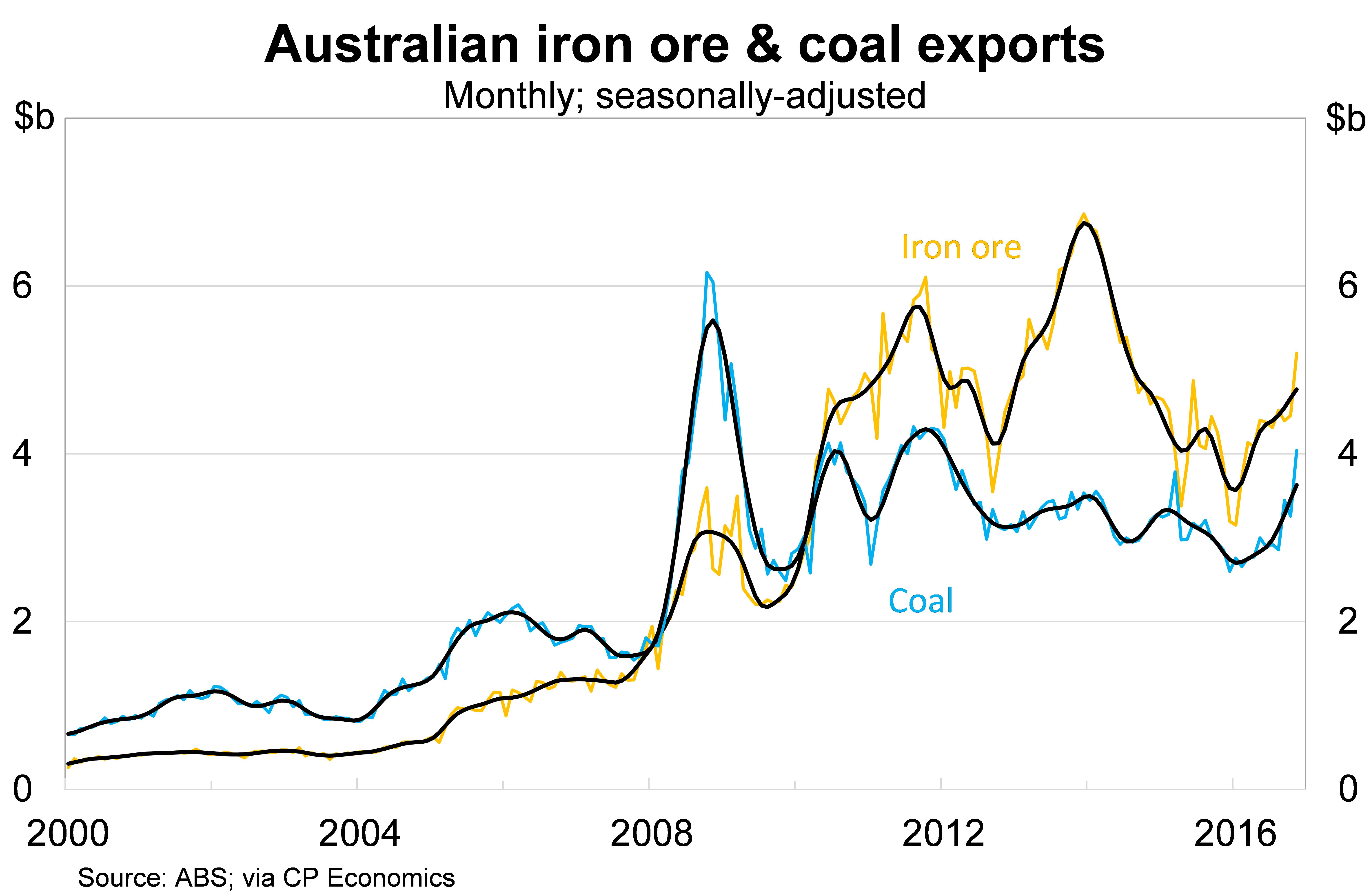

We are seeing some welcome developments across the mining sector recently, with higher prices of iron ore and coal boosting income and profitability across the sector. In the process, Australia's trade balance has shifted into surplus for the first time since March 2014.

The trade surplus sat at $1.24 billion in November, from a deficit of $1.12bn in October, on the back of higher commodity prices. The graph below shows the value of monthly iron ore and coal exports; both remain well below their peak but have improved significantly in recent months.

The key question for investors is one of sustainability. Sure commodity prices have increased but how long is that likely to last? There is always considerable uncertainty surrounding these markets but it appears likely that prices will moderate somewhat during 2017.

Prices have been boosted in large part due to temporary factors that have hit supply but the effect of this is already beginning to diminish. As this occurs we are once again left with excess supply, which was the main reason why commodity prices collapsed in the first place.

Meanwhile, capital outflows from emerging economies, including China, are likely to reduce demand for Australia's major commodities compared with expectations. Capital outflows equal weaker-than-anticipated investment, which is ultimately undesirable for commodity prices and Australian miners.

Since the return to surplus has been driven by higher prices it is unclear what this means for export volumes. It is quite possible that we see an increase in export income despite selling lower volumes, which is the opposite of what has occurred over the past few years.

If that eventuates we would have the odd situation where exports subtract from real GDP growth despite an improvement in mining income and profitability. This would be treated as a negative result by the financial media and yet there isn't a miner in Australia who wouldn't trade lower volumes in return for higher profitability.