A key signal no investor should ignore

| Summary: The latest bond rally signals that markets simply aren’t concerned about central banks changing policy too drastically, if at all, for the foreseeable future. With growth accelerating, employment surging, inflation rising (if modestly) and output gaps closing, uninterrupted asset price inflation is the only game in town now. |

| Key take-out: This government will follow the previous government in pushing for lower rates and a weaker dollar. Equities and property will remain the only game in town for a long time yet. |

| Key beneficiaries: General investors. Category: Economics and investment strategy. |

One of the key risks to the global economy I‘ve noted over recent years is the prospect for a bond yield spike.

The fear was – is – that with yields at record lows there was only one way for them to go as economies recovered and governments relied less on buying their own debt. Yields have risen – the US 10-year yield is up over 100 basis points since a low in 2012. Most of that is due to the Federal Reserve Bank’s tapering (winding back) program, which has seen Fed purchases of US Treasuries drop from $45 billion per month to $25 billion per month now.

What has been surprising since that initial lift is that yields have actually fallen more recently. Normally falling yields signal economic weakness, and to begin with that may have been the case. Recall the deterioration we saw in some US economic indicators, especially payrolls and GDP. There was some concern in the market as to how much of that was wether induced, versus an actual change in economic momentum. The Fed itself was unsure what was going on and so, under those circumstances, a bond rally (falling yields) probably wasn’t unusual.

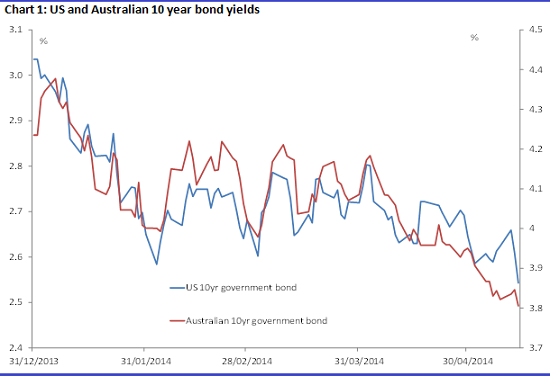

With the passage of time and a rebound in some key economic indicators, the drop in bond yields becomes quite remarkable to be blunt. Just over the last month, the US 10-year bond yield has fallen 30bp – 15bp of that in the last three days. Chart 1 below shows moves relative to a peak at the end of last year. They are decent downside moves, which isn’t what you’d expect given the recent dataflow.

It’s not just a US issue either – US bonds set the pace globally, correlations are high, and so over the last five months or so the Australian 10-year government bond yield has dropped from 4.42% to 3.70% at the time of writing. That’s the lowest rate since about August last year, and only about 1% higher than a generational low rate reached in 2012 – of about 2.75%.

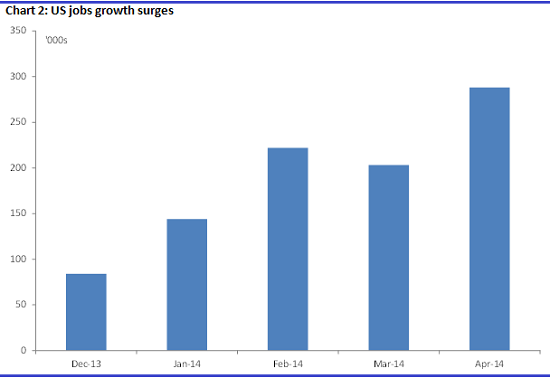

Why this is weird is because the global dataflow, especially out of the US, has been unequivocally positive. Take US payrolls (chart 2 below). We’ve seen an average increase in jobs of over 200,000 for the US over the last three months. That’s very strong growth and a clear acceleration from the winter lull. At this rate, 2.8 million jobs will be created in the US for 2014, the strongest growth in the post GFC expansion thus far.

You’re seeing that in Australia as well, where jobs growth has surged so far this year – 106,000, which is the strongest growth since 2008. The UK recorded the strongest quarterly growth in jobs since 1971, with 283,000 jobs created in the March quarter.

Markets are puzzled as to why bond yields would fall so hard in the face of all of that, and the move has been a hot topic of discussion for analysts and commentators alike. Reasons offered vary from front running the European Central Bank, to simply technical positioning. Regardless of the reasons though, the fact is the rally has occurred in the face of strong economic data and an uptick in inflation. Sure, inflation is still low in the US – but it’s not that low at 1.1% yearn to year (y/y) – on the Fed’s preferred measure of the personal consumption deflator – and the recent surge in producer and consumer prices suggests that may soon pick up.

At the very least, inflation has bottomed. Moreover, inflation isn’t even low in Australia, whilst in the UK, modest inflation outcomes are only a very recent event, with inflation having spent most of the last five years or so at uncomfortably high levels – above target more often than not. That is, the falls are very recent and only reflect the impact of falling commodity prices. Once that effect wears off, inflation rates will once again lift.

So, with growth accelerating, employment surging, inflation rising (if modestly) and output gaps closing – the bond rally signals that markets simply aren’t concerned about central banks changing policy too drastically, if at all, for the foreseeable future. That’s not without just cause mind you – only this week, and immediately after employment data showed UK jobs growth at its strongest since 1971, the governor of the Bank of England effectively hosed down rising expectations for rate hikes.

Readers will know that I’ve written about this myself. I’ve had my suspicions that central banks would keep rates as low for as long as they could get away with. Even so, I’ve been stunned at how strong the bond market rally has been in the face of strengthening economic data. It shows the bond market has reached the same conclusion as I have.

This strongly implies a growing disconnect between economic outcomes, policy and market pricing. Uninterrupted asset price inflation is the only game in town now. Expect market correlations to strengthen, increasingly binary outcomes, and much lower market volatility.

That these developments have occurred around the Australian budget hammers the point home all the more. The Coalition sent a very strong signal that they will be pushing a ‘lower rates for longer’ strategy. I wrote on May 9 (Could the RBA cut rates?) that the market was under-pricing the chance of another rate cut by the Reserve Bank this year, and having read through the budget and had some time to think of the matter, I’m more convinced of that. Global developments ensure it.

As I mentioned on budget night, that’s not because the government’s budget is contractionary or in in some way ‘allows’ the RBA to keep rates low via fiscal prudence and sound economic management. That’s not it at all. The budget merely follows a strategy that has been in place since the GFC spending splurge ended. That strategy is to rely on the economy returning to trend growth in order to return the budget to surplus. There are no cuts in spending.

Instead, spending increases by $60 billion over the forward estimates – an average increase of $15 billion per year. Yet, we were led to believe that the budget was in crisis and that an urgent repair was needed. Recall Wayne Swan’s budgets of “discipline and restraint” with “surpluses built on some difficult savings”. It’s similar to the rhetoric that we are hearing now.

All the while each budget simply increases spending – just like this one. Differences exist only at the margin. Sure, there is a Coalition stamp with Medicare co-payments etc. But whether you think these are a big deal or not comes down to how reasonable you think changes to welfare etc. are. Some people think they are a big deal, others “beers and ciggies’ as it were. I’m not going to go into that. I’m simply noting that, at a broader level – nothing has changed. Once some of the more contentious aspects of the budget are discarded or watered down, even less will have changed. Treasury and the government would have known this. NO change – and that in itself is of huge significance.

This government will follow the previous government in pushing for lower rates and a weaker dollar. It has to, without genuine fiscal restraint; its economic credibility depends on it.

Tying it all up, equities and property are, and are going to remain, the only game in town for a long time yet.