Why Buffett loves airlines, but you should still avoid Qantas

Recommendation

Until recently, no one could have accused Warren Buffett of being a fan of airlines. In 2007, he went so far as to say:

‘The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, then earns little or no money. Think airlines. Here, a durable competitive advantage has proven elusive since the days of the Wright brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.'

Key Points

-

Loyalty division consistently profitable

-

Improving balance sheet and margins

-

Major risks remain; Avoid

A favour no more, apparently. Over the past year, Buffett has purchased large stakes in several airlines for Berkshire Hathaway. As of March, the company owned nearly US$10bn worth of US airlines, including the four largest carriers: Delta, United, American and Southwest.

To the best of our knowledge, Buffett hasn't publically explained why he's had this sudden change of heart, but we suspect a big part of it has been the industry's consolidation and an explosion in profitability thanks to loyalty programs.

Loyal to whom?

In 2014, Qantas Airways made more money selling points than it did selling flights. Though a turnaround at the airline division meant that wasn't the case in 2016, the Loyalty division still throws off cash.

It boasts 11 million members – nearly half the population – with a third of Australian credit cards now in partnership. Points can be spent on everything from flights and hotels to coffee makers, car hire, insurance or a bottle of Penfolds. A foreigner might mistake Qantas points as Australia's de facto second currency.

The funny thing about loyalty programs, though, is that they don't make customers particularly loyal, at least to Qantas – booking flights is still a ‘commodity product', where customers shop around based on price. This explains an average pre-tax profit margin of 3% for Qantas's airline division over the past 10 years.

Loyalty from Qantas's merchant partners, however, is a different story. Businesses use Qantas-branded credit cards as a way to attract customers. Whether or not they fly Qantas, consumers love its reward points system, so retailers such as Woolworths, David Jones, and even online auction house eBay are falling over themselves to be associated with the program. Health insurer NIB even awards points to its members for walking more often.

Loyalty from Qantas's merchant partners, however, is a different story. Businesses use Qantas-branded credit cards as a way to attract customers. Whether or not they fly Qantas, consumers love its reward points system, so retailers such as Woolworths, David Jones, and even online auction house eBay are falling over themselves to be associated with the program. Health insurer NIB even awards points to its members for walking more often.

The banks, in particular, have been a honeypot. Of all the money spent using credit cards in Australia, some 35% is now on a Qantas-linked card. Credit card use has grown at 6% a year over the past decade, which has been a strong tailwind for Qantas.

Qantas earns a couple of cents or so per point awarded – and its partners are clocking up points in the tens of billions. All those points being issued translated into more than $1.5bn in revenue for the company in 2016.

High margins

The old laws of the airline industry are being rewritten. As mentioned above, when selling flights directly to travelers, airlines fight tooth and nail to offer the lowest price, which – given their large fixed cost base – tends to mean wafer thin margins. Increasingly, however, Qantas isn't selling flights to travelers, it's selling points to banks, hotels and businesses.

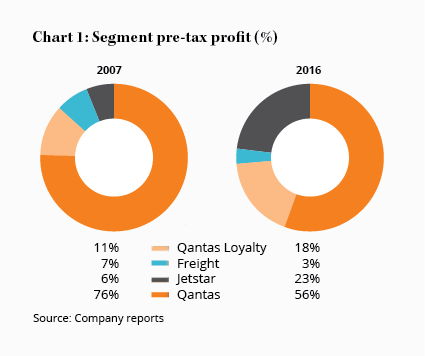

Those businesses know that if they aren't associated with the Frequent Flyer program, they're going to lose customers to a competitor that is, and that makes them more willing to pay up for points. Qantas's loyalty program is twice as profitable as any of its other divisions with a pre-tax profit margin of 24% (see Chart 1).

What's more, the Loyalty division is improving Qantas's balance sheet. Operating an airline requires mountains of capital for the upfront purchase of planes and maintenance. Despite the occasional year of decent returns – this past one being a case in point – Qantas earns terrible returns on capital ‘through the cycle'. Over the past decade, the airline has produced an average net profit of just $61m, yet required more than $3bn of shareholder equity to do so.

The Loyalty division, on the other hand, has been a consistent earner and requires very little capital to operate. It also has more favourable cash flow, because revenue from the merchants arrives when the points are issued, but Qantas only pays for a product or service when the points are redeemed. That may be a good 18 months later and Qantas gets to invest the cash in the meantime. This could be one reason Buffett made his airline bet – their loyalty divisions resemble the Blue Chip Stamps loyalty program that got Berkshire started and the ‘float' generated at its insurers.

The other two-thirds

Buffett's airline purchase suggests that maybe airlines aren't as bad as they once were. With regards to Qantas, we would have to agree. As the Loyalty program grows as a proportion of earnings, the quality of the business improves.

But let's not get ahead of ourselves. It's how Buffett made his bet that's arguably more telling. He didn't try to pick a single winner, he spread his money evenly across the big four airlines. Perhaps he thought they were all undervalued, but it also suggests there is very little to differentiate one airline from another.

So what is Qantas's Loyalty division worth? It earned $1.5bn in revenue in 2016, $346m in pre-tax profit, and that figure has grown at around 10% a year over the past decade. The program's pervasiveness in society – with few major competitors – gives it a reasonable competitive advantage that looks sustainable, at least in the short to medium term.

In 2014, Virgin Australia sold a 35% stake in its Velocity loyalty program to private equity group Affinity Partners for $336m, suggesting a total value of around $960m. At the time, it had around 4.5 million members, with $205m in revenue and $76m in earnings before interest and tax. On a similar valuation, Qantas's Loyalty division could be worth around $4.3bn if it were sold, though its lower margins and slower growth mean something in the $3.0–3.5bn range seems more reasonable.

At Qantas's current market capitalisation of $8.7bn, the Loyalty division accounts for roughly a third of the stock's value – but it's that other two-thirds we worry about. There is a diamond here, but it's surrounded by a big pile of rough. Huge fixed costs, volatile fuel prices, unionized labour, a capital-intensive business model, competition from government subsidised Middle Eastern and Asian airlines, and a fleet of other risks could still leave investors in deep, deep fertilizer if the airline hits a speed bump.

The Loyalty division does give a floor to our valuation, but with Qantas's share price up 60% over the past year and currently trading far above that floor, we're sticking with AVOID.