What's next for Netcomm

On Friday August 14 Netcomm Wireless (NTC) announced its full-year results ahead of the guidance it announced in June. The strong finish to the year has seen the NTC share price more than double since the half-year result in February.

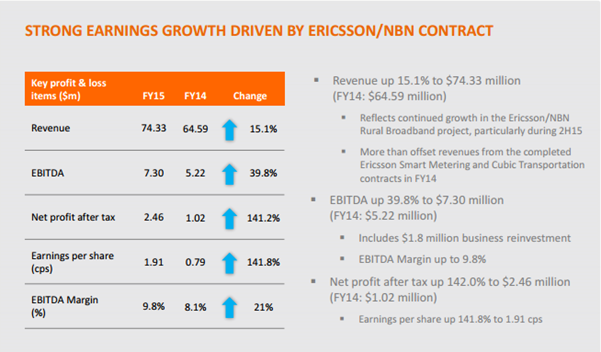

Revenue was up 15.1 per cent to $74.3 million, above previous guidance of $73m. Earnings before interest, tax, depreciation and amortisation (EBITDA) was up 39.8 pe rcent to $7.3m, above previous guidance of $7m. This growth is actually stronger than it may appear as there was an additional $1.8m of business reinvestment costs during the year, which should benefit future years.

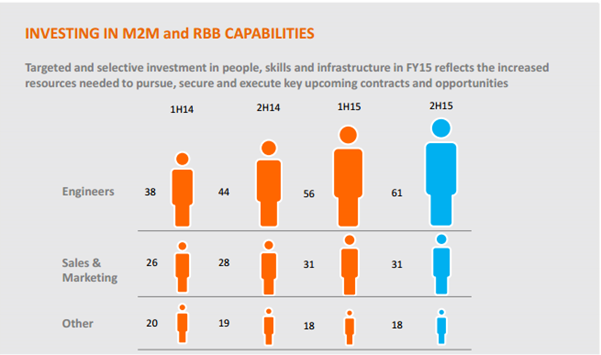

The investment in people and infrastructure is an important component of trying to pursue promising global M2M (Machine-to-Machine) opportunities.

Net profit after tax was up 142 per cent to $2.5m and importantly the benefits of scale have resulted in improved profit margins.

The focus during the year was continuing its global M2M business while benefiting from the increased rural broadband volumes as the NBN roll-out gathered pace. The M2M business accounted for 45.5 per cent of group sales and 54.5 per cent of EBITDA.

In March, NTC announced an agreement with Singtel to market its M2M products and services. This is in line with the company objective of adding partners from the top 20 M2M telecommunications carriers globally. Further, the company was selected to deliver the ICT component of Hitachi's smart energy project in May 2015. In the first half there were also agreements with Arrow Electronics and Tele2.

Although the domestic broadband device business is not the focus for the company's growth it achieved a revenue increase of 29.2 per cent during the year. This was driven by higher sales of powerline devices and ADSL/VDSL products.

The balance sheet is in very good shape with net cash. No dividend will be paid as the board is focused on business reinvestment.

FY16 will see large growth mostly driven by an increased rural NBN roll-out. The company has not provided specific guidance for FY16, and is trading on a PE of 17 times our 5.4 cent FY16 earnings per share forecast.

Although Australian rural NBN will drive further growth into FY17 and FY18, it is the global M2M opportunities which have the potential to be a significant share price driver. It can be seen that management has set up a number of strategic partnerships with leading providers and telco carriers. This includes continued discussion and trials for M2M opportunities and rural broadband opportunities in multiple markets.

Global M2M opportunities

With 50 billion devices expected to be connected by 2020 the M2M industry is experiencing rapid growth and M2M applications are forecast to grow to approximately $150 billion by 2020.

The network connectivity enables the capability to:

- Monitor the environment

- Report their status

- Automate processes

- Receive instructions

- Take action

Networked assets allow businesses to be more aware of operational progress with a faster ability to react with increased productivity.

The improved connectivity of devices is affecting just about all industries. These are some of the key verticals NetComm is targeting:

- Smart metering

- E-health – in-house devices

- Industrial automation

- Business services – point of sale, vending machines, digital display

- Rural NBN – leverage into other developed countries

Overseas offices

As well as Australia the company now has offices in the US, UK, New Zealand, the Middle East and Japan. This means they have exposure in all the key M2M regions.

As a small Australian company, Netcomm is up against significantly larger hardware providers. As such it is important the company sticks to niche areas where it can provide a point of difference.

Differentiators

The way management is attempting to differentiate themselves is by having capabilities for high performance customised devices that deliver long-term contracts and higher margins.

This means avoiding the high volume, low margin one-size fits all market segments that will generally attract more competition from larger suppliers.

Although NetComm is relatively small, the company does have 32 years of engineering experience and low-cost purpose-built manufacturing capabilities in Asia.

With this strategy, even if it can win $5-10m worth of specialised M2M work in each of the offices it will have a material impact on the company valuation.

Another key to the strategy is to partner with relevant telco carriers and other partners to leverage the sales of the company's innovative products and custom solutions.

Rural broadband

Most developed nations are taking a similar approach to shutting down copper lines. That is to replace with fibre in “built up areas” which generally cover 90 per cent of customers.

For the remaining 10 per cent that is regional and rural customers, fixed wireless has generally been accepted as the best solution.

The success of Netcomm's relationship with Ericsson to supply the NBN rural broadband fixed wireless solution may give the company an advantage in bidding for the equivalent overseas NBN work.

AT&T and Verizon in the USA are progressing with plans to shut down their copper networks. A contract win such as this would be a significant share price driver for NTC.

Valuation/summary

Previously the rationale for our buy recommendation was that the share price was at a discount to the valuation that only assumed contracted work. As such the potential global contracts could be viewed as a free option.

With slight upgrades and the rolling forward of our discounted cash flow valuation into FY16 our prior $0.85 valuation is increased to $0.95.

But with the current price at $0.92, further short-term upside may require overseas contract wins. Although the company has no shortage of opportunities, it is very difficult to determine the likelihood of winning a contract with AT&T, for example. As a result we are downgrading our recommendation from buy to hold.

To see Netcomm Wireless' full forecasts and financial summary, click here.