VRT: A solid dividend in the medical space

Despite increasing volatility in global equity markets, I am happy that there remain some exciting businesses on the ASX that are paying strong dividends and have growth potential. This week I met with IVF and assisted reproductive services business Virtus Health (VRT) following the company's full-year result. It was a welcome relief to leave the red screens behind and understand that VRT remains a growing company with healthy cash flow to support an attractive dividend yield.

VRT has lifted after reporting financial results to the market on Tuesday (August 25). However, even after this rebound of sorts, VRT's dividend yield sits around 5 per cent (over 7 per cent if we include franking credits), with an undemanding price to earnings ratio of just over 12.

VRT is operating with a leading market share in an industry that shows promising trends. The company had provided a profit warning back in early June, so there are some risks to this investment, which I have explored further below. But I maintain confidence that VRT is appropriately addressing market changes, and offers both a market leading exposure to IVF and a strong income for investors. In that light, I add VRT to the Income First model portfolio with a 5 per cent weight. Additionally, I initiate coverage of VRT with a buy call and a valuation of $5.41.

Dividends and cash flow

VRT only listed in June 2013 so the company's dividend history is somewhat limited. That said, since listing VRT has paid 26 cents in FY14 and 27 cents in FY15, corresponding to a payout ratio of around 65 per cent of underlying net profit. The company has maintained positive free cash flow, and quite healthy levels of cash generated from operations. This is a key point: VRT appears in a good position to generate sufficient cash flow to cover both dividend payments and a level of reinvestment into the business that will support future growth.

FY15 was a slightly tough period for VRT and there may be more challenges ahead. Thus maintaining strong conversion of earnings into cash is a key quality for a business looking to continue to pay a healthy dividend to investors. I am confident that VRT has sufficient market position to continue to build its dividend track record.

Business operations

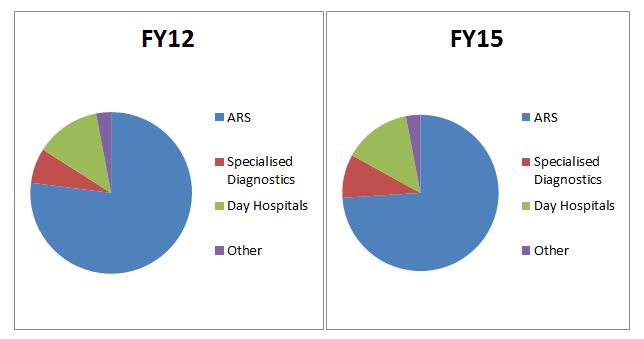

As mentioned, VRT focuses on IVF and associated services. The main function of the business is to facilitate assisted reproduction and its associated services. Thus the business is split into three key operating segments: Assisted Reproductive Services (ARS), Specialised Diagnostics and Day Hospitals.

The ARS segment focuses on IVF cycles, cryostorage, embryo transfer, intra-uterine insemination and other associated services. This segment has traditionally provided the company's core focus and provided the lion's share of both revenue and earnings. In FY15 VRT's ARS segment provided 15,100 fresh IVF cycles in Australia and another 1,878 (plus 86 from Singapore operations) through its international operations in Ireland and Singapore. The structure of this segment is that Virtus contracts with fertility specialists for an initial five-year period, with add-ons thereafter. The number of specialists contracted is a key driver of growth for VRT, but does introduce some risk to the business, that is the risk of losing experts or even increasing contractual pressure.

The company's Specialised Diagnostics segment involves services that allow the contracted fertility specialist to diagnose fertility challenges, in order to increase the patient's chance of success from an IVF cycle. The tests offered are usually lab based and are conducted by VRT in its own labs, with the exception of some specialised blood tests. VRT has found that this value adding service is seeing a trend of increasing volumes and is increasing the company's revenue per IVF cycle.

Finally, the company's Day Hospitals segment offers various medical procedures. This is largely linked to procedures associated with IVF cycles such as egg collection and embryo transfers. In addition to this, the day hospitals provide space for procedures involving ophthalmology, endoscopy, plastic surgery, gynaecology, urology, dental and other surgical procedures. VRT is the operator of these day hospitals, receiving income for procedures conducted in them.

Here is a snapshot of VRT's overall revenue mix for FY15 versus that in FY12. The company's Diagnostics division has been a standout achieving double digit growth in recent years, with an expectation that this will continue in the near term future. International revenue now sits at 11.6 per cent of revenue.

FY15 shows some structural challenges, but industry themes remain strong

The industry for IVF in Australia is encountering some change. Low-cost options are emerging for patients that present with no potential complications. In response to this VRT offers IVF cycles through its own low-cost offering branded The Fertility Centre. While this may initially raise concerns over cannibalisation and margin detraction, VRT management has established that these centres are being run as complementary services and in some cases can identify patients with higher service or diagnostic needs to refer on to full service clinics. This will continue to be a key area of focus for me in terms of how the market develops. Technological progress and the potential for low cost competition to disrupt the market does exist in the longer term. For now, we take solace in VRT's market leading position and strong relationship with fertility specialists.

Outlook, guidance and dividend expectations

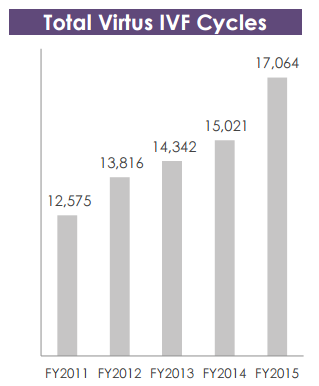

Following a discussion with VRT management, we believe that the company is well placed for some growth, largely through completed acquisitions making a full-year contribution. These include Tas IVF, IVF Sunshine Coast, Sims IVF in Ireland, Rotunda and the Singaporean greenfield business. In light of the strong additional revenue likely to be derived from these acquisitions making a full-year contribution, VRT is well placed to continue to build on its growth since listing. In fact cycle growth in the last five years remains on a strong trajectory:

Source: Virtus Health

Management has not provided much guidance to the market for FY16, other than to remind us of the supportive demographic trends in IVF demand. That said, I think the outlook is somewhat mixed. Trends are supportive of volume growth and VRT's acquisition focus will deliver growth in FY16. Further to this the company has plans to expand into the UK in coming years, with international markets providing significant growth opportunity in the long term.

Offsetting these positives are trends in product mix and competition that may see margins come under some pressure. This pressure is likely to slowly lower margins through the business. With a sound strategy in place to diversify earnings from pure IVF cycles to associated services, VRT management have a good handle on managing this industry change.

In light of strong underlying demand circumstances, a market leading position and a dividend that provides investors with a strong yield, I am happy to add VRT to the Income First model portfolio with a 5 per cent weight. While I acknowledge that there is the potential for some disruption in the space, Australia is a leading innovator in reproductive medicine and VRT is at the forefront of the Australian market. The company's cash flow and dividends are likely to be stable at worst in FY16, thus I initiate coverage of the company from an income perspective with a buy call and a valuation of $5.41.

To see Virtus Health's forecasts and financial summary, click here.