Unlocking value in Amaysim

Recommendation

Mention Walmart, Aldi and Woolworths in the same sentence and you might think the discussion was about to turn to supermarkets. Yet these three retailers have something else in common: they are also mobile phone operators. Welcome to the world of the Mobile Virtual Network Operator (MVNO).

Most mobile markets are dominated by a handful of mobile network operators (MNOs) who own and operate their own assets along with a slice of mobile spectrum. In Australia, the MNOs are familiar names: Telstra accounts for half the mobile market and Optus and Vodafone combined account for another 40%.

The final 10% of the market is serviced not by asset owners but by resellers known as MVNOs. The largest of these in Australia is Amaysim.

Key Points

-

Asset light business model

-

Economics improve as customers expand

-

Can be vulnerable to external shocks

Amaysim has a contract with Optus to lease a slice of its 3G and 4G mobile network at wholesale rates, which it then uses to build plans to sell to retail customers. Optus provides the network, Amaysim takes care of marketing, billing, top-ups and customer service. This same MVNO model is employed the world over and it's the fastest-growing segment of the mobile market.

Australia has, in the past, been a graveyard for virtual networks. With low barriers to entry, many have tried to crack the market and most have failed. Despite this poor history, we're about to recommend Amaysim as a Speculative Buy.

Trading on a PER of over 40, Amaysim doesn't appear obviously cheap but, in our view, current earnings understate how profitable this business can be.

In preview, the business model boasts attractive economics that improve as it grows. High incremental margins and generous rates of return are protected by sustainable advantages against larger MNOs and fellow virtual operators. As we will see, replicating the business model is easy but matching profitability is harder.

Before we can get into those details, though, we must answer one obvious question. Why would Optus ever lease its network and outsource profits rather than take them for itself?

Our mutual friend

MVNOs are attractive for mobile network operators because they represent a reliable source of high-margin revenue.

Optus, for example, doesn't pay a cent to acquire Amaysim customers nor does it have to provide ancillary services like customer service and billing. It simply collects revenues for the use of its network and, like all capital heavy investments, higher utilisation drives higher margins.

MVNOs can also attract different users to those that might use an MNO's core brand. Amaysim, for example, targets users who spend $40 or less; other virtual networks chase customers based on ethnicity, employment or demographic factors. It is difficult for Optus to market to all these niche groups but, by striking deals with MVNOs, it can still collect revenues from them.

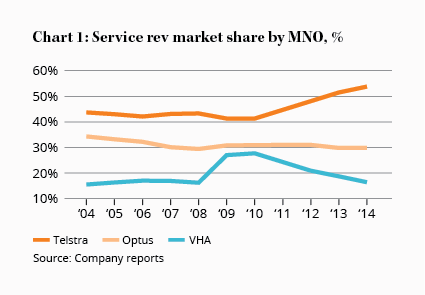

For Optus, MVNOs are particularly important. On our numbers, it appears that Optus's market share has actually fallen over the past decade (see Chart 1) and customer growth would be zero without MVNOs. In other words, all the growth in Optus's user base has come from growth in the MVNO sector.

Amaysim alone has delivered over 800,000 customers onto its network. There are strong incentives to have MVNOs, especially a successful one, stay on the network.

The network agreement

The largest cost for Amaysim are network charges paid to Optus which represent 60–70% of revenue. Those charges, and hence gross margins, are governed by a 'Network Supply Agreement' between Amaysim and Optus, which is set to run until December 2019, with Amaysim having an option to extend for a further five years. After that, the parties can extend the agreement on the same or different terms or cancel it entirely. In the latter case, Amaysim would then need to strike a deal with another MNO and send out replacement sim cards to all its customers – an unpalatable prospect, but not without precedent.

Amaysim pays a fixed charge per customer as well as a smaller variable charge depending on data usage. As the number of subscribers grow so do payments to Optus. The other costs incurred by Amaysim – billing, marketing, service and activation – are all fixed, so unit costs fall as the subscribers rise. This means Amaysim earns high incremental margins, so that, as it grows, so does its profit margin. This is already happening, with its earnings before interest, tax, depreciation and amortisation (EBITDA) margin of 7% growing to 10% in the latest half.

The network agreement also allows for annual price reviews, and if either party believes there's been a significant change to market pricing, there's scope to trigger an immediate change in the wholesale price.

So, if competitors are offering cheaper deals, Amaysim can fight for lower prices. There's no guarantee it will get them, but it does raise the likelihood of margin stability. Predetermined mechanisms to resolve disputes are in place so Amaysim isn't a hostage to Optus and pricing becomes less dependent on discretion and more dependent on market conditions.

Optus also has protections that place a performance onus on Amaysim. According to the agreement, Amaysim must reach 1m subscribers by 2019 and there are ratios to penalise Amaysim should it poach too many Optus customers. Optus can use these performance hurdles to cancel the contract. This is unlikely but it is possible.

Virtually cheaper

MVNOs only work under specific conditions. Gross margins of 20–30% must support service and marketing costs and businesses are only profitable if those costs can be amortised over a large customer base. This is a scale business where size confers a significant advantage.

Amaysim itself has been in business since 2010 but made a profit for the first time last year; 600,000 customers were needed before the business made a profit. The industry may be swamped by competitors but, by our reckoning, Amaysim is the only MVNO (with the possible exception of Optus-owned Virgin Mobile) that has sufficient scale to be profitable. For a fellow MVNO to compete effectively would mean skimping on marketing costs (which an existing brand may do) or accepting years of losses while building scale.

Battling Amaysim – which is increasing profitability – is hard. Every unprofitable customer from a competitor is profitable if rolled into the Amaysim network. This makes acquisitions cheap, profitable and likely.

| 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|

| Revenue, $m | 32.5 | 73.5 | 128.1 | 205.7 |

| EBITDA, $m | -19.1 | -9.2 | -2.2 | 16.4 |

| EBIT, $m | -20.3 | -10.7 | -3.8 | 14.1 |

| ARPU, $/month | 17.04 | 18.89 | 20.86 | 26.12 |

| Subscribers, '000 | 230 | 400 | 619 | 718 |

Network operators like Optus don't face the hurdle of scale but, against a traditional MNO, Amaysim has a far lower cost base.

Consider this: Optus offers two sim-only plans, five prepay plans and five postpaid plans. Each of those plans comes with multiple handset options so complexity builds quickly. Amaysim offers just four plans with no handsets, instantly removing significant costs imposed by multiple deals and, in particular, handset subsidies.

The distribution model also differs. Amaysim has no stores, few staff (140 vs Telstra's army of thousands) and 40% of its activations and 80% of its charges are paid online. Typically, retail activations are ten times as costly as those made online, so savings accumulate quickly and are reflected in lower prices.

There is also the obvious benefit from leasing rather than owning the network. Optus spends about $1bn annually on improvements to its networks; this year it is expected to spend $1.8bn. Amaysim can avoid those massive capital calls and still benefit from them. Unlike Optus, it doesn't have to sink much cash to grow.

The business model itself should generate generous cash flow. Not only does it collect monthly fees from customers, but under the network agreement, Optus pays Amaysim an upfront fee for every customer it collects. That fee is then repaid over 24 months from customer billings granting Amaysim a generous cash flow advantage. Optus, rather than banks, funds growth.

A likely future

Amaysim's share price fell almost 40% after it announced its interim results in February. While the results themselves were fine, the market was spooked by dramatically slower subscriber growth; the business added 185,000 customers in 2014 but just 85,000 last year. If customer growth were to halt, so would the march of profits.

| 2018 EBITDA margin (%) | 10 | 12 | 15 |

|---|---|---|---|

| Subscribers (m) | 1 | ||

| ARPU ($/m) | 27 | ||

| ARPU ($/yr) | 324 | ||

| Revenue ($m) | 324 | ||

| EBITDA ($m) | 32 | 39 | 49 |

| Dep. & Amort. ($m) | 3 | 3 | 3 |

| EBIT ($m) | 29 | 36 | 46 |

| Net profit ($m) | 21 | 25 | 32 |

| EPS (c) | 12 | 14 | 18 |

| PER | 17 | 14 | 11 |

| DPS (c) | 8 | 10 | 13 |

| Div. yield (%) | 4.2 | 5.1 | 6.4 |

However, since last year, Amaysim has triggered a wholesale price review and lowered prices. Its retail plans, which were outdated and expensive, are once again competitive and recent trading conditions have been strong according to management. The ability to trigger price reviews means margins should remain stable although there will be lags. We view the share price plunge as an opportunity rather than a red flag.

Assuming Amaysim will reach 1m subscribers by 2017 – it currently has over 800,000 – and that average revenue per user remains stable at $27 per month, we estimate revenue of $324m by 2017.

Margins remain the tricky part. Internationally, MVNOs typically generate EBITDA margins of 10–15% depending on size and competition. Amaysim, as the largest MVNO, should be able to get margins up to 15%, from 10% today.

In Table 2 we've set out three scenarios, with margins at 10%, 12% and 15%. If Amaysim can claim a 15% margin by the end of 2017, we expect EBITDA of $48m and net profit of $32m. At today's prices, that translates to a price-earnings ratio (PER) of 11 and – assuming a 70% payout ratio – a dividend yield of over 6%.

Even if margins remained at 10% – which we think is unlikely but possible – the business should generate net profit of $20m, giving a PER of 17 and a yield of 4%. That's dear but far from disastrous. The risk-reward payoff is attractive.

We can imagine a disastrous scenario for this business: a network fault that drove customers away from Optus, or being forced off the Optus network. These events could lead to worse outcomes than our 10% margin case and adds extra risk. This means it won't suit conservative investors and, even for those that are comfortable with more risk, we recommend a maximum portfolio weighting of just 3%.

Yet with 65% of handsets now out of contract and the MVNO sector generating strong growth, Amaysim boasts attractive economics and profit potential that isn't being recognised by its current share price. We're upgrading to SPECULATIVE BUY.

Recommendation