The smart money's on Tatts Group

Tatts Group has operated regulated lotteries in Australia since 1897 and has a rich history in the gaming sector, operating under the estate of George Adams as Tattersalls Limited. The business listed in 2005 and today it is made up of lotteries, wagering and gaming operations.

The company continues to pose a strong investment case. The key to TTS as a buy call for us is that the operations have a pseudo infrastructure feel, with long-term lotteries licences and a defensive base of earnings from which to pay dividends. On top of this, the current management team appears to be stabilising the business and looking to the future after a few tumultuous years.

Yes, there are some risks, including regulatory issues, but in my view this creates an opportunity for investors to pick up a stock with a strong track record, a defensive element, and a dividend yield of around 4.5 per cent (above 6.5 per cent if we include the value of franking credits).

Our valuation on TTS is $3.97 and we expect 17 cents per share in total dividends during FY16. It is worth noting that TTS is trading near or just above our valuation at present. Despite this, we are still making a buy call, noting that there are a number of potential catalysts which could cause me to increase the valuation in future. Additionally the buy call is made in the context of the lower volatility in the stock and its strong and growing dividend return.

Dividends and cash flow

In recent years, the revocation and changes to pokies operator licenses in Victoria have caused major changes to TTS. This has led to a rebase in the company's earnings and dividend levels as the income from the pokies operations dried up – TTS operated close to 14,000 gaming machines upon listing in 2005. More than two thirds of revenue and almost 90 per cent of earnings was sourced from gaming operations. There has been an evolution at TTS away from gaming, into lotteries more, and into wagering more recently.

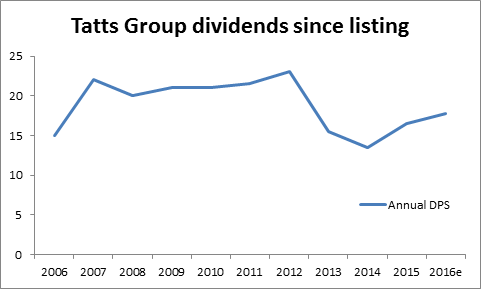

Pleasingly, the dividend appears to have based in FY14, with the FY15 dividends lifting again. Below is a chart of historical dividends from TTS since listing in 2005.

From this chart, two observations can be made:

- The dividend has been inconsistent, especially of late given the loss of income from the Victorian gaming licence that once made up such an important part of the group's earnings. My view is that this is now behind TTS, save for the finalisation of some litigation (more on that below).

- TTS has been a good dividend payer in aggregate since listing: TTS listed at $2.90 in the IPO, and has paid $2.06 in dividends since then. This is a return of more than 70 per cent on the IPO price from dividend receipts alone – an enviable track record in a 10 year performance.

From a cash flow perspective, TTS generated operating cash flow of $439.8 million in FY15, well and truly covering dividend payments (the value of dividends paid in FY15 was around $121m). I am comfortable that the cash generated from the TTS business is sufficient to see continued dividend payments, as well as debt servicing and reinvestment in growth. The issue for investors is TTS's payout ratio and ability to grow earnings, which would lead to increased future dividends. At present, my view is that TTS is well positioned to at least maintain, if not marginally grow, its full year dividend payments for FY16 on that announced in FY15. This is the basis of our assumptions for including TTS as an income focused buy call, though I add that there is also upside risk here should the company see improved operating performances or favourable litigation outcomes.

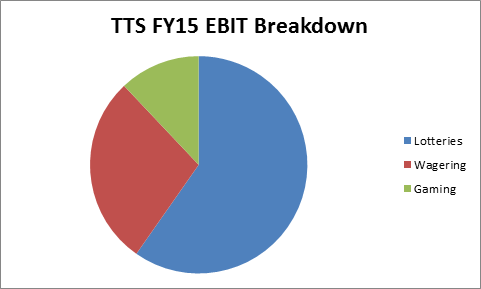

Lotteries are the lion's share of the business

Although the TTS business has moved away from an earlier reliance on gaming revenue, the lion's share of earnings are sourced through the lotteries business. TTS reports three segments to the market.

Lotteries operated by TTS are across all Australian states except WA. The major source of earnings is through the sole licence arrangements in SA, NSW and QLD where TTS has licences with 35 years or more to run – this accounts for 80 per cent of lotteries earnings before interest and tax (EBIT). The lotteries business is considered stable and defensive from competitive forces – possessing a strong moat, as Warren Buffett might say. That said, the income of the lotteries business can be driven by the number of jackpots over the year. The more jackpots, the more attention the lottery commands, and the more tickets are sold, leading to higher earnings. This can be approximated using averages, but there will be some variation year to year.

The wagering business has been a solid contributor to group EBIT, but this has been declining slightly in recent years. The contribution of wagering to the broader business has slipped from over 33 per cent in FY13, to around 28 per cent last financial year. The wagering business owns the TAB agencies in QLD, SA, TAS and NT providing race and sports wagering services. Unfortunately, sports betting has become a technological arms race and the use of mobile capable wagering sites has introduced increased competition. During FY15, revenue from wagering was down 1.5 per cent as a result, and TTS has its work cut out in terms of competing to maintain market share.

The recent launch of Ubet is a positive response. Designed to capture more digital market share, Ubet has the potential to gain traction and help reposition the business. As a result TTS digital wagering sales have been growing at a swift pace, 25.7 per cent in FY15, and 22.9 per cent in FY14. My view is that this segment of the business is likely to continue to feel pressure on both margin and on the top line as competition continues to intensify.

TTS's third division is gaming. It is split into three reportable businesses: Maxgaming, Bytecraft and Talarius, all of which delivered similar levels of revenue in FY15, but only MaxGaming delivered a material EBIT contribution. MaxGaming is the gaming services division, providing the required monitoring of payouts and operations for gaming venues, as well as other valuable services. In FY15, revenue was 2.2 per cent higher to $116.8m with strong earnings margins delivering an EBIT result of $51.3m. Bytecraft and Talarius delivered EBIT of $0.6m and $6.2m respectively.

Regulatory risks

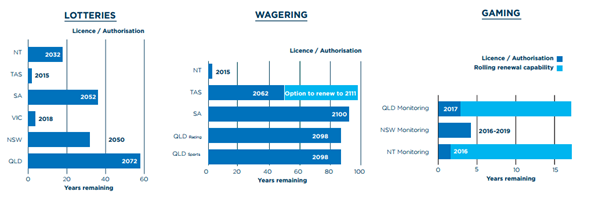

TTS has two perceived regulatory risks. First, the company's lotteries and other operations are predicated on the existence of licences granted usually by Australian state or territory governments. Pleasingly, the company's licence profile is quite strong, with long-term licences in key lotteries underpinning earnings.

The group also recently announced that it had been selected as the preferred licensee for NT race wagering. This has completed the wagering licencing profile, and provides some regulatory stability.

Second, via MaxGaming, licences are provided by state governments for the payout and operations monitoring function in NSW, QLD and NT. These are set to expire in coming years, but have rolling options in both QLD and NT. Given the market share of Maxgaming in QLD, we believe the loss of this licence is unlikely.

Below is an extract from the annexure of TTS's latest financial results presentation summarising the licence situation at the end of FY15:

Regardless of our comfort with the licence situation, a stern reminder of risk exists from the ongoing involvement of TTS in litigation surrounding the expiry of its Victorian gaming operator's licence. Effectively in 2012 the Victorian government revoked TTS's licence to operate gaming venues, removing a significant revenue stream for TTS. The Supreme Court of Victoria ruled in TTS's favour during FY14, and the Victorian government paid TTS $451.2m plus interest of $89.3m. However, leave to appeal to the High Court on this matter has been granted. The final outcome of TTS's eligibility to this $540m remains unknown but TTS flagged in its recent results presentation that the outcome is expected during FY16.

TTS has also mentioned in its presentations that the company will explore potential capital management options should it see an ultimately successful legal outcome. It is worth noting that the company possesses a healthy franking credit balance of $197.054m at the end of FY15, up from $186.790m in the previous year. This high level of accrued franking credits may provide impetus for the company to return capital to shareholders, should the best case scenario emerge for TTS from the High Court.

Balance sheet questions and earnings forecasts

At present TTS includes a current liability on its balance sheet that relates to the abovementioned legal action. This liability is in excess of $540, and is being treated by TTS as unearned income for accounting purposes. This means TTS knows there are appeals afoot so has placed this money in financial limbo pending the outcome of the appeal to the High Court. In my view this is the prudent approach to take, as there is a chance TTS will need to fund the repayment of these legal proceeds should the High Court overturn previous decisions.

Pleasingly, including this on the balance sheet offsets the positive impact of the money received via the Supreme Court and Court of Appeal decisions, and allows me to analyse the balance sheet without major adjustment. I'm comfortable that TTS has the balance sheet stability needed to continue to fund its business, maintain dividends and remain in a stable financial situation.

On a net debt to equity basis, the company's gearing as at the end of FY15 was 16.72 per cent. This includes a paydown of debt facilitated by the legal proceeds received, but even with this included in net debt, gearing remains tolerable at around 36.5 per cent. The balance sheet is strong and any concerns regarding the potential impact of litigation, as it proceeds to the High Court, are also tolerable.

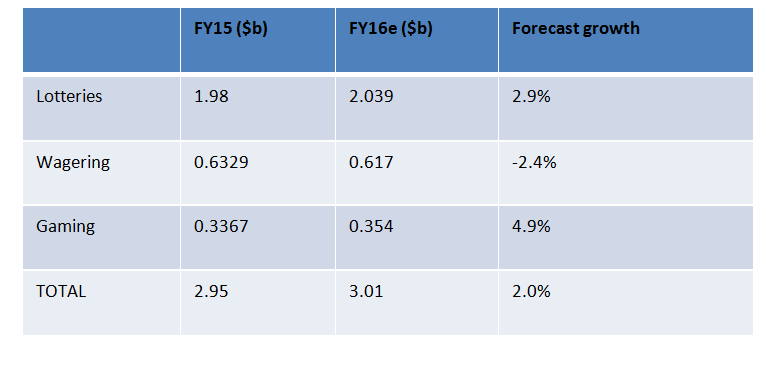

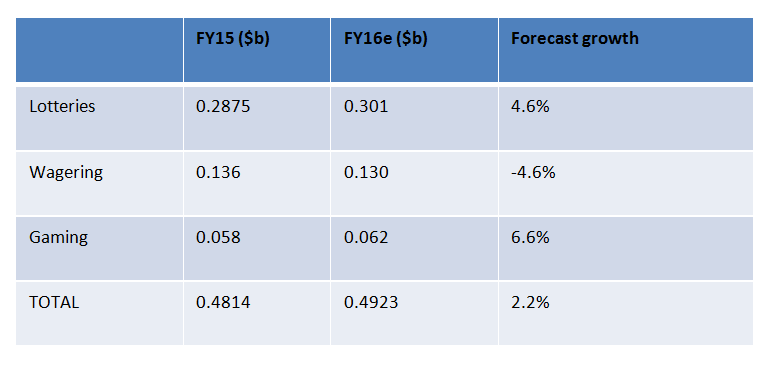

A more difficult question in my view is how to forecast TTS's earnings profile. This is what will drive any gains in the company's dividends paid in coming years and there are a lot of moving parts. Lotteries as a business is unlikely to grow rapidly, but will provide a stable defensive earnings base, and strong cash flow. Given that this business remains over two thirds of earnings, we are taking a conservative approach to forecasting TTS. Our FY16 divisional revenue and EBIT forecasts are below and can be compared to FY15 for the purposes of establishing growth trends.

Revenue forecasts

EBIT forecasts

Income First model portfolio inclusion and investment strategy

Overall, I believe that TTS will add a lot to the Income First model portfolio.

Importantly it is a business that has an outstanding approach to dividend payments. The company's historical payout ratio is above 90 per cent and this is expected to continue into the future. I am further encouraged by the return on the IPO price delivered solely by dividend payments since 2006, and note that this return has been achieved through a period of change outside of the control of the management team.

With expectations that the business will continue to deliver a stable level of earnings from the lotteries and gaming division, with some risks (both positive and negative) in the wagering division, I expect that dividends will grow slightly into FY16 and beyond. My valuation of $3.97 relies on what I believe are conservative assumptions regarding top line growth, so there is always the possibility of additional outperformance.

Finally, from a portfolio perspective, TTS provides a large cap gaming exposure to the portfolio. While this may not be everyone's favourite depending on your approach to ethical investing, it is a sector of the market that is defensive, and should be on the radar for any investor looking to create a solid income portfolio. I am pleased that TTS adds diversification by size and by sector, and we add the company to the portfolio with an initial 6 per cent weight.